April 2014

Egyptian Company for Mobile Services

S.A.E. (mobinil)

Analysts Contact:

Egypt – Cairo

Tel. (202) 3749 5616

Fax (202) 3749 6184

Opportunities/Strengths

Marwa Ezzat M. Osman - Senior Risk Rating Analyst

marwa.ezzat@merisratings.com

Miglena Spasova - Senior Risk Rating Analyst

miglena.spasova@merisratings.com

Radwa Weshahy - Risk Rating Analyst

radwa.weshahy@merisratings.com

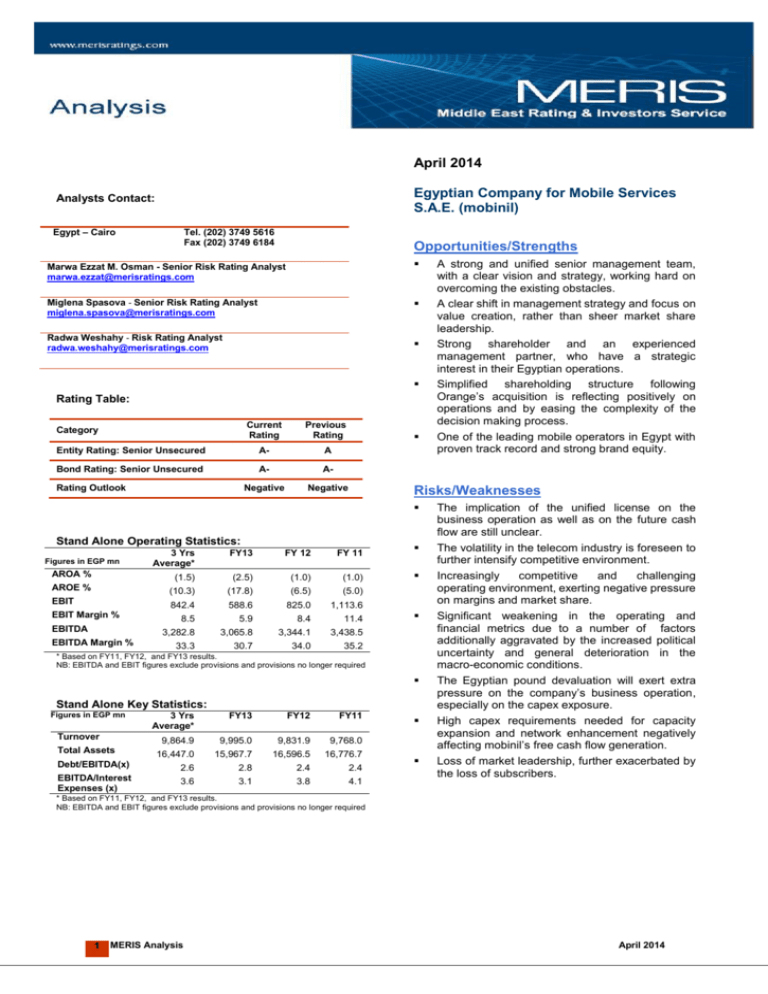

Rating Table:

Current

Rating

Previous

Rating

Entity Rating: Senior Unsecured

A-

A

Bond Rating: Senior Unsecured

A-

A-

Negative

Negative

Category

Rating Outlook

Risks/Weaknesses

Stand Alone Operating Statistics:

Figures in EGP mn

3 Yrs

Average*

FY13

FY 12

FY 11

AROA %

(1.5)

(2.5)

(1.0)

(1.0)

AROE %

(10.3)

(17.8)

(6.5)

(5.0)

EBIT

842.4

588.6

825.0

1,113.6

8.5

5.9

8.4

11.4

3,282.8

3,065.8

3,344.1

3,438.5

33.3

30.7

34.0

35.2

EBIT Margin %

EBITDA

EBITDA Margin %

* Based on FY11, FY12, and FY13 results.

NB: EBITDA and EBIT figures exclude provisions and provisions no longer required

Stand Alone Key Statistics:

Figures in EGP mn

Turnover

3 Yrs

Average*

FY13

FY12

FY11

9,864.9

9,995.0

9,831.9

9,768.0

16,447.0

15,967.7

16,596.5

16,776.7

Debt/EBITDA(x)

2.6

2.8

2.4

2.4

EBITDA/Interest

Expenses (x)

3.6

3.1

3.8

4.1

Total Assets

A strong and unified senior management team,

with a clear vision and strategy, working hard on

overcoming the existing obstacles.

A clear shift in management strategy and focus on

value creation, rather than sheer market share

leadership.

Strong shareholder and an experienced

management partner, who have a strategic

interest in their Egyptian operations.

Simplified shareholding structure following

Orange’s acquisition is reflecting positively on

operations and by easing the complexity of the

decision making process.

One of the leading mobile operators in Egypt with

proven track record and strong brand equity.

The implication of the unified license on the

business operation as well as on the future cash

flow are still unclear.

The volatility in the telecom industry is foreseen to

further intensify competitive environment.

Increasingly

competitive

and

challenging

operating environment, exerting negative pressure

on margins and market share.

Significant weakening in the operating and

financial metrics due to a number of factors

additionally aggravated by the increased political

uncertainty and general deterioration in the

macro-economic conditions.

The Egyptian pound devaluation will exert extra

pressure on the company’s business operation,

especially on the capex exposure.

High capex requirements needed for capacity

expansion and network enhancement negatively

affecting mobinil’s free cash flow generation.

Loss of market leadership, further exacerbated by

the loss of subscribers.

* Based on FY11, FY12, and FY13 results.

