UNITED BANK LTD- UBL - Internship Report

advertisement

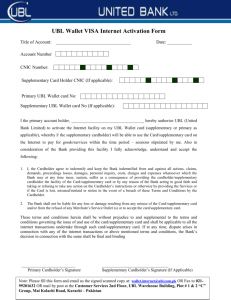

Come & Join Us at VUSTUDENTS.net For Assignment Solution, GDB, Online Quizzes, Helping Study material, Past Solved Papers, Solved MCQs, Current Papers, E-Books & more. Go to http://www.vustudents.net and click Sing up to register. VUSTUENTS.NET is a community formed to overcome the disadvantages of distant learning and virtual environment, where pupils don’t have any formal contact with their mentors, This community provides its members with the solution to current as well as the past Assignments, Quizzes, GDBs, and Papers. This community also facilitates its members in resolving the issues regarding subject and university matters, by providing text e-books, notes, and helpful conversations in chat room as well as study groups. Only members are privileged with the right to access all the material, so if you are not a member yet, kindly SIGN UP to get access to the resources of VUSTUDENTS.NET » » Regards » » VUSTUDENTS.NET TEAM. Virtual University of Pakistan Come & Join Us at www.vustudents.net Acknowledgements By the Grace of Almighty Allah and with the cooperation of entire staff of the branch specifically Branch Manager Mr. Raja Tariq, guided me well enough to prepare this entire report and even during my internship Zahid Hussain Roll No. 07 M.Com_4th(Fiance) Come & Join Us at www.vustudents.net Internship Report TABLE OF CONTENTS • Objectives of Studying the Organization-----------03 • Overview of the Organization - --------------04 • Organizational Structure ------------- 06 • Structure and Function of the UBL ---------------09 • Advances departments • Financial analysis ---------------16 ---------------25 • IT section ---------------29 • Profit & loss Accounts ASP ---------------42 • Balance sheets ---------------44 • Common Size Analysis …………….46 • Ratio Analysis ---------------47 • Financial overview ---------------53 • Strengths ----------------55 • Shortfalls /Weaknesses ---------------58 • Opportunities ---------------59 • Threats ---------------60 • Conclusions ---------------61 • Recommendations ---------------61 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 2 Internship Report OBJECTIVES OF STUDYING UNITED BANK LTD. The main objectives to study in UBL was to gain knowledge about • Personalized banking system. • Domestic saving. • To cope out the rapidly changing environment. • Fully modern and atomized services to their customers. • Acceleration in the commercial activities and capture the large market shares. • The credit requirements of different sectors. • Offer credit to the agriculture sector at a lower rate. • Effective and efficient service among the competitor. • The international trade. • The banking services to urban and rural areas. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 3 Internship Report • Uplift the bank in banking as superior and best banking.Serve commerce and trade community. . OVERVIEW OF THE ORGANIZATION History of banking in Pakistan stands with partition. At the time of independence there were 487 offices of schedules banks in territories now consisting Pakistan. But after the announcement of independence plan, the banking services in Pakistan was seriously suffered the banks transferred their registered offices from Pakistan to India. So, by 30th June 1948, the number of office schedule banks in Pakistan declined from 487 to 195. In June 1959, Mr. Agha Hassan Abedi decided to open a bank different from other to provide modern banking facilities to trade and industry and to promote the habit of saving among common people. Necessary formalities have been compiled for registration certificate to perform business to STATE A\BANK OF PAKISTAN for permission. After all these formalities on 7th November 1959, UBL came in to existence as a schedule bank. Head office was established in New Jubilee Insurance House; I.I.CHUNDRIGAR ROAD KARACHI. It was registered as Joint Stock Company. The bank was incorporated with an authorized capital of Rs.20million, which was later rose up to Rs.96million. Mr.I.ICHUNDRIGAR was its chairman who died in December 1960 and was replaced by Mr.Habib-I-Rehmat. Mian Shafique Saigul was its managing director who was replaced by Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 4 Internship Report Mr.Agha Hassan Abedi in 1962, after nationalized MrA.K Yousaf was appointed as managing director for a short while and later on designated as president; he was replaced by Mr.Aia-ud-din in on 1st January 1997. Progress of this estimated institute could be measured in terms of deposits and number of branches opened. UBL have been ranked as number three banks in Pakistan in terms of deposits and branches. In 1963 first overseas branch was opened in London, in 1966 two branches in Bradford and Birmingham were also opened in 1967 Dubai and Abu Dhabi branches were opened. More important thing is that UBL is pioneer in computerization of banking. Its larger branches are fully computerized. Saving and current deposit art computerized in almost all branches. Now UBL is on the road of growth with reference to market share and network. Br an ch es 1112 Domestic, 17 Overseas Branches Registered Office 13 Floor, UBL Building, Jinnah Avenue, Blue Area Islamabad, Pakistan Head Office State Life Insurance Corp. Building #1, I.I. Chundrigar Road, Karachi, Pakistan P.O. Box No.: 4306 Phone: (92-21) 111-825-111 Gram: "UNITED" Fax: (92-21) 2413492 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 5 Internship Report Organizational Structure Board of Directors President Vice President • Regional Chief---14 ♦ District Managers-----42 Managers------------------1245 Operation Managers----------1245 • Officers--------------------7000 ♦ Clerical staff-------------------- \ Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 6 Internship Report MISSION OF UNITED BANK LTD IS TO BE THE • Leading private sector bank in Pakistan. • With an international presence. • Delivering quality services. • Through innovative technology. • And effective human resource management. • In a modern and progressive organization. • Culture of meritocracy maintaining. • High ethical and professional standards. • While providing enhanced value to our entire stakeholder. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 7 Internship Report VISION TO BE THE WORLD CLASS BANK WHERE YOU COME FIRST Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 8 Internship Report STRUCTURE & FUNCTIONS OF UBL The main Functions of UBL are • Collecting cheques and bills exchange from its customers. • Collecting interest due, divided pensions and other sums to customers. • Transfer of money from place to place. • Acting as an executor, trustee or attorney for the customers. • Providing safe custody and facilities to keep jewelry, documents or securities. • Issuing of travelers chafes to give credit facilities to travel. • Issuing of letter of credit to facilitate imports and exports. • Accepting bills of exchange on behalf of customers. • Purchasing shares for the customers. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 9 Internship Report • Undertaking foreign exchange business. • Furnishing trade information and tending advice to customers. Supervisor Customer Services Two officers are working in Supervisor Customer Services who are providing their services to the customers Mr. Moosa and other is Miss Noshana. These officers perform the following services. UBL has taken progressive steps and has introduced innovative products and services to provide you a variety of banking and financing services. 