Financial Technology and Services at a Time of Economic Turmoil

advertisement

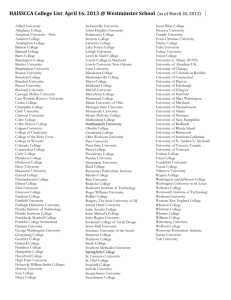

Polytechnic Institute of NYU Department of Finance and Risk Engineering Newsletter No. 7, Fall 2008 FRE@NYU-POLY INSIDE THIS ISSUE 1. Essay: Financial Technology and Services at a Time of Economic Turmoil 2. Department News 3. From the Department Chair FRE Continues to Grow 4. Faculty News 5. Other News Research and Publications 6. Student Activities Financial Technology and Services at a Time of Economic Turmoil changes how prices should be quoted and how orders should be executed. It seems that the financial industry has entered a period of what Schumpeter called “creative destruction.” Established organizations break down and something new and possibly unexpected rises in its place. As Schumpeter and others observed, these creative changes are driven by technology. Indeed, we may also be entering a golden age of financial technology. There are three basic reasons for this: Department Corner Online registration for Spring 2009 will begin shortly. Please check the department’s Blackboard site for class schedules or www.poly.edu/class and search for spring. The dates for the spring session can be found on the main Poly website at www.poly.edu/calendar. By Roy S. Freedman Over the past few years, it seems that the major media outlets are filled with bad and worsening economic and financial news. The sinking dollar implies that foreign goods cost more for Americans; record oil prices imply that it costs more to run industrialized and agricultural economies; the credit crisis means that it is more expensive to borrow money and launch entrepreneurial ventures. Large financial firms are suffering. The financial sector has been underperforming other sectors in the market over the last year. We hear more and more reports on how legacy institutions such as Bear Stearns, Citigroup, Lehman, Fannie Mae need to be rescued. In addition, many venerable trading centers such as the New York Stock Exchange are losing market share; their market structures are changing to forms that would be unrecognizable just a few years ago. These market changes are also affecting government oversight agencies such as the Securities Exchange Commission (SEC). In its quest for “best execution,” the SEC is coordinating the ongoing national market system reorganization (Regulation NMS) that Markets are evolving at an accelerated pace: What is half-life of an exchange? From one perspective, exchanges and markets are consolidating. The New York Mercantile Exchange and the Chicago Mercantile Exchange are merging. Archipelago – an Electronic Matching Network – merged with the 200 year old New York Stock Exchange – which after other consolidations is now NYSE Euronext. A recent headline in Wall Street and Technology indicates what is in store: “NYSE Says Good Bye to Specialists; Hello DMMs.” As markets consolidate, who will integrate the systems? From the opposite perspective: exchanges and markets are fragmenting. For example, there are now about 50 new electronic markets that match buyers to sellers without disclosing identities www.poly.edu | 1-800-polytech Polytechnic Institute of NYU Department of Finance and Risk Engineering Newsletter Financial Technology and Services at a Time of Economic Turmoil (continued) (disclosing who you are to an intermediary might move the market adversely, so that you might not get the best price). These “dark pools” are based on sophisticated order execution algorithms, differing by matching frequency, price formulation, access, and ownership. For example, the London Stock Exchange and Lehman Brothers are jointly forming a new dark pool (which could be jeopardized by the potential sale of Lehman). Dark pools match orders continuously; unlike human driven systems, they neither slumber nor sleep, nor are they subject to conflict of interest or biases. Commensurate with the development of dark pools are various surveillance systems that detect evidence of “order gaming” for market manipulation. Who will design and build these new markets and new trading tools? Increased efficiency due to mature financial communication standards: Financial technology standards such as FIX, FIXML, and FpML are the language of quotes, trades, and confirmations. Exchanges and markets are best modeled as utilities and “liquidity providers” that send feeds containing millions of financial messages to trading and risk management clients. What used to be a human-intensive communication activity is now a computer-to-computer messaging activity. How are these systems specified and maintained? Financial communication technology is also being applied to deal making, especially in the $600 trillion market of derivative contracts. Several years ago, derivative