Keynesian Macroeconomics Mankiw Chapter 9

advertisement

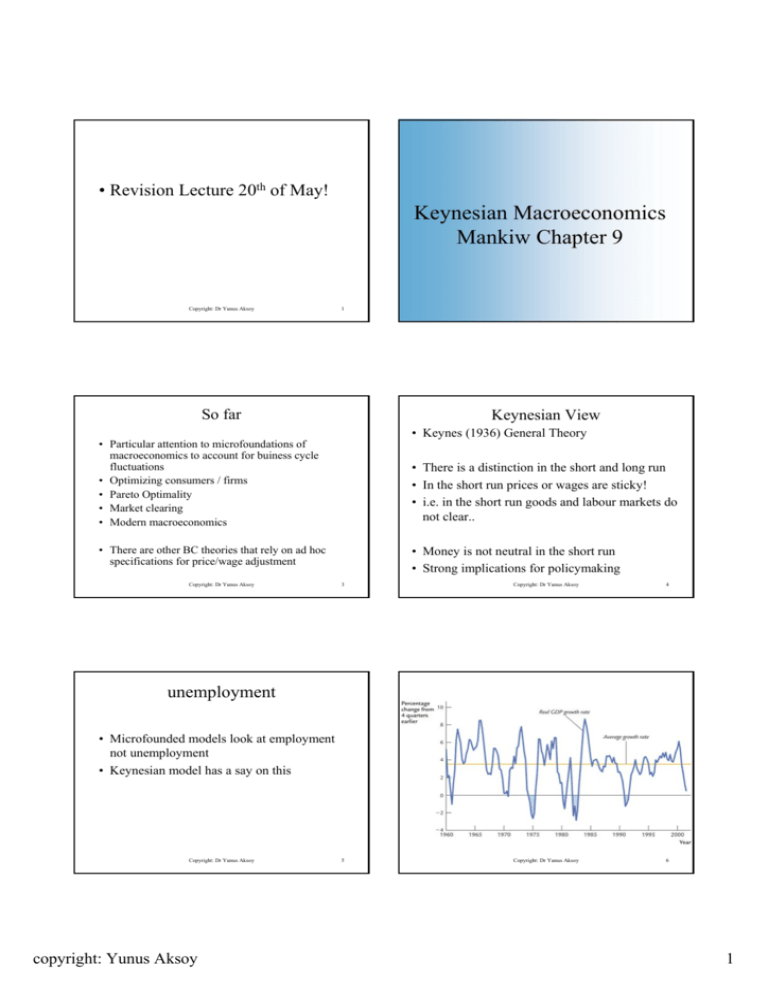

• Revision Lecture 20th of May! Keynesian Macroeconomics Mankiw Chapter 9 Copyright: Dr Yunus Aksoy 1 So far Copyright: Dr Yunus Aksoy 2 Keynesian View • Keynes (1936) General Theory • Particular attention to microfoundations of macroeconomics to account for buiness cycle fluctuations • Optimizing consumers / firms • Pareto Optimality • Market clearing • Modern macroeconomics • There is a distinction in the short and long run • In the short run prices or wages are sticky! • i.e. in the short run goods and labour markets do not clear.. • There are other BC theories that rely on ad hoc specifications for price/wage adjustment Copyright: Dr Yunus Aksoy • Money is not neutral in the short run • Strong implications for policymaking 3 Copyright: Dr Yunus Aksoy 4 5 Copyright: Dr Yunus Aksoy 6 unemployment • Microfounded models look at employment not unemployment • Keynesian model has a say on this Copyright: Dr Yunus Aksoy copyright: Yunus Aksoy 1 Quantity Theory of Money Velocity P×Y V= M Equation of Exchange Aggregate Demand M×V=P×Y • Quantity equation of aggregate demand Quantity Theory of Money 1. Irving Fisher’s view: V is fairly constant 2. Equation of exchange no longer identity 3. Nominal income, PY, determined by M 4. Classicals assume Y fairly constant 5. P determined by M M*V = P*Y Or Quantity Theory of Money Demand 1 M= × PY V M/P = Y/V Md = k × PY Implication: interest rates not important to Md Copyright: Dr Yunus Aksoy 7 Copyright: Dr Yunus Aksoy 8 Shifts in AD P×Y V= = M 2000 = 2 1000 Modern Quantity Theory of Money M×V=P×Y Implication: M determines P × Y Deriving AD Curve M = 1000, V = 2 ⇒ P × Y = 2000 Point A: P=2 Y = 1000 PY = 2 × 1000 Point B: P=1 Y = 2000 PY = 1 × 2000 Point C: P = .5 Y = 4000 PY =.5 × 4000 Conclusion: P ↑ Y ↓, downward sloping AD Shift in AD Curve M ↑: P×Y ↑, so at given P, Y ↑ ⇒ AD shifts right Copyright: Dr Yunus Aksoy 9 Copyright: Dr Yunus Aksoy 10 Aggregate Supply • Keynesian’s distinguish two types of AS.. – short run AS – long run AS Copyright: Dr Yunus Aksoy copyright: Yunus Aksoy 11 Copyright: Dr Yunus Aksoy 12 2 Copyright: Dr Yunus Aksoy 13 Copyright: Dr Yunus Aksoy 14 Copyright: Dr Yunus Aksoy 15 Copyright: Dr Yunus Aksoy 16 Copyright: Dr Yunus Aksoy 17 Copyright: Dr Yunus Aksoy 18 In the short run prices are sticky! • Menu costs • Pricing to market • Etc.. copyright: Yunus Aksoy 3 From Short-run to Long run • In the short run prices are sticky and AS curve is flat • A change in AD affects output not prices • In the long run prices are flexible and AS curve is vertical • Prices adjust • A change in the AD affects prices not output Copyright: Dr Yunus Aksoy 19 Copyright: Dr Yunus Aksoy 20 According to Keynesian’s stabilization possible • Suppose a money demand shock after the millennium bug fears are cleared. • M/P = Y/V • Given money supply, velocity of money rises, • nominal spending should rise when prices are sticky in the SR • Demand push shock • CB can reduce money supply to stabilize inflation • Unlike the case with monetary intertemporal model assume that CB can observe all macroeconomic data! Copyright: Dr Yunus Aksoy 21 Look at the Millennium Bug! (Percentage Change in the US M1 Currency Component) 22 An AS (cost pull) shock • Suppose energy prices go up due to OPEC cartel.. • Stagflation • What to do about it? 5 4 3 2 – Do nothing – Accommodate AS shock at the cost of permanently higher prices 1 Copyright: Dr Yunus Aksoy copyright: Yunus Aksoy 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 1969 1967 1965 1963 1961 1959 0 -1 Copyright: Dr Yunus Aksoy 23 Copyright: Dr Yunus Aksoy 24 4 Copyright: Dr Yunus Aksoy copyright: Yunus Aksoy 25 Copyright: Dr Yunus Aksoy 26 5