Veal Price Forecast July 2014

advertisement

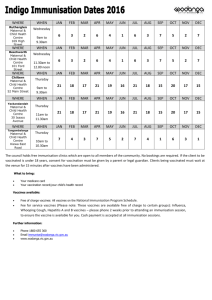

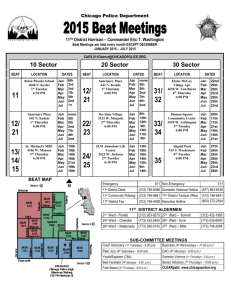

Veal Price Forecast July 2014 VEAL PRICE FORECAST JULY 2014 Lighter demand for veal is attributed to a myriad of factors, but the problem of particular focus is limited buying interest among younger consumers. Suggested causes for this often range from public perception of the treatment of the animals to lack of retail availability. Additionally, relative cost and low awareness of veal cooking techniques may be other factors preventing generation Y from purchasing veal at the grocery store. Remedying the problem of decreased demand in this category will require addressing these aforementioned issues. In conclusion, the seasonality of demand for veal is bittersweet. Seasonal increases in demand help the industry, but the overall decline in demand may continue to be problematic. In thinking of veal as an ongoing concern, it is difficult to call the current trends positive in spite of seasonal price and volume upticks. 295 230 165 100 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Demand for veal peaked in May of 2012, but subsequently declined by 23% through to April 2014. Demand is expected to improve due to seasonal factors throughout the second half of 2014, but it will likely remain below year-ago levels. The expectation is for this year to be more seasonal, with significant improvements seen around the holiday buying seasons. The fourth-quarter rallies may not be as strong as five-year or ten-year seasonal factors might suggest, but it is expected that there will be significant price advances this year over 2012 and 2013 due to tighter supplies. 360 Pounds in Millions So far this year, veal prices have trended higher in both the carcass category as well as most boxed cuts. In fact, with few exceptions, veal prices in all categories are at their highest levels since Urner Barry began collecting quotations in 1993. Strength has largely been attributed to tighter supplies, which in general means that demand does not have to surpass year-ago levels in order to motivate higher prices. Additionally, the higher prices of most proteins this year have provided support for the veal complex as the price gap between veal and other categories has narrowed. USDA Federally Inspected Production, Veal (yearly) Source: USDA, Urner Barry Veal production for 2013 was about 109 million pounds which was down roughly 5% compared to 2012. Jan-to-Jun production numbers for 2014 are nearly 10% lower than the equivalent time period last year. This downtrend has been going on for over 15 years. Yearly production levels have declined 6.5% on average since 1997. USDA Federally Inspected Slaughter, Calves(Weekly) 20.00 18.00 Head in Thousands Concerns about Consumption 16.00 14.00 12.00 10.00 TABLE OF CONTENTS Commentary...................1 Economic Indicators.....4-5 Market Indexes...............2 Veal Cuts....................6-15 Feed................................3 The information, commentary and price quotations contained herein are intended solely for the confidential and exclusive use of our subscribers. All subscribers expressly agree that they will not sell, communicate or give any of said information, commentary or price quotations to any other person, firm or corporation, including any governmental agent or agencies whatsoever and any news distributing or communications company or service. The quotations given herein represent to the best of the reporters’ knowledge prevailing wholesale values in the specified grades of each commodity, sales in stores or warehouse from receivers and wholesale distributors, or by willingness and ability to buy. The use of quotations for contractual or other purposes is beyond the publishers’ control and they will in no case assume any responsibility for such use. They represent in the judgment of the publishers an accurate picture of current business, but they are not “official” in any sense of the word. The publishers disclaim and do not assume responsibility for any damages, alleged or otherwise, that may result or claim to have resulted