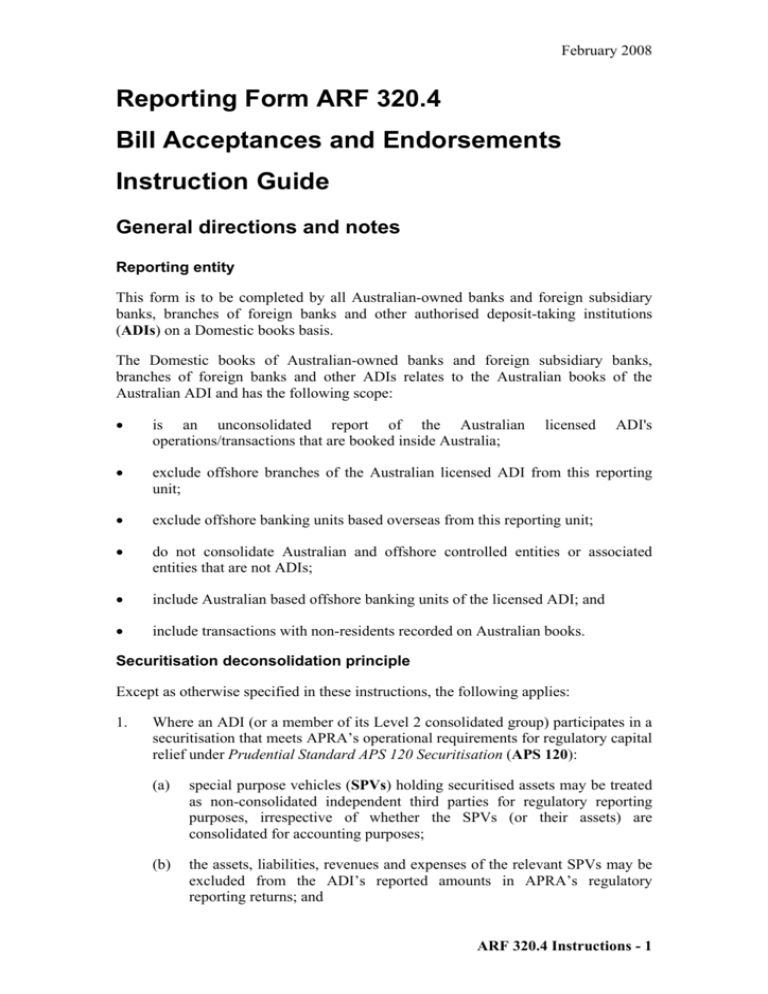

Instructions ARF 320.4 2008

advertisement

February 2008 Reporting Form ARF 320.4 Bill Acceptances and Endorsements Instruction Guide General directions and notes Reporting entity This form is to be completed by all Australian-owned banks and foreign subsidiary banks, branches of foreign banks and other authorised deposit-taking institutions (ADIs) on a Domestic books basis. The Domestic books of Australian-owned banks and foreign subsidiary banks, branches of foreign banks and other ADIs relates to the Australian books of the Australian ADI and has the following scope: • is an unconsolidated report of the Australian operations/transactions that are booked inside Australia; • exclude offshore branches of the Australian licensed ADI from this reporting unit; • exclude offshore banking units based overseas from this reporting unit; • do not consolidate Australian and offshore controlled entities or associated entities that are not ADIs; • include Australian based offshore banking units of the licensed ADI; and • include transactions with non-residents recorded on Australian books. licensed ADI's Securitisation deconsolidation principle Except as otherwise specified in these instructions, the following applies: 1. Where an ADI (or a member of its Level 2 consolidated group) participates in a securitisation that meets APRA’s operational requirements for regulatory capital relief under Prudential Standard APS 120 Securitisation (APS 120): (a) special purpose vehicles (SPVs) holding securitised assets may be treated as non-consolidated independent third parties for regulatory reporting purposes, irrespective of whether the SPVs (or their assets) are consolidated for accounting purposes; (b) the assets, liabilities, revenues and expenses of the relevant SPVs may be excluded from the ADI’s reported amounts in APRA’s regulatory reporting returns; and ARF 320.4 Instructions - 1 February 2008 (c) 2. the underlying exposures (i.e. the pool) under such a securitisation may be excluded from the calculation of the ADI’s regulatory capital (refer to APS 120). However, the ADI must still hold regulatory capital for the securitisation exposures 1 that it retains or acquires and such exposures are to be reported in Form ARF 120.0 Standardised – Securitisation or Forms ARF 120.1A to ARF 120.1C IRB – Securitisation (as appropriate). The RWA relating to such securitisation exposures must also be reported in Form ARF 110.0 Capital Adequacy (ARF 110.0). Where an ADI (or a member of its Level 2 consolidated group) participates in a securitisation that does not meet APRA’s operational requirements for regulatory capital relief under APS 120, or the ADI elects to treat the securitised assets as on-balance sheet assets under Prudential Standard APS 112 Capital Adequacy: Standardised Approach to Credit Risk or Prudential Standard APS 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk, such exposures are to be reported as on-balance sheet assets in APRA’s regulatory reporting returns. In addition, these exposures must also be reported as a part of the ADI’s total securitised assets within Form ARF 120.2 Securitisation – Supplementary Items. Reporting period The form is to be completed as at the last day of the reporting month. Australianowned banks, foreign subsidiary banks, branches of foreign banks and other ADIs should submit the completed form to APRA within 10 business days after the end of the relevant reporting month. Unit of measurement Australian-owned banks, foreign subsidiary banks and branches of foreign banks are asked to complete the form in millions of Australian dollars rounded to one decimal place. Other ADIs are asked to complete the form in whole Australian dollars (no decimal place). Amounts denominated in