Answer key 0

advertisement

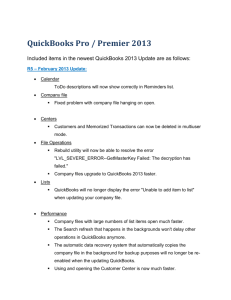

• • • • • • • • • • Answer key 0 Answer key Lesson 1: Getting started Review questions 1 List the three main ways you enter data in QuickBooks. Forms, lists, registers 2 List three ways to access features in QuickBooks. Menu bar, Icon Bar, Centers, Home page 3 What bookkeeping method does QuickBooks use to create most reports? Accrual, but you can see any report (except transaction reports) on a cash basis by changing the reporting preference. 4 Which of the following would you not include in the chart of accounts? a Checking account b Vendor record c Depreciation Expense d Accounts Payable 5 Which of the following is an asset? a Accounts Payable b Accounts Receivable c Company delivery van d Both a and b e Both b and c 6 Checking, savings, and petty cash should be set up as which of the following account types in QuickBooks? a Expense b Other current asset c Bank d Equity 7 Which of the following best describes a balance sheet? a A summary of a company’s finances over the past year b A financial snapshot of a company at a specific point in time c A summary of a company’s revenue and expenses for a fiscal year d None of the above Copyright 2009 Intuit Inc. QuickBooks in the Classroom 2 Answer key Lesson 2: Setting up QuickBooks Review questions 1 During the EasyStep Interview, QuickBooks creates income and expense accounts based on your company’s industry. 2 When setting up a company file in QuickBooks, what does the Start Date signify? a The date the business was created b The first date of the company’s fiscal year c The date the company purchased QuickBooks d The date from which you will be entering transactions in QuickBooks 3 When setting up a company file in QuickBooks at the beginning of a fiscal period, you would normally select which of the following as the start date? a The first day of the current fiscal period b The last day of the previous fiscal period 4 True or false: Once you have set up the chart of accounts, you cannot add, delete, or modify accounts. a True b False 5 Before working in QuickBooks, you need to enter an opening balance for each account. 6 True or false: Choosing a company organization associates a tax form with your business in the QuickBooks file. a True b False 7 In QuickBooks, linking income and expense accounts with tax lines does which of the following? a Helps keep your company profitable b Helps in preparing income taxes c Helps keep track of sales taxes you owe d Both B and C Copyright 2009 Intuit Inc. QuickBooks in the Classroom 3 Answer key Lesson 3: Working with lists Review questions 1 How many custom fields can you set up for items? a 4 b 5 c 7 d 20 2 Which of the following forms and windows could potentially be populated with information from the Vendor list? a Purchase orders b Bills c Write Checks d All of the above 3 Which of the following activities cannot be accessed from the Customers & Jobs list in the Customer Center? a Create statements b Assess finance charges c Enter credit card charges d Receive payments 4 On which tab of the Edit Customer window would you enter a customer’s payment terms (for example, Net 30 Days)? a Address Info b Additional Info c Payment Info d Job Info 5 A customer has three warehouses and you are installing an overhead door at each location. The best way to track this in QuickBooks would be to: a Set up each location as a separate customer b Set up a separate job for each location under the customer c Enter all work as one order under the customer d Use a custom field to track each location Copyright 2009 Intuit Inc. QuickBooks in the Classroom 4 Answer key 6 Products you sell would appear on which of the following lists? a Vendor list b Employee list c Chart of Accounts d Item list 7 A subcontractor would appear on which of the following lists? a Vendor list b Employee list c Customers & Jobs list d Item list 8 Name at least three lists on which you can merge items. a Chart of accounts b Item c Customers & Jobs d Vendor e Employee f Other Names 9 True or false: You can delete list items that are used in transactions. a True b False. You cannot delete items used in transactions, but you can make them inactive. Copyright 2009 Intuit Inc. QuickBooks in the Classroom 5 Answer key Lesson 4: Working with bank accounts Review questions 1 What does the ending balance in a QuickBooks bank account register represent? a Only transactions that have been printed b All transactions entered in the register, including checks that haven’t yet been printed 2 What preference allows you to have QuickBooks prefill the amount from the previous transaction with a payee? a Automatically prefill last amount for this payee b Automatically prefill last amount for this name c Automatically recall last transaction for this name d Automatically recall previous transaction for this payee 3 What preference allows you to have QuickBooks prefill the expense account from previous transactions with a vendor? a Automatically prefill last account for this vendor b Prefill accounts for vendor based on past transactions c Automatically recall last transaction for this vendor d Prefill accounts for this payee based on the last transaction 4 True or false: All income and expense accounts have a register associated with them in QuickBooks. a True b False. Only balance sheet accounts (excluding Retained Earnings) have registers associated with them. 5 Reconciling is the process of making sure that your checking account record matches the bank’s record. 