Characteristics of Money from Fiqhi Perspective

advertisement

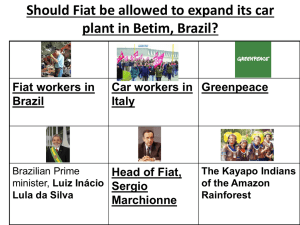

Money from Shari’ah Perspective DR. ZULKIFLI HASAN Contents n n n n n Introduction Discourse on Money by Muslims Jurists Issues on Modern Money Characteristic of Money from Economic Perspective Money from Shari’ah Perspective n Gold and Silver as the only Money n n Money is extended to fiat and fulus. n n n n Characteristics of Shari’ah Money The Unresolved Issues: Fiat Money n n Characteristics of Shari’ah Money Money in the theories of fiqh Fatwa on fiat money Modern Money: Revisit Concluding Remarks Introduction n n n n The classical legal scholars do not develop a concise theory of money It is historically established that the most valuable and accepted metallic monies were gold, silver, and then copper. At the time of the Prophet, the Muslims used Byzantine gold (dinar), Persian silver sigloi (dirham), Himyarite coins from Yemen or raw metals and other commodities as money. Three sorts of metal were used for economic transactions: gold (dinar), silver (dirham) and copper (fals plural fulus). Discourse on Money by Muslim Jurists Phase 1 Phase 2: Scholars were exposed to gold and silver as the main forms of money. Other forms of money did not pose an issue or create economic problems. Scholars were increasingly faced with problems associated with the extensive use of copper based money Phase 3: Scholars were faced with problems associated with the use of fiat money • Fiat money involves fraud, exploitation and injustice, § Clear demarcations on which at the same time accountability & responsibility creates uncertainty § Outlines the level of and accountability and responsibility of the board of involves gharar (Marks). • The U.S-led fiat money system has become a Aims at safeguarding the independence the Shariah weapon ofofeconomic committee in ensuring sound imperialism (Shaefer) Shariah decision-making, and directors, Shariah committee and management of the Islamic financial institutions Fiat Money Trust in gold as a currency is Highlights requirements and easier than trust in the to expected competencies ensure key arewho politicians andfunctions bankers capable of implementing are meant to control the fiat Shariah governance money supply (Ricardo). emphasis on the role of the board of directors in recognizing the independence of the Shariah committee By going off the gold standard, the US has obliged the world’s central banks to finance the U.S. balance-of-payments deficit byset using their surplus Minimum of rules that dollars to buy U.S.importance Treasury emphasizes on the of observing and preserving bonds and maintain large confidentiality and improving amounts of dollar reserves, the level of consistency in whose total amount decision making by therapidly Shariah committee goes beyond “America’s ability or intention to pay” (Dyer). What is money? n n n n n Anything which is specifically used as a medium of exchange, is measurable, and can store value. Ibn Taimiyyah: "Money and coins are not meant for themselves but they are meant to be used for acquiring goods (that is, they are a medium of exchange)” Al Ghazali: “To use money for the purpose not intended for its creation is vicious”. Muhammad Manzoor Ali: “Money is dissimilar to production goods, as it differs in characteristics. That means money is useful only due to its quality of being a medium of exchange” If money needs to be exchanged with money, the Islamic injunction on trading ribawi material is applied. Characteristics of Money from Economic Perspective Acceptability Divisibility Portability/ Convenience People must be willing to accept it as a means of payment and in settlement of a debt Must be capable of division into smaller units to accommodate transactions of differing value Must be portable and easy to use Money of the same value must be of uniform quality Uniformity Stability of value In order to fulfil its various functions, it must retain its value It must be hard to forge Security Durability Must last a reasonable length of time before deteriorating 17 Forms of Money Natural Money: In the form of a commodity with intrinsic value (gold and silver) Artificial or Fiat Money: Without intrinsic value that is used as money because of government decree Muslim Jurists Position on Money Gold and Silver as the only money Accept fulus and fiat money as money First View: Gold and Silver as the Only Money Shafii Scholars Al- Ghazali, al-Nawawi, al Suyuti and al-Maqrizi Hanbali Scholars Mujahid and Nakha‘i. Hanafi Scholars Abu Hanifah and Abu Yusuf Maliki Scholars Ibn Nafi‘, al-Adawi and Shaykh ‘Alish, Mufti of the Maliki madhhab (school) in Egypt. Contemporary Scholars Shaykh Ahmad al-Khatib, Shaykh ‘Abd al-Rahman al Sa‘di, Ibn Badran, Ahmad al-Husayni, Shaykh alMuti‘I, Shaykh Muhammad Amin al-Shanqiti, Taqi alDin al-Nabhani, Muhammad Baqir al- Sadr, Muhammad Makhluf, Hassan Ayyub, Nasir Farid Wasil and Imran Hussein. Reason D’etre Sunnah Taqririyah Muamalah and Ibadah Maliyah Dinar and Dirham in al Quran and hadith Justice Hoarding of gold and silver (iktinaz) is also prohibited Stability of value The Prophet approved the use of gold and silver in Makkah and Madinah Calculation of zakah on