trading was characterized by error-prone human processes, which caused backlogs. Communication standards can now automate the online negotiation of complex trades, brokerage agreements, margin arrangements, and master agreements specified by the International Swaps and Derivatives Association. From a risk management perspective, these standards also enable the development of systems that monitor exposure limits, agreement conflicts, and other adverse events. Low-latency, high-frequency trading exploit market inefficiencies: Globalization, uniform financial communication standards, and concern by regulatory authorities for “best execution” helped evolve a trading environment where a single large order is broken up into several small orders to be executed over time. These orders can be submitted, canceled, or modified thousands of time per second in ways that are impossible for a human to track. Who specifies these algorithms? It is imperative to the development of high-frequency trading that financial networks have a network latency measured in milliseconds or less -- the time from when a liquidity provider’s price goes through a network to when it arrives at a client trading system. Latency depends on market network connectivity, network routing speed and server hardware. Highfrequency trading algorithms usually require many price quote updates per second per financial product (typically running over thousands of products). High-frequency trading systems are currently benchmarked around one million messages per second, with high reliability (several seconds of down time per month.) Because of this, many trading platforms utilize grid computing and other commoditized implementations of commercial off-the-shelf systems. From a risk management perspective, these low-latency financial networks are also being mandated in SEC mandated disaster recovery programs. A golden age of financial technology? There are other aspects of what may be a new golden age of financial technology. More and more developing countries are investing in financial technology. For example, this year the Ethiopia Commodity Exchange opened under the belief that capital markets work better than other methods to end starvation. Other markets such as electricity futures and carbon trading are maturing. In all cases, in order to design, build, and maintain these financial systems, we need people with financial backgrounds who know technology or technology people who know finance. Professor Roy Freedman (FRE-NYU-POLY) is a leading expert on Financial Technology. He is the author of books and articles and an outstanding professor. Department News Bloomberg at Your Service Fred Novomestky recently returned from Switzerland where he attended the Second Workshop on Computational and Financial Econometrics at the University of Neuchatel. He presented a paper on “Least Absolute Deviation Regression: A Lexicographical Linear Goal Programming Formulation.” His paper was documented and presented as a numerical technique for the solution of portfolio investment problems. In the finance industry, companies send employees to Bloomberg for training. Every end of the month, we will send 15 to 20 students and faculty to Bloomberg for training as well. This is a free service provided by FRE and Bloomberg . It will be a monthly training course, no exam, purely learning experience at Bloomberg. The topics would cover “Bloomberg Essentials: Equity,” “Equity news, Research & the Economy,” “Company & Peer Analysis,” “API: Downloading Data/Bloomberg Data to Excel” (Basic and Adv.),”Stock Strategies: Equity Idea Generation,” “Fixed-Income Idea Generation,” “Fixed-Income Portfolio Management” etc. Please RSVP to Irene Liao (wliao@poly.edu) for further information. In addition, we will use Bloomberg intensively for our courses. Professor Charles Stone (Applied Derivatives), and Professor Aime Scannavino (Advanced Financial Econometrics) are two such examples. Ed Emmers joins NYU-POLY after an important career at S&P. Ed will be speaking in a bi-monthly lecture series, along with other esteemed practitioners, on “Outstanding Issues in Global Financial Markets.” This series is a non-credit and complimentary service to the FRE students and NYU-Poly’s family. Charles Tapiero delivered a lecture in Casablanca, Morocco on the “Global Financial Crisis and Contagion.” The lecture was attended by over 700 people from both academia and the Moroccan corporate world. A lecture was also delivered at Polytechnic’s Management program in Israel on the same topic. 