NB: EBITDA and EBIT figures exclude provisions and provisions no longer required

1

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

Summary Rating Rationale

MERIS (Middle East Rating & Investors Service) reviewed the senior unsecured debt - NSR - of the Egyptian

Company for Mobile Service (mobinil). MERIS has downgraded the entity rating to an “A-” grade from “A”, while

maintaining the instrument rating at “A-”. The outlook for both the entity and the instrument ratings remains at

"Negative Outlook".

The change in the entity rating was triggered by the volatility in the telecom industry over the last years, which is

expected to be further intensified over the short to medium term following the entrance of the fourth mobile operator.

The timing of the changes in the industry dynamics is very critical for the already saturated mobile market in general

and mobinil in specific, which already suffers from fragile credit metrics since 2011. Going forward, we expect that

mobinil’s financial ratios will remain weak for at least 2014 with no prospects of recovery in the short term to levels

commensurate with the previous rating category. MERIS is concerned regarding the company’s stressed operating

and financial performance. The drop in performance was evident through (i) the notable decline in the quantitative

aspects, witnessed in weak revenue growth, a significant deterioration in bottom line results, and profitability margins.

This has also adversely affected the leverage and coverage positions; (ii) the loss of its lead market position as a result

of the erosion in market share from 40% in 2010, to roughly 34% in 2013. Moreover, the recent devaluation of the

Egyptian pound exposes the company to significant foreign exchange risk, which adds to the already sensitive cash

flow metrics. MERIS views the capital expenditures related to network expansion and enhancement as a necessary

requirement to maintain the company’s technological competitiveness in the market. It is worth mentioning that

management/shareholders have implemented actions to mitigate the effect of the companies deteriorating domestic

performance on credit metrics, including: i) exploring innovative financing options to enhance the cash resources, in

order to relief the pressure on the leverage as well as coverage fronts, to a certain extent; ii) rationalizing the cost

structure; iii) recommendation of the management to the board not to distribute dividends going forward (which was

accepted in 2012). MERIS believes that management will continue its initiatives to mitigate the risk of the increasingly

tough operating and regulatory environment; nonetheless, we are concerned that these actions might not be sufficient

to fully offset the company's increased business risk amidst a challenging industry and macroeconomic conditions.

Moreover, we believe that further cost cutting opportunities might be diminishing, on top of rising pressure on the

financing need. In a recent action, the Telecom Ministry has announced the unified license preliminary term sheet,

which gives the local telecom operators the rights to provide all the telecommunication services. There are several

details/aspects are still under negotiation, including the detailed payment terms, therefore, the implication of the

proposed license on the business operation as well as the future cash flow is unclear.

Mobinil issued the second unsecured bullet bond amounting to EGP 1.5bn in 2010, which will be maturing in January

2015. At the time of issuance, the bullet feature of the instrument placed the bondholders in a structurally subordinated

position in terms of payment compared to the other lenders of the company. MERIS has reviewed this clause taking

into consideration that the bond is fully due early next year, and the bondholders will be repaid before certain of the

existing lenders. As such, MERIS affirmed the bond rating at A-, with a Negative outlook.

Rating Outlook

The negative outlook reflects the increased risks to M mobinil business from the challenging operating/industry

environment, which might impose further pressure on the company’s business operation and financial performance.

The outlook could move to stable if there is more clear perspective in the regulatory and macroeconomic environment

and there is a stable and contained foreign currency market. A return to positive profitability growth across the industry,

combined with stable margins and sustainable cash flow, would also lead to a stable outlook.

What Could Change the Rating Up

Although not currently expected in view of the recent rating action, MERIS could consider a rating upgrade if the

company: i) improves its financial profile by enhancing its operating margins, cash flow metrics and leverage position

to level close to 2010 results; ii) strengthens its cash-flow generation, translating into sustainable positive free cash

flows; iii) debt protection and coverage ratios were to strengthen significantly as a result of improvements in its free

cash flows and reduction in debt; iv) succeed in fully integrating its business with the key shareholder and thereby

realize marketing and operational synergies.

What Could Change the Rating Down

The rating could be further downgraded if: i) the company’s financial performance continues its downward spiral as a

result of the increased intensity in the competitive environment and the stressed macro-economic conditions; ii) the

cash flow metrics weaken further under the pressure of dividend distribution and/or excessive capex/investment

outlays, which might result in additional indebtedness.

2

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

Company Profile

The Egyptian Company for Mobile Services (ECMS) is a leading wireless telecom service provider in Egypt. ECMS

operates under the brand name mobinil and has 34.8mn subscribers as of December 2013 (33.8mn as of December

2012), which translates into a market share of approximately 34%. Its network of 6620 sites at the end of 2013 and 34

switches currently covers most of the urban areas in Egypt, or 99.66% of the population.

ECMS was initially established in November 1997 by the state-owned Arab Republic of Egypt National

Telecommunication Organization (ARENTO), which was succeeded by Telecom Egypt (TE). The company

commenced its operations in May 1998, when all the mobile-related assets of TE were sold off to Mobinil

Telecommunications, a consortium comprised of one local and two international telecom giants, Orascom Telecom

Holding (OTH) France Telecom (FT), and Motorola. Afterwards, the company was owned by two of its founding

shareholders OTH and FT/Orange Group, with direct and indirect ownership of 34.6% and 36.4% respectively. The

remaining 29% of the shares represented free float. OTH name was changed to Orascom Telecom Media Technology

(OTMT) in light of the acquisition of VimpelCom Ltd. In 2012, Orange acquired additional stake in mobinil, ultimately

gaining majority control of the company with a total shareholding of roughly 94%. As a result, OTMT’s share was

reduced to only 5% and the balance represents free float. According to management, it is not foreseen to have any

significant changes in the shareholding structure, if the macro-economic conditions remain challenging as they are

today”.

