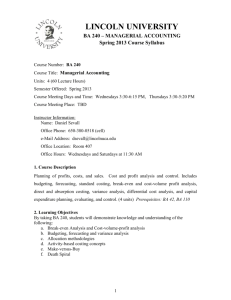

Advanced Managerial Accounting

advertisement

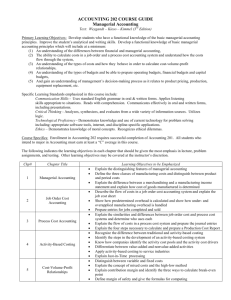

Faculty of Economics & Administrative Sciences Department: Accounting COURSE SYLLABUS Advanced Managerial Accounting Short Description Student’s Copy One copy of this course syllabus is provided to each student registered in this course. It should be kept secure and retained for future use. I. Course Information 1. 2. 3. 4. 5. Course Title Corse Code Credit Hours Prerequisite Corequisite : : : : : Advanced Managerial Accounting : 1303718 3 None None 2. Instructor Information 1. 2. 3. 4. 5. Instructor Office Phone Email Office Hours : Prefessor Abdulnaser Nour : 334 : : anour@zu.edu.jo :Sun,Tu, Thu, 9- 12 AM ,Mon,Tu : 01:00 -02:00 PM 3. Class Time and Place 1. Class Days and Time: Thu 4-7 P M 2. 3. 4. Class Location : Lab Days and Time : Lab Location : 334 ----------- 4. Course Policies University regulations are applied to this course, regarding Class Attendance; Punctuality, Exam, Makeup Exams; Absence with permission; Penalties for Cheating; and Policies for Assignment and Projects. Students Should be aware of all those in addition to other rules and regulations. 5. Resources Main Reference Text Book: . Garrison, R.H. and Noreen, E. W.and PeterH.Brewer,andRania,U.Mardini (2014-2015), Managerial Accounting, 15th ed., McGrawHill. ( The web site of the book is www.mcgraw-hill.co.uk/textbooks/garrison2e_mea ). Additional Reference (s): 1. . Atkinson, A., R. Banker., S. Kaplan., and S. Young. 2011. Management Accounting. 6 ed, Prentice-Hall International, New Jersey, INC, USA. 2- Charles E. Davis & Elizabeth Davis (2012), Managerial Accounting, First Edition, John wiley & sons, Inc. Website of the book, www.wiley.com/college/sc/davis 6. Course Description and Purpose 1. Advance Managerial Accounting – 3 Credits. 2. Purpose: The purpose of this course is to achieving the following purposes: - Provide students with the basic cost concepts, terms and classification. Explain and illustrate the cost behavior. Explain the relationship between cost, volume and profit (CVP) analysis. Discuss and illustrate some of the techniques used in profit planning. Discuss and illustrate the activity – based costing (ABC). Provide students with the basic ideas of short-term decision-making. Provide students with the basic ideas of capital Budgeting Decisions. Explain and illustrate the techniques of Balance scorecard. Explain Job- order costing and process costing. 3. Course Description: This course covers steps for preparing Job-order costing , and budgets, controlling systems, responsibility accounting , and performance evaluation by using the Balanced – scorecard ( BSC ) ,Activity Based costing (ABC) inventory management, using costing analysis in pricing decisions, Master budgets, managing scarce resources, providing relevant information to managers for decision purposes, identifying relevant cost and revenues for decision purposes and employing quantitative analysis in managerial accounting. 7. Course Learning Outcomes Upon successful completion of this course, the learner should be able to: A- Knowledge and understanding (students should):- Be able to distinguish between different cost terms and concepts. - Be able to prepare Job –order costing. - Be able to analyze cost behavior and use cost behavior in predicting cost. - Understand break-even analyses and use it in decision-making. - Understand the steps of budget preparation. - Understand the contribution format income statement. - Be able to use activity-based costing in decision-making. - Use managerial accounting techniques in decision-making. - Be able to use capital Budgeting in decision-making. - Understand the steps and meaning of Balance scorecard. B- Intellectual skills with ability to:- Apply the basic principles of management accounting in decision making. - Apply the management accounting techniques in predicting costs and preparation of the budget. - Prepare Job- order costing. - Prepare a contribution