Tough Times for OJ - WSJ.com

1 of 2

http://online.wsj.com/news/articles/SB100014240527023045610045791...

Dow Jones Reprints: This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or

customers, use the Order Reprints tool at the bottom of any article or visit www.djreprints.com

See a sample reprint in PDF format.

Order a reprint of this article now

COMMODITIES

By ALEXANDRA WEXLER

Oct. 14, 2013 7:10 p.m. ET

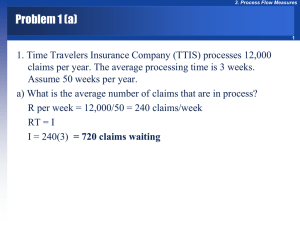

NEW YORK—Orange-juice futures fell Monday after U.S. retail sales of the breakfast beverage dropped

to their weakest level in at least 15 years.

Americans bought just 563.2 million gallons of the beverage in the year ended Sept. 28, according to

Nielsen data. That is the lowest since 1998-99, the oldest data available.

Analysts have said a greater variety of beverages, including acai juice and energy drinks, have taken

market share from orange juice, whose retail prices have soared.

The spread of citrus greening, a disease that chokes off

nutrients to fruit and causes it to drop prematurely from the

tree, has reduced U.S. orange supplies and helped drive up

prices even as demand has slumped. Ten years ago, the

average price for a gallon of orange juice was $4.40 a gallon.

Today, it is $6.20.

U.S. retail-sales volumes of orange juice fell to their

lowest in 15 years. Bloomberg News

Higher prices have kept revenue from orange-juice retail

sales from falling as sharply as volume has. Orange-juice

sales for the year ended Sept. 28 totaled $3.49 billion, down

5.2% from a decade ago, while sales by volume has dropped

by a third over that time.

Furthermore, traders are souring on the market. Open interest, or the number of outstanding positions in

the orange-juice market, fell to a 20-year low of 14,892 contracts Friday, data from the ICE Futures U.S.

exchange showed Monday.

"It's a bit frightening, really—these two data points, one being the open interest and one being the

consumption," said James Cordier, president of brokerage Liberty Trading Group in Tampa, Fla. "This is

what happens before markets go off the board. Orange juice could be seeing the twilight of its contract."

Orange-juice futures, which began trading in 1966, once attracted a broader array of investors and juice

processors, who for decades traded in rowdy pits on the floor of the New York Board of Trade in lower

Manhattan. The contract was immortalized in the 1983 movie "Trading Places," in which Dan Aykroyd and

Eddie Murphy foil a plot to corner the market for frozen orange juice.

10/16/2013 5:18 PM

Tough Times for OJ - WSJ.com

2 of 2

http://online.wsj.com/news/articles/SB100014240527023045610045791...

Orange juice for November delivery on the ICE Futures U.S. exchange fell 0.4% to $1.2590 a pound

Monday, its lowest close since Oct. 3.

Futures prices also have been suffering as traders have been liquidating bets on higher prices amid a

shortage of market-moving news. Last week, a U.S. Department of Agriculture production forecast was

supposed to give traders an idea of what to expect from the coming crop, but that report has been delayed

by the U.S. government shutdown. In addition, hurricane season is winding down and no major storms

have hit Florida, which produces about three-quarters of the oranges used for U.S. juice.

"Just the lack of news right now is part of the reason we're seeing that open-interest decrease," said Boyd

Cruel, senior analyst at Vision Financial Markets in Chicago. "People [who have] been playing the

potential for any weather threats have just gotten out of the market."

However, Mr. Cruel said the market could see some renewed interest in the next month as traders begin

to bet that a frost could damage the orange crop in Florida over the winter.

Write to Alexandra Wexler at alexandra.wexler@dowjones.com

Copyright 2013 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For

non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit

www.djreprints.com

10/16/2013 5:18 PM