Key Rating Considerations

BUSINESS RISK FACTORS

FACTOR 1: Size, Scale, Business Model and Competitive Environment

Mobinil is a leading mobile operator in Egypt. It is the second largest national player in terms of subscribers, roughly

34.8mn subscriber as of December 2013, reporting 2.9% growth rate on Y-o-Y basis, compared to 33.8mn as of FY12.

Management views the decline in the growth of the subscriber base in line with its revised strategy to focus on

capturing value driven/ high quality customers. With equal note, despite the moderate size and scale of the business

by industry norms, Mobinil still enjoys some of the benefits of larger companies by making use of the strength and size

of its strategic shareholder (Orange) and management partner (OTMT), when making equipment purchases and

entering into roaming agreements. Furthermore, mobinil’s commercial and marketing departments maintain strong

links with their counterparts at Orange, sharing best practice and market knowledge. Thus, the relationship with its

strategic shareholder and management partner gives the company some additional strength, beyond that of a pure

independent player.

The company’s business operations experienced a number of challenges over the last years, due to various internal as

well as external factors, which was reflected in substantial changes in the company’s profile. The serious drop in

performance started in 2010, the main challenge facing the company was the limited dial up numbers, which

suppressed the company’s growth prospects. In 2011, the company faced a number of obstacles of various nature,

which adversely affected its operations and financial performance. The main causes for the company’s weakened

position in 2011 included the boycott campaign in 2011, following the highly politicized tweet and the subsequent loss

th

of subscribers and brand damage, in addition to the political and economic turmoil, following the January 25

Revolution . The combined effect of all these events was reflected in a significant drop in mobinil’s market share from

approximately 40% in 2010 to roughly 34% in December 2013, a decline in EBITDA figure by roughly 32% (between

FY10 and FY13). Going forward, the challenging operating environment as well as the stressed macro-economic

conditions added further pressure to the performance. With equal note, the introduction of the unified license, which is

expected to materialize in the short term horizon, is anticipated to further stress the market fundamentals and intensify

the competitive environment.

The management team, which is one of the positive key rating consideration, has a solid experience in the telecom

industry both in the local and the international markets. MERIS met with the top management and believes that they

form a strong and unified team with a clear view and strategy for the company’s way forward. The team is well aware

of the challenges and is working hard to overcome the existing obstacles, which is considered a positive factor to the

rating.

3

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

Historically, mobinil’s strategy has focused on growing its subscribers’ numbers and was the first to introduce new

aggressive offers to the market, maintaining leading market share until 2010/2011. However, in light of the saturation

of the local mobile market, management reviewed the growth strategy to include a more pronounced shift towards

value creation. Nonetheless, management underscored the need to maintain a leading market share as well. This was

reflected in low net ads figures over the last two years (FY13: 968K, FY12: 926k, compared to 2.7mn in FY11). As part

of its value oriented strategy, management is planning to expand rapidly on the data/broadband front, taking into

account the low penetration rate, which offers high growth opportunities. In this regard, mobinil will in particular

capitalize on its fully owned subsidiary Link Dot Net, which was acquired in 2H10.

Mobinil offers a diversified product mix covering both the corporate and retail market segments. With regard to the

retail segment it continued pursuing a dual strategy, targeting both the lower and higher ends of the market. Staying

close to the customers, understanding their needs and creating the right products to address the clients’ different

needs is at the core of mobinil’s commercial strategy. Voice telephony is the main revenue stream for the company,

but following the rollout of the 3G network, it also provides other services such as mobile broadband. Going forward,

the company will continue expanding in value-added services, broadband services and others to compensate for the

expected decline in the voice business.

In terms of business model, mobinil is a local wireless operator with a focus on growing its operations organically and

with no appetite for regional or international expansion. In general, MERIS views a mobile only operation as a less

robust business model than a fully integrated telecom provider. Integrated players have sounder platforms for

adopting a range of new products and benefit from the diversity of their business risks. Nevertheless, pursuing an

integrated business model in Egypt is currently not an option for the wireless operators, as long as Telecom Egypt

remains the sole provider of fixed-line services. The award of the unified license including second fixed-line operator

license has been postponed several times by the government. The Unified license is assumed to liberalize the local

telecom market.

In a recent action, the Telecom Ministry announced the preliminary outline for the proposed license terms and

conditions. The unified license is an integrated license, with four components. It will give the telecom operators the

rights to provide all the telecommunication services, such as, voice services (mobile and fixed lines), transmission

fibers, international gateway, and full unbundling…etc. It will include: 1) granting Telecom Egypt the right to initially

enter the local mobile market by a virtual network, capitalizing on the existing operators mobile networks and once

Telecom Egypt acquired the frequency offered, it will start building their own mobile networks to be ready for the

second phase. The mobile license cost will be EGP 2.5bn, in addition to a revenue sharing agreement; 2) offering the

existing mobile operators full unbundling/the virtual fixed license against EGP 100mn and certain revenue sharing

agreement; 3) reviewing the terms and conditions to the international gateway license which was offered previously,

whereby, mobinil and Vodafone will pay up front fees amounting to EGP 1.5bn and EGP 1.8bn respectively, in

addition to 6% revenue sharing fees; and 4) offering the operators to enter into an infrastructure company that will have

license to build a transmission network against EGP 300mn and certain revenue sharing agreement. Currently there

are on-going negotiations between the telecom operators and several government authorities to finalize the license

terms, at the same time to reach an agreement with regard to the other pending components (i.e. the fiber optic

network ..etc) and to solve the existing disputes/conflicts between the telecom players. According to management they

are currently exploring the feasibility of all the components under the license; therefore, the investments and capex

needs attached to the license are not clear yet. MERIS believes that the outlook for the local mobile industry is

negative, as we expect that the market dynamics will continue to intensify competition and further squeeze profitability

margins to add extra pressure to the fully penetrated market. Moreover, the implication on the cash flow in the short

term, is not certain yet; as it will depend highly on which component management will explore and the payment terms

for each. On the other hand, the recent devaluation of the Egyptian pound as well as the uncertainty surrounding the

th

political and economic environment since the January 25 Revolution, add to the pressure on the company’s revenue

especially that the consumer is anticipated to be increasingly price-sensitive.