2 • www.poly.edu/fe The Department Has Inaugurated its Expanded Space at Rogers Hall Old friends and new are welcome to come to RH 519 to see our expanded suite. The entrance is now directly opposite the elevators on the 5th floor of Rogers Hall. Polytechnic Institute of NYU Department of Finance and Risk Engineering Newsletter Finance and Risk Engineering Continues to Grow at Polytechnic Institute of NYU A Bloomberg station was installed and is fully operational and at the service of students and faculty. It was installed in our new and expanded space in Rogers Hall in Brooklyn. In addition, we will maintain a consulting service for students who seek to use Bloomberg for their research and their study. Already some courses (such as Securitization, Applied Derivatives Finance) are planning to use the Bloomberg station intensely as well as the many possibilities it provides. Charles S. Tapiero Topfer Chair Professor of Financial Engineering and Technology Polytechnic Institute of NYU, New York The Fall 2008 term promises to be challenging and inspiring. The FRE/Financial Engineering Master of Science Degree Programs have opened this year with increased growth in both quality and quantity. The merger with NYU, resulting in Polytechnic Institute of New York University, has not hampered our development and may contribute to additional external services we can provide. The crafting of these services is still in progress. The entering class statistics speak for themselves: The admitted class has an average quantitative GRE/GMAT score of 786+, which is equivalent to that of leading institutions such as MIT and Stanford. At least 160 new students have arrived for the 2008 fall term, making it the most important ever and representing a growth rate of 100 percent over last year. We have added an outstanding academic colleague to the department– Nassim Nicholas Taleb, our Distinguished Professor in Risk Engineering (more on Nassim below). We will likely add another exciting faculty member very soon, raising the quality of the department staff higher, which will help to meet both the qualitative and quantitative challenges we are facing in the classrooms. Currently the FRE family consists of approximately 400 on-going degree seeking students, all at the master’s level with another 60 students pursuing a finance minor in their undergraduate degree (albeit in a separate program and classes). This makes us the largest and probably the most successful program of its kind. It is, therefore, a source of comfort, challenge and responsibility to maintain and augment the quality and the services our educational programs provide. We are pursuing at the same time our research and commitment for the excellence of risk engineering, financial engineering and financial services and technology within the New York University family, emphasizing our commitment to bridge theory and practice. To this end, both a Research Center for Risk Engineering and a Research Center on Financial Engineering and Technology Management are being activated. In addition, this fall term, all FRE students will at last be able to access numerous new services within the department. 5 • www.poly.edu/fe The new space at 55 Broad Street (in Wall Street), dedicated to FRE, will expand both our teaching space facilities with cutting-edge technology and, at the same time, provide an opportunity to meet potential employers, becoming a “home” for the many students who work on Wall Street. Next year, we intend to launch a full and extended summer term, which will allow students to pursue their course requirements and finish the program sooner. At the same time, the summer term will be open to international and joint degrees programs. These programs will provide an opportunity to diversify the FRE educational experience geographically and intellectually. The FRE international programs will provide these opportunities to students in an increasing global world (stay tuned for news). Complementary educational services have also been expanded. Mirella Ivan is renewing her pre-requisite introductory course to mathematics, algebra, probability and statistics. In the past, this course was received extraordinary well and, therefore, we hope to renew this course a number of times during the year. Consulting services within the department have begun and will provide support in handling some of the quantitative problems we face in financial engineering, software programming and the use of the important collection of packaged programs the department has acquired and installed in our financial labs. These functions will be directed by Irene Liao, our IT magician and by Mirela Ivan our quant geek. In addition, senior GAs will be available at all times to provide one-on-one in the many matters that all students are confronted with in dealing with our software collection. The Research Centers for Risk Engineering and Financial Engineering and Technology will be reactivated under my direction with a number of activities that include: An expanded working paper series; the acquisition