from any use made by any person or any reliance made by any person upon any of the statements of quotations appearing at any time herein. J F M A M J J 2014 2013 Source: USDA, Urner Barry A S 2012 O N D 2011 Jan-to-Jun calf slaughter for 2014 is estimated at 302,000 head, which is down approximately 16% compared to the equivalent time period for 2013. Third quarter slaughter is forecasted to decline by 16 percent compared to year-ago calf slaughter, and current estimates have fourth quarter calf slaughter down 15 percent. Market Insight for the Meat and Poultry Industry© 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 Market Data, Analysis and Forecasts by: Published by: While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, and opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 2 Beef Index Pork Cutout 2.44 1.30 2.15 1.14 1.86 0.98 1.57 0.82 1.28 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 The Urner Barry beef index has surged to new highs in 2014. It has pierced the previous ceiling of $200.00/cwt, to the tune of close to 20 percent. The lowest level of cattle supplies in sixty plus years on January 1 is the largest contributing factor. Higher input costs have forced packers to raise prices. 0.66 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 2014 has been a year of record prices in the pork market. The effect of the widespread Porcine Epidemic Diarrhea Virus, or PEDV, which is estimated to have killed up to 7 million piglets since May of 2013, has restricted the amount of available hogs for slaughter. Even though slaughter is anticipated to remain several percentage points below that of last year through the fall, pork production has so far remained on par with last year due to heavier hog weights. Higher year over year pork prices are anticipated across most cuts for the remainder of 2014. Chicken Index Turkey Index 0.93 1.50 1.34 0.84 1.18 0.75 1.02 0.66 0.86 0.57 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Urner Barry’s chicken index has rebounded since its six month decline finishing 2013. It was last year when the wing and breast meat markets drove UB’s index to an all-time high of $.92/lb., but overproduction and diminished demand eventually forced values downward. Since that time, the supply and demand scenario has been restored to a much closer, if not tight, balance. The combination of severe winter weather, an aging breeder flock and underperforming birds has restrained production. Demand has been “seasonal” at worst and at times quite aggressive. Assuming that high prices will continue in the competitive meat arena, the outlook for the chicken market remains strong. 0.70 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Record or near record setting values have been the differentiating characteristic of the turkey market this year. The effects of double digit cutbacks in slaughter, excellent consumer demand in the U.S. and a broadening reach into the export arena have turned the tables on traditional market expectations. Additionally, requirements for grinding materials are at higher levels than ever and have helped to generate the strongest index on record. Even though slaughter is anticipated to advance several percentage points starting in late summer, turkey production has so far remained well below the last two years. The lack of attractively priced protein alternatives, coupled with traditional increases in white meat demand during the summer months, suggest that higher year on year market values will remain in place across much of the turkey complex for the balance of 2014. Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 3 WHEY (Animal Feed Milk Replacer, Central) 0.60 Dollars Per Pound 0.50 0.40 0.30 0.20 0.10 Source: USDA Whey, used as an animal feed milk replacer, has been increasing in value fairly consistently over the course of the past several years. This trend resembles, though technically exceeds, the upward movement seen in liquid milk values. Prices Received For Hay CBOT Corn Continuous Front Month Futures 900 224 800 Cents Per Bushel 193 Cents Per Bushel 700 600 162 500 131 400 300 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Source: Chicago Board Of Trade Corn prices for animal owners have been favorable after falling nearly 48 percent from peak levels in 2012. Optimal growing weather has improved prospects for this year’s plantings. The government projects record level production which should keep a ceiling on prices. 