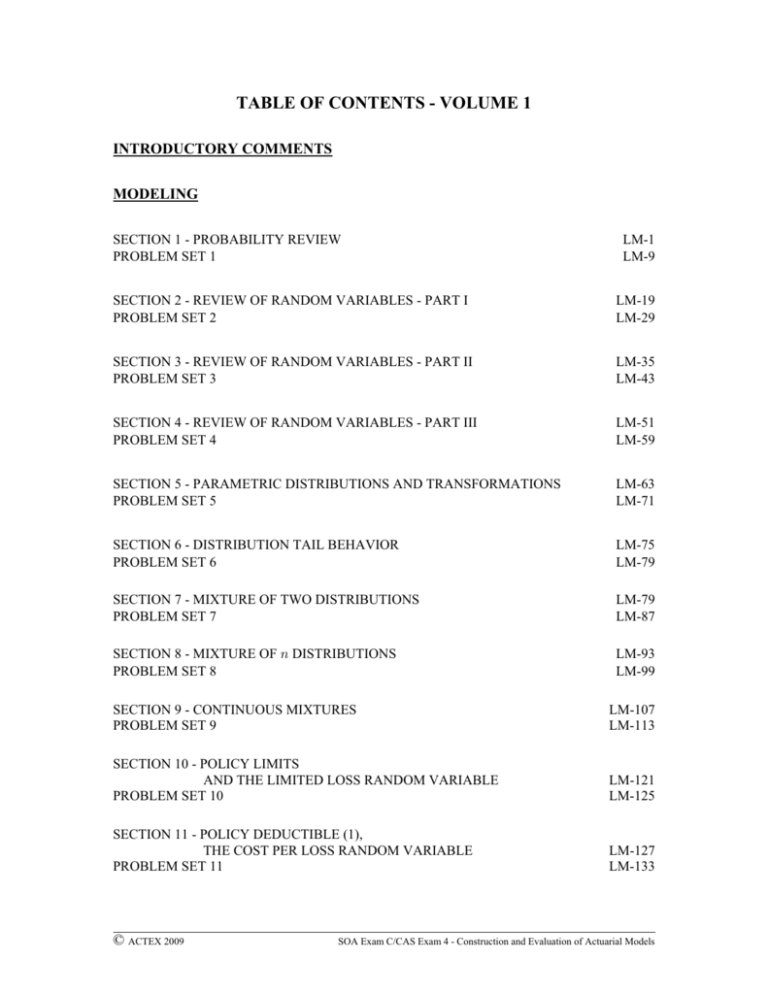

TABLE OF CONTENTS

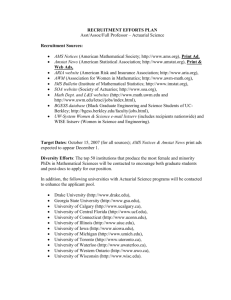

advertisement