money, diyah or blood money, theft punishment and exchange transactions is based on Gold and Silver Indicate that gold and silver are to be used as money. Justice in the monetary system. Riba-free and gharar-free. The reason is to keep gold and silver in circulation, hence, gold and silver perform the function of money The introduction of ‘fulus’ created new kinds of instability and inflation where the causes were mainly monetary phenomenon 17 Characteristics of Money from Fiqhi Perspective 1. Precious metals (gold or silver); n 2. Intrinsic value: the value of the money was ‘inside’ the money and not ‘outside’. n 3. Money was always located within Allah’s creation in a commodity that was created by Allah, with value assigned to it by Allah. n 4. Functions as a medium of exchange, a store/ measure of value and a unit of account n Functions as Money As a medium of exchange, or means of payment: Money is generally accepted by buyers and sellers as payment for goods and services Surah al-Tawbah: 34 prohibits the hoarding of gold and silver indicating the function as money. al-Kahf: 20, silver is used as a medium of exchange. As a store/measure of value: Money serves as an asset that can be used to transport purchasing power from one time period to another. Surah al-Imran: 75, 91 showing the function of gold as a store/measure of value. Al Ghazali: God created the two precious metals, gold & silver to serve as a measure of all commodities The numeraire: A unit of Surah Yusuf: 20 indicating silver as a account: money is a standard measure of value and medium of that provides a consistent way exchange. of quoting prices. Gold and Silver as Money in al Quran Dinar Surah al Imran, 3: 75 and 91, al Zukhruf, 43: 71 and 53, al Fatir, 35: 33, al Haj, 22: 23, al Kahf, 18: 31, al Isra, 17: 93 These verses demonstrate that Allah created gold and silver to be used, among other things, as money. Dinar and Surah al Imran, 3: 14, al Since the early days, Dirham Taubah, 9: 34, al Zukhruf, 43: Muslims regarded 33-35, al Nisa, 4:20, al Insan, gold and silver 76: 21 coins as their only real and stable Dirham Surah Yusuf, 12: 20 wealth (Ibn Khaldun) Gold and Silver in Hadith Abu Bakr ibn Abi Maryam reported that he heard the Messenger of Allah say: "A time is certainly coming over mankind in which there will be nothing (left) that will be of use (or benefit) save a Dinar (i.e., a gold coin) and a Dirham (i.e., a silver coin).” (Musnad Ahmad) Abu Said al-Khudri reported: When the Day of Resurrection comes a Mu'adhdhin (a proclaimer) would proclaim: “Let every people follow what they used to worship.”Then their persons would be forbidden to the Fire; and they would take out a large number of people who had been overtaken by Fire up to the middle of the shank or up to the knees. They would then say: “O our Lord not one of those about whom Thou didst give us command remains in it (in Jahannam)”. He will then say: “Go back and bring out (from the hell-fire) those in whose hearts you find good of the weight of a Dinar.” Then they will take out a large number of people. Then they would say: “O our Lord! We have not left anyone about whom You commanded us.” He will then say: “Go back and bring out those in whose hearts you find as much as half a Dinar of good.” Then they will take out a large number of people, and would say: “O our Lord! not one of those about whom Thou commanded us we have left in it.” Then He would say: “Go back and in whose heart you find good to the weight of a particle bring him out.” They would bring out a large number of people, and would then say: “O our Lord, now we have not left anyone in it (Hell) having any good in him.” (Sahih, Muslim) Both hadith indicate that gold and silver as the only money acceptable by Shari’ah. (Ibnu Khaldun, Al Ghazali, al Maqrizi). Robert Mundell: “Gold will again be part of the international monetary system in the 21st century, providing a stable international unit of account that is missing since WW I” Characteristics of Gold and Silver as Money Homogeno Acceptabil Divisible us ity Mobile Stable Rare Gold Excellent Excellent Excellent Good Excellent Excellent Silver Excellent Very Good Excellent Good Excellent Good Source: Meera and Larbani, (2009: 101) Money is extended to Fulus and Fiat money Hanbali Scholars Ibn Taymiyyah and Ibn Qayyim Hanafi Scholars al-Shaybani Maliki Scholars al-Hattab and al-Wansharisi Zahiri Scholars Ibnu Hazmin Contemporary Scholars Yusuf al-Qaradawi, Muhammad Taqi Usmani, ‘Abd Allah Sulayman al-Mani‘, Majma Fiqh and the Islamic Fiqh Academy of the Muslim World League 2nd View: Characteristics of Money 1. Money is not characterized by Precious metals (gold or silver); or commodities, or intrinsic value:. 