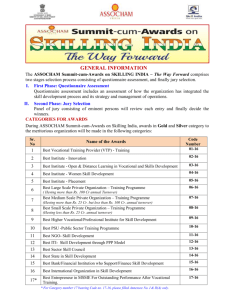

'Make in India' - Pressing the Pedal

advertisement