1. UBL Profit. 2. Business Partner. 3. PLS Term Deposit Receipt. 4. Special Notice Received. 5. PLS Saving Account. 6. Unisaver Account. 7. Foreign Currency Account. 8. Foreign Term Deposit Account. 1. UBL PROFIT • UBL Profit - Certificate of Deposit Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 10 Internship Report Now you can earn a higher income on your surplus cash by investing it in UBL Profit Certificate of Deposit. UBL Profit helps you earn extra income with your hard earned money, while providing absolute trust and security. • Profit on Maturity UBL Profit COD gives you the satisfaction of planning your future by providing a lump sum payment of principal and profit at the time of maturity. • Stable & High Rate of Return Avail one of the best and most stable rates of return by investing in UBL Profit CODs. 2. BUSINESS PARTNER UBL Business Partner is a current account that especially caters to the needs of a businessman by offering the convenience and accessibility of online banking across the country. Features of Business Partner • 350 Online Branches In 71 Cities Now access your account from 71 cities across Pakistan. Our network is growing at an amazing pace and now you can avail services like cash withdrawal, payments, deposit, stop payment, Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 11 Internship Report acquisition of account statement and many more from more than 350 online branches. • 9-5 Non-Stop Banking Banking at your own convenience has been made possible. UBL now offers 9-5 Non-Stop Banking service at more than 450 branches across Pakistan. • Countrywide Instant Cheque Clearance Submit a cheque in one city and get it cleared in another miles away just within minutes. With online banking services, you can get your cheque cleared instantly, without any hassle. • Instant funds transfer Funds transfer was never this easy. Make payments or receive payments within minutes using our online facility. With the introduction of Internet Banking now funds transfer is even made easier and is just a click away. Other benefits*: • Free demand draft, pay order, TT and numerous other banking services. No restrictions on the number of withdrawals and deposits. Free ATM cards allow you to withdraw cash from more than 300 ATM’s Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 12 Internship Report • Anytime. • State of the art Internet Banking services 3. PLS Term Deposit Receipt. If you wish to make a secured long-term investment, UBL’s Term Deposit Receipt is the smart choice, just make an investment and see your deposit grow over time. By investing in UBL TDR’s: • You get an attractive rate of return. • Your profit is credited to your account every six months. • You have the flexibility to choose from a wide range of tenure. • Your investment is secured. • You can avail the Rollover or Renewed option at any time before encashment • You can get your TDR en-cashed at any time before maturity period. • Available Tenures: • One Month • Two Months • Three Months • Six Months • One Year • Two Years Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 13 Internship Report 5. • Three Years • Five Years PLS Saving Account For all you saver’s. If you choose to keep a deposit in a secured savings account, which also gives an attractive rate of return then UBL’s PLS, Savings Account will serve all your financial needs. By keeping your deposits in UBL’s PLS Savings Account you can also avail the following services: • 350 Online Branches In 71 Cities Now access your account from 71 cities across Pakistan. Our network is growing at an amazing pace and now you can avail services like cash withdrawal, payments, deposit, stop payment, acquisition of account statement and many more from more than 350 online branches. • 9-5 Non-Stop Banking Banking at your own convenience has been made possible. UBL now offers 9-5 Non-Stop Banking service at more than 450 branches • across Pakistan Countrywide Instant Cheque Clearance Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 14 Internship Report Submit a cheque in Karachi and get it cleared in Peshawar within minutes. With online banking services, you can get your cheque cleared instantly, without any hassle. • Instant funds transfer Funds transfer was never this easy. Make payments or receive payments within minutes using our online facility. With the introduction of Internet Banking now funds transfer is even made easier and is just a click away. 6. UNISAVER ACCOUNT UBL Unisaver Account is an innovative way of serving your banking needs. Be it trade, business or personal finance, the UBL Unisaver allows you maximum flexibility, yet gives you optimum returns. Special Features • Daily Profits on your daily balance • Higher returns on higher balances • Attractive rate of return • Backed by the bank awarded AAA Credit Rating 7. FOREIGN CURRENCY SAVING ACCOUNT Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 15 Internship Report If you wish to maintain a secured foreign currency savings account then UBL is the safest bet. By opening a UBL foreign currency savings account: • You get to choose from different range of currencies i.e. US Dollar, British Pound, and Euro etc. • You can avail different attractive rates depending on the currency you choose. 8. FOREIGN TERM DEPOSIT ACCOUNT If you wish to make a secured long-term foreign currency investment, UBL’s Foreign Currency Term Deposit Receipt is a smart choice, just make an investment and see your deposit grow over time. By investing in UBL TDR’s: • You get to choose from different range of currencies i.e. US Dollar, British Pound, and Euro etc. • You can avail different attractive rates depending on the currency you choose. • You get the pleasure of availing the best rate of return in the market. This is what you call value for money. UBL BASIC BANKING ACCOUNT – BBA To accommodate the banking needs of low income groups, United Bank Limited is pleased to launch the UBL Basic Banking Account Scheme (UBL BBA) from February 25, 2006 across its branch network all over Pakistan. This is primarily aimed toward helping the low income group to benefit from the banking services without having the pressure to maintain specific balance amount with the banks. Find below basic product features of the Product: Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 16 Internship Report ADVANCES DEPARTMENT Financing is the major source of income of UBL, its loans remains approximately two times of its deposits. Driven by considerable growth in the local credit market and UBL’s ability to offer competitive rates, the bank’s loan portfolio registered a considerable increase during 2004, capturing 8.6% of the domestic market share of advances. UBL deals with different kinds of loans for different sectors. The following are the products of its advances. 