6 How can you determine whether or not a check has been cleared in QuickBooks? a A checkmark displays in the bank account register b The word “Cleared” is stamped on the check in QuickBooks c All of the above d None of the above 7 True or false: If you are tracking bills with Accounts Payable and have already entered a bill, you should pay the bill by writing a check from the Write Checks window. a True b False. You should use the Pay Bills window to write the check. Copyright 2009 Intuit Inc. QuickBooks in the Classroom 6 Answer key 8 Which of the following might affect a bank account reconciliation? a Interest b Depreciation c Service charges d Both a and c e All of the above 9 When would you not want to use the Write Checks window when paying bills? a When paying sales tax b When paying payroll taxes c When using a handwritten check d When paying bills you track with Accounts Payable e None of the above f Both a and b g a, b, and d Copyright 2009 Intuit Inc. QuickBooks in the Classroom 7 Answer key Lesson 5: Using other accounts in QuickBooks Review questions 1 Accumulated depreciation is typically set up as what type of account in QuickBooks? a A subaccount of a fixed asset account b A subaccount of a current asset account c A subaccount of a liability account d An expense account 2 Equity type accounts would be used to track which of the following? a Capital investments b Draws c Retained Earnings d All of the above 3 Which of the following would likely be considered a long-term liability? a Vehicle loan b Accounts payable c Rent d Credit card account 4 Retained Earnings is defined as which of the following? a The amount of money that a business retains for paying its employees b The earnings from non-essential business services c The amount of interest saved from paying off a loan early d The accumulation of a company’s net income or loss from its start date 5 Which of the following would not decrease the value of a company’s equity? a The company paying corporate dividends b The company incurring a net loss for the fiscal year c An owner drawing money out of the company d The company taking a loan out to purchase a new asset Copyright 2009 Intuit Inc. QuickBooks in the Classroom 8 Answer key Lesson 6: Entering sales information Review questions 1 When receiving payment at the time of sale, you create a sales receipt in QuickBooks. 2 When customers are returning items, you record the return on a credit memo. 3 In QuickBooks, you can record payments made using which of the following? a Cash b Check c Credit card d All of the above 4 Which item type should you use when recording a partial payment from a customer on an invoice? a Subtotal b Payment c Service d Non-inventory Part 5 True or false: QuickBooks lets you save sales forms as PDF files. a True b False 6 If you regularly invoice a customer for similar items or services, you can memorize the invoice to save time. Copyright 2009 Intuit Inc. QuickBooks in the Classroom 9 Answer key 7 From which list (or lists) does QuickBooks get the information for A, B, and C in the graphic below? a Customers & Jobs list b Customers & Jobs list (if associated terms with the customer); Terms list c Item list A B C 8 List the item types used in the line item area of the invoice above. Inventory Part, Subtotal, Discount, and Service. 9 On which of the following can you not use price levels? a Invoices b Sales receipts c Credit memos d Purchase orders 10 QuickBooks: Pro allows you to assign price levels to which of the following? a Specific customers b Individual line items on sales forms c Both a and b d None of the above Copyright 2009 Intuit Inc. QuickBooks in the Classroom 10 Answer key 11 If a wood door costs $120.00 and you set the rounding option to 1.00 minus .11, what price would appear on an invoice for the wood door? a $120.11 b $120.89 c $119.89 d $119.11 12 True or false: Price levels affect Discount items. a True b False (Price levels only affect Service, Inventory, Non-Inventory Part, and Inventory Assembly items) 13 Which of the two methods described in this lesson for providing customers with information about overdue invoices allows you to assess finance charges? a Invoice letters b Reminder statements Copyright 2009 Intuit Inc. QuickBooks in the Classroom 11 Answer key Lesson 7: Receiving payments and making deposits Review questions 1 A company has set up three different jobs for a single customer. The customer writes one check to make a partial payment on open balances for all three jobs. In QuickBooks, that payment... a Must be applied to the first invoice for the first job for the customer b Must be applied to the most recent invoice for the customer c Can be applied to any combination of invoices and jobs for the customer d Cannot be applied to any invoices or jobs for the customer until full payment is received 2 QuickBooks supports which of the following types of payment scenarios? a Down payments for products or services b Overpayments from customers c Partial payments from customers d All of the above 3 True or false: You can enter a customer payment directly in the customer register. a True b False. You must enter payments in the Receive Payments window. 