Factor 2: Operating Environment

(a) Regulatory & Industry Framework

In MERIS’s view, the regulatory environment in Egypt is still volatile with a considerable degree of uncertainty.

Liberalization of the Egyptian telecom market started in 1998 through the issuance of two mobile network operating

4

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

licenses. Furthermore, 1998 saw the establishment of the Ministry of Communications and Information Technology

(MCIT) with the responsibility of developing Egypt’s ICT infrastructure, stimulating the knowledge economy and forging

an e-government strategy and a legal framework that is in line with international digital requirements. Liberalization

was further advanced by the Telecommunication Regulation Law (No. 10) of February 2003. The law rests on four

main pillars: information disclosure, free competition, the provision of unified services and user protection. A central

aspect of the law was the creation of the National Telecom Regulatory Authority (NTRA), which replaced the Telecom

Regulatory Authority (TRA) in 2003 and took over all the regulatory functions as an independent regulatory authority.

While liberalization has been progressing relatively smoothly, criticism has centered on the overprotection of the

incumbent telecom operator. Among some of the challenges to the liberalization process is the role of the Ministry of

Communications and Information Technology in overseeing both the regulator and Telecom Egypt (80% government

owned and the sole fixed line service provider), a dual role that makes for a difficult balancing act.

The intricate position of the regulator has been played out in the recent interconnection dispute between mobinil and

Telecom Egypt (TE) since 2007. NTRA had sided with TE’s decision to lower its fixed-to-mobile termination rates,

despite the existing effective agreement between TE and the wireless operator. mobinil, as well as Vodafone, have

appealed the decision and filed law suits against NTRA, to decide on which interconnection rate to apply (i.e. either the

initially agreed upon rate stated in the contracts or the lower rate proposed by NTRA). At the same time, there is

another lawsuit appealed by the same mobile operators against NTRA claiming that the regulator has no right to

interfere in the termination rates agreed upon between telecom operators. On August 2013, the court ruled out a final

and non-appealable decision on the first litigation, confirming the mobile operators rights to stick to the initial terms of

the contracts between TE and mobile operators. As for the second lawsuit, it is still in court; however, there is no

financial or any other obligation that may arise from the remaining case as it is on the substance of the problem not on

the termination rate itself.

Over the last three years, the dynamics of the telecom industry in Egypt notably have changed; due to the weak

macroeconomic conditions and the low GDP growth rate, which keeps consumer price sensitive. MERIS believes that

the outlook for the local mobile industry is negative, as the market will entail higher business risk, especially following

the entrance of a fourth mobile operator. In general, the integrated incumbent operators such as TE might fare better

than companies with just mobile or fixed offerings because they can offer bundled voice and data services, adding

extra pressure to the already squeezed sector margins. Despite the fact that the changes in the market dynamics will

enhance the service offering, it will further intensify the competition; as the companies will fight to gain or retain their

market share. As such, the sector will remain on negative outlook due to the slow pace of the macroeconomic

conditions and the intensified competition, this is reflected in uncertain sustainability of the revenue recovery, as well

as margins and financial metrics.

(b) Technology Risk

MERIS’s ratings take into consideration a company’s exposure to technological advancement and how well positioned

it might be in handling such developments. The ratings also factor in the potential capital expenditure implications of

any technological improvements and advances.

(c) Market Share

As we highlighted earlier, mobinil’s market share was pressured significantly since 2010 culminating in the loss of its

market lead to Vodafone in 2011; dropping from 40% to 34.2% as of FY13. As we mentioned earlier, the main reasons

contributing to the drop in market share were the tweet-related political controversy, which led to a boycott campaign

against the company, in addition to the challenging operating and market environment. Despite the fact that

management is working hard on maintaining the current market share, the entrance of the fourth mobile operator is

expected to further challenge the current position.

On the subscribers’ front, mobinil’s subscriber mix remains predominantly prepaid, as the local market is predominantly

prepaid in nature. Initially, the rapid expansion of prepaid services in the market has been the main tool for the

operators in their quest for expanding their respective market shares. It is worth mentioning that the increasing

prominence of prepaid tariffs, however, has been reflected in the operators’ declining ARPU levels, as prepaid

spending levels are 6-7 times lower than postpaid levels. This stark difference in spending levels between the two

market segments illustrates the acute need for operators to improve their subscriber mixes and introduce new

services. Mobinil have slightly higher number of postpaid customers. Historically, Vodafone used to have a relatively

better subscriber mix, as illustrated by its higher ARPU. However, following vodafone’s aggressive subscriber base

5

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

expansion initiatives, which led to the acquisition of mostly lower income clients, it has recently narrowed the gap with

mobinil’s blended ARPU. Going forward, in accordance with management’s revised growth plan, mobinil will continue

to focus on the postpaid segment, with relatively higher income generation capacity. Moreover, management

introduced new postpaid bundle offers to cater to the needs of the upper bracket of the prepaid segment. These

initiatives decreased the contribution of prepaid segment to the total subscriber base to 87% in 4Q13 compared to

around 95%. This action was reflected in maintaining the global ARPU figures at the range of EGP 23 over the last two

years.