2. Money is anything that has functions as a medium of exchange, a store/measure of value and a unit of account. n Ahmad ibn Hanbal: There was no harm in adopting as currency anything that is generally accepted by the people. Reason D’etre Sunnah Taqririyah Sunnah taqririyyah supports the view of gold and silver as money, but it cannot be interpreted to limit money to only gold and silver Principle of Ibahah There is no prohibition for the use of other than gold and silver as money The authority is given to scholars to determine the type of money based on the sources of Shari‘ah Al Masalih al Mursalah To remove hardship Convention or Custom Usage of fulus or copper money/ Maghshus (mixed metal) Hardship if money is restricted to only gold and silver due to limited supply to fulfill contemporary economic and financial needs The meaning of money is to be seen in its function as a medium of exchange and measure of value. It does not have to be limited to gold and silve Both have an intrinsic value below the face value. Fulus is the first example of conventional money. 17 The Unresolved Issues n n n n n n Modern money: n the fiat money and n the bank credit money What is the basis for using fiat money, which has an exchange value that exceeds the intrinsic value? Current monetary regime dominates financial transactions with elements of riba and gharar. Currency speculators earned money by manipulating weaknesses in the international monetary regime. Bank Credit Money: The creation of bank deposits, loaning out the same money through numerous means such the various types of loans, credit cards, and the market created electronic money (Khan, 1999). The main issue regarding bank credit money is the regulation regarding fractional reserve requirement and the credit that the bank created. Fiat Money n n n n n n in Latin means 'let there be' Fiat money is money declared by a government to be legal tender. Fiat money serves as the medium of exchange by government declaration. Fiat money is a type of money that is not backed by any physical good or commodity. The value of fiat money or its purchasing power lies on public acceptance, government decree and relative scarcity. Currency notes and coins (state-issued money) and accounting money (bank credit money) Discourse on Fiat Money by Muslim Jurists Phase 3: Phase 1: Usage of fulus and maghsush as an alternative money Phase 2: Currency is based on the gold standard Fiat money can be viewed as a bond on the deposit of gold or silver. Example: Fatwa from the Azhar mosque in Cairo . No currency is based on the gold standard. (i) Fiat money is treated as a fungible good (dayn). (ii) Suftaja: Fiat money is regarded as a replacement for the athman of silver and gold (iii) Fiat money has the same position as fulus (iv) Money as a simple good (v) Money as thaman Fiat Money in the Theories of fiqh As al Dayn • The rules for exchange of debts apply. • Money cannot be exchanged for money (dayn bi aldayn) and no salam • the exchange of money for gold or silver is not permitted As Suftaja • Regarded as a replacement for the athman silver and gold as precious metal. • Can only be justified if it is completely backed by a precious metal. As Fulus • Same legal position as fulus. • Social control cannot guarantee the exchange value of paper money as it did for copper coins. • an exchange in unequal numbers is not prohibited. As Thaman • Different currencies as well as gold, silver and fals are regarded as different types. • Strong danger of gharar. Money is not backed by real assets, only the strength of the economy serves as a guarantor. As a Simple Good • Fiat money is seen as goods. • using paper money for payment is not a sale of paper • The face value is not based on the market for paper. 5 Fatwa on Fiat Money n 3rd conference of Islamic Fiqh Academy which held in Amman Jordan on 16 October 1986: n "Fiat money is a currency that stands with its own value. Its rule is similar with the rule of gold and silver. Thus, it is treated as one of zakatable as well as ribawi (usurious) items". Fatwa on Fiat Money n n n n Resolution of the Islamic Fiqh Academy of the Muslim World League in Makkah in 1985, Resolution No. 6, Regarding Paper Currency. Paper currency has become the medium of exchange for today’s goods; it has replaced gold and silver in today’s financial transactions, and as it is the standard by which goods are valued. Fiat money is used to store value in savings, even though it lacks intrinsic value. The people’s confidence in it and their regard for it as the medium of exchange has bestowed the quality of being a counter-value for any exchange upon it. Paper currency is an independent form of money, and the rules for gold and silver money apply to it; therefore, it is compulsory to pay zakah on it. Reason D’etre Qiyas Scholars of usul fiqh make analogy between fiat money with gold and silver which had been used as currencies during. Illah: Holding monetary value Istihsan As fiat money become the only acceptable payment around the world its use is inevitable either in domestic market or at international trade level Non-contradict with the textual revelation neither from the Quran nor the Sunnah and the subject matter must be a Social Convention/ Urf general custom (al 'urf al `am). Al Masalih al Mursalah Interest, welfare, advantage and wellbeing Blocking the means which leads to unlawful matter Sadd al Zarai’ Fiat Money: Revisit Issue on Intrinsic Value n Issue on Allah’s authority to create Money n Issue on Medium of Exchange n Issue on Store of Value n Issue on Stability of Value n Issue on Seigniorage n Issue on Ownership n Issue on Free Will n Issue on Intrinsic Value n n n n Fiat money has no intrinsic value. Fiat money do not carry any