4 The Undeposited Funds account acts like a “cash drawer” and is used to hold funds until you deposit them into a bank account. 5 True or false: QuickBooks allows you to print deposit slips that you can take to the bank. a True b False Copyright 2009 Intuit Inc. QuickBooks in the Classroom 12 Answer key Lesson 8: Entering and paying bills Review questions 1 You use the accounts payable account to track money that you owe to vendors. 2 List the two steps involved in using the accounts payable features in QuickBooks: a Enter bills b Pay bills 3 When you make a payment (from the checking account) in the Pay Bills window, you can see the transactions in the checking and accounts payable registers. 4 True or false: When tracking accounts payable in QuickBooks, the Enter Bills window is the only place you can enter bills and vendor credits. a True b False. You can also enter bills and vendor credits directly in the accounts payable register, which may allow for faster data entry. 5 Which of the following tasks can you perform in the Pay Bills window? a Enter a partial payment on an outstanding bill b Make a payment using a credit card c Pay all outstanding bills d All of the above 6 You paid a vendor $1,000.00 through the Pay Bills window (using the Checking account). QuickBooks automatically creates a journal entry that: a Deletes the bill b Shows $1,000.00 as a Credit in Accounts Payable and shows $1,000 as a Debit in the Checking account. c Shows $1,000.00 as a Debit in Accounts Payable and shows $1,000 as a Credit in the Checking account. d Shows $1,000.00 as a Debit in Accounts Payable and shows $1,000 as a Credit in the Accounts Receivable. Copyright 2009 Intuit Inc. QuickBooks in the Classroom 13 Answer key Lesson 9: Analyzing financial data Review questions 1 QuickZoom is the tool that allows you to drill down on summary reports and graphs in QuickBooks. 2 When can you generate a QuickReport? a Only when viewing an active customer or account b Only when viewing a list, register, or form c Only at the end of the current fiscal period d Only when viewing balance sheet accounts 3 In which report category would you find the a list of open invoices? a Company & Financial b Sales c Customers & Receivables d List 4 Report filters let you set custom criteria for the transactions you want to include in a report. 5 Once you’ve customized a preset report to meet your needs, how can you save your settings so you don’t have to customize the report each time you run it? a Choose Save Settings from the Report menu b Choose Save Setting from the File menu c Click Memorize on the button bar d Click Modify, and then choose Memorize 6 True or false: Once you’ve exported report data to Excel, you can send modified data back to QuickBooks. a True b False Copyright 2009 Intuit Inc. QuickBooks in the Classroom 14 Answer key Lesson 10: Setting up inventory Review questions 1 True or false: The Purchase Orders account does not affect the balance sheet or income statement. a True b False 2 You placed an order with a vendor for inventory parts. The items have arrived, but you have not received the bill yet. Which option should you choose from the Vendors menu? a Enter bills b Receive items and enter bill c Receive items d Enter bills for items received 3 True or false: You must have inventory items on hand before you can enter a sale for them. a True b False 4 You complete a physical inventory and discover that you have five more of a particular item than show in QuickBooks. How do you update the inventory records in QuickBooks? a Complete the physical inventory worksheet b Enter an item receipt c Adjust the quantity using the Adjust Quantity/Value on Hand window d None of the above 5 Which of the following provide you with a list of all purchase orders created in a file? a QuickReport on the Purchase Orders account b Purchase Orders list report c Open Purchase Orders d All of the above Copyright 2009 Intuit Inc. QuickBooks in the Classroom 15 Answer key Lesson 11: Tracking and paying sales tax Review questions 1 Which of the following statements is false? a You can set up both taxable and non-taxable items b You can associate different sales tax rates with different customers c QuickBooks automatically sets up your sales tax rates based on the city and state you enter in the Company Information window. d All of the above 2 Use a sales tax group item to combine multiple sales tax items into one amount on sales forms. 