Denver Retail: Mile High, Getting Higher

advertisement

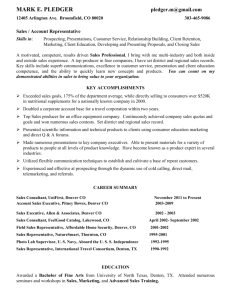

A Tale of Many Retail Markets—In One City NEW YORK CITY—Is it true that Brooklyn prices are growing to compete with Manhattan? And where are the hot markets? Learn all about the changing retail dynamics of the Big Apple in this exclusive video interview with Lee & Associates local principals. Read More Last Updated: December 18, 2015 01:00am ET Denver Retail: Mile High, Getting Higher DENVER—Listen to the mainstream media and one gets the impression that the changes in the marijuana laws are the only drivers of retail activity in Denver. Local brokers know better. A major influence for sure, but there’s so much more to the current upcycle in the Mile High City that should be counted—considerations such as the influx of millennials and the aggressive eye being cast on the city by investors. But Denver is not without its challenges, and in a wide-ranging conversation with GlobeSt.com, Jeffrey Hallberg, principal of the local office of Lee & Associates, covers it all. GlobeSt.com: Overall, what grade would you give the retail sector in Denver? Jeffrey Hallberg: The retail market is very strong in Denver right now. Vacancy rates have been on a steady decline since mid-2009—in fact, by as much as 5.7%, with net absorption outpacing new construction for some time. Currently, net absorption hovers around 1.4 million square feet. With the lack of new multi-tenant projects coming online and that declining vacancy, asking rents continue to go up. That said, I would give the market as a whole a B+. Two Long-Lackluster Submarkets Find Their Upcycle NEW YORK CITY—On the surface, there’s little commonality between Williamsburg, Brooklyn and the Arts District of Los Angeles. But look closer. Read More Are You a Thought Leader? GlobeSt.com Thought Leaders are the industry's leading experts on commercial real estate trends. Find out more! GlobeSt.com: So what are the hot submarkets and what are they getting for peak asking? Hallberg: The CBD, South, Southeast and Southwest markets are the hotspots in the metro area. Downtown and the CBD have an average asking rent of $31 per square foot triple net with peaks near $50 for new developments. GlobeSt.com: How does the Mile High city compare to markets like New York or Los Angeles? Are you seeing much interest by investors or name-brand retailers? Hallberg: Denver's market is comparable with L.A. and not far behind cities such as New York, Boston and San Francisco as it relates to rent growth, decreasing vacancy and strong investor activity. Investors still can find better value in the Denver market compared to the aforementioned metros. With very favorable interest rates and a lack of new product coming to market, the single-tenant assets, especially credit tenants and drug stores, are seeing a lot of activity. The strong demographics of the Denver market are causing retail investors to get much more aggressive in finding the right assets to invest in. The population is growing at a very strong pace, which is appealing to retailers since obviously this drives up spending. With the lack of new space in the market, this has all retailers moving quickly to fill vacant space to keep up with the demand for retail services. GlobeSt.com: Much is said about the concentration of Millennials in the Denver area. Are you seeing a direct impact on the retail market…and specifically in retail real estate? Hallberg: Denver is a very attractive place to work and live because of the strong employment growth in healthcare; construction; natural resources; and technology, education, professional and business services. The climate and the proximity to the mountains, along with surging job creation, is very favorable to Millennials looking at different places to start a career and make a home. This influx of Millennials has a direct impact on the retail market, driving up spending and increasing demand from retailers seeking more locations to better serve this growing demographic. GlobeSt.com: How has the marijuana industry impacted the retail market in Denver? Hallberg: The marijuana industry has had a significant impact on the retail market, not only in Denver but throughout Colorado. Marijuana retailers/dispensaries can pay higher rents than average tenants—by as much as 40%—making them sought after by those Landlords that are not averse to the use or the issues that surround them. In addition, they can lease otherwise hard-to-lease space and charge more for it. Other tenants get a direct benefit from marijuana retailers as centers with dispensaries increase traffic for all of the co-tenants in these centers. Last month marijuana sales in Colorado topped $100 million for the month. And through August of this year, there was more than $85 million in tax revenue generated by the sale of marijuana, far outpacing 2014. This has a direct effect on such issues as infrastructure construction, including schools, new roads and bridges. GlobeSt.com: What impact do you see e-commerce having on brick and mortar? Hallberg: It definitely has some impact though people still like to go out, see, touch and feel the product. Big-box retailers are being much more selective on the locations—and the number of locations—they’re opening, but they still need a presence in the market, even if people still prefer to buy online. GlobeSt.com: With the Federal Reserve raising interest rates, do you see any impact on the retail market? Hallberg: It will impact the investment market to some degree, though the attractiveness of the higher cap rates in the Denver market compared to other bigger markets will still lure those investors looking for a stable return in a growing market. This is especially true for 1031 exchange investors that are being priced out of their markets. I expect bidding to continue at a brisk pace as investors look to purchase assets before the Fed increases rates again. They’ve also indicated that this rate hike is a tentative beginning to a gradual tightening cycle while they monitor the effect on inflation. GlobeSt.com: So what’s the outlook? What do you see happening in 2016? Hallberg: When I look to 2016, I see a Denver economy that will expand and attract new companies to the market. The city will see continued strong job growth and lower unemployment. The Denver market will still have challenges in the affordable housing sector that will need to be addressed as we see more influx from millennials, issues such as demand driving rents and sales higher, pricing many out of the market. The demand for retail space will continue to drive rates up because of the limited competition from new retail projects coming online. Investor activity will outpace 2015 for both single and multi-tenant investments as investors look to capitalize on the still-low interest rates and the lack of good investment opportunities in competing markets. Construction of new developments will continue in an effort to keep up with the demand of a growing population and lack of available inventory. The developments that are preleased will lead the way in new construction. About Lee & Associates At Lee & Associates® our reach is national but our expertise is local market implementation. This translates into seamless, consistent execution and value driven market-tomarket services. Our agents understand real estate and accountability. They provide an integrated approach to leasing, operational efficiencies, capital markets, property management, valuation, disposition, development, research and consulting. We are creative strategists who provide value and custom solutions, enabling our clients to make profitable decisions.