100 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Source: USDA The longer term trend of higher hay prices looks like it is going to continue. Tighter production and supplies are anticipated for the foreseeable future. Both supply and demand fundamentals should be supportive of elevated prices. Tighter hay production and supplies are further limited by drought conditions across the U.S. while global demand is expected to remain strong. Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 4 Per Capita Veal and Lamb Consumption 110 2 95 1.6 80 1.2 Pounds Pounds Per Capita Red Meat and Poultry Consumption 65 0.8 50 0.4 35 0 Source: Urner Barry, USDA BEEF PORK TOTAL POULTRY This chart measures the amount of red meat and poultry consumption by each individual in the United States. It is calculated by dividing the total number of pounds of meat consumed in the US by the total population. Beef consumption peaked in the late 1970s and has steadily declined. At about the same time, consumption of poultry has risen dramatically. This can be used to help determine demand for each area, but is not the sole measure of demand. Increased population and wealth tend to lead to increased consumption. The rapid rise in population, however, is outweighing production increases, especially on the beef side. Source: Urner Barry, USDA Veal Lamb Despite the fact that slightly over half of all meat consumed are red meat products- beef, pork, veal, lamb, and mutton; veal and lamb consumption in the U.S. is small relative to other red meat items. Consumption for veal and lamb has been on the decline with veal falling at a greater pace. The U.S. is a net exporter of beef right now. Exports have increased annually and should drive growth in the foreseeable future. Japan, Mexico, China/Hong Kong, and Canada are the primary markets. The U.S. also imports beef, mainly muscle cuts from Canada and manufacturing beef from Australia, New Zealand and Central & South America. Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 5 DPI & PCE Monthly Percent Change 1.00 CPI-U 12 Month Change Disposable Personal Income 7.00 Personal Consumption Expenditures 0.52 Percentage Percentage Meat, Poultry, Fish, and Eggs Food at Home Food Away from Home 5.60 0.76 0.28 0.04 -0.20 All Items Dec-13 Jan-14 Feb-14 Mar-14 4.20 2.80 1.40 0.00 Apr-14 Source: Urner Barry, BLS Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 Source: Urner Barry, BLS Disposable personal income has slowly grown each month. But as the CPI-U12 Month Change chart shows, higher prices on food and energy have increased personal consumption expenditures faster. We continue to see year-over-year gains in consumer prices. Two measures that could be telling to the veal industry are the Meat, Poultry, Fish and Eggs and the Food Away From Home categories. The former continues to see the largest increases over last year, with food inflation running high. Food Away From Home is also important, as much of the consumption for veal is in restaurants. With the economy still recovering, restaurants were reluctant to pass sharply higher costs to consumers but some are now altering portion/packaging sizes or offering alternate items in an effort to ease price increases. 450,000 101.8 444,000 101.4 438,000 101.0 432,000 100.6 426,000 100.2 RPI Dollars Retail and Foodservice Sales, Monthly Seasonally Adjusted and Restaurant Performance Index 420,000 Retail and Foodservice Sales Dec-13 Jan-14 Restaurant Performance Index (RPI) Feb-14 Mar-14 Apr-14 99.8 Source: Urner Barry, Board of Governors of the Federal Reserve System, National Restaurant Association Restaurant health and outlook sentiment continues to be positive, as measured by the Restaurant Performance Index, where a greater than 100 reading indicates expansion. This has been fueled by increased traffic and same-store sales. This is an important consumer gauge of the economy. Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 6 Veal: Carcass Veal, Hide-off, 255/315, North East-(LTL) Carcasses are expected to be steady to slightly firmer. Slaughter declines remain noticeable when compared to last year. In fact, every week so far this year has been down between 5 and 25 percent compared to the equivalent week for 2013. The first three weeks of June showed the average slaughter was down 20 to 25 percent compared to a year ago. The third and fourth quarter calf slaughter is expected to be 15 to 16 percent lower than 2013. MARKET PRICES AND PROJECTIONS $3.94 $3.58 $3.22 $2.86 '09-'13 $2.50 Jan Feb Mar Apr May Jun 13 Jul 14P Aug 14 Sep Oct 15P Nov Dec PROJECTED Explanation of Ratios YS Carcass Veal, Hide-off, 255/315, North East-(LTL) 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 3.68 3.57 3.55 3.36 2.72 2.18 2.87 Feb 3.71 3.56 3.53 3.45 2.73 2.20 2.88 Mar 3.75 3.60 3.50 3.56 2.74 2.34 2.91 Apr 3.79 3.60 3.50 3.65 2.75 2.30 2.91 May 3.81 3.64 3.50 3.68 2.79 2.35 2.90 Jun 3.83 3.69 3.50 3.70 2.84 2.37 2.91 3.69 3.50 3.68 2.90 2.40 2.93 Jul Aug 3.69 3.50 3.64 2.95 2.43 2.93 Sep 3.74 3.58 3.63 3.04 2.47 2.96 Oct 3.79 3.60 3.63 3.20 2.55 3.02 Nov 3.76 3.60 3.54 3.24 2.61 3.02 Dec 3.77 3.60 3.54 3.28 2.63 3.04 Avg 3.76 3.61 3.54 3.59 2.93 2.40 2.94 High 3.83 3.69 3.60 3.70 3.28 2.63 3.04 Low 3.68 3.56 3.50 3.36 2.72 2.18 2.87 MONTHLY 5-YR SEASONAL FACTOR On the succeeding pages we’ll provide a table of ratios intended to show the relationship of the market value of a particular veal cut compared to the market value of the veal carcass. This tool can be used as a measure of performance for a particular veal item. This following example will explain how the ratios are calculated and hopefully help you to understand their purpose: The value of a cut on April 1, 2013 was $1000/cwt. One year later (April 1, 2014), the price was again $1000/cwt. At first glance one might believe that this cut showed consistent performance from year-to-year. However, when taking into account the entire carcass, things are viewed differently. Let’s say that the value of the carcass on April 1, 2013 was $325/cwt (the ratio would be 1000/325 or 3.08) and the carcass price on April 1, 2014 was $380/cwt (the ratio would be 1000/380 or 2.63). Under this scenario, the price of the cut has not kept pace with the entire carcass, which is shown by the lower ratio on April 1, 2014. A cut to carcass ratio can be helpful when comparing it to historical ratios. MONTHLY VEAL CARCASS PRICES 110% $3.94 105% $3.58 100% $3.22 95% $2.86 90% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $2.50 '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 7 Veal: 306 Hotel Rack, 7-Rib 14/20-(LTL) As demand continues to build, hotel racks should level off a little before moving higher going into the fourth quarter. Prices have pushed to new historical highs above $9.00/lb. A steady upward trend is expected for the rest of 2014. MARKET PRICES AND PROJECTIONS $9.65 $8.55 $7.45 $6.35 '09-'13 $5.25 Jan Feb Mar Apr May Jun PROJECTED 13 Jul Aug 14 Sep Oct 15P Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 306 Hotel Rack, 7-Rib 14/20-(LTL) 2015 14P 2014 2013 2012 2011 2010 5-Yr Avg VEAL RATIO: UB Carcass Veal vs UB 306 Hotel Rack 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 8.76 8.50 8.23 6.60 5.13 3.93 5.83 Jan 2.38 2.38 2.32 1.96 1.88 1.80 2.01 Feb 9.22 8.60 8.27 7.50 5.13 4.18 6.04 Feb 2.49 2.42 2.34 2.17 1.88 1.90 2.07 Mar 9.34 8.70 8.30 7.57 5.33 4.37 6.12 Mar 2.49 2.42 2.37 2.13 1.94 1.87 2.08 Apr 9.44 8.70 8.30 7.71 5.42 4.41 6.13 Apr 2.49 2.42 2.37 2.11 1.97 1.91 2.08 May 9.46 8.82 8.30 7.73 5.45 4.60 6.10 May 2.48 2.42 2.37 2.10 1.96 1.96 2.08 Jun 9.46 2.47 2.45 2.37 2.09 1.92 1.91 2.05 2.45 2.37 2.10 1.92 1.92 2.05 9.05 8.30 7.73 5.45 4.53 6.04 Jun Jul 9.04 8.30 7.73 5.56 4.60 6.07 Jul Aug 9.14 8.30 7.77 5.80 4.60 6.11 Aug 2.45 2.37 2.13 1.96 1.90 2.06 Sep 9.21 8.32 7.82 5.93 4.77 6.18 Sep 2.46 2.33 2.16 1.95 1.93 2.06 Oct 9.39 8.46 7.91 6.15 4.98 6.33 Oct 2.48 2.35 2.18 1.93 1.95 2.07 Nov 9.60 8.50 8.01 