1. UBL Money 2. UBL Cashline 3. UBL address 4. UBL Drive 5. UBL Small Business Scheme 6. Agricultural Finance 1. UBL MONEY UBL Money, the Personal Installment Loan from UBL provides you with power, control, convenience and the flexibility to manage your financial requirements and realize your dreams. UBL Money is a fixed installment loan. It gives you access to funds starting from Rs. 50,000/- up to a maximum of Rs. 500,000/- without any collateral. Features of UBL Money • Flexibility Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 17 Internship Report UBL Money provides you the flexibility to manage your monthly installments according to your income stream. You can select any tenor from 1 to 5 years in the multiple of 6 months. • Payment Options You have the option of getting a Pay Order or transfer to an existing UBL account, Balance Transfer Facility for Credit Cards, or any other loans. • Exciting Features -Zero-prepayment penalty option -Complimentary Credit Insurance -Competitive mark up Repayment options You can pay your installments through a Repayment Account at designated branches. This is not feasible to show because this not execute till now in Bahawalpur. Eligibility Criteria You are eligible if: • You are within the age bracket of: For salaried individuals 21-60 years For self employed or Businessmen 21-65 years Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 18 Internship Report • Your monthly gross income is For salaried individuals Rs. 10,000/- For self employed or Businessmen Rs. 25,000/- • You have been: Employed for the last 6 months or have been in business for the last 3 years. • You can use UBL Money to: Pay off your credit card balance Finance your child's education Buy home accessories Finance your vacations Buy anything you wish Getting UBL Money is very easy. Just follow the simple steps: • Fill the UBL Money application form • Attach a copy of your CNIC and your proof of income a) A Salary slip if you are a salaried employee b) A Tax document / Bank Statement if you are self employed • Hand the application form along with your documents to any UBL Money sales staff Member 2. UBL CASHLINE Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 19 Internship Report Have you ever wished for a loan that was flexible enough to be used anywhere, anytime, and as many times as you wanted? UBL introduces Cash line – the most flexible loan, providing you up to Rs. 500,000/- the perfect solution! Features of the CashLine • Flexible • Convenient • Cheque Book • ATM/Debit Card • Net Banking • Funds Transfer • Online Bill Payments • Balance Transfer Facility How can you get Cashline? If you are: • A salaried person of 21 to 60 years, and your monthly net salary is Rs. 10,000 Or • A self employed business person/professional between the ages of 21 to 65 years, and your monthly net take home income is Rs. 25,000 3. UBL ADDRESS Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 20 Internship Report You have always dreamt of having a permanent address. Now you can turn your dreams into reality with UBL Address- the unique offering that makes you the owner of your home while remaining within your limited income. UBL Address understands your home financing needs and offers you a variety of fixed, floating and adjustable rate options-because at UBL, where you come first. Features of UBL Address • Fixed Rate for 20 years Fix your repayments for 20 years today. The fixed markup rate gives you peace of mind and allows you to plan your cash flows better. • Mark-up Monthly, Principal Annually (20 years) For the first time tin Pakistan, UBL address provides an alternative to high monthly rentals by offering a flexible repayment option to suit your cash flows. Pay only markup for 11 months every year. Pay 5% of principal along with the markup in 12th month every year. Enables a fast principal repayment and hence lowers total markup over life of the loan. Installment reduces every year. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 21 Internship Report Example on the loan of Rs.1000000 your annual principal repayment will be Rs. 50,000 while you will only pay the markup as monthly installment. • Pay As You Select (PAYS) In addition to normal financing, UBL address offer you the facility to design your own repayment plan to suit your present and future expected cash flows. • PAYS_UP (10years, to 15 years PAYS_UP allows you to start with low installments that increase every year. For example, on a 15 year loan of RS. 1,00,000 your monthly installment will begin from Rs. 9270 in year one and will rise to Rs. 15679 in year fifteen. • PAYS_Down (10years, to 15 years) PAYS_Down (10 years, to 15 years allows you to pay higher installments initially, with installments reducing in subsequent year. No pre-payment penalty after the initial 3 years. For example, on a 15 year loan of Rs.1, 000,000 your monthly installment will begin from Rs. 12,652 in year one and will fall to Rs. 9631 in year fifteen. Floating Rate In this option, you get a fixed rate for a period of 12 months that gets re-priced annually. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 22 Internship Report 4. UBL DRIVE UBL Drive is a unique auto-financing product, which offers you features, options and flexibility unmatched by any other bank, because at UBL, You come first. Types of Finance 1. New Car Financing UBL Drive allows you to drive away in your own car by making a down payment of just 10% and to top that with low monthly installments. 2. Used Car Finance With UBL Drive you can buy your favorite used car (up to 5 years old) at the most affordable rates. 3. Cash Your Car UBL Drive is the quick and hassle free route to the car of your choice. Offering you for the first time in Pakistan, No Down Payment and processing charges till your application is approved. After approval, you can take your Purchase Order to any of our authorized dealers, pay the Total Cash Outlay amount and simply drive away with your preferred car. • Feauture Car Tracking Device Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 23 Internship Report Insurance Options • Process Charges A processing charge of Rs. 4,000 will apply. 5. SMALL BUSINESS SCHEME / BUSINESSLINE Introduction UBL Businessline… a complete solution to all your Business Financing needs. With UBL Business Financing facility, you can now take your business to greater and newer heights, and achieve the level of success that you truly deserve. UBL Businessline is a running Finance facility that not only provides funds for growth but also enables you to capitalize on profitable opportunities. With UBL Businessline, now you will surely say: "Ab Hui … Kamiyaabi Meri Manzill'. If you have a small or medium-sized business, UBL can assist you with the right mix of banking services that will help you manage and grow your business. Our experts will facilitate you in the varied financial situations that you come across. We will respond to your needs promptly because we understand how much your customers, your employees and YOU depend on us Eligibility Criterion: If you fall in the following criteria, then UBL Business line is just the right choice for you • Minimum monthly income: Rs. 25,000 and above Age: 25– 65. Resident: Pakistani. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 24 Internship Report • Self-Employed Professional / Self-Employed Businessman. 