Factor 3: Management’s Financial Strategy

1

In May 2012, Orange (formerly France Telecom) acquired roughly 94% of mobinil’s capital, through its wholly-owned

subsidiary, MT Telecom SCRL (“MT Telecom”). So far, there is no clear plan for fully integrating mobinil’s business

into the FT group, nonetheless, the simplified shareholding structure increased the efficiency of running the business,

through easing the complexity of the strategy formulation and decision making process.

Historically, the dividends distribution practices, coupled with the fierce market competition has put significant pressure

on the company’s cash flow position over the last few years. Mobinil used to follow a high dividend payout policy to

meet its shareholders' objectives. The company’s cash flow has also been used to support the high capex and

investment (i.e. 3G license payment) requirements, especially those associated with the payment of the 3G license

and network upgrading. The company’s high dividend payout policy, coupled with the capital intensive nature of the

industry have already constrained mobinil’s financial flexibility. Going forward, the company’s management has

affirmed its orientation to balance the shareholders’ requirements with the need to maintain a healthy debt profile.

Accordingly, the company will be flexible in reviewing the future strategy based on market, economic and funding

conditions. The company’s financial strategy for the next 3 years is to maintain it within the covenants range and to

continue to invest heavily to further upgrade and expand its network. At the same time, it is carefully assessing the

feasibility of any other expansion initiatives in the local market (i.e. international gateway, 4G network, etc.). According

to management, the financing needs for the coming years will cover mainly the unified license, if needed, and the

capex/investment requirements. It is worth mentioning that the future cash flow requirements will depend highly on the

terms and conditions of the proposed licenses. In terms of geographical expansion, mobinil remains committed to its

growth within Egypt, with no appetite for further diversification by embarking on a regional expansion. The

management strategy and tolerance for financial risk have a direct impact on the debt level and credit quality and is

therefore paramount for the rating grade.

Management will continue with the cost cutting initiatives which was introduced in 2012, as it proved to partially

contain the negative impact of the challenging operating environment. Going forward, management is planning to

continue with the cost cutting strategy, although such opportunities might be increasingly difficult to find and

implement, especially in light of the devaluation of the local currency, and the challenging operating environment which

is excessively pressuring the cost structure. Furthermore, the company has plans to increase the tariff and to pass any

potential cost/tax increases to consumers, in order to relief the foreseen pressure on the cash flow.

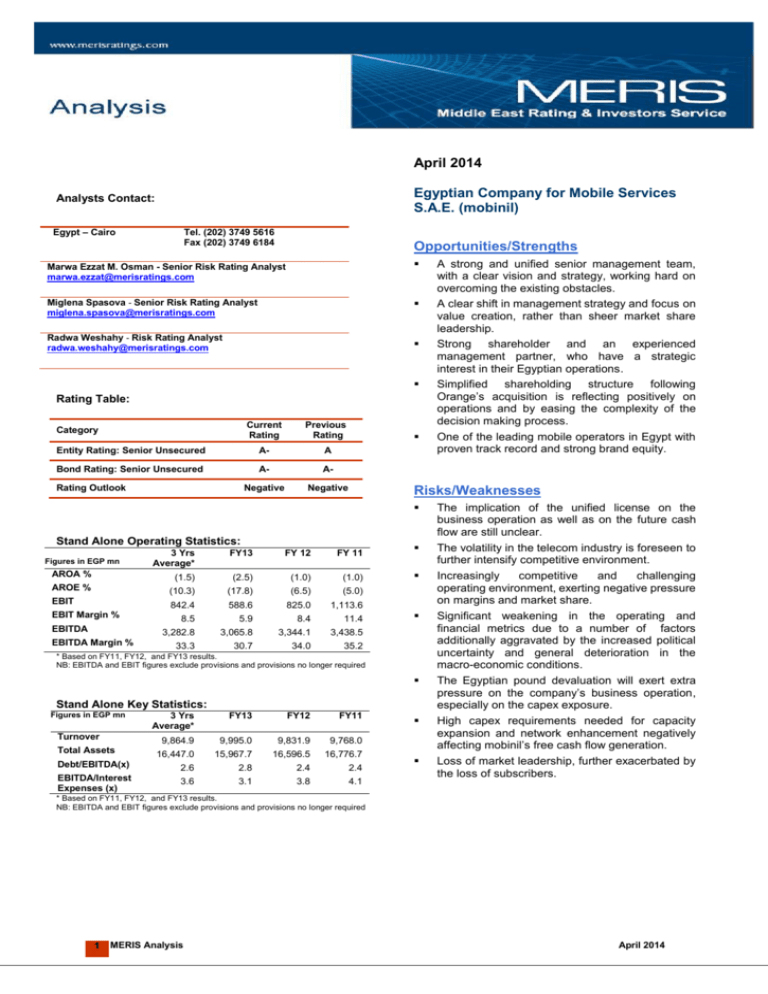

FACTOR 4: Operating Performance

Mobinil financial statements are audited by Ernst & Young. The company's financial statements have been prepared in

accordance with Egyptian Accounting Standards (EAS). However, in the auditor's opinion, there are no material

differences between EAS and the International Accounting Standards (IAS). For the entity rating, as well as the bond,

MERIS analysis is based on the audited unconsolidated accounts (a stand-alone basis); as such we didn’t take into

consideration Link Dot Net investment.