6.63 5.09 6.47 Nov 2.55 2.36 2.26 2.05 1.95 2.11 Dec 9.70 8.50 8.22 6.63 5.08 6.45 Dec 2.57 2.36 2.32 2.02 1.93 2.09 Avg 9.28 8.73 8.34 7.69 5.72 4.60 6.16 Avg 2.47 2.42 2.36 2.14 1.95 1.91 2.07 High 9.46 9.05 8.50 8.22 6.63 5.09 6.47 High 2.49 2.45 2.37 2.32 2.05 1.96 2.11 Low 8.76 8.50 8.23 6.60 5.13 3.93 5.83 Low 2.38 2.38 2.32 1.96 1.88 1.80 2.01 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 110% $3.94 105% $3.58 100% $3.22 95% $2.86 90% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $2.50 '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 8 Veal: 309 Chuck, Square Cut 36/47-(LTL) As spring demand winds down, look for prices to drift lower through summer. The trend should be higher for the fourth quarter of the year. Chucks will likely be one of the more stable items in the market. MARKET PRICES AND PROJECTIONS $3.33 $3.01 $2.69 $2.37 $2.05 '09-'13 Jan Feb Mar Apr May 13 Jun PROJECTED 14P Jul 14 Aug Sep 15P Oct Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 309 Chuck, Square Cut 36/47-(LTL) 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 3.04 2.96 2.90 2.57 1.90 1.65 2.11 Feb 3.16 2.99 2.90 2.80 1.94 1.65 2.17 Mar 3.21 2.98 2.90 2.82 2.08 1.81 2.23 VEAL RATIO: UB Carcass vs 309 Chuck, Square Cut 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 0.83 0.83 0.82 0.77 0.70 0.76 0.73 Feb 0.85 0.84 0.82 0.81 0.71 0.75 0.74 Mar 0.86 0.83 0.83 0.79 0.76 0.77 0.76 0.83 0.78 0.80 0.78 0.77 Apr 3.26 2.98 2.90 2.85 2.19 1.80 2.25 Apr 0.86 0.83 May 3.27 3.02 2.90 2.85 2.25 1.77 2.23 May 0.86 0.83 0.83 0.78 0.81 0.75 0.76 Jun 3.21 0.84 3.07 2.95 2.68 2.25 1.75 2.21 Jun 0.83 0.84 0.72 0.79 0.74 0.75 Jul 3.02 3.00 2.53 2.28 1.75 2.20 Jul 0.82 0.86 0.69 0.79 0.73 0.74 Aug 3.03 3.00 2.53 2.33 1.75 2.21 Aug 0.82 0.86 0.69 0.79 0.72 0.75 Sep 3.09 3.02 2.55 2.47 1.83 2.27 Sep 0.83 0.84 0.70 0.81 0.74 0.76 Oct 3.14 2.90 2.75 2.50 1.88 2.31 Oct 0.83 0.81 0.76 0.78 0.73 0.76 Nov 3.15 2.88 2.80 2.50 1.88 2.32 Nov 0.84 0.80 0.79 0.77 0.72 0.76 Dec 3.20 2.88 2.90 2.50 1.88 2.35 Dec 0.85 0.80 0.82 0.76 0.72 0.77 Avg 3.19 3.00 2.93 2.72 2.27 1.78 2.24 Avg 0.85 0.83 0.83 0.76 0.77 0.74 0.75 High 3.27 3.07 3.02 2.90 2.50 1.88 2.35 High 0.86 0.84 0.86 0.82 0.81 0.78 0.77 Low 3.04 2.96 2.88 2.53 1.90 1.65 2.11 Low 0.83 0.83 0.80 0.69 0.70 0.72 0.73 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 107% $3.94 102% $3.58 97% $3.22 92% $2.86 87% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $2.50 '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 9 Veal: 310 Shoulder Clod 14/20-(LTL) The low in the shoulder clod market likely happened back in April at the $5.75/lb. This year’s average price will likely continue the trend of being at a premium to previous year’s high. Strength can be attributed to reduced supplies. MARKET PRICES AND PROJECTIONS $6.40 $5.80 $5.20 $4.60 '09-'13 $4.00 Jan Feb Mar Apr May 13 Jun PROJECTED 14P Jul 14 Aug Sep 15P Oct Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 310 Shoulder Clod 14/20-(LTL) VEAL RATIO: UB Carcass vs UB 310 Shoulder Clod 2015 2014 2013 2012 2011 2010 5-Yr Avg 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 6.12 5.90 5.73 5.43 4.28 3.85 4.60 Jan 1.66 1.65 1.61 1.61 1.57 1.77 1.61 Feb 6.16 5.90 5.73 5.43 4.39 3.85 4.63 Feb 1.66 1.66 1.62 1.57 1.61 1.75 1.61 Mar 6.25 5.76 5.73 5.58 4.50 3.86 4.67 Mar 1.67 1.60 1.64 1.57 1.64 1.65 1.60 Apr 6.30 5.75 5.73 5.63 4.59 3.87 4.69 Apr 1.66 1.60 1.64 1.54 1.67 1.68 1.61 May 6.30 5.84 5.73 5.63 4.60 4.07 4.69 May 1.65 1.60 1.64 1.53 1.65 1.73 1.62 Jun 6.30 5.94 5.73 5.63 4.60 3.99 4.67 Jun 1.64 1.61 1.64 1.52 1.62 1.68 1.61 Jul 6.04 5.73 5.63 4.74 3.95 4.70 Jul 1.64 1.64 1.53 1.64 1.65 1.61 Aug 6.06 5.73 5.63 4.82 3.91 4.69 Aug 1.64 1.64 1.54 1.63 1.61 1.60 Sep 6.08 5.74 5.63 4.87 4.01 4.77 Sep 1.63 1.61 1.55 1.60 1.62 1.62 Oct 6.20 5.83 5.63 5.21 4.08 4.91 Oct 1.64 1.62 1.55 1.63 1.60 1.64 Nov 6.29 5.90 5.65 5.43 4.08 4.98 Nov 1.67 1.64 1.60 1.68 1.56 1.66 6.33 5.90 5.73 5.43 4.13 5.01 Dec 1.68 1.64 1.62 1.65 1.57 1.66 Avg Dec 6.24 5.85 5.76 5.60 4.79 3.97 4.75 Avg 1.66 1.62 1.63 1.56 1.63 1.66 1.62 High 6.30 5.94 5.90 5.73 5.43 4.13 5.01 High 1.67 1.66 1.64 1.62 1.68 1.77 