foreign currency are to be converted to AUD in accordance with AASB 121 The Effects of Changes in Foreign Exchange Rates (AASB 121). The general requirements of AASB 121 for translation are: 1. foreign currency monetary items outstanding at the reporting date must be translated at the spot rate at the reporting date; 2 1 Securitisation exposures are defined in accordance with APS 120. Monetary items are defined to mean units of currency held and assets and liabilities to be received or paid in a fixed or determinable number of units of currency. Spot rate means the exchange rate for immediate delivery. 2 ARF 320.4 Instructions - 2 February 2008 2. foreign currency non-monetary items that are measured at historical cost in a foreign currency must be translated using the exchange rate at the date of the transaction; 3 3. foreign currency non-monetary items that are measured at fair value will be translated at the exchange rate at the date when fair value was determined. Transactions arising under foreign currency derivative contracts at the reporting date must be prepared in accordance with AASB 139 Financial Instruments: Recognition and Measurement (AASB 139). However, those foreign currency derivatives that are not within the scope of AASB 139 (e.g. some foreign currency derivatives that are embedded in other contracts) remain within the scope of AASB 121. For APRA purposes equity items must be translated using the foreign currency exchange rate at the date of investment or acquisition. Post acquisition changes in equity are required to be translated on the date of the movement. As foreign currency derivatives are measured at fair value, the currency derivative contracts are translated at the spot rate at the reporting date. Exchange differences should be recognised in profit and loss in the period which they arise. For foreign currency derivatives, the exchange differences would be recognised immediately in profit and loss if the hedging instrument is a fair value hedge. For derivatives used in a cash flow hedge, the exchange differences should be recognised directly in equity. The ineffective portion of the exchange differences in all hedges would be recognised in profit and loss; and 4. translation of financial reports of foreign operations. A foreign operation is defined in AASB 121 as meaning an entity that is a subsidiary, associate, joint venture or branch of a reporting entity, the activities of which are based or conducted in a country or currency other than those of the reporting entity. • Exchange differences relating to foreign currency monetary items that form part of the net investment of an entity in a foreign operation, must be recognised as a separate component of equity. • Translation of financial reports should otherwise follow the requirements in AASB 121. Timing Report assets and liabilities as at the date change of ownership took place. 3 Examples of non-monetary items include amounts prepaid for goods and services (e.g. prepaid rent); goodwill; intangible assets; physical assets; and provisions that are to be settled by the delivery of a non-monetary asset. ARF 320.4 Instructions - 3 February 2008 Netting Unless otherwise specifically stated, institutions are to comply with the prerequisite for netting outlined in Australian accounting standards AASB 139, AASB 132 Financial Instruments: Disclosure and Presentation and AASB 7 Financial Instruments: Disclosures and any relevant prudential standards. Term to maturity References to term to maturity in this form are references to original term to maturity. Valuation and currency conversion Closing balances should be reported at market price effective at the reference date. Where denominated in foreign currency, market values in foreign currency should be converted to AUD at