Legitimacy Vacuum and Structural Imprinting

advertisement

The Survival Chances of New Firms in New Industries: Legitimacy Vacuum,

Structural Imprinting, and the First-Mover Disadvantage

Stanislav D. Dobrev and Aleksios Gotsopoulos

University of Chicago GSB, 5807 S. Woodlawn Ave. Chicago, IL 60637

sdobrev@chicagogsb.edu

Tel. 773.834.5965

The Survival Chances of New Firms in New Industries: Legitimacy Vacuum,

Structural Imprinting, and the First-Mover Disadvantage

(abstract)

Unfavorable conditions at founding may result in consistently lower survival chances for new

firms. We focus on the effect of industry entry in the early years of an industry when clarity about

the form and function of a new category of firms is lacking. This population-level legitimacy

vacuum effect is persistent and adversely affects new entrants in an emerging industry for the

duration of their lifetimes. These ideas are integrated with received theory in organizational

ecology and help to extend broader notions of structural imprinting in organization theory. They

also help to explicate some of the inconclusiveness surrounding the metaphor of first-mover

advantages. Results from the analysis of survival rates of firms in the U.S. auto industry from its

inception in 1885 until 1981 support our conjectures and demonstrate the value of employing an

ecological approach to studying the role of history in organizational evolution.

0

INTRODUCTION

It is widely acknowledged that new ventures, for a variety of reasons—insufficient

capital, poor design, inexperienced management, etc...—have much higher failure rates than more

established firms. For a relatively small and clearly distinct set of entrepreneurial firms, however,

the primary reason behind early failure is quite different. At least anecdotally, firms who enter an

industry in its very early stages are often said to have been “ahead of their time,” or “too fast to

market” (Tellis and Golder, 1996), and to have suffered a “first-mover disadvantage” (Lieberman

and Montgomery, 1998). One of our two objectives in this paper is to build theory which

transcends metaphors and case-based insight and offers an empirically testable mechanism to

explain the failure of new firms in new industries. We argue that organizations are precariously

close to failure due to their inability to evoke institutionalized claims in pursuit of resources or to

invest resources optimally when they operate under conditions of legitimacy vacuum—conditions

in which clarity about the form and function of these organizations collectively as a socially

familiar categorical type or a blueprint is lacking.

Our second objective is to extend arguments of structural imprinting from organizational

sociology (Stinchcombe, 1965) by theorizing the causal forces that put new firms in new

industries at a persistent disadvantage relative to later entrants. We claim that firms that belong to

the first cohort of entrants in an emerging market have consistently worse survival chances than

firms from later cohorts and that this difference persists throughout their lifetimes. Initial

exposure to legitimacy vacuum is imprinted in the structure and processes of new firms and its

deleterious effect on survival is generally irreversible.

In pursuing our two research objectives, we advocate and employ an ecological approach

for two reasons. First, the density delay theory (Carroll and Hannan, 1989) in organizational

ecology represents one systematic way for modeling the persistent effect of founding conditions

on organizations’ life chances. This theory specifies two mechanisms, resource scarcity and tight

niche packing, that explain how competitive crowding at the time of founding (high population

density) leads to persistently higher death rates for organizations founded under such conditions.

We extend the density delay argument by proposing that even if resources are not scarce or

highly contested, securing access to them is jeopardized under conditions of legitimacy vacuum

when constitutive paradigms for linking organizational means and ends are non-existent.

Moreover, we claim that even if early industry entrants are able to acquire resources, their

chances of investing them in a manner consistent with what would later prove to be the successful

track record of an industry is contemporaneously impossible at the industry’s embryonic stage.

So we claim that the imprinting of the legitimacy vacuum effect results from both insufficient

resources and the uncertainty about their appropriate long-term investment.

Second, employing an ecological framework for the analysis of imprinting effects is

useful because it forces a disciplined analytical framework on an intuitively appealing but largely

underdeveloped theoretical argument. The notion of structural imprinting is popular in

organization theory but it has rarely been challenged on theoretical grounds or subjected to

rigorous empirical scrutiny. At least partly, the problem is excess generality. It is not known, for

example, what exactly accounts for the imprinting process in the sense that direct mechanisms for

explaining what features of social structure get imprinted into which organizations are scant.

Surely, no one has argued that all features of the social structure get imprinted into every new

organization founded at any given time. The ecological approach mandates that the imprinting

effects are confined to a specific set of environmental conditions (e.g., an emergent industry), and

that they neither apply similarly to all social actors exposed to these environmental conditions

(e.g., investors, producers, suppliers, analysts, etc…), nor do they apply differently to each social

actor when actors share homogeneity in resource dependence (e.g., members of an organizational

2

population). Instead, the ecological approach to imprinting underscores how resource-overlapping

entities acquire “particular social object preferences” (Immelman, 1975: 21) by considering the

time-constraint on the occurrence of imprinting (a brief sensitivity period after birth), the fact that

its effects are irreversible, and that imprinting is inherently a supra-individual, population-level

phenomenon (Lorenz 1935). Consistent with this approach, we consider imprinting to occur at the

time of a firm’s founding, to influence its survival chances significantly, and to affect similarly all

organizations in a population exposed to the same initial conditions in their environment.

In the next section, we develop an argument for the detrimental effect of legitimacy

vacuum at the time of organizational founding on survival chances and integrate it with the

original predictions of density delay theory. In the methods section, we justify the use of

secondary data and offer a modeling strategy that takes into account the specificity of the

historical contexts and the predictions of arguments that intuitively contradict our theory. In the

results section we interpret our findings and evaluate them in light of the first-mover metaphor

which they overtly contradict. We conclude by stating the advantages of an ecological approach

utilizing simple and generalizable models with flexible specifications to studying the impact of

historical contingencies on organizational evolution.

THEORY

Legitimacy Vacuum and Structural Imprinting

Holding the level of available resources constant, what are the factors that determine

whether new organizations can mobilize these resources? In addressing this question,

Stinchcombe (1965: 161) surmised that “…an organization must have an elite structure of such a

form and character that those people in the society who control resources essential to the

organization’s success will be satisfied that their interests are represented in the goal-setting

3

apparatus of the enterprise…” In short, an organization has to meet the expectations of external

constituents not just with respect to its goals and objectives but also in terms of the ways in which

resources will be deployed to pursue and accomplish these goals (Pólos, Hannan, and Carroll,

2002). The social consent that nascent entities must elicit to secure resources hinges on the

credibility of the claims that they make and to demonstrate such credibility, organizations

develop structures in support of the legitimacy of their means and ends. Given their audience’s

limited attention and likely varied opportunity to distribute resources, claims of legitimacy are

easier to make within a set of comparability with other similar social actors (White, 2001).

Legitimacy thus emerges at the level of categorically similar organizations and when

accomplished as a collective good, it leads to the emergence of a new form whose blueprint

serves as a model of organizing for other nascent entities. These blueprints attain a taken-forgranted status with both entrepreneurs and gatekeepers of resources and often become inveigled

in institutional myths of rationality only loosely tied to objective features of organizational

structure (Meyer and Rowan, 1977).