Revenue and Margins Pressured on the Back of a Difficult Operating Environment

Mobinil revenues have been almost stable over the last two years; while the decline continued on the EBITDA level. As

the graph below shows, the decline was steeper on the EBIT front with roughly 29% drop in absolute figures as of

December 2013. This was due to the instability in the political and economic environment, along with the devaluation

of the local currency, in addition to the severe competitive pressure. Going forward, the pressured performance is

1

Orange long-term issuer and senior unsecured rating was downgraded in January 14th, 2014, to Baa1 from A3 by Moody's

Investors Service. The outlook on the ratings is stable.

6

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

expected to continue in the short term horizon, in light of the intensified competitive environment. Accordingly, the

profitability margin is expected to be further squeezed, in light of the increasing operating expenses. According to

management, operating profitability is anticipated to be maintained at below 10%.

In FY12 bottom line was hit dramatically to reach EGP 165.7mn in losses and EGP 401mn in FY13. The severe drop

resulted from the overall poor operating performance, followed by the notable increase in interest expenses. In view of

the saturation of the market, as well as the difficult macroeconomic and political environment in Egypt, MERIS believes

that the coming years will continue to challenge the local mobile operators in general and mobinil in specific, especially

after losing its leading position and the entrance of the fourth player into the local mobile marker. As we expect

revenues will show limited growth in 2014, it is not clear how sustainable any recovery will be in the near future.

In a recent action, the company published lately

the 2013 full year results. Reporting 1.7%

growth in revenue figure to stand at roughly

EGP 10bn, while EBITDA figure has reached its

bottom point at EGP 3bn. Also, the profitability

margins is showing a downward trend with

EBITDA and EBIT margins of 30.7% and 5.9%,

respectively. The net income was dropped

significantly to reach negative EGP 401mn. The

continued decline in performance was due to the

stressed macroeconomic conditions which

negatively affected the performance, along with

the devaluation of the Egyptian pound which

inflated cost and expenses notably. Also the

increase in interest rate contributed to the drop in

the bottom line.

Revenue & Profitability

FY13

FY12

Revenue

Growth (%)*

Figures in EGP mn

9,995.0

1.7

9,831.9

0.7

FY11

9,768.0

(6.5)

10,450.1

(3.2)

FY10

EBIT

EBITDA

EBITDA Margin (%)

Operating Profit Margin

(%)

588.6

3,065.8

30.7

5.9

825.0

3,344.1

34.0

8.4

1,113.6 **

3,438.5

35.2

11.4

2,515.3

4,486.3

42.9

24.1

Interest Expense

Interest Income

(988.1)

67.9

(876.6)

68.4

(838.8)

42.6

(631.5)

43.5

Net Income/loss

Net Income Margin (%)

(401.4)

(4.0)

(165.7)

(1.7)

(171.0)

(1.8)

1,378.0

13.2

* Y-o-Y Basis

** In an action to separate between the shareholders’ remunerations and employees’ profit

sharing, management changed the accounting treatment of the employees’ bonus in 2011, to be

accounted for in other operating cost (employees bonus accounts for EGP 225mn in FY11, and

EGP 58mn in 1Q12).

In terms of revenue mix, prepaid subscribers

continue to be the company’s key driver

NB: EBITDA and EBIT figures exclude provisions and provisions no longer required figures

accounting for roughly 87% in FY13, compared to

a historical average of 97% of customer base, which comes in line with management strategy to shift to the value

share strategy. Although prepaid customers are expected to continue dominating the revenue mix going forward, a

minor erosion of their share might be foreseen in light of the management intention to shift to a value extracting

strategy. By service type, currently, voice revenue is considered the main revenue driver, accounting for more than

85% of revenues. Despite the fact that the share of non-voice and other revenues registered a significant increase by

more than 60% in FY13, voice revenues will continue to have the dominant share on the medium term, since the

Egyptian consumer is mainly voice oriented. Roaming revenue accounted for less than 2% of revenue down from 4%

th

in 2010, due to the drop in tourist visitors to Egypt since the January 25 revolution in 2011.

12,000

50%

Profitability

10,000

40%

8,000

EGPmn

30%

6,000

20%

4,000

10%

2,000

0%

2007

-2,000

Revenues

Net Income*

2008

2009

2010

2011

EBITDA*

EBITDA Margin %

2012

2013

-10%

EBIT*

EBIT Margin %

*Adjusted for employees' bonus retroactively for 2007, 2008, 2009 and 2010

7

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

Historically, mobinil has been more aggressive in terms of customer acquisition – especially in the middle and lowerend segments, which jeopardized its ARPU figures and profitability margins, which were relatively lower compared to

its peer group. In 2011, management indicated a shift in its growth strategy towards value extraction in an attempt to

ease the pressure on the company’s operating metrics. Nevertheless, given the intensified competitive environment,

especially in a saturated market with more than 100% penetration, MERIS expects that the company’s margins will

remain weak in 2014 with no prospects of recovery in the short term to levels commensurate with the previous range.

FACTOR 5: Financial Strength

Difficult Operating Environment, Challenging Credit Metrics

Historically, the company has been

generating strong operating cash flow.

Nonetheless, the free cash flow position

was pressured by the aggressive

dividends distribution policy, coupled

with the significant capex requirements.

The cut down in shareholders

remuneration, since mid-2012, relieved

the pressure on the cash flow position to

a certain extent. Going forward, in FY13,

mobinil generated EGP 847.4mn

negative free cash flow, which was

mainly due to negative changes in

working capital as well as the payment

of EGP 750mn to the regulator against

the last installment of the spectrum fees.