1.66 Low 6.12 5.75 5.73 5.43 4.28 3.85 4.60 Low 1.64 1.60 1.61 1.52 1.57 1.56 1.60 MONTHLY 5-YR SEASONAL FACTOR 107% MONTHLY VEAL CARCASS PRICES $3.94 104% $3.58 100% $3.22 97% $2.86 93% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $2.50 '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 10 Veal: 332 Loin, 4x4 Trimmed 12/18-(LTL) Prices have likely already seen lows for the year and are expected to be steady to slightly higher for the rest of 2014. Supplies will be slightly tighter than last summer's levels, providing price support and probably keeping prices above year-ago levels. MARKET PRICES AND PROJECTIONS $6.40 $6.05 $5.70 $5.35 '09-'13 $5.00 Jan Feb Mar Apr May Jun PROJECTED 13 Jul 14P Aug Sep 14 Oct 15P Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 332 Loin, 4x4 Trimmed 12/18-(LTL) VEAL RATIO: UB Carcass vs UB 332 Loin, 4x4 Trimmed 12/18 2015 2014 2013 2012 2011 2010 5-Yr Avg 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 6.35 6.13 6.20 5.75 5.20 4.30 5.27 Jan 1.73 1.72 1.75 1.71 1.91 1.97 1.86 Feb 6.29 6.13 6.12 5.75 5.11 4.41 5.23 Feb 1.70 1.72 1.73 1.67 1.87 2.01 1.84 Mar 6.24 5.86 5.84 5.75 5.40 4.41 5.21 Mar 1.66 1.63 1.67 1.61 1.97 1.89 1.81 Apr 6.22 5.85 5.75 5.79 5.40 4.51 5.21 Apr 1.64 1.63 1.64 1.59 1.96 1.96 1.82 May 6.32 5.95 5.97 5.80 5.41 4.92 5.30 May 1.66 1.64 1.70 1.58 1.94 2.10 1.86 Jun 6.45 1.68 6.24 6.18 5.93 5.33 5.00 5.35 Jun 1.69 1.77 1.61 1.88 2.11 1.87 Jul 6.17 6.20 6.10 5.14 5.08 5.34 Jul 1.67 1.77 1.65 1.77 2.12 1.85 Aug 6.23 6.20 6.19 5.22 5.10 5.38 Aug 1.69 1.77 1.70 1.77 2.10 1.87 Sep 6.26 6.09 6.29 5.38 5.08 5.40 Sep 1.67 1.70 1.73 1.77 2.05 1.85 Oct 6.30 6.08 6.30 5.55 5.08 5.44 Oct 1.66 1.69 1.74 1.74 1.99 1.83 Nov 6.26 6.13 6.14 5.58 5.17 5.44 Nov 1.66 1.70 1.73 1.72 1.98 1.82 Dec 6.30 6.13 6.15 5.75 5.23 5.49 Dec 1.67 1.70 1.74 1.75 1.99 1.83 6.31 6.03 6.07 5.99 5.37 4.86 5.34 Avg 1.68 1.67 1.72 1.67 1.84 2.02 1.84 High 6.45 6.24 6.20 6.30 5.75 5.23 5.49 High 1.73 1.72 1.77 1.74 1.97 2.12 1.87 Low 6.22 5.85 5.75 5.75 5.11 4.30 5.21 Low 1.64 1.63 1.64 1.58 1.72 1.89 1.81 Avg MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 108% $3.94 104% $3.58 100% $3.22 96% $2.86 92% $2.50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 11 Veal: 334 Leg, Single 35/45-(LTL) Leg values are expected to be about steady through the end of the summer before trending higher. Supplies in some areas are expected to be more readily available in the short term. MARKET PRICES AND PROJECTIONS $6.75 $6.30 $5.85 $5.40 $4.95 '09-'13 $4.50 Jan Feb Mar Apr May Jun PROJECTED 13 Jul Aug Sep 14 Oct 15P Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 334 Leg, Single 35/45-(LTL) 2015 14P 2014 2013 2012 2011 2010 5-Yr Avg VEAL RATIO: UB Carcass vs UB 334 Leg, Single 35/45 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 6.35 6.13 6.15 5.38 4.23 3.85 4.76 Jan 1.73 1.72 1.73 1.60 1.55 1.77 1.66 Feb 6.35 6.13 6.15 5.38 4.23 3.86 4.77 Feb 1.71 1.72 1.74 1.56 1.55 1.75 1.66 Mar 6.47 6.13 6.15 5.44 4.53 4.01 4.87 Mar 1.73 1.70 1.76 1.53 1.65 1.71 1.68 Apr 6.58 6.13 6.15 5.53 4.80 3.96 4.92 Apr 1.74 1.70 1.76 1.51 1.75 1.72 1.70 May 6.65 6.18 6.15 5.65 4.83 4.07 4.95 May 1.75 1.70 1.76 1.54 1.73 1.73 1.72 Jun 6.65 1.74 6.37 6.15 5.65 4.83 4.10 4.94 Jun 1.73 1.76 1.53 1.70 1.73 1.71 Jul 6.33 6.15 5.64 4.83 4.10 4.91 Jul 1.72 1.76 1.53 1.67 1.71 1.69 Aug 6.32 6.15 5.60 4.86 4.10 4.91 Aug 1.71 1.76 1.54 1.65 1.69 1.69 Sep 6.41 6.13 5.67 5.13 4.10 4.98 Sep 1.71 1.72 1.56 1.68 1.66 1.69 Oct 6.46 6.13 5.77 5.13 4.10 4.99 Oct 1.70 1.70 1.59 1.60 1.60 1.66 Nov 6.54 6.13 5.93 5.19 4.10 5.04 Nov 1.74 1.70 1.68 1.60 1.57 1.68 Dec 6.69 6.13 6.15 5.38 4.12 5.14 Dec 1.77 1.70 1.74 1.64 1.56 1.70 6.18 6.14 5.65 4.83 4.04 4.93 Avg 1.73 1.71 1.74 1.58 1.65 1.68 1.69 Avg 6.51 High 6.65 6.37 6.15 6.15 5.38 4.12 5.14 High 1.75 1.73 1.76 1.74 1.75 1.77 1.72 Low 6.35 6.13 6.13 5.38 4.23 3.85 4.76 Low 1.71 1.70 1.70 1.51 1.55 1.56 1.66 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 108% $3.94 105% $3.58 101% $3.22 98% $2.86 94% $2.50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 12 Veal: 348A Leg, TBS 3-Piece 24/32-(LTL) Supplies will tighten into early