Recasting the vast literature on constitutive legitimacy in organizational sociology for the

purpose of our theory raises two questions. First, given the importance of gaining an institutional

standing of taken-for-grantedness for all organizations in a population, is it useful to emphasize

its particular importance for new organizations? Second, if it is, should the particular liability of

new organizations to lack of legitimacy not be explained with recourse to received theory on

liability of newness (Stinchcombe, 1965; Hannan and Freeman 1989; Hannan 1998)? Our

answers to these questions follow.

There is no shortage of argument and evidence that link the improved survival chances of

all organizations bearing the same form to the presence of established normative expectations of

what these organizations do, how they do it, and what social boundaries they must observe. When

4

such expectations are lacking, survival chances are low. As legitimacy builds, access to resources

improves, and so do the survival chances of all organizations. But organizations founded in

legitimacy vacuum continue to be at a disadvantage relative to their peers because exposure to a

weak institutional environment during the nascent stage imprints in the highly resilient initial

structures that new firms develop. At the time of founding these structures are especially

malleable and influenced by external conditions. And when external conditions are unfavorable,

as the imprinting argument goes, the effect is irreversible.

Of course, the hazardous position of young organizations, including lack of legitimacy, is

often understood with recourse to their own age as in Stinchcombe’s (1965) liability of newness

story. New organizations find it hard to substantiate their claims for resources because external

constituents lack evidence in the form of past experience based on which to evaluate the

credibility of their claims. New organizations need time to develop routinized activities, to build

trust between members and relationships with outsiders, to learn how to coordinate between tasks

and how to monitor and incentivize members. For all these reasons, young organizations improve

their survival chances as they mature. And those that survive eventually become better fit than the

at large pool of potential entrants that have not yet faced the test of trial-by-fire (Swaminathan,

1996; Lomi and Larsen, 1998). In contrast to the liability of newness story, we surmise that when

lack of legitimacy is understood as a property of the environment, rather than of individual

organizations (an approach defined by the ecological framework of analysis), it is likely to leave

a lasting mark on entities founded under such conditions. A new organization that represents a

widely taken-for-granted form can rely on the form’s constitutive legitimacy to make claims

about its own right of passage, an ability that helps it to outgrow its own liability of newness. By

contrast, a new firm founded in an institutionally unrecognized social space is overwhelmed by

the compounded disadvantage of its own age and of the illegitimacy of its social position. In our

5

view, recovering from such a disadvantage is unlikely. While liability of newness is transitory

and passes with age, the imprinting effect of legitimacy vacuum is permanent. We suggest three

reasons to substantiate this claim—organizational founders’ finite resources, obsolescence, and

uncertainty—all of which relate the imprinting effect of legitimacy vacuum to low organizational

survival chances.

Ecological Mechanisms for Imprinting

Our goal in this section is to develop mechanisms that can substantively account for the

imprinting effect of legitimacy vacuum on survival chances of organizations in an industry.

Density delay theory (Carroll and Hannan, 1989) argues that firms founded in crowded markets

suffer persistently reduced competitive fitness for two reasons. First, organizations founded under

conditions of crowding when available inputs are highly contested tend to develop structures

designed to take advantage of insufficient resources that emphasize the ability to make do under

conditions of deprivation. By contrast, organizations experiencing resource affluence at founding

are able to devote attention and resources to organizing for growth, a likely advantage in latter

stage organizational experience. Initial exposure to scarce resources thus generates a lasting

liability that is difficult to overcome because it engrains in the evolving structure of the fledgling

entity. The second mechanism behind the density delay argument is that when the resource space

is tightly packed at the time of an organization’s initial entry, its choice of location is inflexible.

Incumbents occupy the resource rich areas of the market and newcomers are invariably pushed to

peripheral locations with sparse resources. Selection of initial market position is consequential

because alignment with local conditions where resources are embedded imprints into the nascent

entity’s organization. The persistence of structural arrangements made in the early period of

existence thus confines an organization to its initial location or likely exacerbates survival

6

chances when position moves are attempted. As long as resource distributions within an industry

remain stable over time, positional inertia disadvantages firms whose initial positions (forged by

the nature of the competitive environment faced at founding) are on the periphery.

Both arguments in density delay theory deal with a firm’s early experience in acquiring

resources and specifically, with the deleterious effect of crowding which limits resource

accessibility. We think that there is another reason—the illegitimacy of deploying resources in a

manner that is socially unrecognized. For example, perceptions of usury as deeply unethical

complicated the early rise of banking in Renaissance Florence (Parks, 2005) while in the U.S., the

inexperienced public’s irrational ambivalence about electric batteries stalled early

experimentation with electric cars in the nascent automobile industry (Kirsch, 2000). While both

industries eventually prospered, few of the early entrants shared in this prosperity. In short, the

idea of legitimacy vacuum summarizes features of the environment not merely reducible to

variation in resource levels and competitive crowding. In fact, it highlights the important

consequences of social experience in a firm’s formative period (i.e., the strife for acceptance and

recognition), an argument that perhaps most closely reflects Stinchcombe’s (1965) original claim

of social structural imprinting.

Founder roles and imprinting. Consistent with the resource scarcity argument in density

delay theory, we expect that insufficient resources adversely affect the design of a nascent

organization. But the mechanism we articulate is different—developing an organizational

structure inapt to support future growth results not only from stiff resource competition but from

the need for founders to invest a disproportionately higher amount of time and effort in acquiring

resources under conditions of legitimacy vacuum, a requirement which disrupts the balance

between the internal and external organizational roles entailed in the founder’s position.

7

It is often argued that even when organizations are brand new, they rarely constitute a

tabula rasa (Mitchell, 1989; Levinthal and Myatt, 1994). Type and duration of prior work

experience, position in social networks, ability and pertinent expertise and other social and human

capital characteristics of founders imbue a nascent organization with resources and opportunities.

In fact, perhaps the most developed line of theory on organizational imprinting to date examines

the influence of founders on the structure of their organizations (Kimberly, 1979, Freeman, 1986;

Boeker, 1988; Baron, Hannan, and Burton, 2001; Phillips, 2002). This research shows that

founders often have a clear idea of how they want to shape and model their creation, and that,

when instilled in the early years, such initial blueprints tend to persist even after the founder’s

departure (Hannan, Burton, and Baron, 1996). Research on the organizational roles of founders

posits that in the formative period of their ventures, founders are fully immersed both in the

internal workings of the organization and in mediating between it and the environment (Dobrev

and Barnett, 2005). The balance between the two activities is crucial to structuring an

organization that will not only materialize the founder’s idea but that will also gain support from

and fit well with its environment. Under conditions of legitimacy vacuum, the role of the founder

is unstable because the lack of institutional consent for her creation means that a

disproportionately higher fraction of the founder’s finite resources needs to go towards building

and maintaining claims to the external audience related to the shape and function of the new

entity and to developing the logic and rationale for supplying it with necessary resources.

