EQUITY RESEARCH FERRARI (RACE)

advertisement

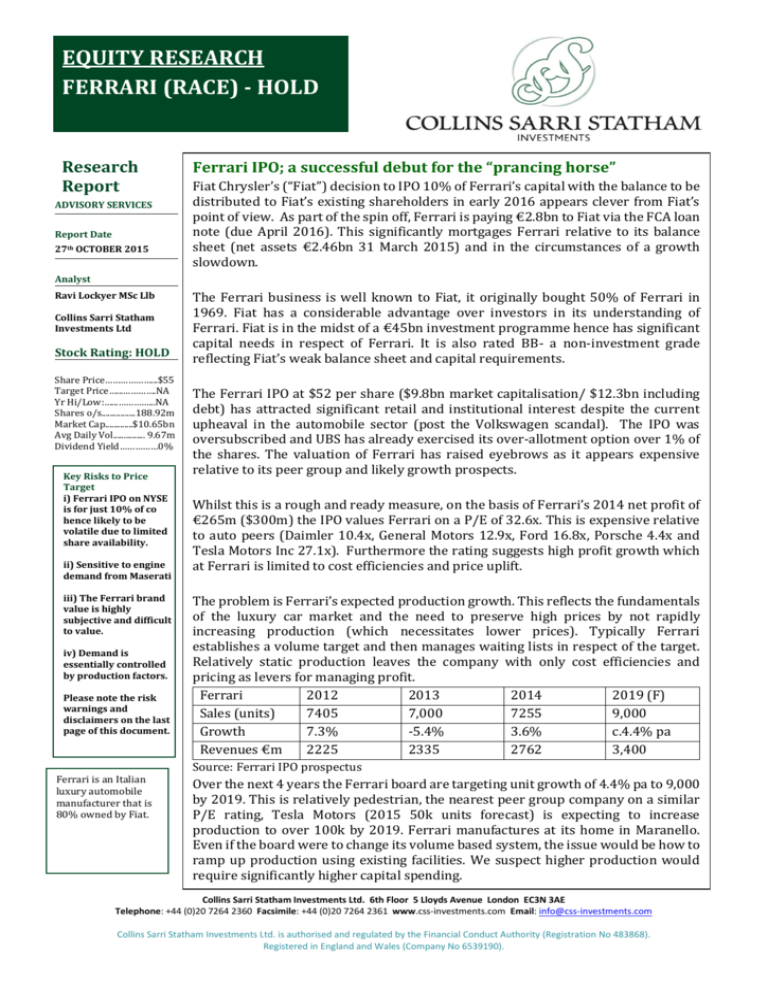

EQUITY RESEARCH Research FERRARI (RACE) - HOLD Report: Research Report ADVISORY SERVICES Report Date 27th OCTOBER 2015 Ferrari IPO; a successful debut for the “prancing horse” Fiat Chrysler’s (“Fiat”) decision to IPO 10% of Ferrari’s capital with the balance to be distributed to Fiat’s existing shareholders in early 2016 appears clever from Fiat’s point of view. As part of the spin off, Ferrari is paying €2.8bn to Fiat via the FCA loan note (due April 2016). This significantly mortgages Ferrari relative to its balance sheet (net assets €2.46bn 31 March 2015) and in the circumstances of a growth slowdown. Analyst Ravi Lockyer MSc Llb Collins Sarri Statham Investments Ltd Stock Rating: HOLD Share Price………………...$55 Target Price…...………….NA Yr Hi/Low:…...…………...NA Shares o/s................188.92m Market Cap.............$10.65bn Avg Daily Vol............... 9.67m Dividend Yield……………0% Key Risks to Price Target i) Ferrari IPO on NYSE is for just 10% of co hence likely to be volatile due to limited share availability. ii) Sensitive to engine demand from Maserati iii) The Ferrari brand value is highly subjective and difficult to value. iv) Demand is essentially controlled by production factors. Please note the risk warnings and disclaimers on the last page of this document. Ferrari is an Italian luxury automobile manufacturer that is 80% owned by Fiat. The Ferrari business is well known to Fiat, it originally bought 50% of Ferrari in 1969. Fiat has a considerable advantage over investors in its understanding of Ferrari. Fiat is in the midst of a €45bn investment programme hence has significant capital needs in respect of Ferrari. It is also rated BB- a non-investment grade reflecting Fiat’s weak balance sheet and capital requirements. The Ferrari IPO at $52 per share ($9.8bn market capitalisation/ $12.3bn including debt) has attracted significant retail and institutional interest despite the current upheaval in the automobile sector (post the Volkswagen scandal). The IPO was oversubscribed and UBS has already exercised its over-allotment option over 1% of the shares. The valuation of Ferrari has raised eyebrows as it appears expensive relative to its peer group and likely growth prospects. Whilst this is a rough and ready measure, on the basis of Ferrari’s 2014 net profit of Research €265m ($300m) the IPO values Ferrari on a P/E of 32.6x. This is expensive relative to auto peers (Daimler 10.4x, General Motors 12.9x, Ford 16.8x, Porsche 4.4x and Report: Tesla Motors Inc 27.1x). Furthermore the rating suggests high profit growth which at Ferrari is limited to cost efficiencies and price uplift. The problem is Ferrari’s expected production growth. This reflects the fundamentals of the luxury car market and the need to preserve high prices by not rapidly increasing production (which necessitates lower prices). Typically Ferrari establishes a volume target and then manages waiting lists in respect of the target. Relatively static production leaves the company with only cost efficiencies and pricing as levers for managing profit. Ferrari 2012 2013 2014 2019 (F) Sales (units) 7405 7,000 7255 9,000 Growth 7.3% -5.4% 3.6% c.4.4% pa Revenues €m 2225 2335 2762 3,400 Source: Ferrari IPO prospectus Over the next 4 years the Ferrari board are targeting unit growth of 4.4% pa to 9,000 by 2019. This is relatively pedestrian, the nearest peer group company on a similar P/E rating, Tesla Motors (2015 50k units forecast) is expecting to increase production to over 100k by 2019. Ferrari manufactures at its home in Maranello. Even if the board were to change its volume based system, the issue would be how to ramp up production using existing facilities. We suspect higher production would require significantly higher capital spending. Collins Sarri Statham Investments Ltd. 6th Floor 5 Lloyds Avenue London EC3N 3AE Telephone: +44 (0)20 7264 2360 Facsimile: +44 (0)20 7264 2361 www.css-investments.com Email: info@css-investments.com Collins Sarri Statham Investments Ltd. is authorised and regulated by the Financial Conduct Authority (Registration No 483868). Registered in England and Wales (Company No 6539190). Ferrari brand is key Part of the Ferrari