6. UBL AGRICULTURAL FINANCING / INPUT FINANCING UBL's agricultural loans on easy terms and conditions to small-scale land owning farmers boost the country's economy and yield greener harvests. UBL enables farmers to buy good quality seeds, fertilizers, pesticides and agricultural implements. Through the Government's Loan Schemes for Haris, UBL lets your crops prosper and your dreams materialize, making Pakistan's economy stronger. Agricultural loaning is an art or science of business, which deals with productions of Crops and rearing of birds and animals to meet the basic necessity of life that is food cloth and shelter. Sources of Funds The only and strong sourcing of financing agricultural loans is banks own deposits and income receiving from its investment. Type of Financing There are three types of financing which are as follows…. • On the basis of Time Period Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 25 Internship Report Short-Term Loans (for 1 to 1 and half year). Medium-Term Loans (for 1 and half year to 5 years) Long-Term Loans (6 years and onward) • On the Basis of Utilization Production Loans are normally short-term Loans. This type of Financing is for the purchase of seeds, fertilizer, labors, and Food for animals etc. Development Loans are normally medium-term and long-term loans. This type of financing is for the purpose of purchase of Tractors, Tubwells, godowns, storage houses, bulldozers, land labeling, agri Equipments or any material for the construction of poultry form or fish Form etc. • On the Basis of Land Utilization Form Loans are for the purchase of seeds and Tubwells, in this type it should be necessary that land should utilized. Non-Form Loans are for the purchase of those things, which cannot utilize the land diary form, fishing form and pottery from etc. • On the basis of Limit Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 26 Internship Report Demand Finance is for the production loans, which should be renued every year it can be for 3 to 7 years. Cash / Running Finance is production loans it is fixed for 3 years not will be renued. Criteria of Financing The following persons are fallowing in the criteria financing for agri loans. • On the basis of land holding Subsistence holding are those who holds 12 and half acre and blew. Economic holding are those who holds 12 and half acres to 50 acres. Above economic are those who hold above 50 acres land. 80% landlords fall in the first category, 50% loans of 50% given To subsistence holding according to state bank of Pakistan for Production purposes. • On the basis of cultivation Owner’s cultivators are those who is cultivating their own land. Owners and tenant cultivators are those who cultivate their own as well others on lease. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 27 Internship Report Tenant cultivators are those who cultivate only leased land. Terms and condition • The person should not be defaulter of any bank. • He should himself be cultivator. • Satisfactory track record. • The security should be insured. • Copies of NIC of party and his witnesses • Two photographs of party • No objection certificate from that area Financial intuitions • If loan is above 5 lac then CIB report should clear. • Prof of cultivation. • Security as per requirement. • IB 7 (Islamic Banking). • Letter of continuity for running finance. • Letter of hypothecation (delivery). • Charge creation certificate. • Naqal intacal. Securities acceptable • Agricultural land possiton will remain to the party. • Any urban or roller property with the name of party. • Gold and Silver etc. • Liquid Securities like saving certificate, bonds, shares and TFC’s. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 28 Internship Report • Any other Securities, which is acceptable according to rules of UBL. • Personal guaranty of two persons. • Hypothecations of property. Sanction Limits For productions Sugarcane per acre Rs 16,000 Cotton per acre 10,000 Wheat per acre 6,000 Rice per acre 6,000 Rate and limits can vary area to area. For Development The person should bring quotations of the thing for which he is approving loans from three authorized dealers. It is in the option of the bank that which one is accepted, one of them should be acceptable. After accepting the quotation bank can sanction one these debt equity ratio 90:10, 80:20 and 75:25. Markup Markup is vary from property to property upto 18% its internal and plus KIBOR. Repayment Schedules Demand Finance for productions purposes paid at maturity. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 29 Internship Report Demand Finance for Development repay on the basis of installments on quarterly, half yearly an yearly on the will of party after judging his cash flow. Cash Finance for production should clean up for 3 days at any time once in a year, there is no renewal of documents. Markup is charge on daily product basis. Foreign Exchange and ATM Dealer In this department Mr. Muhammad Fazal is working and providing foreign exchange and ATM services. Dealing of Foreign Exchange The following instruments are used in term conversion of foreign exchange. 1. Money Gram 2. Taz Raftar Cheaques 3. Hamrah 1. MONEY GRAM The Money Gram money transfer service was started in 1988 by integrated Payment Service a US based division of First Data Corporation (FDC), a data processing company. At that time, American Express owned FDC. In 1996,Money Gram Payment System Inc was floated on the New York Stock exchange. Money Gram Payment System is based in Denver USA. There is call center located there; it handles transactions for all non-automated agents and answers queries from Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 30 Internship Report customers on a 24-hour hotline. Money Gram has a world -wide agent base of over 29,000 agents, which allows customers to transfer funds around the world within minutes in over 130 countries. The Money Gram service will enable our customers to send and receive funds in 10 minutes. Money Gram is a 10-minute person-to-person money transfer service, which is quick and reliable and allows customers to send money worldwide. Benefits of Money Gram • Reliable and secure service An extensive network of Money Gram agents, linked by computers around the world, ensures that our customer's money is transferred safely. Thousands of people already use the Money Gram service every day, taking advantage of the extensive Money Gram equality agent network. • Fast and convenient In just 10 minutes, customer's money can be in another continent, ready and waiting to be picked up at once of the many Money Gram agents. Over 29000 agents in more than 125 countries are linked worldwide to make sure that money is transferred without delay. There are no complicated procedures and there is no requirement for a bank account or credit card. Value for money Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 31 Internship Report Money Gram offers a fast, safe; service at highly competitive rates MoneyGram is the cheapest money transfer service available to customers. • Free message service An added personal touch with every transaction you send, customers can include a 10-word message at no extra cost. 2. TEZRAFTAAR Free Doorstep Remittances With-in the country or from abroad, UBL offers the most efficient and price competitive service. With our large network of branches, we are poised to offer you service almost at your doorstep. UBL's new remittance service, TezRaftaar offers all overseas Pakistanis the fastest and the most convenient delivery of their money to their beneficiaries in Pakistan. Best of all, TezRaftaar is completely cost free and is available at all UBL branches along the Bank's Network in the Middle