Pigeon Corp. (7956)

SR Research Report 2014/3/20

Pigeon Corp. (7956)

Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at sr_inquiries@sharedresearch.jp

or find us on Bloomberg.

Pigeon Corp. (7956)

2014/3/20

Contents

http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 2/57

Pigeon Corp. (7956)

2014/3/20

Executive summary

Pigeon operates five business segments: Domestic Baby & Mother Care (31.6% of total sales in FY01/14), Overseas (49.7%), Health & Elder Care (8.7%), Childcare Service (8.5%), and Other (1.5%). Pigeon’s core products are baby bottles and nipples and its main market are mothers of babies 0-24 months old. About a half of the segment sales, these two product types therefore represent approximately 20% of domestic sales (SR Inc. understands the number to be about 25% of total consolidated sales). Apart from bottles and nipples, the product lineup includes breast pads, baby wipes, bottom wipes, skincare goods, maternity products, strollers, and electric breast pumps.

Trend and Outlook

FY01/14 full-year consolidated sales were JPY77.5bn (+19.0% YoY), operating profit was JPY10.4bn (+46.3% YoY), recurring profit was JPY11.0bn (+48.9 YoY), and net income was JPY7bn (+52.7% YoY). For FY01/15, Pigeon expects consolidated sales of JPY84.5bn (+9.1% YoY). Sales forecasts by segment are D omestic Baby & Mother Care: JPY24.5bn (+0.2% YoY), Childcare Service: JPY6.3bn (-4.5% YoY), Health & Elder Care: JPY7.1bn (+5.6% YoY), Overseas: JPY45.6bn (+18.3% YoY). Operating profit is expected to reach JPY11.6bn (+11.9% YoY) For FY01/17, the company expects consolidated sales of JPY100bn (+29.1% vs FY01/14). Sales forecasts by segment are Domestic Baby & Mother Care: JPY27bn (+10.4% vs FY01/14) , Childcare Service: JPY6.7bn (+1.5% vs FY01/14) , Health & Elder Care: JPY8bn (+19.0% vs FY01/14) , Overseas: JPY57.3bn (+48.7% vs FY01/14). Operating profit is expected to reach (+44.7% vs FY01/14).

Strengths and weeknesses

SR believes Pigeon Corp’s strengths center on its strong brand and trustworthiness, Overwhelming share in a niche market, and Growth potential in overseas Weaknesses center on its possible competition against giants in peripheral businesses, limited domestic growth potential, and minor-player status in Europe and the U.S. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 3/57

Pigeon Corp. (7956)

2014/3/20

Key financial data Income Statement (million yen) Total Sales

YoY Gross Profit YoY GPM Operating Profit YoY OPM Recurring Profit

FY01/10 Cons.

53,432

0.6% 20,891 3.4% 39.1% 4,604 7.8% 8.6% 4,609

FY01/11 Cons.

57,062

6.8% 23,266 11.4% 40.8% 4,547 -1.2% 8.0% 4,435 YoY RPM 7.3% 8.6% -3.8% 7.8%

Net Income

YoY Net Margin

2,840

-0.5% 5.3%

2,928

3.1% 5.1% Per Share Data (after stock split adjustments) Number of Shares (thousands) 20,276 20,276 EPS EPS (Fully Diluted) Dividend Per Share Book Value Per Share

Balance Sheet (million yen)

Cash and Equivalents

Total Current Assets

Tangible Fixed Assets, net Other Fixed Assets Intangible Assets

Total Assets

Accounts Payable Short-Term Debt

Total Current Liabilities

Long-Term Debt

Total Fixed Liabilities Total Liabilities

70.9

32.0

1,288.1

6,906

22,273

14,040 1,951 1,231

39,494

4,312 1,470

10,694

1,000

2,535 13,229

73.2

44.0

1,325.7

6,828

24,163

15,409 1,925 1,188

42,685

3,985 3,258

12,227

1,615

3,414 15,641 Net Assets

Interest-Bearing Debt

Cash Flow Statement (million yen)

Operating Cash Flow Investment Cash Flow Financing Cash Flow

Financial Ratios

ROA ROE Equity Ratio

26,264

2,470 4,964 -2,105 -2,018 7.3% 11.4% 65.3%

27,044

4,873 3,206 -3,948 886 7.1% 11.2% 62.2%

FY01/12 Cons.

