The Decision to Invest in Wendy's Restaurants

advertisement

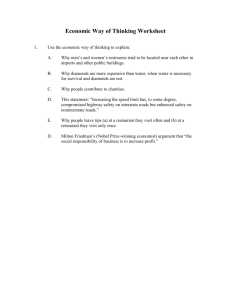

Homework 1 Please read the case study below and answer all questions in full sentences and in English language. Send your answers (1-2 pages) by e-mail (PDF or DOC) to wolfgang.frimmel@students.jku.at Deadline for submission: Friday, November 21, 2008 The Decision to Invest in Wendy’s Restaurants Peter Salg has just opened a new Wendy’s restaurant next to the University campus. Wendy’s International, Inc., expects to see at least 400 more operations like Mr. Salg’s completed by the end of the year. The year before, 450 were opened. “The last fifteen years have been times of ever-increasing demand for restaurant services,” Mr. Salg explains. “When I was a kid, you went out to eat once a month,” he recalls. “Now people eat out four or five times a week.” Higher incomes and the rapid flow of women into the work force account for a large part of the increased demand for eating out. “But all of that is slowing down,” Mr. Salg says. “In the past you could open a restaurant and manage it well, and you’d do well. Now if you want more customers, you have to take them away from other restaurants. We have to take customers away from McDonald’s, take them away from Burger King, and take them away from the Mom-and-Pop restaurant down the street.” Mr. Salg confirms a hunch of Wendy’s executives—that the key to surviving is being big. “That’s the attraction of franchising,” he says. “Without the millions—sometimes billions—spent on marketing, a restaurant just won’t be able to survive. Just being good isn’t enough anymore. You have to be big and good.” For restaurants owners like Mr. Salg, this boils down to a growing competitive fervor with increased awareness of the factors that affect the demand for meals at their restaurants, including demographic conditions, location, income levels, and prices. Many of the planning discussions that stem from the analysis of these factors are made in Dublin, Ohio. Detailed feasibility studies, prepared by analysts there, discuss data such as median income, population, and average age of the people working and living in a given area. They then estimate the number of fast-food restaurants the area can sustain and decide upon the number of Wendy’s restaurants to build in the area. Executives then discuss the results of the studies with people like Mr. Salg, who have “area agreements” with the corporation. Two years ago, for example, Wendy’s analysts determined that Mr. Salg’s area, which includes a four-county area north of Denver, could sustain at least 10 more Wendy’s restaurants. Mr. Salg agreed to build them. If he had refused to build the restaurants, Wendy’s would have offered the rights to build to individual buyers. The price of an established franchise varies with the revenue the restaurant is expected to generate. A restaurant near a college campus, for example, commands a higher price than a similar restaurant away from the heavy flow of fast-food restaurant patrons. A franchise that is expected to generate €17,000 per week earned by a typical Wendy’s restaurant will cost more than the average €500,000 purchase price—a price that does not include the physical asset of the building. Before construction can begin on a new restaurant, an owner must pay Wendy’s headquarters a €25,000 franchise fee and sign a contract pledging to turn over 10 percent of the restaurant’s total sales to the corporation. “This is the price,” Mr. Salg comments, “of being part of the family.” In addition, an owner signs a detailed agreement that outlines what products the restaurant will sell, how the products will be prepared and served, and the hours the store will operate. Over 60 percent of the money pledged by individual owners makes up Wendy’s advertising budget, providing television commercials, billboards, and flashy brochures for audiences at national, regional, and local levels. Another benefit of “being part of the family” is the discount rates on food and paper products available to individual restaurant owners. Wendy’s International does not supply Mr. Salg with the beef, potatoes, and paper cups he uses in operating his restaurants. But the corporation does make national contracts with large-scale distributors for the benefit of franchise owners. “We don’t have to use those distributors, but we get enormous cost cuts if we do,” Mr. Salg says. Owners may purchase products from any vendor whose products fulfill Wendy’s specifications “Wendy’s does not tell us what we can charge for our meals,” he explains. To determine the prices of menu items, Mr. Salg looks at his costs, particularly his food costs. His “target food cost” lies between 28.7 and 29 percent of the retail price of the meal. Mr. Salg charges sale prices that will yield food costs within his target. For some items, such as beverages, food costs are only 20 percent of the price of the item. For others—hamburgers, for example—food costs comprise 45 percent of the sale price. The overall food cost for a typical meal, however, must fall within his 28.7 to 29 percent target range. If Mr. Salg notices that his food costs are going over 29 percent of total sales, he considers raising his prices. Before he decides to do so, he “takes a walk to McDonald’s to see what they’re doing.” The McDonald’s restaurant nearest him generally charges 5 to 10 cents more for menu items comparable to Mr. Salg’s. “So I always have a margin,” he says. If Mr. Salg discovers a 10-cent spread between the price of a single hamburger at his restaurant and a comparable burger at McDonald’s, he will experiment with a 5-cent increase in the price of his burger. If the extra nickel fails to produce enough additional revenue to put him within his target, he will increase the price of side items. “I don’t raise my prices unless I have to,” Mr. Salg says. “Every time we raise prices, we lose customers.” The number of customers he loses depends on the degree to which he increases prices. With a 5-cent (4 percent) increase in the price of a single hamburger, Mr. Salg expects only a small loss of customers. “Those customers usually come back,” he says. “But an increase in the price of a burger by 15 cents (12 percent) causes a tremendous reduction of customer traffic.” Questions: 1. Is the demand for burgers elastic or inelastic? How does this affect mark-up pricing? Explain why raising the price marginally, seems to lead to a different elasticity as raising them by a large extent? 2. Why can prices vary between restaurants of the same franchise? 3. Why seems raising the price of side items instead of the burger price itself to be a good idea for Mr. Salg? Also explain the underlying concept. 4. Mr. Salg has several restaurants in Upper Austria. Suppose he has two restaurants in Linz, restaurant A and restaurant B. His total cost is TC=100+5(QA+QB). Demand for Salg’s restaurant on the two locations is given by QA=70-2PA and QB=55-PB. If Salg price discriminates between the two cities, what will the relation between the two prices be (PA/PB)? 5. What would be the highest profit in a monopoly market if the company has the possibility to conduct pure bundling or sell the two products independently? The company experiences constant marginal costs of € 0,50 for both products and the willingness to pay for two different consumers (A and B) is shown in the following table. Burger French Fries A € 1,20 € 2,00 B € 1,80 € 0,90