A negative trend which is expected to

continue in 2014.

Cash flow & Coverage

Figures in EGP mn

FY13

FY12

FY11

FY10

Funds From Operation (FFO)

- Dividends

Retained Cash Flow (RCF)

2, 919.4

0.0

2, 919.4

3,301.8

0.0

3,301.8

3,233.1

(1,412.3)

1,820.7

4,063.9

(889.3)

3,174.7

Funds From Operation (FFO)

+/- Changes in Working

Capital

Cash Flow From Operation

(CFO)

- Dividends

- Capex

- Investments (license Fees)

Free Cash Flow (FCF)

2, 919.4

3,301.8

3,233.1

4,063.9

(1,134.6)

(1,372.2)

(900.0)

(1,136.8)

1,784.9

1,929.6

2,333.0

2,927.1

0.0

(1,757.2)

(875.0)

(847.4)

0.0

(1,918.6)

0.0

(786.9)

(1,412.3)

(1,707.7)

0.0

(787.0)

(889.3)

(1,919.4)

(1,850.0)

(1,731.5)

1.8

3.0

1.7

3.8

1.1

4.1

1.7

7.1

RCF/Capex (%)

EBITDA/ Interest Exp (x)

As highlighted earlier, management demonstrated its commitment to scale down and even completely forego

shareholder returns, when market conditions made such cash preservation tactics necessary. This conservative

dividend distribution policy is viewed positively by MERIS. With equal note, the devaluation of the Egyptian pound is

anticipated to impose serious pressure on the company’s credit metrics. As such, management might cut capex

expenses to offset this challenge, to a certain extent. On the other hand, the future capex and investment requirements

are unclear, taking into consideration that the detailed terms and conditions of the unified license are not fully released

yet.

5,000

Cash Flow

4,000

EGPmn

3,000

2,000

1,000

-1,000

2007

2008

2009

2010

2011

2012

2013

-2,000

-3,000

Retained Cash Flow (RCF)

8

MERIS Analysis

Cash Flow from Operations (CFO)

Free Cash Flow (FCF)

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

In terms of interest coverage, mobinil's position deteriorated significantly from the 7x range to 3x in FY13, which is

associated with the higher debt level linked to network enhancement, license fees and working capital requirements

along with the drop in the EBITDA figures.

A Highly Leveraged Debt Profile

Mobinil's leverage position has been

pressured over the last couple of

years.

The company’s borrowing

Figures in EGP mn

FY13

FY12

FY11

FY10

increased since 2010, after the EGP

Short-term Debt

2,929.5

1,958.2

2,111.2

1,017.2

1.5 billion bond, which was followed

Long-term Debt

5,647.6

6,119.3

6,300.8

5,968.2

by the EGP 2bn, seven-year

Total Debt

8,577.1

8,077.6

8,412.0

6,985.4

unsecured syndicated loan in 2011

Cash and Cash Equivalent

660.1

969.8

1,208.0

546.3

and the EGP 2.9bn medium term

syndicated loan undertaken in

Net Debt

7,916.9

7,107.7

7,204.0

6,439.1

September 2012, which will mature in

2019. The latter is divided into two

O. Financial Obligations (License fees)

0.0

750.0

750.0

750.0

equal tranches: (i) a medium-term

Total Financial Obligations

8,577.1

8,827.6

9,162.0

7,735.4

loan amounting to EGP 1.1bn to

partially refinance existing debts and

Debt Adjustments:

to finance capex and working capital

Capital commitments & contingent L.

494.0

790.0

593.0

699.0

requirements; (ii) a declining revolving

Adjusted Debt

9,071.0

9,617.6

9,755.0

8,434.3

facility amounting to EGP 1.79bn, to

be paid gradually over the two years

Equity

2,052.5

2,461.5

2,640.5

4,227.0

before the debt maturity. The loan

entails a floating interest rate to be

EBITDA – Capex / Interest Exp. (x)

1.3

1.6

2.1

4.1

paid semiannually.

The favorable

FFO + Interest Exp / Interest Exp (x)

4.0

4.8

4.9

7.4

terms and conditions of the newly

Net Debt/EBITDA (x)

2.6

2.1

2.1

1.4

negotiated syndicated facility in a

Gross Debt/Equity (x)

4.2

3.3

3.2

1.7

difficult political and macroeconomic

Gross Debt/ EBITDA (x)

2.8

2.4

2.4

1.6

environment are a clear testimony to

Adj. Debt / Capitalization (%)

87.4

96.0

94.6

97.3

the strong partnership of mobinil with

FCF/Adjusted Debt (%)

(9.9)

0.8

(8.6)

(22.4)

the local banks. In early 2014,

RCF / Adjusted Debt (%)

32.2

34.3

18.7

37.6

management secured a new debt,

amounting to EGP 2.26bn, from eight banks. The seven year debt carries approx. two years grace period and will be

used for refinancing existing debts. With equal note, the syndicated loan also entails a floating interest rate, which will

be paid semiannually. According to management, the company will operate within a target leverage range (Net

Debt/EBIT) of around 2.0 – 3.0x. The company’s debt profile is considered well spread, with approximately 30% of the

outstanding balance short-term in nature, containing the current portion of long-term debts and credit facilities.

Meanwhile, management also, is exploring other sources of non-bank finances to secure its financial obligations.

Financial Leverage

Mobinil’s second unsecured bullet bond, issued in 2010 and maturing in January 2015, amounted to EGP 1.5bn. The

bond bears a fixed coupon rate of 12.25%, payable semi-annually. It is non-convertible and callable after three years.