intrinsic value, but by and large they are money that has “nominal” value owing to the fact that a sovereign state has declared it legal tender supplanting money that is universally regarded as having intrinsic value independent of any state decree (Khan, 1999). The principle of “nominalism”: Being a legal tender at the time of payment money involves an obligation to pay for material goods regardless of its intrinsic value. Fiat money is created by the government at no cost, apart from that of materials. Issue on the Authority to Create Money n n n n The money creating functions of the private banks are subjected to government regulation. Fiat money has resulted in the delegation of wide power of money making to the banking system the power that the legislature itself does not have (Parks, 1998). Money creation would cause a gradual shift of power into the hands of those who control the financial system. Bank’s ability to produce credit money is not regulated but rests on its economic prudent, policy choice and reserve requirements and this is worsened by the banking industry’s deregulation (Selgin, 1994 and Dow, 1996). Such a wide and arbitrary power is against the principles of trust or accountability and adl (justice) under the Shari’ah (al Quran, 38:26; 4:58; 8:25, 39; 10:85; 59:7). Issue on Medium of exchange Imam Malik: “any merchandise commonly accepted as a medium of exchange.” n (i) Money has to be merchandise. It could be paper. But fiat money is only for the value of the paper itself, not for what is written on it. Money must be something tangible (‘ayn). n (ii) Money must be commonly accepted. Therefore it cannot be imposed. n The fraudulent nature of the offer: Oblige to accept something above its value. n Issue on Store of Value Fiat money is no longer backed by gold, hence it is not considered to be appropriate store of value. n In contemporary financial systems, money is not a good store of value since its value generally depreciates over time, i.e. its purchasing power erodes due to inflation. n Issue on Stability of Value n n n n Is the fiat money system inherently unstable? Ibrahim, (2006): Expansion in money supply exerts an upward pressure on price levels and operates, with interest, as a destabilizing influence on stock prices. The speculative and arbitrage activities are due to the existence of different currencies and the cross exchange rates between them. These exchange rates constantly fluctuate, either due to forces of demand and supply for the currencies or even manipulative attacks. Roy W. Jastram. The Golden Constant (1977) and Silver: The Restless Metal, (1982): Figures for the price level based on the wholesale price index in Britain from the 1500s to the present, and for the U.S. from 1800. Data provides a very consistent series of prices over four centuries when things are priced with gold. Issue on Seigniorage in a Fiat Money n n Seigniorage: The percentage share of the crown in the bullion people brought to the royal mint to get converted into coins. It is the value given to fiat money over and above its intrinsic value. The benefit obtained by the first user of the fiat money: n n n n n (i) The bankers in the case of credit money, and (ii) the government in the case of currency notes and coins. Seigniorage of the international fiat currencies is, in large part, behind the current instability of the global monetary order (Robert Mundell). Contemporary Muslims Jurists including Majma Fiqh are silent on the issue of seigniorage in developing the theories of money from fiqh perspective. Seigniorage is not compatible with the Maqasid Shari’ah. Is the creation of fiat money is a serious form of riba? Issue on Ownership n n n n n Human effort (physical or intellectual) is prerequisite for the creation of ownership. Every transfer of asset, except a gift, inheritance or likewise, must be compensated for. Most money in the present monetary system is created by privately owned commercial banks, by means of the fractional reserve banking system (FRB). FRB creates ownership out of nothing, without work and taking on legitimate risks; thereby transferring ownership wrongfully. Surah al Baqarah, (2: 188) and al Nisa, (4: 29): Prohibition of transferring wealth through batil (wrongful) means. Issue on Free Will Freedom to choose medium of exchange. n People were forced to accept things without intrinsic value as measures of value the legal tender law. n The established legal tender laws coerce people to accept the modern monetary system when disputes are adjudicated in the courts. n Concluding Remarks n n n n n n Classical and contemporary Muslim Jurists do not develop a concise theory of money. The foundations for money have changed considerably, from precious metal to gold standard and finally fiat money without a real counter value. New aspects of using money, call for new directions in Islamic legal thought and theories. The existing theories of fiqh on fiat money seem to be insufficient and need further research. Is total abandonment of the use of gold and silver is permissible? Is the Maqasid Shari’ah are attainable in a fiat monetary system? Serious need to revisit the fatwa on both the fiat money and the fractional reserve banking system.