Division Manager - African Development Bank

advertisement

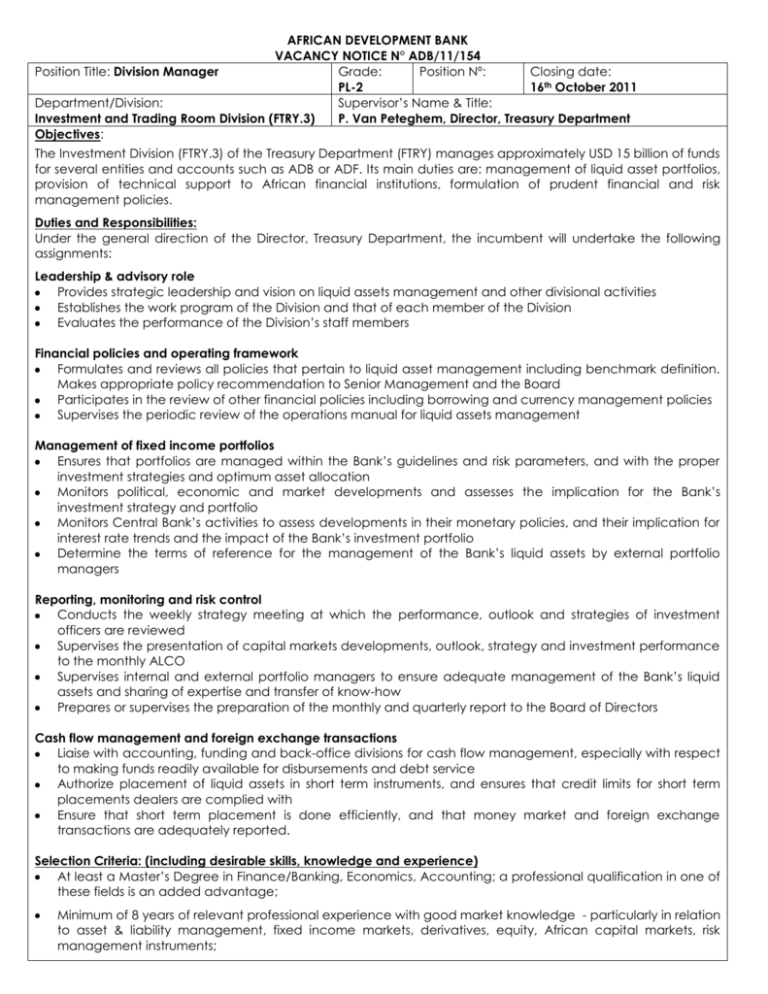

AFRICAN DEVELOPMENT BANK VACANCY NOTICE N° ADB/11/154 Position Title: Division Manager Grade: Position Nº: Closing date: PL-2 16th October 2011 Department/Division: Supervisor’s Name & Title: Investment and Trading Room Division (FTRY.3) P. Van Peteghem, Director, Treasury Department Objectives: The Investment Division (FTRY.3) of the Treasury Department (FTRY) manages approximately USD 15 billion of funds for several entities and accounts such as ADB or ADF. Its main duties are: management of liquid asset portfolios, provision of technical support to African financial institutions, formulation of prudent financial and risk management policies. Duties and Responsibilities: Under the general direction of the Director, Treasury Department, the incumbent will undertake the following assignments: Leadership & advisory role Provides strategic leadership and vision on liquid assets management and other divisional activities Establishes the work program of the Division and that of each member of the Division Evaluates the performance of the Division’s staff members Financial policies and operating framework Formulates and reviews all policies that pertain to liquid asset management including benchmark definition. Makes appropriate policy recommendation to Senior Management and the Board Participates in the review of other financial policies including borrowing and currency management policies Supervises the periodic review of the operations manual for liquid assets management Management of fixed income portfolios Ensures that portfolios are managed within the Bank’s guidelines and risk parameters, and with the proper investment strategies and optimum asset allocation Monitors political, economic and market developments and assesses the implication for the Bank’s investment strategy and portfolio Monitors Central Bank’s activities to assess developments in their monetary policies, and their implication for interest rate trends and the impact of the Bank’s investment portfolio Determine the terms of reference for the management of the Bank’s liquid assets by external portfolio managers Reporting, monitoring and risk control Conducts the weekly strategy meeting at which the performance, outlook and strategies of investment officers are reviewed Supervises the presentation of capital markets developments, outlook, strategy and investment performance to the monthly ALCO Supervises internal and external portfolio managers to ensure adequate management of the Bank’s liquid assets and sharing of expertise and transfer of know-how Prepares or supervises the preparation of the monthly and quarterly report to the Board of Directors Cash flow management and foreign exchange transactions Liaise with accounting, funding and back-office divisions for cash flow management, especially with respect to making funds readily available for disbursements and debt service Authorize placement of liquid assets in short term instruments, and ensures that credit limits for short term placements dealers are complied with Ensure that short term placement is done efficiently, and that money market and foreign exchange transactions are adequately reported. Selection Criteria: (including desirable skills, knowledge and experience) At least a Master’s Degree in Finance/Banking, Economics, Accounting; a professional qualification in one of these fields is an added advantage; Minimum of 8 years of relevant professional experience with good market knowledge - particularly in relation to asset & liability management, fixed income markets, derivatives, equity, African capital markets, risk management instruments; Very good knowledge of financial policies and operating framework for asset & liability management, as well as investment transactions Excellent understanding of financial issues and challenges related to liquidity policy, operating framework, investment strategies; Strong managerial skills, particularly the ability to manage a team with the right balance of flexibility and control Excellent written and verbal communication skills, in French or English, good working knowledge of the other language; Competency in the use of financial-related IT systems such as Summit, Bloomberg, and also knowledge of the standard software used in the Bank, particularly PowerPoint Excel and Word. Submitted by: Mohamed Youssouf, Division Manager, CHRM.1 Date : Approved by: Gemina ARCHER-DAVIES, Director, CHRM Date : Only applicants who fully meet the Bank's requirements and are being considered for interview will be contacted. Applicants will only be considered if they submit an online application, and attach a comprehensive Curriculum Vitae (CV). The President, AfDB, reserves the right to appoint a candidate at a lower level. The African Development Bank is an equal opportunities employer and female candidates are strongly encouraged to apply: www.afdb.org/jobs