allure is its enduring global appeal in the premium sports car segment. This is due to Ferrari’s ability to maintain its supercar program which began in 1988 with the F40 – now the main models are the 458 Italia, F12berlinetta, FF and California. For 2015 the plan is to turbocharge all future V8 models starting with the California (its least expensive model at $202k) in 2015. There is a significant expertise at Ferrari in car engine design/ technology and brand/ licensing opportunities. Ferrari manufactures engines for Maserati (2014: 36,500 units sold +136% on 2013) an area of significant growth. In addition to merchandising lines, eyewear, pens, pencils, perfume, clothing, bicycles, watches, mobile phones using the Ferrari brand. The merchandising are useful adds-on but not the core business. Whilst we recognise the significant brand value at Ferrari, (the major reason for the premium Ferrari valuation) making an investment in Ferrari stock or indeed any other recognisable brand on this basis alone has had mixed results. One recalls the high profile global brands of the 1990’s, companies like Apple, Merrill Lynch, Nike, McDonalds, Vodafone. Our suggestion is a brand is a great asset, but investors should not invest solely on this basis. Ferrari / Fiat Chrysler next step is a distribution Fiat will hold an EGM on December 3rd 2015 to approve the demerger of its 80% stake in Ferrari to Fiat shareholders. This is a demerger of a very high proportion of the Ferrari capital and likely to be the main driver of the Ferrari share price. This transaction will increase the free float from 10% to 90% (Piero Ferrari holds the balance 10%) hence removing pricing anomalies caused by the low float in the NYSE IPO by early 2016. Hence the next few months will be a fast moving sequence of events as Fiat holders anticipate and possibly hedge against their forthcoming Ferrari distribution. Nearer to the demerger date (as yet undecided) it is likely that Fiat shares will reflect the forthcoming demerger possibly presenting a cheap way into Ferrari via Fiat. It will certainly represent an alternative way to buy exposure to Ferrari. CONCLUSION One perceived reason for the IPO is to create investor interest ahead of the distribution to “whet investor appetite”. It has certainly achieved that objective with the shares holding onto a 6% premium despite the top of the range pricing. The initial range was $48-$52. We are sitting on the fence at the moment, recognising the brand value, but weary of the high Ferrari valuation and forthcoming events. It is likely that investors will be able to pick up the shares post the distribution in an environment of a high free float, rather than the rather artificial tight conditions at the moment. Ferrari sits perfectly within our HOLD criteria with potential investors advised to await key events notably the forthcoming Fiat demerger of the balance 80% stake. Collins Sarri Statham Investments Ltd. 6th Floor 5 Lloyds Avenue London EC3N 3AE Telephone: +44 (0)20 7264 2360 Facsimile: +44 (0)20 7264 2361 www.css-investments.com Email: info@css-investments.com Collins Sarri Statham Investments Ltd. is authorised and regulated by the Financial Conduct Authority (Registration No 483868). Registered in England and Wales (Company No 6539190). Collins Sarri Statham Investments Ltd - Analyst Rating Definitions: BUY: A “buy” rating is applied to companies with established businesses that are profitable and where there is further profit growth expected. A “buy” recommendation means the analyst expects the share to reach the share price target on the note. HOLD: The company’s valuation appears to reflect investor expectations in the short-term. Alternatively the company is awaiting key developments that will impact on the share price. Investors are advised to await the resolution of these key developments. SELL: The company’s valuation appears too high having regard to material uncertainties, declining profit prospects or has sizeable funding requirements. A sell recommendation may also be applied where the board have failed in key objectives or appear to be frequently changing strategy. A sell recommendation means the analyst expects the share to fall to the price target on the note. NEUTRAL (Not Rated): The analyst does not maintain a view in either direction. Key to Material Interests: Please be aware that the following disclosures of Material Interests are relevant to this research note: Ferrari Relevant disclosures: < 2> 1. The analyst has a personal holding in the securities issued by the company or of derivatives linked to the price of the company’s securities. 