59,145

3.7% 24,333 4.6% 41.1% 5,043 10.9% 8.5% 4,917 10.9% 8.3%

3,183

8.7% 5.4% 20,276 79.5

44.0

1,370.5

4,212 -1,871 -1,776 7.4% 11.8% 62.7% Figures may differ from company materials due to differences in rounding methods.

Gross profit figures before reserves for returned products 7,294

25,443

15,059 1,985 1,285

43,773

3,758 3,256

12,383

1,642

3,454 15,837 27,936

4,898 Source: Company data, SR research

FY01/13 Cons.

65,075

10.0% 27,744 14.0% 42.6% 7,086 40.5% 10.9% 7,390 50.3% 11.4%

4,574

43.7% 7.0%

FY01/14 Cons.

77,465

19.0% 34,473 24.3% 44.5% 10,366 46.3% 13.4% 11,002 48.9% 14.2%

6,986

52.7% 9.0%

FY01/15 Est.

84,500

9.1% 11,600 11.9% 13.7% 11,800 7.3% 14.0%

7,300

4.5% 8.6% 20,276 114.3

57.5

1,582.5

10,574

29,103

16,208 2,051 1,176

48,539

3,864 1,416

11,616

2,204

4,558 16,173 32,365

3,620 7,656 -1,848 -3,149 9.9% 15.5% 65.3% 40,551 174.5

88.0

977.5

13,103

35,363

19,023 2,127 1,441

57,955

4,518 1,400

12,819

2,012

5,155 17,974 39,982

3,412 7,656 -1,848 -3,149 13.1% 19.7% 67.5% 182.4

90.0

http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 4/57

Pigeon Corp. (7956)

2014/3/20

Recent Updates

On March 20, 2014, SR updated comments on Pigeon Corp.’s FY01/14 earnings based on an interview with the company; see the results section for details. On March 7 2014, SR updated comments on the company’s FY01/14 earnings based on the company’s results briefing; see the results section for details. On March 3, 2014, the company announced earnings results for FY01/14. On the same day, the company also announced its fifth mid-term management plan and an upward revision to its dividend for FY01/14.

For corporate releases and developments more than three months old, please refer to the News & Topics section.

Trends & Outlook Quarterly Trends & Results

Quarterly Performance (million yen)

Sales YoY GP YoY GPM SG&A YoY SG&A / Sales OP YoY OPM RP NI YoY RPM YoY NPM

Q1

14,346 10.0% 6,096 15.7% 42.5% 4,691 2.5% 32.7% 1,408 105.4% 9.8% 1,608 119.0% 11.2% 1,051 211.3% 7.3%

FY01/13 Q2

16,862 9.6% 7,150 13.6% 42.4% 5,331 9.1% 31.6% 1,817 29.6% 10.8% 1,659 24.6% 9.8% 860 -1.9% 5.1%

Q3

16,778 10.7% 7,292 15.6% 43.5% 5,092 5.1% 30.3% 2,205 50.5% 13.1% 2,249 65.2% 13.4% 1,538 75.7% 9.2% Source: Company data, SR research.

Figures may differ from company materials due to differences in rounding methods.