of additional research books; International research scientists and visitors including among other Ron Kenett (KPA Consulting and a leading research on Risk), Tyrone Duncan a famed Mathematician in Fractal Mathematics, Aime Scannavino (University of Paris II), Bertrand Munier (University of Paris II), Konstantin Kogan (Bar Ilan University) and other visitors from the Technion (Israel), Concordia University, Canada, Stanford etc. The research center has also created a position of research fellows with some prolific and academic experts joining the center’s activities (for example Professor Anne Zissu, and Charles Stone). We will also provide to a selected few, motivated students a stipend to focus their Capstone Project on selected research projects to be evaluated by the center’s academic staff. Polytechnic Institute of NYU Department of Finance and Risk Engineering Newsletter Faculty News Farewell to Juliette Acker, a Pillar of the FRE Department Our FRE Program Manager, Juliette Acker, has left Polytechnic and relocated to Brazil to pursue an international career. Juliette was a pillar in this department and a committed and outstanding professional manager who contributed to every facet of the department’s growth from its origins to what it has achieved today. We wish Juliette all the best that life can bring in this new adventure and are grateful to her for contributions to FRE and to Polytechnic. She will be greatly missed. Renowned Author of The Black Swan, Nassim Nicholas Taleb: Distinguished Professor of Risk Engineering Joins NYU-Poly’s Department of FRE We are excited to welcome the internationally acclaimed author and world renowned scholar, Nassim Nicholas Taleb to Polytechnic Institute of NYU. Taleb, who will join Polytechnic as Distinguished Professor of Financial and Risk Engineering, has authored The Black Swan: The Impact of the Highly Improbable (2007) and Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets (2001, 2005), and Dynamic Hedging: Managing Vanilla and Exotic Options (1997). His books have sold more than 1.4 million copies with more than 50 translations in print. The Black Swan has been the highest selling publication in the world in 2007 and 2008. Taleb’s current concentration focuses on the development of the rules of decision making and the identification of unreliable theories and models and how they can work to shield individuals and society from them (“how to live in a world we don't understand”). Previously, he served as derivatives trader and “quant” for more than 20 years before starting a fulltime career as a scholar of applied probability and risk management. He is known for a “multidisciplinary but no-nonsense” approach to analyzing model errors and the role of high-impact rare events or “black swans.” Taleb is currently visiting professor at the London Business School and co-director of the Decision Science Laboratory focusing on errors in the estimation of remote events. He was the Dean’s Professor in the Sciences of Uncertainty at the University of Massachusetts at Amherst and taught derivatives model errors at the Courant Institute of New York University for eight years. Before becoming a researcher, he held senior derivatives positions with such major institutions as Credit Suisse First Boston, UBS, BNP-Paribas, Bankers Trust (now Deutsche Bank). In addition, Taleb worked as a trader in the Chicago Mercantile Exchange, and ran his own derivatives firm for six years. Taleb continues to advise central banks and various government agencies on security, model risk, and risk management. He currently is the principal of a hedge fund and member of the board of several institutions. Taleb holds an MBA from the Wharton School and a PhD from the University of Paris. Select Honors: Power 30 Wall Street Journal/Smart Money ( 2007), Frost & Sullivan Visionary of the Year (2008), Derivatives Strategy Hall of Fame (2000). The London Times called him “a giant of Mediterranean thought ... Now the hottest thinker in the world.” Erich Kunhardt, Provost; Susan Lestingi, VP Marketing and Communications; Nassim Nicholas Taleb, Distiguished Professor FRE; Charles Tapiero, FRE Department Chair 3 • www.poly.edu/fe Polytechnic Institute of NYU Department of Finance and Risk Engineering Newsletter Other Highlights In Memoriam We welcome Jonnette Romano as our new staff addition. She is secretary and assistant to the department chair. Jon has extensive and previous experience having worked in the Financial Services Industry (AIG) and we are excited about her dynamic energy and high level of commitment. Please stop by to say hello to Jon. An Unexpected and Painful Loss Mark Your Calendars for October NYU-Poly FRE Career Fair! On October 16 and 17, the NYU-Poly Career Fair, the NYU-Finmath Fair, the premier career fair