format income statement. - Use activity based costing techniques in studying cost behavior and improving cost decisions. - Use cost terms, cost analysis, cost behavior in decision making, planning and performance evaluation. C- Subject Specific Skills: At the end of the course, students will be able to: - Realize the cost classification for managerial purpose. - Realize the relevant cost and benefits for decision making purpose. - Use managerial accounting in controlling, planning and decision-making. - Realize the Job- order costing. D- Transferable skills – with ability to:- Display an integrated approach for the development of financial and non financial data for managerial purpose. - Provide decision makers with useful information and help them in analyzing and interpreting the components of managerial reports. 8. Methods Of Teaching The methods of instruction may include, but are not limited to: 1. Lectures 2. Discussion and problem solving 3. Brainstorming 4. Individual assignments 5. Case Study 6. Asking students to give a presentation in a specific subject or problem related to the course 7. Lecturing using PowerPoint Presentations, mixed with discussion with students 8. Asking students to prepare a term paper about a subject or a problem related to the course, and discuss it in the class. 9. Course Learning Assessment/Evaluation The following methods of learning assessment will be used in this course: Assessment a 2 Tests - Mid Exam - Final Exam Weight 30% 40% Actives such as Quizzes b 10% c Assignments Research proposal 10% d Presentations/participation 10% Total 100% Description - Multiple choice questions - True/False - Short answers - Essay Questions - Problem solving - Explanations - Multiple choices questions - True /False - Short answers - Problem solving - Asking students to prepare a term paper about a subject or a problem related to the course, and discuss it in the class - Student participation - Course portfolio Note: The details for the above methods of assessment are presented below: (a) Tests Test Mid Final Total Weight % 30% 40% 70% CLO 1-5 1-12 12 Due Date Week 6 Week 16 (b) Quizzes Method+ Weight CLO Quizzes 10% Every Chapter Total 10% Focus & Scope To be defined by instructor Due Date To be defined Relevant CLO will be addressed based on selected topics, will be determined by the instructor according to his/her decision regarding emphasis on selected topics. (c) Assignments Assignment Weight CLO 10% 1-3 Assignments Scope & Focus Ch2,Ch3, Ch5,Ch6,Ch7,C h8,ch11.ch12 Due Date after finish every Chapter (d) Participation Method Weight CLO - Participation& Presentation 10% ** - Total Focus & scope Student contribution and cooperation Course portfolio Due Date All weeks 10% All CLO's will be addressed in the students' participation, depending on the class and topic under consideration 10. Wk No. Course Schedule/Calendar Topic 1, Managerial Accounting : An Overview 2,3 Managerial Accounting and Cost Concepts Assignments/ workshops due date non E:1,2,3,4,5,8,10,11,12 P:14,17,21,22 after Reference in the textbook Ch1 Ch2 CLO 1 finish the chapter Job – Order Costing 3,4 P: 21,22,23 after 2 Ch3 finish the chapter Cost – Volume – Profit Relationships 4 6 E:1,2,3,4,5,6,7,15 E :1,2,4,6,7,8,9,11,12 P: 23.24 after finish the chapter Mid Exam 11/12/2014,Thu E:1,2,4,6,7,8,9,11,12 Ch5 Ch1, Ch2, Ch3, and Ch5 7 Variable Costing and Segment Reporting: Tools for Management E:1,2,4,6,7,8,9,11,12 8,9 Activity-Based Costing: A tool to Aid Decision Making after finish the chapter Ch 7 Profit Planning E 1,2,3,4,5,6,8,9,14 Ch8 Ch6 P: 16,19 after finish the chapter 12,13 Performance Measurement in Decentralized Organizations 14,15 Differential Analysis: The Key to Decision Making 16 P: 17,18,20 after finish the chapter 10,11 E:1,2,3,5,6,7,8,9 P: 14,15 after finish Ch11 the chapter Final Test Special Equipment or Supplies Personal Computer 3 E: 1,5,7,8,10,13,14 P: 18 after finish the chapter 24/1/2015 Ch12 5 1-4 6 7 8 11 12 Ch1, Ch2, Ch3, Ch5,Ch6,Ch7,Ch8,Ch11 1-12 and Ch12