3 Which of the following can you use to determine your sales tax liability? a Sales Tax Payable account register b Pay Sales Tax window c Sales tax liability report d All of the above 4 To correctly affect sales tax liability, you should make payments to tax collecting agencies from which QuickBooks window? a Write Checks b Pay Sales Tax c Either a or b d None of the above 5 In what part of the program do you assign sales tax codes and items to customers? a In the Sales Tax Code list b On the Customer tab of the New or Edit Item window c On the Additional Info tab of each customer’s record in the Edit Customer window d None of the above Copyright 2009 Intuit Inc. QuickBooks in the Classroom 16 Answer key Lesson 12: Doing payroll with QuickBooks Review questions 1 What is required in order for QuickBooks to calculate payroll? Tax tables 2 Which two accounts are typically linked to payroll items? a Payroll Liabilities b Payroll Expenses 3 Which of the following are QuickBooks payroll item types? a Compensation b Paid Time Off c Retirement Benefits d All of the above 4 What report would you run to determine how much you owe in payroll taxes? Payroll Liability Balances 5 What QuickBooks feature would you use to make setting up payroll easier when a number of employees have the same hourly wage, payroll schedule, and base deductions? a Tax tables b Employee defaults c Payroll items d Assisted payroll 6 True or false: Payroll schedules are required to run payroll in QuickBooks. a True b False. You can still run payroll using Special Payroll in the Payroll Center. 7 Payroll schedules help you do which of the following? a Group employees with the same pay frequency b Write bonus checks c Prepare termination checks d Pay payroll tax liabilities Copyright 2009 Intuit Inc. QuickBooks in the Classroom 17 Answer key Lesson 13: Estimating and progress invoicing Review questions 1 QuickBooks tracks estimates using what kind of account? a Posting b Non-posting 2 True or false: QuickBooks allows you to create multiple estimates for a single customer. a True b False 3 Which of the following is not an option when creating an invoice from an estimate? a Create an invoice for the entire estimate b Create an invoice for a percentage of the entire estimate c Create an invoice for selected items or different percentages of each item d None of the above 4 You prepared an estimate for a customer and were subsequently awarded the contract. How would you change the job status from “Pending” to “Awarded?” a Create the invoice from the accepted estimate—this changes the status automatically b Use the Job Status drop-down list in the customer’s record c Use the Job Status drop-down list in the Create Estimates window d None of the above 5 What QuickBooks feature would you use to charge customers as you complete various phases of a job? a Progress invoicing b Phased invoicing c Partial invoicing d None of the above Copyright 2009 Intuit Inc. QuickBooks in the Classroom 18 Answer key Lesson 14: Tracking time Review questions 1 List four ways to enter time in QuickBooks. a Weekly timesheet b Time/Enter Single Activity window c The Timer application available with QuickBooks: Pro and higher editions d QuickBooks Time Tracker (additional requirements, terms, conditions, and fees apply) 2 For which of the following can the time tracking features in QuickBooks not be used? a Notifying you that more staffing is required for a given project b Tracking the cost of an employee’s gross pay by job c Providing hours worked on an employee’s paycheck d Invoicing customers based on time spent on a job 3 Which report would you use to determine how many hours were spent on each activity and whether or not the customer had been billed for the time? a Time by item b Time by name c Time by job summary d Time by job detail 4 When paying owners or partners, you should use an equity account to track the payment. 5 Which of the following is a step involved in the process for invoicing a customer for time worked? a Select the customer’s name in the Create Invoices window b Click Add Time/Costs c In the Choose Billable Time and Costs window, click to select the items you want to transfer to the invoice d All of the above Copyright 2009 Intuit Inc. QuickBooks in the Classroom 19 Answer key Lesson 15: Customizing forms and writing QuickBooks Letters Review questions 1 List three forms that can be customized in QuickBooks: a Invoice b Sales receipt c Credit memo d Statement e Purchase order f Estimate g Sales order (available in Premier and higher editions only) 2 True or false: The column order on QuickBooks forms is fixed and cannot be changed. a True b False 3 You use the Layout Designer window to move and resize fields on forms. 4 You can add fields from which of the following lists to QuickBooks Letters? a Customers & Jobs b Employee c Vendor d All of the above 5 True or false: You can convert an existing Microsoft Word document into a QuickBooks Letter to which you can add QuickBooks data. a True b False Copyright 2009 Intuit Inc. QuickBooks in the Classroom 20