Although every new organization lacks an established social standing, following a widely

accepted blueprint for organizing helps to convey a robust identity fitting with the prevalent

categorical schemas for the role and place of the new entity (Hsu and Hannan, 2005). When such

blueprints are undeveloped or non-existent, the task of imparting the organization to the external

audience as a legitimate social actor falls squarely on the founder’s shoulders. The more time and

8

effort the founder spends managing external expectations, the less of each of it can she devote to

managing the internal organization of the fledgling entity. Crucial decisions about key

architectural arrangements in the new firm are given secondary priority. This means that the

overall design of the firm may be poor and may not support its key strategic and technological

assets. To the extent that fundamental transformations in design are costly and difficult, an initial

internal misalignment between strategy and structure may persist and continuously diminish the

firm’s competitive strengths.

External misalignment and imprinting. The jeopardy of operating in unrecognized,

undeveloped markets also pertains to a process different from the one that gives rise to external

misalignment when position shifts are attempted. Long-term repercussions of an initial position

in unfavorable environment on organizational fitness can partly be understood in terms of

location, but this is only a special case (perhaps an especially simple one) of this relationship.

Unlike the positional inertia argument in density delay theory which assumes that location

characteristics are stable (e.g., peripheral location is associated with permanently limited

resources), features of the social structure vary in both time and space. In fact, assessing the

plausibility of a claim that firms founded in legitimacy vacuum have persistently lower

competitive fitness is only possible if the market in which they operate eventually develops and

gains legitimacy. This is consistent with the key theoretical insight in the imprinting story in

which organizational structure tends to persist even after the external conditions that once defined

it have shifted. As Stinchcombe (1965) observed, national fraternities whose charters did not

explicitly disavow racial segregation tended to be founded mostly in the South but from a

historical perspective, the meaningful predictor of variance in fraternities’ social organization

proved to be their time of founding (e.g., in the aftermath of the Civil War) rather than location.

9

Again, our prediction agrees with the expectations of density delay theory that lower

survival chances result from misalignment between a firm’s position and its environment. But,

while the positional inertia argument assumes that this misalignment is triggered when a firm

positioned in a resource scarce market location attempts to move, we contend that the

misalignment is generated by shifts in the environment itself without the need for a firm to

attempt a position shift. Specifically, organizations founded under conditions of legitimacy

vacuum develop routines and processes needed to deal with this environmental deficiency and

which become obsolete once the new organizational form they embody becomes institutionalized

(i.e., when legitimacy vacuum dissipates).

A focus on gaining external endorsements during the stage of legitimacy vacuum leads to

building organizational processes specifically geared to “sell” the firm’s model to gatekeepers of

resources who have the capacity to disperse resources despite the lack of broad social consent on

how they are to be used. While this may be helpful for the firm’s immediate survival it invariably

produces a long-term liability because success in a focal market is impossible unless the market

eventually gains legitimacy. When that happens, organizational structures primarily designed to

support a fit with an institutionally weak environment become obsolete and must be replaced. In

short, core structural change is likely mandated of firms founded in legitimacy vacuum because

the founder’s success at aligning the firm with an environment initially lacking constitutive

legitimacy produces strong misalignment pressures once the new market gains social acceptance.

And since routines established in the early years are likely to persist (Nelson and Winter, 1982)

and early organizational blueprints are more resilient to change than other features (Baron,

Hannan, and Burton, 2001), firms founded under legitimacy vacuum are especially susceptible to

inertia when attempting fundamental shifts in design. As a result, they face higher opportunity

and influence costs and ultimately lower competitive fitness than peer firms founded at a later

10

time. 1 So by prompting the adoption of stable organizational structures and processes that

eventually become obsolete, legitimacy vacuum at founding leads to elevated failure hazards.

Uncertainty and imprinting. The arguments about poor internal design and obsolescence

in external fit both suggest indirect effects of legitimacy vacuum—through devising means to

facilitate resource acquisition whether by redefining the founder’s role or by a strong alignment

with a shifting, transitory environment—on structural imprinting and diminished survival

chances. We also conjecture that there is a direct effect, one that does not have a clear analogue in

density delay theory. This direct effect pertains to the role of uncertainty in the founders’

decisions about how to invest the resource endowments they have successfully solicited for their

firms. Even if founders are able to successfully resolve the resource acquisition problem under

conditions of legitimacy vacuum, investing these resources in a way that is conducive to future

growth and improved survival chances under such conditions may be unrealistic. Periods of

legitimacy vacuum in the environment are likely to coincide with the formative years of a new

market, industry or technology, periods during which it is unknown what evolutionary course the

system will take. And legitimacy is not only about what organizations should look like to obtain

resources but about how these resources should be deployed. Absent such set expectations,

organizations are likely to experiment with their investments thereby shaping the variance of

outcomes that sets the stage for the future course of the system. Organizational members in such

periods face the improbable task of having to guess the future of the market or industry.

While most organizational decision-makers confront this challenge, those working in new

organizations in a nascent industry have to do it from the standpoint of its most unpredictable

1

Of course, firms founded at any time during an industry’s evolution can become subjected to pressures of external

misalignment and suffer elevated failure hazards. Unlike firms founded during legitimacy vacuum, however, firms

founded during institutional regimes that are being swept by social change can point to the legacy of their past to

justify future contributions. Stark (1996) provides several excellent examples of Hungarian state socialist firms’

claims for occupying a central position in the rapidly shifting post-socialist environment.

11

state. Historically, they are most likely to be proven wrong in their choice of resource

commitments and to be exposed to its consequences. As David (2000: 14) explains, “…The point

is not that these folks ought to have seen the shape of the future. Rather, it is that the shape of the

larger system that evolved was built upon their work…” Even if adequate resources are secured,

their ‘appropriate’ investment during a period of uncertainty is elusively difficult not the least

because it is only definable in retrospect once the evolutionary course of the industry has

unfolded.

To summarize, we argue that legitimacy vacuum has both direct and indirect effects on

the imprinting process within organizations in a population. The direct effect emanates from the

uncertainty that invariably permeates an environment where the means by which resources should

be deployed are contested and the value of new technologies is unclear. The indirect effects arise

either because the need to deal with the consequences of legitimacy vacuum requires of

organizational founders to prioritize and disproportionately allocate their limited resources to

processes and tasks geared to secure external endorsements (likely at the expense of improving

the internal fit between strategy and structure) or because building an organization well

positioned to garner resources during legitimacy vacuum leads to obsolescence and increasingly

deteriorating external fit once the organizational form becomes institutionalized.

Population density, survival chances, and imprinting. Ideas about constitutive legitimation

are central in organizational ecology and are an integral part of the density dependence model of

organizational evolution (Hannan and Freeman, 1977, 1989; Hannan and Carroll, 1992). The

theory holds that organizational proliferation within a population drives both the legitimation of a

new form and diffuse competition for resources. But it does so at different rates, such that

increases at low levels of density drive legitimation more than competition, and increases at high

levels of density drive competition but not legitimation (which has a theorized ceiling effect).

