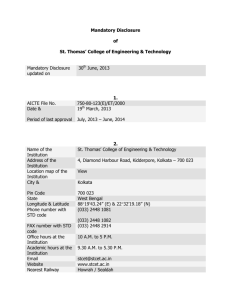

Knowledge, competition and appropriability

advertisement

Knowledge, competition and appropriability Is strong IPR protection always needed for more and better innovations? G. Dosi1 1 St. L. Marengo1 C. Pasquali 2 Anna School of Advanced Studies, Pisa 2 University of Teramo The problem I The idea that a positive and uniform relation between innovation and strong IP protection is based on a standard market-failure, positive externalities argument, which assumes: 1. a specific representation of knowledge and its nature (knowledge = codified information (Arrow, 1962), i.e. non-rival, hardly excludable and easily transferred) 2. a specific representation of markets and their functioning (perfect competition model: price competition on homogeneous products) 3. an assumption of rationality of innovators who anticipate the erosion of returns and thus do not engage in innovative activities I . . . but points 1 and 2 contrast with (most of) what we know on the economics of technological change; on 3 we know almost nothing Our thesis I if we start from a richer picture of knowledge and competition the economic foundations of IPRs become less clear: 1. the nature of knowledge and competition have a strong impact on appropriability regimes and IPRs dynamic efficiency 2. knowledge and competition features are highly technology-, industry-, and firm-specific 7→ variety of appropriability regimes Outline I (brief) discussion of the assumptions on knowledge I (brief) discussion of the assumptions on competition I (brief and informal) outline of an evolutionary model of industry dynamics Market failures I The classical argument for strong IPRs in the form of legally enforced rights is based on the idea of market failure: 1. Knowledge is a (to a large extent) public good: it will be underproduced and it will receive insufficient investments. 2. An artificial scarcity is thus created to amend non rivalry and non excludability in such a way that an appropriate degree of appropriability of returns from R&D investments is set. I The problem then becomes that of balancing out the detrimental effect of deadweight loss implied by a legally enforced monopoly and the beneficial effect of knowledge dissemination and investments in R & D. Some questions about knowledge I knowledge = information? I I I I tacitness and non-codifiability; imitation is costly (Mansfield) and requires absorptive competencies and assets (Cohen-Levinthal); are digital goods an exception? knowledge = quasi public good? I I non-rivarly vs. expansibility (David) embodied vs. disembodied technological knowledge (Boldrin-Levine, Quah) I “innovation” as a well-defined, discrete event? I I I I complementary knowledge, physical and organizational assets not available at competitive prices (Teece) cumulative/sequential knowledge (Bessen-Maskin, Scotchmer) complexity and interdependencies in knowledge (patent thickets, tragedy of anti-commons, and more in general non separabilities) technological opportunities: I I where do they come from? (exogenous vs. endogenous opportunities) to what extent are determined by incentives? Some consequences I imitation and diffusion is costly and problematic I appropriability issue more general than IPR issue: control of complementary assets and contractual/transaction costs issues I . . . technology-, industry-, and organization- specific knowledge dimensions: complexity, cumulativeness, opportunities I interdependencies limit the efficiency of the property rights / market solution to the coordination problem Markets and their functioning I I the benchmark is the static efficiency of resource allocation in the perfect competition model however: I I I this notion is hardly relevant in terms of empirical and descriptive adequacy markets are also places in which novelty is (imperfectly) produced, (imperfectly) tested and (imperfectly) selected (variation + selection) product innovations often create quasi-independent sub-markets and competitive processes are displaced before they settle into an “efficient” equilibrium Some consequences I IPRs do not only determine a hypothetic static efficiency but also the dynamic path of innovation I IPRs have an influence on technological opportunities as they drive the new product generation mechanism I IPRs set constraints to which paths can be followed, as some of them are blocked by patents I . . . especially if knowledge is “complex”, i.e. complementary or interdependent I e.g. patent thickets, tragedy of anti-commons Towards a more realistic model Main features: I product innovation, where products are complex systems of interdependent components (complex product space); I innovation can generate new products weakly (or not at all) competing with existing ones if enough differentiated in the product space (sub-markets) I imitation is costly and problematic (complex/interdependent systems cannot be usually imitated “piecewise”) Main features continues: I R&D investment is a boundedly rational routinized decision subject to adaptive learning (cf. models of Schumpeterian competition à la Nelson and Winter) I firms decide the amount of innovative R&D; imitative R&D and scope of R&D (how many product dimensions do research on) I patentability standard and patent breadth are defined on the product metric space I patent “coarseness”: what gets patented, a product system or single components? Knowledge complexity An anti-Coasian perspective: coarse vs. fine IPRs I Coase: IPRs internalize knowledge externalities: finer IPRs bring higher efficiency (transactions costs aside) I but finer IPRs put more constraints on innovation paths and block useful recombinations of interdependent pieces of knowledge I non-neutrality of IPRs with respect to innovation paths Some results I I patents increase R&D intensity (though this is not determined by rational calculation but by adaptation and selection) but overall R&D expenditure, overall product quality and social welfare may be lower with patents than without them, because: I I I patents deter imitative entry patents increase concentration net effect depends upon: I I I exogenous vs. endogenous technological opportunities sub-markets differentiation product space complexity Knowledge complexity I as knowledge complexity increases, “finer” patents on single components decrease overall product quality and social welfare for three reasons: I I I prevent all imitation favor firms doing specialized R&D on single components against those pursuing systemic innovation prevent useful re-combinations of existing pieces of knowledge I . . . however they increase variety across products and firms I competitive pressure towards excessively “fine” IPRs and over-modularization of R&D