Initially the bullet feature of the bond placed it in a structurally subordinated position in terms of repayment compared

to the other lender of the company. As such and taking into consideration that the bond is due during the coming year,

this clause has been reviewed and the bondholders will be repaid before certain of the existing lenders. As illustrated

in the graph below, regardless of the notable increase in mobinil's indebtedness, the amortization of the loans is

designed in a way, which alleviates the pressure on the company’s liquidity metrics.

It is worth mentioning that roughly EGP 3bn of the company’s debt profile will mature over 2014 and the 1Q15.

According to management these outstanding balances will be mostly funded through the already secured new loan.

Drop in Debt Protection Ratios

RCF figures dropped significantly in FY11 on the back of the deterioration in operating performance, as well as the

excessive dividends distribution. This resulted in a substantial hit to the RCF/Adjusted Debt ratio, which declined from

mid 40% range in FY09 to 18.7% in FY11. In 2012 the ratio has improved, thanks to the cut in the dividends

distributions figures which reflected positively on the RCF position. It is worth mentioning that the adjusted debt ratio,

9

MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

takes into consideration the debt obligation (bank debts as well as bonds), in addition to license payment obligations,

capital commitments and contingent liabilities.

The company’s indebtedness has been on the rise as reflected in the Gross Debt/EBITDA position, which deteriorated

from 1x in FY09 to 2.4x in FY12 and 2.8x in FY13 . While, the gross debt to equity ratio is showing a downward trend

over the last years, as a result of the shrinkage in the equity base, associated with the generated loss. At the same

time, the net debt to EBITDA ratio has deteriorated as well, where it dropped from 0.8x in FY09 to 2.1x in FY12 and

2.6x in FY13.

In terms of coverage, despite the deterioration, the company was still able to report healthy ratios with enough room to

serve interest obligations after fulfilling its on-going investment needs. As detailed in the table above, EBITDA less

Capex/Interest Expense ratio was around 1.3x, in FY13, compared to around 4.1 x in FY10.

Times (x)

9

Indebtedness and Coverage

4.0

8

3.5

7

3.0

6

2.5

5

2.0

4

1.5

3

1.0

2

0.5

1

0.0

Times (x)

4.5

0

2008

2009

2010

2011

Gross Debt/Equity (x)

Gross Debt/EBITDA (x)*

EBITDA/Interest Expense (x)* (right axis)

2012

2013

Net Debt/Equity (x)

Net Debt/EBITDA (x)*

*Adjusted for employees' bonus retroactively for 2007, 2008, 2009 and 2010

Other Considerations

Liquidity Position is Considered Adequate

Mobinil's liquidity position is considered adequate. As of December 2013, mobinil had more than EGP 660mn in cash

and cash equivalent.

It is also worth noting that the single obligor limit with the banks improved significantly following the Orange takeover

and the subsequent removal of mobinil from the OT group exposure. This has provided the company with additional

opportunities for access to bank debt. As of January 2014, the company had short term credit facilities sourced from

12 different banks, amounting to roughly EGP 1.3bn. Around 40% of the total authorized limits were unutilized.

Furthermore, mobinil has an additional available limit of EGP 1.8 billion as a revolving loan under the syndicated loans,

in addition to another EGP 100mn under the EGP two billion facility, which is also supportive of its liquidity position.

10 MERIS Analysis

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

Annex 1: Shareholding Structure

ECMS

MT Telecom (MTT)

94%

11 MERIS Analysis

Orascom Telecom Media and

Technology Holding (OTMT)

5%

Free Float

1%

April 2014

Egyptian Company for Mobile Services (S.A.E.) mobinil

Annex 2: National Rating Scale

Gilt edged

AAA

Very high

AA+

AA

AA-

Upper-medium

A+

A

A-

Medium grade

BBB+

BBB

BBB-

Questionable

BB+

BB

BB-

Poor quality

B+

B

B-

Very poor

Quality of credit

CCC+

CCC

CCCCC

C

Short

term

Prime 1

Prime 2

Investment Grade

Long

term

Prime 3

Not Prime

Speculative Grade

Quality of credit

© Copyright 2014, (“MERIS”) Middle East Rating and Investors Service. All rights reserved. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY COPYRIGHT LAW AND NONE OF

SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD,

OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON

WITHOUT MERIS PRIOR WRITTEN CONSENT. All information contained herein is obtained by MERIS from sources believed by it to be accurate and reliable. Because of the possibility of

human or mechanical error as well as other factors, however, such information is provided “as is” without warranty of any kind and MERIS, in particular, makes no representation or warranty,

express or implied, as to the accuracy, timeliness, completeness, merchantability or fitness for any particular purpose of any such information. Under no circumstances shall MERIS have any

liability to any person or entity for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error (negligent or otherwise) or other circumstance or contingency within

or outside the control of MERIS or any of its directors, officers, employees or agents in connection with the procurement, collection, compilation, analysis, interpretation, communication,

publication or delivery of any such information, or (b) any direct, indirect, special, consequential, compensatory or incidental damages whatsoever (including without limitation, lost profits), even if

MERIS is advised in advance of the possibility of such damages, resulting from the use of or inability to use, any such information. The credit ratings and financial reporting analysis observations,

if any, constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hold

any securities. NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR

PURPOSE OF ANY SUCH RATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MERIS IN ANY FORM OR MANNER WHATSOEVER. Each rating or other opinion

must be weighed solely as one factor in any investment decision made by or on behalf of any user of the information contained herein, and each such user must accordingly make its own study

and evaluation of each security and of each issuer and guarantor of, and each provider of credit support for, each security that it may consider purchasing, holding or selling.

12 MERIS Analysis

April 2014