12

Empirically, the model is specified by estimating a non-monotonic effect of the contemporaneous

number of organizations in a population on their failure hazards predicting that the process of

building legitimacy reduces failure rates and intensified resource competition increases the

hazard. By contrast, in considering the role of density at founding for organizational evolution,

the density delay model specifies an imprinting effect of crowding and competition on survival

but not of legitimacy or its absence. Our theory suggests that there is a good reason to revise the

original model. The empirical prediction that emerges from the combination of density delay

theory and our conjectures about the imprinting effects of legitimacy vacuum is that the effect of

density at founding on the hazard of failure is nonmonotonic and has a U-shape: low-level

increases in density at founding contribute more to building legitimacy than to raising

competitive pressures. Accordingly, at low counts, density at founding decreases the failure

hazard. By contrast, high-level increases in density at founding only drive competitive crowding

because once an organizational form has attained a taken-for-granted status and the legitimacy

vacuum has been filled, the constitutive diffusion process (driven by organizational proliferation)

that helps the audience learn and become accustomed to a new category of social actors becomes

mute. Once something is learned, teaching it is unhelpful. At high counts, density at founding

only intensifies crowding and its effect on the hazard is positive.

Importantly, this prediction only applies to organizations operating at the dawn of a new

industry. Low density in a developed industry may reflect consolidation, intensified competition,

or stricter regulation, none of which are likely to affect the constitutive legitimacy of an

established organizational form. So the first-order density-at-founding effect should not hold for

firms founded at low density counts past the formative stage of the industry.

DATA AND METHODS

13

Empirical Analysis

Our choice of empirical application is guided by an effort to integrate the specificity of

historical context with the construction of general models. Below we report results of the

empirical analysis of survival rates of U.S. automobile manufacturers between 1885 and 1981.

Earlier analysis of this organizational population (Hannan et al., 1998) reports fully specified

density effects on organizational survival including a test of density dependence theory. The

internal validity of our results would be strengthened if we can show that they hold over and

above the baseline density effects. Building directly on an established density specification also

provides a conservative test of our theory because the margin between improving model fit by

introducing an additional density variable and overspecifying density effects is particularly small

when the baseline models are elaborate.

The form of automobile manufacturers was legitimated very quickly and mostly through

the widespread fascination with and interest in the novelty of the product (Flink, 1988). This

historical uniqueness of the population has to bear on the empirical specifications testing our

theory. This approach allows us to take note of earlier critiques of ahistoricism in ecological

analysis (Baum and Powell, 1995) while preserving the simplicity and generalizability of

ecological theories (Hannan and Carroll, 1995).

Data and measures. The U.S. automobile data were constructed from reports of

automobile historians and collectors, and include entries for all car producers ever known to

operate in the U.S. between 1885 and 1981. The end of the observation period reflects the last

year covered in the most comprehensive data source, a multi-volume encyclopedic book that

provides thorough authoritative coverage: The Standard Catalogue of American Cars (Flamang

1989; Kimes and Clark 1989; Gunnell, Schrimpf, and Buttolph 1992; Kimes et al. 1996; Kowalke

1997). Data on more recent periods were obtained from Kutner (1974) and Automotive News

14

(1993). The collection effort discovered an abundance of small, short-lived, and obscure firms

that frequently introduced peculiar automobile designs and production schemes. The data are

structured in event-history format so that each record corresponds to a single firm-year age spell

with the initial year split into two half-year periods to accommodate missing entry and exit data

for short-lived firms. The failure event is defined as exit to another industry, dissolution of the

firm, or if the firm drops out from the industry for an unknown reason. Merger and acquisition

cases are coded as (uninformatively) censored on the right. The years of the Second World War

are excluded from the data because car production was almost entirely devoted to military needs

during this period.

Our baseline model builds on Hannan et al.’s (1998) model and includes the same

measures and variables. Prior existence marks up firms that conducted other activities prior to

entering the automobile market. 2 Contemporaneous organizational density (N) is specified

nonmonotonically, consistent with established theory and findings in organization ecology

(Carroll and Hannan, 2000), to include a linear and second-order term of annual counts of the

number of producer organizations. Industry age (t) is measured as the number of years elapsed

since the inception of the industry in 1885. Organizational size is measured as the natural

logarithm of the firm's annual production of automobiles, Ln(Size). Relative size of a firm is the

ratio of each firm's size to the size of the largest firm in the population at the time. A dummy

variable for size less than or equal to an annual production of 50 cars captures the compounded

absolute-small-size disadvantage, (Size ≤ 50). To control for socioeconomic and environmental

2

Of course, our arguments are about founding effects and clearly only apply to new firms, not to lateral entrants. We

include these firms in our data (and control for their baseline effect) because the evidence in the historical record is

not sufficiently clear on whether these were successful firms that transitioned from other industries or firms that

failed in their operation in another industry and were completely reorganized for entry into automobile production

(i.e., were de facto new firms). As a conservative precaution, we estimated all the models reported below (available

from the authors) by excluding firms with prior experience from the data. The results remained unchanged. The

results also did not change when we interacted the indicator variable marking up these firms with density at founding

and the additional effect was not significant.

15

factors our specifications include effects of economic depression (Depression year dummies), the

level of the gross domestic product (GDP) adjusted for inflation (taken from Maddison, 1991),

and dummy period effects representing industry regimes (Mass production, Product

differentiation, JIT/TQC) as defined by Womack, Jones, and Roos (1990).

Methods

We estimate our models in terms of the instantaneous rate of failure (Tuma and Hannan,

1984; Blossfeld and Rohwer, 1995). This approach requires specifying a functional form of

duration dependence. We represented variation in organizational tenure (u) as a stochastic

piecewise-exponential function where the breakpoints for the pieces are denoted as

0 ≤ τ1 ≤ τ2 ≤ " ≤ τP. Assuming that τP+1 = ∞, there are P periods:

Ip = {u | τp ≤ u ≤ τp+1}, p = 1,..., P. We specify that the disbanding/exit rate μi is a function of

tenure in the industry ( u ) and industry age ( t ). The general class of models we estimate has the

form: μ i (u, t) = μ i (u, t) * exp (m p ) ⋅ ψ (N 0 iu , t), u ∈ I p

where μ i (u, t) * is the baseline rate for organization i estimated as a function of observables and

mp denotes a set of tenure-specific effects. The functions for assessing the imprinting arguments

relate to density at founding (N 0 ) and its interaction with industry age (t), denoted by ψ (N 0iu , t) .

The u-subscript in N 0iu indicates that we allow the density-at-founding effects to vary with

organizational tenure. Our model implies a non-monotonic effect of population density at

founding on the hazard of failure. Organizations founded at very low density have high failure

rates that decrease as the number of organizations at founding increases. The turning point in the

effect occurs when constitutive legitimacy is accomplished and further increases in density at

16

founding only intensify crowding. Specifying the exact functional form of the relationship

depends on context-specific historical developments as we explain below.

The automobile industry in the U.S. began in 1885, experienced an enormous boom

around the turn of the 20th century and by the time of the Great Depression was already highly

consolidated. The onset of competition was triggered by the quick legitimation of the new form,

which in turn was driven largely by the public’s fascination with automobility (Flink, 1988).