the spot rate effective as at the reference date. Basis of preparation Unless otherwise specifically stated, institutions are to comply with Australian accounting standards regarding the measurement of asset, liability and equity items. Definitions A bill of exchange is an unconditional order drawn (issued) by one party, sent to another party (usually a bank) for acceptance and made out to, or to the order of, a third party, or to bearer. It is a negotiable instrument with an original term to maturity of 180 days or less. Accepted bills of exchange have been signed by a bank as the drawee which "accepts" liability to pay out the funds on the due date. Endorsement of a bill of exchange creates a contingent liability by the endorser to pay out the funds conditional on the bearer/holder demanding payment. Specific instructions Bill acceptances and endorsements by drawer Report the amount of bills of exchange that have been accepted or accepted and endorsed by this ADI at market value by counterparty of drawer. Only endorsed bills where the bank is the first endorser of a non-ADI or Registered Financial Corporation accepted bill should be included. Include: • holdings of own acceptances or endorsed bills. Exclude: • bills of exchange neither accepted nor endorsed; ARF 320.4 Instructions - 4 February 2008 • endorsed bills drawn by the general government; and • bills of exchange held by this ADI, but accepted by another party. Reconciliation with ARF 320.0 Statement of Financial Position (Domestic Books) (ARF 320.0) Total acceptances of customers The sum of: • total non-financial counterparties - accepted (ARF 320.4 Bill Acceptances and Endorsements) (ARF 320.4); • total financial corporations - accepted (ARF 320.4); and • less holdings of own acceptances. equals: • acceptances of customers (ARF 320.0). Example - Treatment of own holdings of own acceptances Suppose that a company (called the drawer or borrower) draws a bill of exchange payable in 180 days. The ADI then accepts these bills, and therefore accepts liability to pay to the person presenting the bill (called the holder) the face value of the bill on maturity. The ADI, as acceptor of the bill, will on maturity of the bill require the drawer (borrower) to pay the face value of the bill to the ADI. This bill acceptance is reported on ARF 320.4 by the ADI accepting the bill at market value, which at inception is equal to the face value of the bill minus the discount, whether or not the bill is held within the ADI’s portfolio. If this bill is accepted and not held within the ADI's portfolio, then this acceptance is reported on ARF 320.0 as a liability item "Acceptances", which represents the liability arising from the acceptance of the bill of exchange. A corresponding contra asset is reported as "Acceptances of customers", which represents the drawers' commitment to repay the face value of the bill to the ADI at maturity. Holdings of own bill acceptances If this bill is accepted and held within the ADI's own portfolio it should be included as an asset on ARF 320.0 and classified to either trading or investment securities. This type of bill acceptance is excluded from the liability item "Acceptances" on the ARF 320.0, since the ADI is also the holder of the bills. It is also excluded from the contra asset item "Acceptances of customers", since this claim on the drawer is classified as a security holding. Holdings of own bill acceptances should also be reported to bills of exchange (bank accepted) on ARF 320.1 Debt Securities Held (ARF 320.1). Bills purchased by the bank, which are accepted by other ADIs, will also be classified to trading or ARF 320.4 Instructions - 5 February 2008 investment securities, and reported to bills of exchange (bank accepted) on ARF 320.1. ARF 320.4 Instructions - 6