the hong kong polytechnic university hong kong community college

advertisement

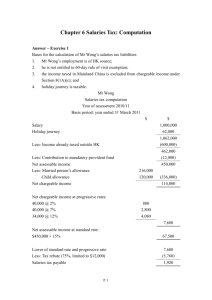

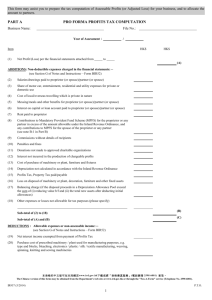

THE HONG KONG POLYTECHNIC UNIVERSITY HONG KONG COMMUNITY COLLEGE ________________________________________________________________________________ Subject Title : Taxation Subject Code : CCN3101 : Semester One, 2013/14 Session Numerical Answers Section B Question B HKCC Limited Profits tax computation Year of Assessment 2012/13 Basis period: year ended 31 March 2013 HK$ Net profit per account Add Increase in general provision 20,000 Increase in special provision (staff loan) 8,000 Agents whose identities were not disclosed 50,000 Early termination of lease of the old office 100,000 Special contribution in one lump sum (200000 160,000 x 4/5) Paid to Mr Chan, an individual director 65,000 Paid for HengSeng Bank loan with security 80,000 Paid for lease of new office 70,000 Refurbishment expenses (280000 X 4/5) 224,000 Payment of company’s profits tax 250,000 Travelling expenses related to Shanghai project 22,000 Depreciation expenses 500,000 Donations 220,000 Less Offshore consultancy fee Dividends from quoted shares Interest on loans (available in UK) Interest on qualifying debt instrument Interest on a US$ fixed deposit in Shanghai Damages of ventilation system Cancellation of a major business contract HK dollar bills of exchange in the US Less Depreciation allowances Less Approved charitable donations (max 35%) 120,000 300,000 15,000 12,000 33,000 23,000 500,000 80,000 HK$ 531,000 1,769,000 2,300,000 1,083,000 375,000 842,000 220,000 Page 1 of 5 Assessable profits 622,000 Profits tax payable: @ 16.5% 102,630 Section C Question C1 Jason Property tax computation Year of Assessment 2011/12 (original) Rental income ($25,000 x 12) Carpark fee ($4,000 x 12) Premium ($100,000 x 12/24) Assessable value Less: rates Less: 20% statutory deduction NAV Property tax liability @15% HK$ 300,000 48,000 50,000 398,000 6,000 392,000 78,400 313,600 47,040 Jason Property tax computation Year of Assessment 2012/13 Rental income ($30,000 x 10 - $30,000 x 1)) Premium $120,000 x 10/24 Expenses borne by tenant ($9,000 - $6,000) Less: irrecoverable rent ($29,000 x 13) Irrecoverable rent carried backward to set off in 2011/12 HK$ 270,000 50,000 3,000 323,000 377,000 (54,000) Jason Property tax computation Year of Assessment 2011/12 (revised) Rental income ($25,000 x 12) Carpark fee ($4,000 x 12) Premium ($100,000 x 12/24) Less: irrecoverable rent carried backward from 2012/13 Assessable value (revised) Less: rates Less: 20% statutory deduction HK$ 300,000 48,000 50,000 398,000 54,000 344,000 6,000 338,000 67,600 Page 2 of 5 NAV 270,400 Property tax liability (revised) @15% Less: tax previously paid Property tax refund 40,560 47,040 6,480 Question C2 Mr Patter Salaries tax computation Year of assessment 2012/13 $ Salary (50,000 x 9) Bonus Commission Car running costs reimbursed ($40,000 x 50%) Travelling allowances (5,000 x 9) Gain on stock option [5,000 x (10-5) – 1,500] Child education benefit Less: allowable expenses Travelling expenses Rental value (948,500 – 23,500) x 10% Less: Rent suffered $(30,000 – 25,000) x 9 Less: Self-education Charitable donation Contributions to recognized retirement scheme NAI after concessionary deductions Less: Married person allowance Child allowance (63,000 x 2) Disabled dependent allowance Net chargeable income Tax at NCI at progressive rates $(439,500 – 120,000) x 17% + $8,400 Tax at standard rate: 871,500 x 15% Salaries tax payable [lower of (A) and (B)] $ 450,000 250,000 100,000 20,000 45,000 23,500 90,000 978,500 (30,000) 948,500 92,500 (45,000) (240,000) (126,000) (66,000) 47,500 996,000 (60,000) (50,000) (14,500) 871,500 (432,000) 439,500 62,715 (A) 130,725 (B) 62,715 Page 3 of 5 Question C3 (a) Mr and Mrs Law Personal Assessment Computation Year of assessment 2012/13 Mr Law $ Net assessable value ((120,000-8,000) x 80%)/2 for 44,800 both ; (40000x12-6000x4) x 80% for Mrs Law Net assessable income 1,003,600 ((880,000+84,000+40,000+32,000) x 1.1 - (34,00026,000) x 12 – 40,000) Net assessable profit 0 Total income 1,048,400 Less: mortgage loan interest for producing rental income (60,000/2) for both ; 300,000 for Mrs Law (30,000) (restricted to NAV) 1,018,400 Less: Concessionary deductions MPF contribution (14,500) Home loan interest (jointly owned, restricted to (50,000) $50,000 per person) Reduced total income 953,900 Less: Personal allowances Married person’s allowance Child allowance x 2 Net chargeable income NCI at progressive rates: $40,000 @ 2% $40,000 @ 7% $40,000 @ 12% Remaining (897,500 – 120,000) @ 17% Reduced total income at standard rate (1,263,500 x 15%) Total tax payable under personal assessment[lower of (A) or (B)] Tax payable by: Mr Law = $140,575 x 953,900 / 1,263,500 Mrs Law = $140,575 x 309,600/1,263,500 800 2,800 4,800 132,175 Mrs Law $ 409,600* Total $ 0 280,000 689,600 (330,000)% 359,600 0 (50,000) 309,600 1,263,500 (240,000) (126,000) 897,500 140,575 (A) 189,525 (B) 140,575 106,129 34,446 Page 4 of 5 Question C4 HKCC Limited Computation of Depreciation Allowances Year of assessment 2012/13 10% pool 20% pool 30% pool WDV b/f Additions ($110,000 + $200,000) Less: IA (60%) Transfer in Less: Disposals Less: AA WDV c/f HK$ 200,000 HK$ 400,000 110,000 HK$ 600,000 200,000 0 66,000 120,000 0 200,000 150,000 50,000 5,000 45,000 0 444,000 100,000 344,000 68,800 275,200 171,500* 851,500 80,000 771,500 231,450 540,050 Total allowance for the year of assessment 2012/13 Total Allowance HK$ 186,000 305,250 491,250 Page 5 of 5