Proliferation of producers led to proliferation of car marques and models which quickly entered

the social discourse through three product-related mechanisms: the frequent rallies and car races,

the extensive reporting by the media, and the automobile fairs for new car models created an

institutional environment which itself precipitated the constitutive acceptance of the new

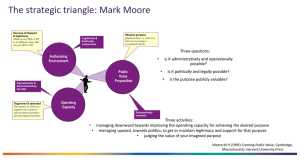

organizational form (Rao, 1994). Figure 1, which plots the historical density and number of

foundings in the population, illustrates these developments. The early rise in density somewhat

deviates from the typical pattern observed by ecologists in which the formative years of a

population initially witness a slow and gradual increase in density followed by a steep rise

(Hannan and Carroll, 1992). But in this case, the first phase of the process is almost non-existent

as density quickly shifted from close to zero to several hundred in the decade surrounding the

turn of the century. If legitimacy vacuum at founding was a factor, it would be confined to a very

short period. To reflect this brevity in the institutionalization of the blueprint of an automobile

producing firm and the onset of competitive crowding, we emphasize the variance over the very

low counts of population density. Accordingly, we transform density at founding into its natural

logarithm and enter it as a model covariate. In a second-order polynomial specification the simple

term reflects the build-up of constitutive legitimacy and is expected to have a negative effect on

the failure rate; the squared term captures crowding and should increase the hazard. Assuming

17

that density-at-founding effects are confined to the formative years of the industry, we expect:

ψ1 (lnN 0iu ) < 0; ψ 2 (lnN 20iu ) > 0; ψ 3 (lnN 0iu ⋅ t) > 0; ψ 4 (lnN 20iu ⋅ t) < 0.

[Figure 1 about here]

FINDINGS

Descriptive statistics and correlation coefficients are presented in Table1 and the

inferential statistics are presented in Table 2. We begin with a simple model (model 2.1) which

includes all the control variables and the main term of density at founding; its effect is positive

and significant, consistent with Hannan et al.’s (1998) estimates and supports the original density

delay argument. In the next model (model 2.2) we test for nonmonotonicity in the density at

founding effect and the estimates confirm our expectation. The first-order effect is negative and

the second order effect is positive 3 . We use the estimates from this model to plot the multiplier

of the hazard across the observed range of density in Figure 2a. Note that with only a single

organization present at founding, failure chances are almost as high as when crowding is near its

peak. But as legitimacy builds, failure rates decline and at the point which by our estimates

coincides with the ceiling effect of legitimacy, the rate is reduced by nearly one half of what it is

at the height of legitimacy vacuum. Although model 2.2 does show the most general specification

3

We use two logarithmic functions of density at founding (N0) because we expect the overall effect of that variable

to diminish as its values increase. This specification is in contrast to traditional density effects specifications where at

least the squared term of density is non-logged to allow for the competitive effect to increase at an increasing rate.

Our model takes into account arguments that as the auto industry quickly consolidated and partitioned into segments,

processes of both mutualism and competition came to be driven more by ecological and social forces emanating from

position in one of the industry’s three main market segments rather than by population level density. Nevertheless,

we compared our model to a traditional non-logged specification of N0 effects. We found that in that specification the

N0 effect is monotonically positive (obviously because it does not capture variance in the very low counts of N0) and

that the overall model fit is inferior to the fit of our specification. To further assuage concerns of ad hoc modeling,

we estimated a model with a simple step-function of N0 (instead of the logged N0 functions) which confirmed that the

effect of N0 is nonmonotonic and reversing direction at low counts.

18

for modeling the predictions of our theory, it does not represent a complete test. Two additional

considerations remain to be addressed.

[Tables 1 and 2 and Figure 2a about here]

First, an argument that challenges the imprinting component of density delay theory holds

that, assuming heterogeneity in firm-level frailty, competitive crowding at founding may act as a

catalyst for the failure of frail firms. The survivors, however, emerge from this trial-by-fire

experience as stronger competitors and over time exhibit higher survival chances (Swaminathan,

1996; Lomi and Larsen, 1998). The empirical expectation is that density at founding will show a

positive effect on failure across the early tenure segment but that this effect will reverse to

negative across the high range of the tenure distribution.

A similar alternative explanation relates to the legitimacy-vacuum effect. Firms founded

in a period of high uncertainty may have initially high exit rates but those that survive that

precarious stage extract a strong learning benefit both from the failures of their pioneering peers

and from their own experience. Vicarious and experiential learning turn new firms in new

industries into stronger survivors if they outlast the formative stage of the industry. In empirical

terms, this conjecture predicts that the disadvantage of early entrants manifested in higher hazards

of failure when density at founding is very low will transform into an advantage with firm tenure

so that low density at founding for experienced firms will be associated with lower failure

chances.

To test this alternative hypothesis, in our next model (model 3.1 in table 3), we allow the

density at founding effects to vary with organizational tenure in the industry. If the alternative is

supported, we will see that the baseline effects of density at founding (negative and positive for

the main and squared terms, respectively) will reverse as firm tenure increases. The estimates

from our model clearly show that this is not the case: neither the linear nor the squared effect is

19

significant past the third-year tenure segment. More importantly, the likelihood ratio test of model

fit shows that allowing the density-at-founding effects to vary with tenure is not justified

(ΔLL=3.98, Δd.f.=2, p>.10) so it ought to be rejected in favor of the tenure-invariant

specification in the original model. Substantively, this finding confirms that both the legitimacy

vacuum and the crowding effects experienced at birth are persistent and irreversible. Of course,

there are strong learning effects as evidenced by the negative age dependence evidenced by the

estimates for the tenure piece constants but these effects occur independently of the imprinted

disadvantage of operating under legitimacy vacuum at founding.

[Table 3 about here]

A second consideration in interpreting our initial results is the need to allow for the

density-at-founding effects to vary with industry evolution. As we explained, the legitimacy

vacuum effect only obtains among early entrants at the start of the industry so we should observe

that as the industry matures, the legitimacy effect will disappear. Similarly, as competition

embeds in the evolving industry structure, it becomes less driven by mere ecological crowding

and more so by the competitive relationships leading to direct rivalry (Hannan, 1997). A general

way to model these expectations involves interacting the two density-at-founding terms with

industry age. If the initial density-at-founding effects wear off with time, we expect to see the

interaction effects work in the opposite direction, thus reducing the main effects. We test this

specification in our next model (model 3.2) which reveals that while the main and squared terms

of density at founding continue to be negative and positive (respectively), their interactions with

industry age show smaller coefficients that are in the opposite direction—positive and negative.

All density-at-founding effects are significant. 4

4

We also estimated all of our models by including Hannan et al.’s (1998) extended population inertia specification of

contemporaneous density effects in which the quadratic specification is interacted with population age. Our density-

20

DISCUSSION

Our goal here was to develop and test mechanisms that explain the relationship between

legitimacy vacuum, imprinting, and survival chances. We articulated three such mechanisms that

account for the lower survival chances of organizations founded under conditions of legitimacy

vacuum—the disproportionate investment of founders’ finite resources to manage the external

presentation of her venture as a legitimate social actor, the likelihood of such investments to

produce stable organizational routines that become obsolete and generate external misalignment

once legitimacy vacuum dissipates, and the likelihood of ineffective long-term investment of

resources available at birth during a period of uncertainty when the future evolutionary course of

the industry is unknowable. We argued that these three factors emanate from lack of constitutive

legitimacy at the level of the population to which an organization belongs and that, as ecological

and institutional theories predict, constitutive legitimacy is driven by increasing population

density. We combined these ideas with the logic of an established theory, the density delay model

in organizational ecology, which posits that as density at founding increases, organizational

survival chances deteriorate. In the revised version of the theory that we advanced here, the effect

of density at founding is non-monotonic—it improves survival chances as density at founding

increases at low counts (based on the arguments we introduced earlier) but failure hazards rise as

density at founding increases at high counts (based on the crowding argument in original density

delay theory).