East, UK and US. Benefits of TezRaftaar • Fastest delivery to your given address in Pakistan • Doorstep delivery by authorized courier or credited to the recipient's account. • Free of charge transfer service. • Open to all including those who are not UBL account holders • Complete reliability of transaction 3. HAMRAH Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 32 Internship Report We Are Now Offering Denominations Up To Rs. 10,000 Only UBL has always been at the forefront in identifying and meeting the financial needs of its valued customers. UBL was the pioneer in introducing Rupee Travelers Cheques facility in Pakistan, as early as 1971. In continuation of the same tradition, UBL in the shape of "Hamrah" Rupee Travelers Cheque enhances this facility for the convenience of its valued customers by offering denominations up to Rs. 10,000. UBL "Hamrah" has been designed keeping in mind, both convenience and security - be it business, property, trade or personal needs. "Hamrah" Rupee Travelers Cheques are the ideal and safest way of carrying cash when traveling anywhere in Pakistan. Hamrah RTC's are now accepted at more than 2000 places such as hotels, shops, real estate agents, jewelers, car dealers, etc and of course at all our UBL branches. UBL has a 24-Hours customer help-line, providing its customers with round the clock tele-verification of "HAMRAH" travelers’ cheques. Benefits of Hamrah • Absolutely FREE - No Bank Commission, No Excise Duty: Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 33 Internship Report Whatever the value of "Hamrah" purchased, no Bank Commission or Excise Duty will be charged. • Denominations: Available in denominations of Rs. 10,000 and Rs. 5,000. • Easily transferable and encashable: At any of the large network of designated UBL Branches, countrywide. Transferable/encashable through a single signature • Available to all: Holding an account with UBL not mandatory for availing this facility • Ease of immediate assistance in case of loss or theft: Just dial "Hamrah" Hotline UAN for assistance 111-111-825 or contact nearest designated UBL Branch. • Special facility of refund: Indicate choice of designated UBL Branch for refund, which will be within days only. Most convenient while in transit anywhere in Pakistan Dealing of ATM ATM card ubl wallet Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 34 Internship Report UBL wallet ATM/Debit card is all the convenience and security you desired and the quality you deserve. This wallet holds all the cash in your bank account. With UBL wallet you can withdraw cash at ATM’s any time or make cash less purchases at outlets though\rough the debit card facility. With no joining fee and an accompanying complimentary cardholder for your convenience, UBL Wallet has been designed to exhibit the best in features and facilities, as well as look & feel. Because at UBL, you come. Salient Features • All the Cash you need UBL is the only bank that offers the ATM and Debit Card facility to all account holders at all UBL branches, regardless of whether their branch is online or offline • Nine supplementary Cards UBL Wallet also gives you the facility of having up to 9 supplementary cards issued against one primary card. All supplementary cardholders will be able to conduct ATM/Debit transactions and will share the transaction limits of the primary card account. • 24 X 7 Tool-free Contact center UBL's dedicated staff is at your service 24 hours a day, 7 days a week. You can call our contact center at 0800-11-825 (Toll-Free), or Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 35 Internship Report you can simply pick up the telephone placed next to every UBL ATM and be instantly connected to our customer service representative via a hotline. • UBL Wallet your ATM Card ATM Network: UBL already has its own network of 53 ATMs, which continues to expand by the day. Moreover, UBL Wallet is part of the 1-Link switch, which is a fast expanding ATM network of more than 12 banks. This allows you to use your UBL Wallet across Pakistan at more than 300 ATMs • Funds Transfer UBL Wallet allows three kinds of instant funds transfers through UBL ATMs from your UBL account: Into any of your UBL accounts. Into any pre-linked UBL account.Into any other UBL account. • Human Assistant For the first time in Pakistan, selected UBL ATMs feature a Virtual Human Assistant, who guides you in conducting your ATM transactions. • Security Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 36 Internship Report Your UBL Wallet functions on a PIN (Personal Identification Number) based system, ensuring complete security of your transactions. • Mini Statement Get a printed statement of your account that shows all recent transactions. • Fast Cash Swiftly withdraw your desired amount by selecting from one of the options of preset denominations. UBL Wallet your Debit Card With UBL Wallet as your Debit Card, you can shop all you want, eat all you can, or fill up your car tank without carrying any cash. Simply use your UBL Wallet for direct debit from your bank account. The Debit Card facility is being offered in association with the Orix network, which offers connectivity at more than 1600 outlets across the country. You can use your UBL Wallet to conduct a debit transaction at any outlet in Pakistan that displays the Orix logo. Your debit transactions are safe and secure, since only you are aware of your Personal Identification Number (PIN). A debit transaction is conducted only when you type your PIN into the Point of Sale (POS) terminal located at the retailers' premises. Annual Fee (Rs.) Card Type Gold • Primary Supplementary 500 250 Daily Limits (Rs.) ATM Debit Funds Withdrawal 40,000 Card 100,000 Transfer 500,000 Attested copy of NIC. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 37 Internship Report • Copy of FIR. RTC department is immediately in formed about the lost RTC, so that caution is marked. The branch officer after verification of genuineness of the case and proper identification will send the case duly recommended. Lost RTC number will be circulated through lost RTC bulletin, the claim will be settled in cash or credit to part’s account. Refund in lieu of lost RTC Rs.300 per application. Furthermore two services are also performed by these officers, which are as follows. • Outward Banking Collection (OBC) • Interbank Credit Advice (IBCA) Types of Cheques Cheques collected by clearing department are of three type: 1. Transfer cheques 2. Transfer delivery cheques 3. Clearing cheques Transfer Cheques Which are collected and d paid by the same branch of the bank. Transfer Delivery Cheques Which are collected and paid by two different branches of a bank situated in the same city. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 38 Internship Report Clearing Cheques When the payee or endorsee (which deposits the cheques for collected), and the drawer of cheques maintain accounts with different bank, the collecting bank can receive the amount of cheques from the paying bank in any of the following manner: It can send its representative to each of the paying to collect the amount of cheques. But this procedure is risky and wasteful of time and labor. It can maintain accounts with various paying banks. Functions of the Clearing Deptt. • To accept transfer, transfer delivery and clearing cheques from the customers of the • Branch and to arrange for their collection. • To arrange the payment of cheques drawn on the branch and given for collection to • Any other branch of UBL or any other member or submember of the local clearing House. • To collect amount of cheques drawn on members or sub-member of local clearinghouse, sent for collection by UBL branches not represented at the local clearinghouse. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 39 Internship Report Cash Department Mr. Javad Ahmad and Mr. Iqbal are working in this department as cash supervisor and cashier. They are performing following functions. 1. Cash Related 2. Unrelated with Cash 1. CASH RELATED The following are the function with is related to cash. • Collection of debit slip. • Receiving of utilities Bills. • Balance of Cash available at day end with total received. • Proper send the cash to the regional office or any where at the instruction of head office. 2. UNRELATED WITH CASH Mainly related to bills entry, BILLS are auto of charges from the seller to buyer. Bills department performs the function of collection of these bills. It is of two types: • Clean collection • Documentary collection Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 40 Internship Report 1. Clean collection Collection of financial document not accompanied with commercial & transport documents is called clean collection e.g. collection of cheques demand drat, dividend bill of exchange promissory note etc Procedure Suppose our client brings a cheque of habib bank LAHORE for collection. UBL Fared gate branch will endorse it to ubl main branch Lahore, through special crossing. That branch must be the clearing agent and after clearing from stat bank following entries will be passed. State bank account Dr Head office account Cr Then that branch will inform us through intimation, and bank will pass the following entries after paying the party; Head office account Dr Party account credit Cr If instead of some there banks the cheques is of some branch of UBL, Lahore then there e no need of clearing. The entries passed by bank that branch will be Party account Dr Head office account Cr And after receiving intimation bank will pass the entries like; Head office Party account Dr Cr Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 41 Internship Report 2. Documentary / Inward bills for collection The collection of out station cheques of our own branches or that of other bank. Procedure Suppose a transaction is carried between is seller accountholder of Habib Bank Lahore and a buyer, account holder UBL Bahawalpur. Buyer paid the seller through cheques. Seller gives cheques for collection to Habib Bank Lahore; they endorse it to Habib Bank main branch Bahawalpur through special crossing. HBL Bahawalpur sends it to UBL main branch Bahawalpur through clearing this OBC for HBL Bahawalpur. We (payee) will pass the following entries; Party A/C Dr State Bank A/C Cr And send intimation to HBL Bahawalpur and this bank will pass the following entry. State Bank A/C Dr H O A/C Cr And HBL Lahore (collecting agent) will pass this entry. H O A/C Dr Party A/C Cr Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 42 Internship Report UNITED BANK LIMITED PROFIT & LOSS ACCOUNT AS AT DECEMBER 31,2008 (Rupee in 000) 2008 2007 2006 Mark-up / return / interest earned 9,233,881 8,944,260 11,020,035 Mark-up / return / interest expense 1,732,760 1,888,349 5,379,435 7,501,121 7,055,911 5,640,600 435,41 4444,871 851,958 (100,381) 104,871 (160,289) 3,841 12,897 47,904 Provision against non-performing loans an advances Provision for diminution in the value of investment Bad debts written off directly 338,874 562,053 739,573 Net mark-up /return/interest income after provision 7,162,247 6,493,858 4,901,027 NON MARK-UP/ INTEREST INCOME Fee, commission and brokerage income 1,654,475 1,442,642 1,351,147 Dividend income / gain on sale of investments 1,102,510 2,057,314 414,881 Income from dealing in foreign currencies 668,085 436,656 1,051,778 Other income 981,154 607,500 454,313 4,406,224 4,544,112 3,272,119 11,568,471 11,037,970 8,173,146 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 43 Internship Report NON MARK-UP / INTEREST EXPENSES Administrative expenses 6,702,709 6,153,913 5,390,233 Other provision / write offs / (reversals) (34,422) 551,840 Other charges Total non mark-up / interest expenses Extraordinary items PROFIT BEFORE TAXATION Taxation - Current 10,456 6,678,743 4,889,728 283,083 - Prior year(s) 285,201 - Deferred 619,900 1,188,184 5,501 27,353 24,252 6,711,254 5,441,838 - - 4,326,716 2,731,308 193,050 195,871 223,070 18,701 1,274,978 1,102,420 1,691,098 1,316,992 PROFIT AFTER TAXATION 3,701,544 2,635,618 1,414,316 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 44 Internship Report UNITED BANK LIMITED BALANCE SHEET AS AT DECEMBER 31,2008 (Rupee in 000) ASSETS 2008 Cash and balances with treasury banks 2007 2006 23,844,435 17,274,461 15,649,561 Balance with other banks 17,699,334 11,386434 9,985,788 Lending to financial institutions 16,262,504 23,096,028 3,627,557 Investments 54,953,728 56,516,760 69,244,328 Advances Performing 144,806,581 92,513,736 Non-performing 6,118,006 3,611,442 67,355,236 5,452,870 Other assets 4,393,852 3,001,793 3,636,065 Fixed assets 3,969,006 3,754,236 2,710,892 45,728 283,171 314,712 Taxation recoverable Deferred tax asset-net 5,194,89 5,486,357 5,026,457 272,612,663 216,924,418 183,003,466 LIABILITIES Bills payable 3,811,284 Borrowings from financial institution 2,975,910 1,832,981 11,975,684 7,710,375 5,347,349 Deposits and other accounts Sub-ordinate loans 230,256,627 185,071,502 158,263,495 3,500,000 - - Liabilities against assets subject to finance lease Other liabilities 288 39,995 81,548 3,513,569 4,541,704 5,544,441 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 45 Internship Report Deferred liabilities 2,191,180 1,535,059 861,935 255,248,632 201,874,545 171,931,749 17,364,031 15,049,873 11,071,717 NET ASSETS ----------Share capital 5,180,000 ---------- --------- 5,180,000 5,180,000 Reserves 5,915,928 4,678,317 4,243,352 Unappropriated profit/ loss 3,274,439 1,384,490 (797,100) 14,370,367 11,242,807 8,626,252 Surplus on revaluation of assets 2,993,664 3,807,006 2,445,465 17,364,031 15,049,873 11,071,717 ---------- ---------- Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net --------- 46 Internship Report Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 47 Internship Report United Bank Limited Balance Sheet Common Size Analysis Rs in '000 Assets 2008 Common size (%) 2007 2006 2008 2007 2006 Cash/Bal. With Banks 23,844,435.00 17,274,461.00 15,649,561.00 8.75 7.96 8.55 Bal.with other banks 17,699,334.00 11,386,434.00 9,985,788.00 6.49 5.25 5.46 lending to F.Is 16,262,504.00 23,096,028.00 3,627,557.00 5.97 10.65 1.98 Investment 54,953,728.00 56,516,760.00 69,244,328.00 20.15 26.05 37.84 144,806,581.00 92,513,736.00 67,355,236.00 53.11 42.65 36.8 Advances-Non performing 6,118,006.00 3,611,442.00 5,452,870.00 2.24 1.66 2.98 Other Assets 4,393,852.00 3,001,793.00 3,636,065.00 1.61 1.38 1.99 Fixed Assets 3,969,006.00 3,754,236.00 2,710,892.00 1.46 1.73 1.48 45,728.00 283,171.00 314,712.00 0.02 0.13 0.17 Advances-Performing Taxation recoverable Deferred Tax Assets-net Total Assets 519,489.00 5,486,357.00 5,026,457.00 0.19 2.53 2.75 272,612,663.0 0 216,924,418.00 183,003,466.00 100 100 100 3,811,284.00 2,975,910.00 1,832,981.00 1.5 1.47 1.07 