next year and even though demand will likely be steady going forward, the limited availability will probably result in a higher price trend. MARKET PRICES AND PROJECTIONS $10.85 $10.20 $9.55 $8.90 $8.25 '09-'13 Jan Feb Mar Apr May Jun PROJECTED 13 14P Jul Aug 14 Sep Oct 15P Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 348A Leg, TBS 3-Piece 24/32-(LTL) 2015 2014 2013 2012 2011 2010 5-Yr Avg VEAL RATIO: UB Carcass vs UB 348A Leg, tbs 3-piece 24/32 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 10.37 9.93 9.88 9.60 8.53 8.10 8.99 Jan 2.82 2.78 2.78 2.86 3.13 3.72 3.20 Feb 10.39 9.94 9.88 9.60 8.64 8.10 8.97 Feb 2.80 2.79 2.80 2.78 3.17 3.68 3.18 Mar 10.43 10.00 9.86 9.60 8.84 7.89 8.94 Mar 2.78 2.78 2.82 2.70 3.22 3.37 3.13 10.52 10.00 9.83 9.75 8.98 8.14 9.03 Apr 2.78 2.78 2.81 2.67 3.26 3.53 3.17 May 10.54 10.07 9.83 9.80 8.98 8.17 9.02 May 2.77 2.77 2.81 2.67 3.22 3.48 3.19 2.74 Apr 10.63 9.83 9.67 8.98 8.14 8.92 Jun 2.88 2.81 2.62 3.16 3.43 3.15 Jul 10.42 9.83 9.50 8.98 8.25 8.89 Jul 2.82 2.81 2.58 3.10 3.44 3.12 Aug 10.25 9.83 9.50 9.16 8.25 8.93 Aug 2.78 2.81 2.61 3.10 3.40 3.14 Jun 10.48 Sep 10.08 9.90 9.50 9.23 8.25 8.96 Sep 2.70 2.77 2.62 3.03 3.34 3.10 Oct 10.12 9.93 9.55 9.40 8.25 9.00 Oct 2.67 2.76 2.63 2.94 3.23 3.05 Nov 10.38 9.93 9.61 9.60 8.30 9.05 Nov 2.76 2.76 2.72 2.97 3.18 3.06 10.24 9.93 9.87 9.60 8.38 9.17 Dec 2.72 2.76 2.79 2.92 3.18 3.09 Avg Dec 10.46 10.09 9.87 9.63 9.07 8.18 8.99 Avg 2.78 2.80 2.79 2.69 3.10 3.42 3.13 High 10.54 10.63 9.93 9.87 9.60 8.38 9.17 High 2.82 2.88 2.82 2.86 3.26 3.72 3.20 Low 10.37 9.93 9.83 9.50 8.53 7.89 8.89 Low 2.74 2.77 2.76 2.58 2.92 3.18 3.05 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 104% $3.94 102% $3.58 100% $3.22 99% $2.86 97% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $2.50 '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 13 Veal: 349A Top Round, Trimmed, Cap-Off 8/10-(LTL) Top rounds are expected to dip short term before moving higher into the fourth quarter with a possible modest increase late in the year. Supplies will be tighter during the fourth quarter. MARKET PRICES AND PROJECTIONS $16.25 $15.00 $13.75 $12.50 '09-'13 $11.25 Jan Feb Mar Apr May Jun PROJECTED 13 Jul Aug 14 Sep 15P Oct Nov Dec PROJECTED VEAL RATIO: UB Carcass vs ub 349A Top Round, Trimmed MARKET PRICE: YS Boxed Veal Cuts, 349A Top Round, Trd, Cap-off 8/10-(LTL) 2015 14P 2014 2013 2012 2011 2010 5-Yr Avg 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 15.94 15.00 15.01 13.55 12.50 8.93 12.12 Jan 4.33 4.20 4.23 4.03 4.59 4.10 4.23 Feb 15.99 15.00 15.13 13.55 12.50 9.03 12.12 Feb 4.31 4.21 4.28 3.92 4.59 4.11 4.22 Mar 16.11 15.00 15.09 13.76 12.67 9.21 12.22 Mar 4.30 4.17 4.31 3.86 4.62 3.94 4.20 16.13 15.00 15.03 13.88 12.63 9.43 12.22 Apr 4.26 4.17 4.29 3.80 4.59 4.09 4.22 May 16.11 15.14 14.89 13.96 12.63 9.81 12.15 May 4.23 4.16 4.25 3.80 4.53 4.18 4.21 15.25 14.96 13.92 12.56 10.42 12.23 Jun 4.20 4.14 4.27 3.76 4.43 4.40 4.23 15.32 14.98 13.93 12.45 10.66 12.19 Jul 4.15 4.28 3.78 4.30 4.45 4.19 Apr Jun 16.10 Jul Aug 15.33 14.98 13.93 12.49 11.14 12.24 Aug 4.15 4.28 3.82 4.23 4.59 4.21 Sep 15.48 14.99 14.04 12.85 11.67 12.43 Sep 4.14 4.19 3.87 4.22 4.72 4.22 Oct 15.66 15.00 14.32 13.12 11.95 12.60 Oct 4.13 4.17 3.95 4.10 4.68 4.19 Nov 15.90 15.00 14.68 13.42 12.29 12.80 Nov 4.23 4.17 4.15 4.14 4.72 4.25 Dec 16.01 15.00 14.87 13.55 12.50 12.95 Dec 4.25 4.17 4.21 4.13 4.75 4.27 Avg 16.06 15.07 15.00 14.03 12.78 10.59 12.36 Avg 4.27 4.17 4.24 3.91 4.37 4.39 4.22 High 16.13 15.25 15.13 14.87 13.55 12.50 12.95 High 4.33 4.21 4.31 4.21 4.62 4.75 4.27 Low 15.94 15.00 14.89 13.55 12.45 8.93 12.12 Low 4.20 4.14 4.17 3.76 4.10 3.94 4.19 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 105% $3.94 103% $3.58 101% $3.22 99% $2.86 97% $2.50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 14 Veal: 1312 Osso Buco, Foreshank-(LTL) Supplies are tighter as production continues to decline. Expect some short-term buying opportunities as demand is seasonally slower throughout the summer months. MARKET PRICES AND PROJECTIONS $10.80 $10.00 $9.20 $8.40 $7.60 $6.80 $6.00 '09-'13 Jan Feb Mar Apr May Jun PROJECTED 13 Jul Aug