At a broad level, our arguments are essentially about the role of history for organizational

evolution so we strived to depart from the common approach in economic and organizational

at-founding effects are unchanged when added to this specification but we do not present it here because it greatly

complicates the interpretation of our effects.

21

analysis in which this role is reduced to a factor that is uniformly viewed as important (and

controlled for in most empirical specifications) but that does not lend itself to theoretical

generalizations. Not generalizing from historical occurrences is certainly warranted in many cases

in which path-dependence leads to realities sui generis with idiosyncratic outcomes. But we also

emphasized the importance of imprinting effects that may parallel any other relevant pathdependent sequence. Bridging ideas from structural imprinting theory (Stinchcombe, 1965) and

the density delay theory in organizational ecology, both of which highlight the importance of

environmental characteristics at birth, we proposed one way to systematically examine and

summarize environmental conditions at the time of organizational founding related to the

difficulty of securing and investing resources during an industry’s early years. We recognize that

these conditions may vary greatly between markets or industries but conjecture that a measure of

population density summarizes these conditions reasonably well, even across different contexts.

The obvious advantage of a single, simple measure is not only that it makes

generalizations possible but that its application can be adapted flexibly to contexts with extended

degrees of specificity. We aspired to demonstrate this by selecting for our analysis an

organizational population with a rather unique history. Legitimation in the U.S. automobile

industry was only an indirect function of density. The early automobile offered by industry

pioneers generated sensational excitement among the public and quickly became inextricably

enmeshed in the social discourse. The numerous car rallies and fairs fueled this excitement, and

the media extensively catered to it (Flink, 1988). The consequence of such product-driven

legitimation was that it did not require as many firms as the typical diffusion of a new form

usually does. Accordingly, we used a simple logarithmic transformation of density at founding to

account for the early institutionalization of the nascent form and the impending shift to

competition for resources. The results strongly support the logic of our theory. After all, if the

22

poor survival chances of early entrants could be explained without recourse to our theory of

legitimacy vacuum, then their failure hazards would not have improved dramatically, as our

results demonstrated, with increases in density-dependent constitutive legitimation.

The first-mover (dis)advantage. Our theory of legitimacy vacuum and structural

imprinting appears to directly contradict notions of first-mover advantages (FMA) that are

popular in the strategic management literature. Given the conceptual haze surrounding the FMA

metaphor (Lieberman and Montgomery, 1988: 52) and the overwhelming sample selection bias in

most empirical studies in the FMA literature (i.e., a retrospective approach to the fates of

dominant survivors whose success is identified exclusively post hoc), we would not have

considered this contradiction had it not been for the fact that one of the strongest claims of

evidence in support of FMA comes from the analysis of the U.S. auto industry. Klepper (2002),

who used a different and more limited dataset of the industry, showed that first movers enjoyed

persistent survival advantages over later entrants. However, Klepper’s dataset traced the origin of

the industry to 1895 (a full decade later than Hannan et al.’s (1998) data that we used here), thus

entirely omitting the period of legitimacy vacuum. Every indication from the historical record is

that by 1895, the automobile was a social fact, not a curious novelty and that automobile

producers as an organizational form have by that time achieved a legitimate constitutive

standing—the first flagship industry publication Horseless Age published its inaugural issue in

December of 1895. Moreover, the subsequent few years provided clear evidence that the notion

of the automobile had become widespread—the convention of introducing new models through

the media began in 1897 (Flink, 1988), and it was also in that year that the New York Times

declared: “The new mechanical wagon with the awful name automobile has come to stay...”

Technically, our results agree with Klepper’s in that we too showed firms entering the

market when legitimacy vacuum had dissipated yet competitive crowding was still low to have

23

had the best chances of long-term success. But we also emphasized that these firms were not the

first movers. Instead, these firms, whether fortuitously or by great vision, entered the industry at

the point at which a sufficient number of incumbent firms had served to socially disseminate the

image and features of the new organizational form yet this number was insufficiently high to

generate crowding-out and resource scarcity effects. In terms of our model, this point is the

turning point in the U-shaped relationship between density at founding and failure hazards.

It appears then that our model may help to explicate some of the inconclusiveness

surrounding research on FMA once this framework explicitly allows for the legitimacy vacuum

effects that we theorized and evidenced here. And this would not be entirely at odds with current

conjectures. For example, Lieberman and Montgomery (1998: 1112) acknowledge that

“…pioneers often miss the best opportunities, which are obscured by technological and market

uncertainties,” and Tellis and Golder’s (1996: 66) descriptive analysis concludes that “early

leaders enter an average of thirteen years after pioneers yet are much more successful.” Given the

evidence we provided in support of the imprinting effect of legitimacy vacuum—a strong and

persistent first-mover disadvantage—perhaps it is useful to think of the mechanisms generating

FMA that Klepper (2002) articulated (e.g., economies of scale in R&D) as accruing to firms that

are first movers in a second wave of industry entrants.

CONCLUSION

We think that our model of the survival rates of new firms in new industries, which relies

on a single, simple explanatory measure, provides an empirically and theoretically tractable way

to model the impact of structural imprinting on organizations’ life chances. Unlike measures of

specific historical periods (typically marked up by indicator variables, as in our analysis here), the

density at founding measure and its effects are generalizable across contexts. Of course, testing

24

the theory in different contexts requires knowledge of historical conditions so the model can be

appropriately specified. If it is not, the danger is not that the predicted empirical relationships will

not be confirmed but that they might be even if the logic of the theory suggests otherwise

(Denrell and Kovács, 2006). This highlights perhaps the greatest weakness of ecological

models—their reliance on relatively simple measures makes them prone to misspecification.

Certainly, the mechanical application of density models can be completely atheoretical. But,

theoretical insight is at least as likely to derive from the historically informed (and accordingly

modified) application of simple ecological models as from models with more complicated

measures which may be harder to replicate and whose effects may be less clear to interpret. The

argument and evidence presented here lend credence to this claim.

25

REFERENCES

Automotive News. 1993. “America on the Wheel: 100 Years of the Automobile in America”. 4.

September, Special Issue.

Baron, J. N., M. T. Hannan, and M. D. Burton. 2001. “Labor pains: Change in organizational

models and employee turnover in young, high-tech firms.” American Journal of Sociology

106: 960-1012.

Baum, J. A. C., and W. W. Powell. 1995. "Cultivating an Institutional Ecology of Organizations:

Comment on Hannan, Carroll, Dundon, and Torres." American Sociological Review 60:

529-538.

Blossfeld, H. P., and G. Rohwer. 1995. Techniques of Event-History Analysis. Mahwah, NJ:

Erlbaum.

Boeker, W. 1988. “Organizational origins: Entrepreneurial and environmental imprinting at time

of founding.” in G. R. Carroll (ed.) Ecological models of organizations. Cambridge, MA:

Ballinger.