for FE, takes place. Please follow up with Polytechnic’s Career Management Department and Melissa Kutchner at NYU. Students should remember to go to Polytechnic’s career office so that résumés can be reviewed and uploaded to CareerLink, NYU-Poly’s career database, for participation in this grand event. Note many employers only look at résumés uploaded on online system. Barbara Lord of the Department of Career Management is organizing a meetings to assist FRE students in this process. A Joint Topfer Chair Seminar: Financial Engineering and Electrical Engineering The department of financial and risk engineering, our staff, students, and the entire Polytechnic community are deeply saddened by the loss of one of own FRE students, Andrei Koloskov. Andrei, fine student outstanding member of the Polytechnic community, was killed in an auto accident earlier this month. We extend our sympathies to Andrei’s family and loved ones. He will be missed. Research and Publications A New Journal, “Risk and Decision Analysis” co-edited by with Alain Bensoussan and Charles S. Tapiero will publish its first issue in October 2008. Jean-Carlo Bonilla, Himanshu Kasana, and Karen Zhang have a research team working on algorithmic trading. The themes they work on include: Opportunities in Coupled Market for Intraday Trading, and Fusion Analysis: Tech and Fundametal Analysis. Professor Tyrone Duncan will be visiting FRE for a week in October 20 and will be delivering both a class to FRE students on fractal calculus and another at a first and joint seminar with the Department of Electrical and Computer Engineering on Mutual Information. Professor Duncan is an outstanding academic with an important collection of contributions to fat tails and fractal mathematics. Professor Duncan will also be available to discuss with students the many research possibilities of fractal mathematics in finance. Charles S. Tapiero, Orders and Inventory Commodities with Price and Demand Uncertainty in Complete Markets International Journal of Production Economics, 2008. Abstract of the Seminar: Mutual Information and Estimation, University of Kansas Bertrand Munier and Charles S. Tapiero, “Risk Attitudes, with Bertrand Munier, Encyclopedia of Quantitative Risk Assessment,” Brian Everitt, and Ed Melnick (Eds), USA, Editors, Wiley, 2008. Mutual information provides a quantitative relation between two stochastic processes. It is a basic notion in information theory and is used empirically to determine a quantitative measure of the relation between two time series. In this talk, the mutual information between a signal and an observation process of the signal is given explicitly as an estimation (filtering) error. Another description of the observation process has the signal multiplied by a positive parameter. For this model the rate of change of the mutual information with respect to the parameter is given explicitly as an estimation (smoothing) error. Two noise models are considered in the observation process. The first model is fractional Brownian motion. Fractional Brownian motion is a family of Gaussian processes that includes Brownian motion as well as other processes that can often be justified empirically as models of random phenomena. The observation process is the sum of a fractional Brownian motion and a signal. The second model is a pure jump Levy process which is a stationary, independent increment process with purely discontinuous sample paths, for example, a Poisson process. An observation process is a pure jump process where the rate function for the Levy process depends on the signal. Charles S. Tapiero and Konstantin Kogan, Risk-Averse Order policies with random prices in complete markets and retailers’ private information. European Journal of Operations Research, 2008. A. Grando and C.S Tapiero, co-editors of a special issue of Risk Measurement and Assessment, Fall 2008. www.poly.edu/fe • 4 Student Activities Breaking the Ice with FRE Students FRE students gathered for festivities, music, fun and games at the Financial Engineering Ice Breaker in Polytechnic’s Silleck Lounge. This amazing night filled with fest and fun provided an excellent opportunity for Financial and Risk Engineering students to meet fellow students and Financial Engineering Association (FEA) members, share their unique experiences and program information with classmates and benefit from networking opportunities. The party was hosted by the Financial Engineering Association, the student group at NYU-Poly in the Department of Finance and Risk Engineering. FRE @ POLY News Department of Finance and Risk Engineering Polytechnic Institute of NYU Six MetroTech Center Brooklyn, NY 11201 For more information about the Power of PolyThinking and the Department of Finance and Risk Engineering, please visit: www.poly.edu/fe