Financial Planning Association of Australia

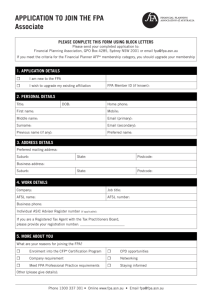

advertisement

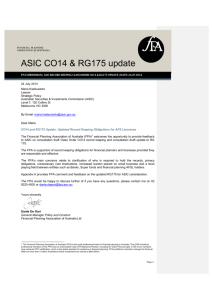

18 December 2009 Financial Planning Association of Australia Limited ABN 62 054 174 453 Expert Panel Unconscionable Conduct Issues Paper Competition and Consumer Policy Division Treasury Langton Crescent PARKES ACT 2600 Level 4, 75 Castlereagh Street Sydney NSW 2000 GPO Box 4285 Sydney NSW 2001 Tel: 02 9220 4500 Fax: 02 9220 4580 Member Freecall: 1800 337 301 Consumer Freecall: 1800 626 393 Fax: 03 9627 5280 via email: unconscionableconduct@treasury.gov.au Dear Sirs fpa@fpa.asn.au www.fpa.asn.au 1 The Financial Planning Association (FPA) appreciates the opportunity to offer comments on the Treasury‟s issues paper on unconscionable conduct regulation, with specific relationship to the Trade Practices Act (TPA). Given the nature of the FPA‟s membership, our interests are in financial services more so than in other lines of business as typically covered by TPA provisions. However, given the statutory relationship between the TPA and the ASIC Act we are very concerned by the consultation paper‟s references to potential „automatic‟ modification of the ASIC Act. We note the recommendations of the Senate Standing Committee on Economics to engage industry participants in an inquiry process on examples of unconscionable conduct to be added to the TPA, and to consider an associated statement of principles. We also note the consultation paper‟s statement that, “[s]ince the unconscionable conduct provisions of the TPA are mirrored in the ASIC Act with respect to financial services, consideration of any option for amending the TPA must also take into account the potential impact of the option on the supply of financial services.” As such, we are concerned about the potential for changes in the TPA to inadvertently affect the law governing financial services, as embodied in the ASIC Act. Financial Services provision is uniquely complex, and so we encourage the panel to limit its consideration to issues outside the scope of financial services. It is our strong view that modifications of the ASIC Act should only be done after specific consultation on the effect of those changes on the ASIC Act itself and definitely not through delegated change in another Act dealing with differently regulated activities. Should such a consultation take place, the FPA would be happy to participate. Should you wish to discuss this further, please contact me on 02 9220 4514 or jo-anne.bloch@fpa.asn.au. Yours sincerely Jo-Anne Bloch Chief Executive Officer 1 The FPA is the peak professional organisation for the financial planning sector in Australia. With approximately 12,000 members organised through a network of 31 Chapters across Australia, the FPA represents qualified financial planners who manage the financial affairs of over five million Australians with a collective investment value of more than $630 billion. New South Wales / ACT GPO Box 4285 Sydney NSW 2001 Ph: 02 9220 4500 Fax: 02 9220 4580 nsw@fpa.asn.au Queensland 433 Logan Rd Stones Corner Qld 4120 Ph: 07 3394 8288 Fax: 07 3394 8289 qld@fpa.asn.au NT / SA / Tas / WA Suite 20, Carrington House 61-63 Carrington St Adelaide SA 5000 Ph: 08 8237 0520 Fax: 08 8237 0582 sa@fpa.asn.au Victoria PO Box 109, Collins St West Melbourne Vic 8007 Ph: 03 9627 5200 Fax: 03 9627 5280 vic@fpa.asn.au