Carroll, G. R. and M. T. Hannan. 1989. “Density delay in the evolution of populations of

newspaper organizations: A model and five empirical tests.” Administrative Science

Quarterly 34: 411-30.

Carroll, Glenn R. and Michael T. Hannan. 2000. The Demography of Corporations and

Industries. Princeton, NJ: Princeton University Press.

David, P. A. 2000. “Path dependence, its critics and the quest for ‘historical economics’.” in P.

Garrouste and S. Ioannides (eds.) Evolution and Path Dependence in Economic Ideas:

Past and Present. Cheltenham, England: Edward Elgar Publishing.

Denrell, J. and B. Kovács. 2006. “Population Selection Bias: The Case of Density Dependence.”

Working Paper, Stanford Graduate School of Business.

26

Dobrev, S. D. and W. P. Barnett. 2005. “Organizational Roles and Transitions to

Entrepreneurship.” Academy of Management Journal, 48, 3: 433-449.

Flamang, J. M. 1989. Standard Catalog of American Cars 1976-1986. 2nd edn. Krause, Iola,

Wisconsin.

Flink, J. J. 1988. The Automobile Age. The MIT Press.

Freeman, J. 1986. Entrepreneurs as Organizational Products: Semiconductor Firms and Venture

Capital Firms. In Gary Libecap (Ed.) Advances in the Study of Entrepreneurship,

Innovation, and Economic Growth. Greenwich, CT: JAI Press.

Gunnell J. A., Schrimpf, D., and Buttolph, K. 1987. Standard Catalog of American Cars 19461975. 2nd edn. Krause, Iola, Wisconsin.

Hannan, M. T. 1997. "Inertia, Density and the Structure of Organizational Populations: Entries in

European Automobile Industries, 1886-1981". Organization Studies. 18: 193-228.

Hannan, M. T. 1998. "Rethinking Age Dependence in Organizational Mortality: Logical

Formalizations." American Journal of Sociology 47:126-164.

Hannan, M. T., D. M. Burton, and J. N. Baron. 1996. “Inertia and change in the early years:

Employment relations in young, high technology firms.” Industrial and Corporate

Change 5: 503-536.

Hannan, M. T., and G. R. Carroll. 1992. Dynamics of organizational populations: Density,

legitimation and competition: New York and Oxford: Oxford University Press.

Hannan, M. T., and G. R. Carroll. 1995. “Theory Building and Cheap Talk about Legitimation:

Reply to Baum and Powell.” American Sociological Review 60: 539-44.

Hannan, M. T., G. R. Carroll, S D. Dobrev, J. Han, and J C. Torres. 1998. “Organizational

Mortality in European and American Automobile Industries, Part II: Coupled Clocks.”

European Sociological Review 14: 303-313.

27

Hannan, M. T., and J. Freeman. 1977. "Population Ecology of Organizations." American Journal

of Sociology 82:929-964.

Hannan, M. T., and J. Freeman 1989. Organizational Ecology. Cambridge, MA: Harvard

University Press.

Hsu, G., and M. T. Hannan. 2005. “Identities, genres, and organizational forms.” Organization

Science 16: 474-90.

Immelman, K. 1975. “Ecological Significance of Imprinting and Early Learning”. Ann. Rev. Ecol.

And Syst. 6:15-37.

Kimberly, J. R. 1979. “Issues in the Creation of Organizations: Initiation, Innovation, and

Institutionalizations.” The Academy of Management Journal 22: 437-457.

Kimes B.R. 1996. Standard Catalog of American Cars, 1805-1942. 3rd edition. Iola, WI: Krause

Publications.

Kimes, B. R. and H. A. Clark. 1989. Standard Catalog of American Cars 1805-1942. 2nd edn.

Krause, Iola, Wisconsin.

Kirsch, David. 2000. The Electric Vehicle and the Burden of History. Rutgers University Press

Klepper, Steven. 2002. “Firm Survival and the Evolution of Oligopoly”. The Rand Journal of

Economics. Vol. 33, No. 1. (Spring, 2002), pp. 37-61.

Kowalke, R. (ed). 1997. Standard Catalog of American Cars 1946-1975. 4th edn. Krause, Iola,

Wisconsin.

Kutner, R. M. 1974. The Complete Guide to Kit Cars, Auto Parts and Accessories. Auto Logic,

Wilmington, Delaware.

Levinthal, D., and J. Mayatt. 1994. “Co-Evolution of Capabilities and Industry: The Evolution of

Mutual Fund Processing.” Strategic Management Journal 15: 45-62.

28

Lieberman, Marvin B., and David B. Montgomery. 1998. “First Mover (Dis)Advantages:

Retrospective and Link with the Resource-Based View”. Strategic Management Journal.

19: 1111-1125.

Lomi A., Larsen E. 1998. “Density Delay and Organizational Survival: Computational Models

and Empirical Comparisons”. Computational and Mathematical Organizational Theory,

3(4): 219-247.

Lorenz, Konrad. 1935. “Der Kumpan in der Umwelt des Vogels. Der Artgenosse als auslösendes

Moment sozialer Verhaltensweisen“. Journal für Ornithologie 83, 137-215, 289-413.

Maddison, A. 1991. Dynamic Forces in Capitalist Development. New York: Oxford University

Press.

Meyer, J. W., and B Rowan. 1977. "Institutionalized Organizations - Formal-Structure as Myth

and Ceremony." American Journal of Sociology 83:340-363.

Mitchell, W. 1989. “Whether and When? Probability and Timing of Incumbents' Entry into

Emerging Industrial Subfields.” Administrative Science Quarterly 34: 208-230.

Nelson, R. R., and S. G. Winter. 1982. An Evolutionary Theory of Economic Change. Cambridge,

MA: Belknap Press of Harvard University Press.

Parks, Tim. 2005. Medici Money: Banking, Metaphysics, and Art in Fifteenth-Century Florence.

New York: W. W. Norton & Co, Inc.

Phillips, D. J. 2002. “A genealogical approach to organizational life chances: The parent-progeny

transfer among Silicon Valley law firms, 1946-1996.” Administrative Science Quarterly

47: 474-506.

Pólos, L., M. T. Hannan, and G. R. Carroll. 2002. “Foundations of a theory of social forms”

Industrial and Corporate Change 11: 85-115.

29

Rao, H. 1994. “The Social Construction of Reputation: Certification Contests, Legitimation, and

the Survival of Organizations in the American Automobile Industry: 1895-1912.”

Strategic Management Journal 15: 29-44.

Stark, David. 1996. "Recombinant Property in East European Capitalism." American Journal of

Sociology. vol. 101, no. 4 (January 1996), pp. 993-1027.

Stinchcombe, A. L. 1965. Organizations and Social Structure. In: J. G. March (Ed.), Handbook of

Organizations (pp. 153-193). Chicago: Rand McNally.

Swaminathan, A. 1996. “Environmental Conditions at Founding and Organizational Mortality: A

Trial-by-Fire Model.” The Academy of Management Journal 39: 1350-1377.