2. Collins Sarri Statham Investments Ltd has clients who hold either shares or CFD positions in this security. ANALYST CERTIFICATION: The report’s author certifies that this research report accurately states his personal views about the subject security, which is reflected in the ratings as well as the substance of the report. RECOMMENDATIONS: Collins Sarri Statham Investments Ltd (CSS) does not in any of its publications take into account any particular recipient's investment objectives, financial situation, and specific needs and demands. Therefore, all CSS publications are, unless otherwise specifically stated, intended for informational and/or marketing purposes only.CSS shall not be responsible for any loss arising from any investment based on a perceived recommendation. No publication (including recommendations) shall be construed as a representation or warranty that the recipient will profit, nor avoid sustaining losses, from trading in accordance with a trading strategy set forth in a publication. This research is non-independent and is classified as a Marketing Communication under FCA rules detailed in their Conduct of Business Rulebook (COBS). As such it has not been prepared in accordance with legal requirements designed to promote independence of investment research and it is not subject to the prohibition of dealing ahead of the dissemination of investment research outlined in COBS 12.2.5. RISK WARNING: Trading in the products and services offered by Collins Sarri Statham Investments Ltd (CSS) may, result in losses as well as profits as the value of investments may go down as well as up. You may not get back the full amount you have invested. Any reference to past performance should not be viewed as an indication of any future performance. Investments held in overseas markets are subject to the effects of changes in exchange rates which will impact on the value of the underlying investment. Investments made in AIM and penny shares carry an increased risk due to the difficulty in creating a market in these shares. There may be a substantial difference in the buy and sell price. Leveraged products such as Contracts for Difference (CFDs), derivatives, commodities & Foreign Exchange (FX), carry a higher risk to your capital. They can lose their value rapidly and you may lose substantially more than your initial investment. Investment trusts are specialised investments and may not be appropriate for all investors. Investment Companies including investment trusts use or may have the ability to use gearing as an investment strategy or may invest in companies that use gearing. Movements in the price of these securities may be more volatile than the movement in the price of the underlying investment. SPECULATIVE TRADING IS NOT SUITABLE FOR ALL INVESTORS. The information contained herein is based on materials and sources that we believe to be reliable however we make no representation or warranty, either express or implied, in relation to the accuracy, completeness or reliability of the information contained herein. Please note that the figures shown may, in some instances, be rounded to the nearest penny. Prices can move sharply from those quoted in this document. Current prices can be verified by calling one of our brokers. CSS is under no obligation to update the information contained herein. Neither CSS, nor its affiliates, nor its employees shall have any liability whatsoever for any indirect or consequential loss or damage arising from the use of this document. Collins Sarri Statham Investments Ltd. 6th Floor 5 Lloyds Avenue London EC3N 3AE Telephone: +44 (0)20 7264 2360 Facsimile: +44 (0)20 7264 2361 www.css-investments.com Email: info@css-investments.com Collins Sarri Statham Investments Ltd. is authorised and regulated by the Financial Conduct Authority (Registration No 483868). Registered in England and Wales (Company No 6539190).