Sep 14 Oct 15P Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 1312 Osso Buco, Foreshank-(LTL) 2015 14P 2014 2013 2012 2011 2010 5-Yr Avg VEAL RATIO: UB Carcass vs UB 1312 Osso Buco, Foreshank 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 9.48 9.38 9.78 7.77 5.30 4.80 6.53 Jan 2.58 2.63 2.75 2.31 1.95 2.20 2.24 Feb 9.67 9.38 9.88 8.03 5.38 5.39 6.74 Feb 2.61 2.63 2.80 2.33 1.97 2.45 2.31 Mar 9.84 9.38 9.97 8.23 5.49 5.59 6.80 Mar 2.62 2.60 2.85 2.31 2.00 2.39 2.30 Apr 9.90 9.38 9.65 8.42 5.81 5.45 6.78 Apr 2.61 2.60 2.76 2.31 2.11 2.36 2.29 May 10.00 9.53 9.65 8.63 5.83 5.35 6.77 May 2.62 2.62 2.76 2.35 2.09 2.28 2.29 2.62 9.68 9.65 8.69 5.82 4.92 6.69 Jun 2.63 2.76 2.35 2.05 2.08 2.25 Jul 9.45 9.65 8.36 5.98 4.85 6.63 Jul 2.56 2.76 2.27 2.06 2.02 2.22 Aug 9.55 9.65 8.48 6.13 4.98 6.71 Aug 2.59 2.76 2.33 2.07 2.05 2.25 Sep 9.56 9.23 8.60 6.50 4.98 6.72 Sep 2.56 2.58 2.37 2.14 2.01 2.23 Oct 9.86 9.21 9.02 6.90 4.98 6.91 Oct 2.60 2.56 2.49 2.16 1.95 2.25 Nov 10.14 9.38 9.32 7.15 5.09 7.10 Nov 2.70 2.60 2.64 2.21 1.95 2.31 Dec 10.45 9.38 9.71 7.60 5.23 7.29 Dec 2.77 2.60 2.75 2.31 1.99 2.36 Jun 10.03 Avg 9.82 9.45 9.59 8.60 6.16 5.13 6.80 Avg 2.61 2.62 2.71 2.40 2.09 2.14 2.28 High 10.03 9.68 9.97 9.71 7.60 5.59 7.29 High 2.62 2.63 2.85 2.75 2.31 2.45 2.36 Low 9.48 9.38 9.21 7.77 5.30 4.80 6.53 Low 2.58 2.60 2.56 2.27 1.95 1.95 2.22 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 114% $3.94 108% $3.58 102% $3.22 96% $2.86 90% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec $2.50 '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information. Market Insight for the Meat and Poultry Industry | Released JULY 2014 | PAGE 15 Veal: 1337 Osso Buco, Hindshank-(LTL) Buying interest is at or near the yearly lows for this item. Expect inquiries to increase near the end of the third quarter and for this increase to continue through the end of the year. MARKET PRICES AND PROJECTIONS $15.00 $13.25 $11.50 $9.75 '09-'13 $8.00 Jan Feb Mar Apr May 13 Jun PROJECTED 14P Jul 14 Aug Sep 15P Oct Nov Dec PROJECTED MARKET PRICE: YS Boxed Veal Cuts, 1337 Osso Buco, Hindshank-(LTL) VEAL RATIO: UB Carcass vs 1337 Osso Buco, Hindshank 2015 2014 2013 2012 2011 2010 5-Yr Avg Jan 13.30 13.13 13.30 10.80 7.78 7.75 Feb 13.50 13.18 13.30 11.13 7.91 7.75 9.61 Feb 3.64 3.70 3.77 3.22 2.90 3.52 3.33 Mar 13.59 13.28 13.11 11.32 8.16 8.40 9.78 Mar 3.62 3.69 3.74 3.18 2.97 3.59 3.35 Apr 9.52 Jan 2015 2014 2013 2012 2011 2010 5-Yr Avg 3.61 3.68 3.75 3.22 2.86 3.56 3.30 13.75 13.28 13.00 11.58 8.41 8.07 9.78 Apr 3.63 3.69 3.71 3.17 3.06 3.50 3.35 May 13.86 13.38 13.27 11.58 8.43 7.72 9.77 May 3.64 3.68 3.79 3.15 3.02 3.28 3.36 Jun 13.50 13.75 11.61 8.43 7.24 9.77 Jun 3.68 3.66 3.93 3.14 2.97 3.05 3.35 Jul 13.31 12.98 11.87 8.74 7.15 9.72 Jul 3.61 3.71 3.22 3.02 2.98 3.32 Aug 13.20 12.75 11.68 8.98 7.15 9.66 Aug 3.58 3.64 3.20 3.04 2.95 3.30 Sep 13.38 12.75 11.93 9.19 7.34 9.79 Sep 3.58 3.57 3.29 3.02 2.97 3.31 Oct 13.80 12.99 12.35 9.64 7.65 10.07 Oct 3.64 3.61 3.41 3.02 2.99 3.33 14.08 Nov 14.22 13.13 12.72 10.26 7.74 10.32 Nov 3.78 3.65 3.60 3.17 2.97 3.41 Dec 14.55 13.13 13.19 10.66 7.78 10.50 Dec 3.86 3.65 3.73 3.24 2.95 3.44 Avg 13.68 13.52 13.12 11.81 8.88 7.64 9.86 Avg 3.64 3.68 3.71 3.29 3.02 3.19 3.35 High 14.08 14.55 13.75 13.19 10.66 8.40 10.50 High 3.68 3.70 3.93 3.73 3.24 3.59 3.44 Low 13.30 13.13 12.75 10.80 7.78 7.15 9.52 Low 3.61 3.66 3.57 3.14 2.86 2.95 3.30 MONTHLY 5-YR SEASONAL FACTOR MONTHLY VEAL CARCASS PRICES 114% $3.94 108% $3.58 102% $3.22 96% $2.86 90% $2.50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec '09-'13 14 Jan Feb Mar Apr May Jun 13 15P 14P Jul Aug Sep Oct Nov Dec Market Insight for the Meat and Poultry Industry © | A publication of Obsono, LLC | 732-240-2349 | P.O. Box 312, Bayville, NJ 08721 While the data contained in this report is gathered from reliable sources, accuracy and completeness cannot be guaranteed. The publisher does not give investment advice or act as an investment advisor. All data, information, & opinions are subject to change without notice. This publication is protected by U.S. copyright laws. Do not copy or redistribute this information.