Tellis, Gerard J., and Peter N. Golder. 1996. “First to Market, First to Fail? Real Causes of

Enduring Market Leadership”. Sloan Management Review. 37: 65-75.

Tuma, Nancy Brandon, and Michael T. Hannan. 1984. Social Dynamics:Models and Methods.

New York: Academic.

White, H. C. 2001. Markets from Networks: Socioeconomic Models of Production. Princeton, NJ:

Princeton University Press.

Womack, J. P., D. T. Jones, and D. Roos. 1990. The Machine that Changed the World. New

York: Rawson Associates.

30

Table 1: Descriptive statistics and correlation coefficients for variables in the life-history spell file of U.S. autofirms

Variable

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

Max.

Mean

S.D.

1

2

3

4

5

6

7

8

9

10

11

12

Industry Tenure (u)

0.00

78.00

Mass Production

0.00

1.00

Production Differentiation

0.00

1.00

JIT / TQC

0.00

1.00

Prior existence

0.00

1.00

Relative size

0.00 5284.50

ln(size):

-2.30

15.48

Size ≤ 50

0.00

1.00

Depression year

0.00

1.00

GDP

42.40 977.10

Industry age (t)

1.00

96.00

1.00 345.00

Density (n)

0.00

11.90

n2 ( × 10-3)

5.84

Ln[Density at founding (no)] 0.10

0.01

34.15

Ln(no)2

0.10 558.47

Ln(no) × t

0.01 3248.86

Ln(no)2 × t

4.85

0.90

0.14

0.08

0.57

35.55

3.12

0.68

0.17

200.75

35.15

204.90

5.40

5.17

27.50

170.95

866.73

9.15

0.30

0.35

0.27

0.50

284.97

3.48

0.47

0.38

221.07

22.06

109.55

4.01

0.88

7.86

82.24

384.93

0.15

0.22

0.13

0.09

0.59

0.65

-0.48

0.04

0.23

0.33

-0.32

-0.29

0.04

0.05

0.52

0.65

0.13

0.10

-0.01

0.04

0.21

-0.17

0.06

0.19

0.31

0.29

0.30

0.22

0.22

0.41

0.45

0.73

-0.29

0.21

0.14

0.01

-0.19

0.91

0.90

-0.61

-0.53

-0.62

-0.63

0.75

0.44

-0.26

0.13

0.10

0.04

-0.14

0.90

0.76

-0.42

-0.38

-0.44

-0.46

0.67

0.43

-0.05

0.10

-0.16

0.04

-0.29

-0.27

0.18

0.16

0.22

0.22

-0.20

-0.08

0.40

-0.18

-0.02

0.18

0.21

-0.18

-0.15

0.07

0.07

0.36

0.47

-0.87

0.06

0.19

0.30

-0.25

-0.24

0.03

0.03

0.44

0.52

-0.07

-0.01

-0.12

0.10

0.10

-0.09

-0.09

-0.22

-0.31

-0.15

-0.10

-0.08

-0.10

0.03

0.04

-0.06

-0.01

0.94

-0.58

-0.52

-0.56

-0.58

0.84

0.55

-0.65

-0.59

-0.56

-0.58

0.92

0.65

0.97

0.69

0.70

-0.52

-0.28

Variable

14

15.

16.

17.

Ln[Density at founding (no)]

Ln(no)2

Ln(no) × t

Ln(no)2 × t

Min.

13

14

15

16

0.61

0.63 0.99

-0.48 -0.24 -0.26

-0.27 0.16 0.15 0.90

Table 2: ML estimates of density at founding effects on the failure rate of U.S. autofirms

Model 2.1

Tenure (u):

u < 0.5

0.5 ≤ u < 1

1≤u<3

3≤u<7

u≥7

Mass Production

Production Differentiation

JIT / TQC

Prior existence

Relative size

ln(size):

Size ≤ 50

Depression year

GDP

Density (n)

n2 ( × 10-3)

Ln(no)

Ln(no)2

Log-likelihood

LR test vs. model (d.f.)

Model 2.2

-1.09**

-1.20**

-1.71**

-1.95**

-2.04**

0.79**

0.00

-0.61*

-0.12**

-0.02**

-0.13**

0.53**

-0.27**

0.002**

-0.01**

0.06*

(0.28)

(0.28)

(0.28)

(0.28)

(0.29)

(0.11)

(0.21)

(0.34)

(0.05)

(0.01)

(0.02)

(0.15)

(0.07)

(0.001)

(0.00)

(0.03)

-0.04

-0.14

-0.65

-0.89*

-1.00*

0.78**

0.00

-0.66*

-0.12**

-0.03**

-0.13**

0.54**

-0.28**

0.002**

-0.01**

0.05*

(0.45)

(0.46)

(0.46)

(0.46)

(0.45)

(0.11)

(0.21)

(0.34)

(0.05)

(0.01)

(0.02)

(0.15)

(0.07)

(0.001)

(0.00)

(0.03)

0.18**

(0.06)

-0.38*

0.07**

(0.21)

(0.03)

-3709.11

-3705.99

6.24 vs. Model 2.1 (1)

Numbers in parentheses are standard errors; Number of spells:8892; Number of events: 2051.

* significant at .05, ** significant at .01, one-tailed tests

Table 3: ML estimates of density at founding effects (by tenure and industry age) on the failure rate of

U.S. autofirms

Model 3.1

Tenure (u):

u < 0.5

0.5 ≤ u < 1

1≤u<3

3≤u<7

u≥7

Mass Production

Production Differentiation

JIT / TQC

Prior existence

Relative size

ln(size):

Size ≤ 50

Depression year

GDP

Density (n)

n2 ( × 10-3)

Ln(no) [all u]

u<3

u≥3

Ln(no)2 [all u]

u<3

u≥3

Ln(no) × t

Ln(no)2 × t

Log-likelihood

LR test vs. model (d.f.)

0.86

0.76

0.26

-1.74*

-1.85**

0.76**

0.01

-0.66*

-0.12**

-0.03**

-0.13**

0.55**

-0.29**

0.002**

-0.01**

0.04

(0.61)

(0.61)

(0.61)

(0.76)

(0.76)

(0.11)

(0.21)

(0.34)

(0.05)

(0.01)

(0.02)

(0.15)

(0.07)

(0.001)

(0.002)

(0.03)

-0.82**

0.04

(0.29)

(0.35)

0.12**

0.02

(0.03)

(0.04)

-3704.00

3.98 vs. Model 2.2 (2)

Model 3.2

0.65

0.54

0.04

-0.20

-0.35

0.28**

0.10

0.69*

-0.11**

-0.02**

-0.15**

0.48**

-0.26**

-0.01**

-0.003**

0.03

(0.44)

(0.44)

(0.44)

(0.44)

(0.44)

(0.14)

(0.21)

(0.40)

(0.05)

(0.01)

(0.02)

(0.15)

(0.07)

(0.001)

(0.001)

(0.03)

-0.99**

(0.24)

0.15**

(0.03)

0.02**

-0.003**

(0.005)

(0.001)

-3685.60

40.78 vs. Model 2.2 (2)

Numbers in parentheses are t-statistics; Number of spells:8892; Number of events: 2051.

* significant at .05, ** significant at .01, one-tailed tests

33

35