11,975,684.00 7,710,375.00 5,347,349.00 4.69 3.82 3.11 230,256,627.00 185,071,502.00 158,263,495.00 90.21 91.68 92.05 1.37 0 0 Liabilities B/Payables Borrowings from financail ins. Deposits & othes account Sub-ordinate loans Liabilities againest assets subj. To F.L 3,500,000.00 288.00 39,995.00 81,548.00 0 0.1 0.05 Other Liabilities 3,513,569.00 4,541,704.00 5,544,441.00 1.38 2.25 3.22 Deffered Liabilities 2,191,180.00 1,535,059.00 861,935.00 0.86 0.76 0.5 255,248,632.00 201,874,545.00 171,931,749.00 100 100 100 Share Capital 5,180,000.00 5,180,000.00 5,180,000.00 29.83 34.42 46.79 Reserves 5,915,928.00 4,678,317.00 4,243,352.00 (797,100.00 34.07 31.09 38.33 Unappropriate Profits/Losses 3,274,439.00 2,993,664.0 1,384,490.00 3,807,006.0 18.86 9.19 -7.19 17.24 25.29 22.09 100 100 107.19 Total Liability - - Shareholder's Equity Surplus on revaluation of assets 0 Total 0 0 17,364,031.0 ) 2,445,465.0 0 15,049,873.0 0 11,071,717.0 0 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 48 Internship Report UNITED BANK LIMITED RATIO ANALYSIS 2008 2007 2006 BANKS SPECIAL Earning Assets to Total Assets 95.01% 94.23% 93.61% Return on Earning Assets 1.43% 1.26% 0.83% Equity Capital to Total Assets 6.37% 6.94% 6.05% 93.63% 93.06% 93.95% 14.70 13.41 15.53 4.12% 4.00% 10.32% 10.33% SOLVENCY RATIOS Debt Ratio Debt-equity Times ACTIVITY RATIOS Total Asset Turnover Ratio 3.39% Operating Asset Turnover Ratio 10.25% PROFITABILITY RATIOS Net Profit Margin Return on Investment 40.09% 29.47% 12.83% 3.77% 4.66% 3.95% Return on Equity 21.32% Return on Assets 1.36% 17.51% 12.78% 1.21% 0.77% Earning Per Share Rs. 7.15 5.09 0.60 Current ratio 1.52 1.04 1.03 Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 49 Internship Report Earning Assets to Total Assets 95.50% 95.00% 94.50% 94.00% 93.50% 93.00% 92.50% Earning Assets to Total Assets is increasing trend. In 2008 it become almost double of 2006. Which shows that bank is investing in earning asset rapidly. From 2006 to 2008 the total assets and earning asset in amount also increased which show bank’s strength. Return on Earning Assets 2.00% 1.50% 1.00% 0.50% 0.00% 2008 2007 2006 Return on Earning Asset is in increasing trend. Banks strategy about to increase its earning asset becomes successful. But the proportion of increasing of return on earning assets is lesser than the increase of earning assets to total assets. If bank concentrate to increase the return of earning asset, it can increase. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 50 Internship Report Equity Capital to Total Assets 7.50% 7.00% 6.50% 6.00% 5.50% Equity Capital to Total Asset is increase 2006 to 2007 little bit but it become decrease in 2008 but this decrease is lesser than the proportion of increase. In 2007 the Total Equity was higher than the 2006 and 2008. It may be call back its shares or its profit become low in 2008 due to which this ratio become decrease. Debt Rati o 94.20% 94.00% 93.80% 93.60% 93.40% 93.20% 93.00% 92.80% 92.60% Debt Ratio is decrease in 2007 but it become increase in 2008, this increase is lesser than the decrease. This ratio shows that in 2007 the bank pay its liabilities or its asset become decrease and in 2008 its total liabilities increase as compare to total Assets, which shows that other interested partied want to built their relationship with UBL Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 51 Internship Report Debt-e quity Times 16 15.5 15 14.5 14 13.5 13 12.5 12 Debit/equity Time decrease in 2007 but increase in 2008, which shows that in 2007 bank have pay its debts and rise its equity but in 2008 once again its liabilities increase to 14.70 time of its equity which is favorable for the bank. This ratio show the relationship of the other interested parties with this bank especially creditors. Total Asset Turnover Ratio 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Total Asset Turnover increase in 2007 very little bit but it becomes decrease in 2008, which is not so favorable. This ratio indicates that the proportion in the turnover is not sufficient as the amount of total asset increase it should be necessarily that turnover increased. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 52 Internship Report Operating Asset Turnover Ratio 10.35% 10.30% 10.25% 10.20% Operating Asset Turnover is in decreasing trend this trend is not favorable which shows that increase in the turnover is not according to the increase of the operating so participating in turnover of the operating asset is little bit. UBL should control its operating cost. Net Profit Margin 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% Net Profit Margin is increasing trend, which is favorable for the UBL This ratio shows that a great achievement is happening from 2006 to 2008 in its net profit margin. Great achievement to control its expenses and increase its other income. This shows that the administrative department is working well. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 53 Internship Report Return on Investment 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Return on Investment is increase in 2007 but it become decrease in 2008, decrease is grater than the increase this is unfavorable trend for the UBL in 2008. Because the investment is not giving return as well as is should. So it is not profitable to invest in investment it will be better for the bank to invest to other Asset, which give grater return. Return on Equity 25.00% 20.00% 15.00% 10.00% 5. 00% 0. 00% Return on Equity is in increasing trend, which is favorable for the UBL. The decision about to maintain equity weither to increase or decrease becomes successful because it proportion going increase year to year. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 54 Internship Report Return on Assets 1.60% 1.40% 1.20% 1.00% 0.80% 0.60% 0.40% 0.20% 0.00% Return on Asset in increasing trend, which is favorable for the UBL. The strategy about the whether to increase or decrease remain Earning Per Share Rs 8 7 6 5 4 3 2 1 0 successful because the proportion going to increase year to year. Earning Per Share is in increasing trend, which is favorable for the UBL. Great achievement is from 2002 to 2008, which is almost 6time increase. This ratio shows that the right decision about the Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 55 Internship Report number of shares floating in the market, and proper management Current ratio 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 regarding controlling of expenses. After this the company become eligible to pay dividend to its shareholder. Current Ratio is in increasing trend, which is favorable for the UBL. This ratio shows that the bank have much liquidity to pay its shortterm debts with in shorter period of time. The bank has achieved to increase its current asset over current liabilities. It shows the good credibility of the Bank. Economic outlook Pakistan economy is on the constant growth trajectory achieving highest growth level in the last five years, however, the build up of inflationary pressures are posing some concern. The real GDP growth rate for the FY05 is being projected at 7.4% - 7.8% per annum, as against 6.6% per annum target. This Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 56 Internship Report growth is mainly on the back of bumper cotton and wheat crops. The high pace of monetary expansion, led by increasing demand for credit by the private sector and coupled with shortage of liquidity has fueled inflationary trends that have resulted in a revision of the FY 05 CPI change, which is expected to be in the range of 8.2% to 8.8% per annum as against the initial target of 5%. The short-term interest rates have continued there upward movement, with the cut-off rate on government treasury bills increasing by 106 to 185 basis points. Credit Rating The JCR-VIS Credit Rating Company Limited has assigned a short-term credit rating of “A-1+” to the Bank. This is the maximum rating in the short-term and denotes outstanding short-term liquidity with highest certainty of timely payments. Further, the medium to long-term credit Rating assigned is “A+”, indicating good credit quality, moderate risk and strong protection factors. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 57 Internship Report SWOT Analysis of United Bank Limited STRENGTHS 1. UBL has its own online software, this software also sell to the other banks and earn. 2. It has larger network with over 1058 domestic and 15 overseas branches most of them are online. 3. It has many attractive products in advances like agricultural, commercial and cash line etc. 4. Its main branches are placed art good locations with beautiful buildings. 5. UBL has good credit rating from JCR-VIS with “A-+”, in short-term and “AA” in long-term. 6. Well organized program for internees and also provide them attractive stipend. 7. Help line is available with the ATM for 24 hours to contact with head office at any problem regarding ATM. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 58 Internship Report 8. UBL is innovator in chip credit card. 9. All officers of the UBL acting as BDO and participating to achieve targets, whole staff works as a team. 10. There is no union anywhere in UBL branches. 11. From financial statement analysis it shows that UBL give preference to advances and investment, Pakistani community also relay on UBL. 12. UBL’s diversified deposit base and extensive nationwide outreach continues to be its key advantage. 13. Till May 2005, the bank had successfully issued over 50,000 credit cards within the country. 14. In the long run, a new corporate image, a large, core, deposit base and innovative loan products will act as key drivers to improving the bank’s positioning in the financial sector. 15. Core capital of the bank stood further enhanced to Rs. 14.55b (FY03: Rs. 11.24b) at March 31, 2005. 16. UBL has set up a Business Risk Review Department to monitor risk management processes within the bank. 17. The bank has also expanded its ATM network from 10 to 53 ATMs by year-end 2004. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 59 Internship Report 18. UBL has also acquired a new consumer banking software – ‘FAIRIZER’ - comprising 3 separate systems, one system each for consumer banking, credit initiation & recovery. 19. Driven by considerable growth in the local credit market and UBL’s ability to offer competitive rates, the bank’s loan portfolio registered a considerable increase during 2004, capturing 8.6% of the domestic market share of advances. 20. Net markup income increased from Rs. 7.05b to Rs. 7.5b as a result of increased investment in credit portfolio. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 60 Internship Report SHORTFALLS / WEAKNESS 1. The promotion of UBL employees almost depends on bringing of deposits respectively. 2. Some process becomes late due to UBL centralization. 3. UBL at No third in deposit without BDO. 4. Employees are not well grooming as compare to other modern commercial banks. 5. In restructuring the No of employees too much fire especially in big cities so now need become appear. 6. From car drive UBL take nominal share although it has larger network this are due to they not entertaining Land Lord. 7. There is no any HR officer in Hub level. 8. UBL mostly depend upon one to one marketing for deposit not organized setup. 9. UBL’s ATM remains most of the time upset. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 61 Internship Report OPPORTUNITIES 1. UBL have well experienced IT programmer they can make their own ATM network like one link and M.net. 2. They can sash their old well-experienced employees to give promotion. 3. It has largest network due to this it can take benefit from restructuring. 4. They can increase their market share due to chip credit card with the help of U phone co. 5. UBL has larger network but not whole branches are online, if all branches become online then its business should boost up. 6. UBL has overseas branches most of those countries in which other main competitors not have if so it can take benefit after inspiring those govt. 7. Govt. of UAE has declared a free industrial estate which having its own free poor as Jabl-eali on which no tariffs to be imposed, UBL has already there it branch and take benefit and open one more that location. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 62 Internship Report THREATS 1. The ATM network has not its own that’s why huge amount transfer into the ABN ambro account. 2. Well-experienced employees leaved UBL because they receive good offer from other banks. 3. Due to its IPO’s in last share offering its report badly damaged. 4. All banks/DFI’s are facing stiff competition to attract new customers with the privatization program that began in 1991, so five NCB’s and three DFI’s become privatized and have new private banks were setup. 5. This is the age of competition, expansion with all good SFI’s and banks with new technology. It is threat for loosing its market share. 6. Pakistani political environment is not stable which leave bad effect on all sectors. 7. Freezing of foreign currency accounts by the govt. of Pakistan is also a f\ear for all Pakistani banks. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 63 Internship Report Conclusions This organization is well managed with organized structure and efficient employees. Due to its growth in online branch system, it has bright future in Financial Organizations. SUGGESTIONS & RECOMMENDATIONS • At the end of every report, it needs suggestions and recommendations. According to my judgment the following are the suggestions and recommendations. • As UBL is expending with it network 1058 branches, it should be beneficial for the bank to computerized all the branches and earn more than before. • The proportion of performance related work should be more than the proportion of deposits in promotions. • This strategy should be developing that decentralized means some authority given the branches. • UBL should appoint the BDO’s at least hub level with the help of this strategy UBL can increase it deposits. • It should be necessary for the UBL that for the old employees training session for well grooming, because Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 64 Internship Report even they don’t know that how to deal with new technology. • UBL should be appoint at least one HR officer at hub level for dealing HR related work. • As UBL have well in IT sections, I think they can develop their own ATM network as M.net and 1 link. • The ATM machine is some times in small cities remain disturb that’s why customer become dissatisfied, if UBL have its own network related ATM than this problem should solve. Zahid Hussain (M.Com) Come & Join Us at www.vustudents.net 65