Florida Industrial - David Murphy

advertisement

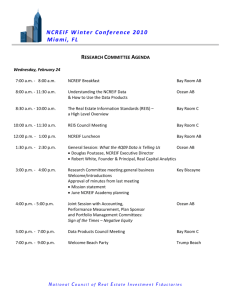

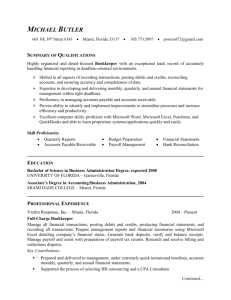

This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. FLORIDA INDUSTRIAL Market Review David J. Murphy, MAI, SIOR, CCIM Senior Vice President Industrial Properties This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. David J. Murphy, p y, MAI,, SIOR,, CCIM Senior Vice President Industrial Properties NAIOP of Central Florida Industrial Broker of the Year – Nine Consecutive Years Commercial Property Executive Magazine – Top 10 Emerging Professionals for 2010 2011 Overall Top Producer, Central Florida Commercial Association of Realtors Named one of the Top 25 Commercial Brokers in Florida by Real Estate Florida Magazine CBRE National Recognition Conference (Top 200) CBRE Industrial Advisory Council CBRE | Page 2 Client’s represented: Walt Disney JP M Morgan Eastman Kodak AT&T Viacom Siemens Frito Lay Lockheed Martin Universal Studios R.R. Donnelley CalEast First Industrial Progress g Energy gy CB Richard Ellis Investors American General FiServ Duke Realty Corp. RREEF Cardinal Health This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Total Vacancy -vs- Average Direct Asking Lease Rate (NNN) — Total Vacancy 9.4% — Avg Dir Asking Lease Rate $5.03 Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 3 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida Industrial Market Statistics Submarket Building SF Total Vacancy (%) Miami 209,484,743 5.9 8.9 865,951 2,109,696 391,352 $4.93 Broward 93,422,749 8.0 11.6 (36,256) 228,510 264,074 $6.62 Palm Beach 44,998,586 9.0 12.3 257,100 462,124 0 $6.35 Tampa Bay 135,519,151 9.9 14.1 (75,881) 57,614 47,679 $5.03 34,597,239 13.0 16.7 202,607 894,958 562,000 $4.21 106,259,674 13.5 17.6 842,435 2,581,734 87,814 $5.00 97 711 759 97,711,759 11 9 11.9 16 7 16.7 372 194 372,194 381 568 381,568 0 $3 98 $3.98 State of Florida Markets 721,993,901 9.4 13.2 2,428,150 6,716,204 1,352,919 $5.03 South Florida Markets 347,906,078 6.9 10.1 1,086,795 2,800,330 655,426 $5.67 North Florida Markets 374,087,823 11.7 16.0 1,341,355 3,915,874 697,493 $4.65 Polk Orlando Jacksonville Total Availability (%) Qtrly Net Absorption YTD Net Absorption Under Construction Avg Dir Asking Lse Rate (NNN) Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 4 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida Industrial Avg Direct Asking Lease Rates (NNN) $5.03 Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 5 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida Industrial Net Absorption: 2012 YTD SF (Thousands) 6,716 K Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 6 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. SF (Thousands) Florida Industrial Completions: 2012 YTD 653 K Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 7 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida Economic Influence Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 8 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida’s Third Quarter 2012 Sales Market Building SF Buyer Property/Address Sales Price Jacksonville 327,400 Bedrosians Tile 8313 Baycenter Road, Jacksonville Miami 302,825 Stockbridge RE Partners Aventura Industrial Center/320 NE 187th Street, Miami Jacksonville 240,000 Dalfen America Corporation 10089 N Main Street, Jacksonville Miami 232,500 Stockbridge RE Partners Sysco Building/555 Northeast 185th Street, Miami $13,500,000 Palm Beach 220,000 Stockbridge RE Partners Congress Park Business Center/420 S Congress Avenue Delray Beach Avenue, $8,770,000 Miami 147,740 Codealtex LLC 1600 E 11 Court, Hialeah Miami 138,000 Terrano Realty Corporation Avborne/7500-7600 NW 26 Street, Miami Orlando 120,603 Exeter Financial Group Lake Mary Business Center/1150 Emma Oaks Trail,, Lake Maryy $7,300,000 Tampa Bay 117,234 Brennan Investment Group JV Gatehouse Bank Builders FirstSource/1602 Industrial Park Drive, Plant City $3,332,800 Miami 116,486 Gramercy Capital Corp JV Garrison Investment Group 17100 NW 59 Avenue, Hialeah Broward 100,000 Weeks Robinson Properties 3901 NE 12 Avenue, Pompano Beach Miami 95,583 Caribbean Investments LLC 4760 NW 165 Street, Hialeah Miami 77,463 Major Brand 3201 NW 72 Miami 75,000 Terreno Realty Corporation Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 9 th $18,700,000 $3,887,500 $5,400,000 th th th th nd $7,000,000 $12,100,000 $9,459,077 $3,000,000 $4,400,000 Avenue, Miami $4,536,000 1401 NW 78 Avenue, Miami $4,200,000 th This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida 3Q 2012 Sales Volume Billions $1,039 , M Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 10 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida 3Q 2012 Sales Statistics 2012 YTD # Deals Total SF Volume $ PSF Cap Rate Miami 42 8,250,135 $622,109,343 $75 6.8% Broward 19 881,308 $73,824,233 $84 9.2% Palm Beach 8 465,511 $30,933,250 $66 N/A Tampa p Bay y 16 1,956,467 $96,587,790 $49 8.5% 3 949,202 $33,800,000 $36 8.0% 13 2,992,080 $148,700,000 $50 7.7% 6 1,131,963 $33,307,500 $29 N/A 107 16,626,666 $1,039,262,116 $63 7.7% Polk Orlando Jacksonville State of Florida Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 11 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida 3Q 2012 Leases Market Building SF Tenant Property/Address Miami 280,000 Perez Trading Prologis Gratigny Industrial/11400 NW 32nd Avenue, Miami Miami 273,000 Schenker Branch DCT Commerce Center Bldg A & B/1801 NW 135th Avenue, Doral Tampa Bay 243,903 Highlands Packing Solutions Gordon/1410 Gordon Food Service, Plant City Miami 204,000 Aeroturbine Miramar Centre Business Park/15701 SW 29th Street, Miramar Tampa Bay 202,500 Coca-Cola Refreshments Madison Industrial Park/4429 Madison Avenue, Tampa Miami 139,000 Yusen International Corporate Park/10200 NW 21st Street, Miami Jacksonville 129,500 Sams Club Alta Lakes Industrial Park/2562 Cabot Commerce Circle, Jacksonville Orlando 123,553 Shaw Industries, Inc Orlando Central Park/2900 Titan Row, Orlando Broward 98,704 Land ‘N” Sea Distribution, Inc Sample 95 Business Park/3101 N Andrews Ave Ext, Pompano Beach Broward 90,243 Florida Supplement, LLC Miramar Park of Commerce/3700 Commerce Parkway, Miramar Jacksonville 84,244 JanPak, Inc Crossroads Distribution Center/6600 Pritchard Road, Jacksonville Jacksonville 80,000 Monavie LLC Center Point Business Park/6601 Executive Park Court, Jacksonville Jacksonville 56,420 River City Security Services, Inc Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 12 Central Park/3728 Philips Highway, Jacksonville This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida 3Q 2012 Leases YTD Deliveries Building SF Vacancy % Avg Asking Rate West Polk 300,000 0.0 N/A Miami Airport/Doral 189,906 99.9 $9.25 IG Southridge Commerce Park 2354 Commerce Park Orlando SW Orange 76,158 27.3 Negotiable Polk 4070 S Pipkin Road Lakeland West Polk 59,200 100.0 $ $4.50 NNN Orlando 6651 Narcoossee Road Orlando SE Orange 27,600 93.8 $7.50 MG Property City Submarket Polk Rooms To Go Distribution Center 1480 Airport Road Lakeland Miami Beacon Lakes Building 13 12650 NW 25th Street Orlando Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 13 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida 3Q 2012 Leases Building SF Avg Asking Rate West Polk 562,000 N/A Miramar Southwest Broward 264 074 $7.00 264,074 $7 00 NNN Flagler Station/10315 NW 112th Avenue Miami Medley 171,680 N/A Miami Pan American West Business Park/1801 NW 135th Avenue Doral Airport/Doral 167,200 N/A Orlando Southridge Commerce Park/2252 Commerce Park Drive Orlando Southwest Orange 87,814 Negotiable Tampa Bay Garba Industrial/4915 Denver Street Tampa East Tampa 20,159 N/A Miami Silver Palms Business Center/13400 NW 38th Center Opa Locka North Central Dade 16,355 N/A Tampa Bay 7040 Anderson Road Tampa Northwest Tampa 15,360 N/A Miami Silver Palms Business Center/13400 NW 38th Center Opa Locka North Central Dade 14,630 N/A Tampa Bay 1988 Tampa East Boulevard Tampa East Tampa 12 160 12,160 N/A Miami 10851 NW 24th Street Doral Airport/Doral 10,812 N/A Miami Silver Palms Business Center/13400 NW 38th Center Opa Locka North Central Dade 10,675 N/A Under Construction Property City Submarket Polk Publix/3050 New Tampa Highway Lakeland Broward Miramar Centre Business Park/15701 SW 29th Street Miami Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 14 This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. Florida Industrial Inventory Jacksonville Inventory Inventory Size 97,711,759 + 200 MSF 100 MSF – 200 50 MSF – 99 MSF MSF Below 50 MSF Vacancy Asking % Rate 11.9% $3.98 NNN Orlando Inventory Tampa 106,259,674 Vacancy % Asking Rate 13.5% $5.00 NNN Inventory Vacancy Asking % Rate 135,519,15 9.9% $5.03 1 NNN Polk Inventory Vacancy Asking % Rate 34,597,239 13.0% $4.21 NNN Palm Beach Inventory 44,998,586 Miami Broward Inventory Inventory Vacancy Asking % Rate 209,484,743 5.9% $4.93 NNN Source: CBRE Research - Third Quarter 2012 MarketView CBRE | Page 15 Vacancy Asking % Rate 9.0% $6.35 NNN Vacancy % 93,422,749 8.0% Asking Rate $6.62 NNN This document was presented during the 2012 NCREIF Fall Conference. The author(s) take full responsibility for all content. This posting is for informational purposes only; neither NCREIF nor its Board express any opinion of the content presented herein. FLORIDA INDUSTRIAL David J. Murphy, MAI, SIOR, CCIM Senior Vice President Industrial Properties