Q4

17,090 9.9% 7,206 11.5% 42.2% 5,561 12.0% 32.5% 1,656 11.1% 9.7% 1,874 25.8% 11.0% 1,125 2.9% 6.6%

Q1

16,896 17.8% 7,364 20.8% 43.6% 5,438 15.9% 32.2% 1,913 35.9% 11.3% 2,188 36.1% 12.9% 1,328 26.4% 7.9%

FY01/14 Q2

19,726 17.0% 8,822 23.4% 44.7% 5,912 10.9% 30.0% 2,901 59.6% 14.7% 2,974 79.3% 15.1% 1,793 108.5% 9.1%

Q3

20,919 24.7% 9,466 29.8% 45.3% 5,876 15.4% 28.1% 3,607 63.6% 17.2% 3,729 65.8% 17.8% 2,517 63.7% 12.0%

Q4

19,925 16.6% 8,821 22.4% 44.3% 6,872 23.6% 34.5% 1,944 17.4% 9.8% 2,111 12.6% 10.6% 1,347 19.8% 6.8%

FY01/14 Results (announced on March 3, 2014; please refer to the table above)

FY01/14 % of FY

100.3%

FY Est.

77,200 101.6% 102.8% 107.5% 10,200 10,700 6,500 For Q4 FY01/14 (November-January), consolidates sales were JPY19.9bn (+16.6% YoY), operating profit was JPY1.9bn (+17.4% YoY), recurring profit was JPY2.1bn (+12.6% YoY), and net income was JPY1.3bn (+19.8 YoY). http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 5/57

Pigeon Corp. (7956)

2014/3/20 As a result, FY01/14 full-year consolidated sales were JPY77.5bn (+19.0% YoY), operating profit was JPY10.4bn (+46.3% YoY), recurring profit was JPY11.0bn (+48.9 YoY), and net income was JPY7bn (+52.7% YoY). Sales and Gross Profit Sales by segment were as follows: Domestic Baby & Mother Care: JPY24.5bn (+2.4% YoY); Childcare Service: JPY6.6bn (+3.3%); Health & Elder Care: JPY6.7bn (+0.3%); Overseas: JPY38.5bn (+42.9%).

The introduction of new products was the main driver of profits in the company’s mainstay Domestic Baby & Mother Care segment. In the Health & Elderly Care segment, the company reorganized its operational structure and sought to strengthen sales activities at care facilities. While Q4 (November-January) sales declined 1.7% from a year earlier during this period of transition, the company stated that it was now ready for a business expansion toward next fiscal year. Gross profit margin by segment was as follows: Domestic Baby & Mother Care: 45.8% (46.8% a year earlier) Childcare Service: 11.5% (11.7% a year earlier) Health & Elder Care: 29.8% (30.6% a year earlier) Overseas: 52.6% (50.6% a year earlier) In overseas businesses, the company enhanced its marketing and promotional activities in China. This opened up new locations for sales, such as specialist baby stores. Sales significantly exceeded a year-earlier level after the company continued to introduce new products following the launch of disposable diapers in July and baby food in November. Sales of disposable diapers were about JPY1bn, missing the company’s initial target of JPY2.4bn, as competitors lowered prices when Pigeon released its product. However, sales at the retail level seem to have been rising steadily since October 2013. Sales of existing products probably rose more than 20% in local currency terms. According to the company, sales rose 15% in coastal areas (such as Shanghai, Beijing, and Guangzhou) and 30% in other cities. Coastal areas and inland regions comprised 40% and 60% of the company’s sales, respectively. The number of affluent customers is increasing in the inland areas. Sales by region were as follows: China: JPY22.4bn (+58.8% YoY; +26.4% YoY in local currency terms) Other Asia: JPY6.1bn (+16.8% YoY) North America: JPY5.4bn (+47.7% YoY; +20.6% in local currency terms) The Middle and Near East: JPY2.1bn (+12.8% YoY) Other Regions: JPY2.4bn (+19.4% YoY) Average foreign exchange rates during the period were USD=JPY97.72 (JPY79.8 a year earlier) and CNY=JPY15.91 (JPY12.66 a year earlier).

Operating Profit (Operating Profit Margin)

Operating profit in the Domestic Baby & Mother Care segment was JPY3.4bn (+1.0% YoY). This quarter saw operating profit increase once again after recording a cumulative YoY fall of 1.2% in Q3. This was http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 6/57

Pigeon Corp. (7956)

2014/3/20 because SG&A expenses, which had previously increased with marketing costs for new product launches, settled down in Q4 (November-January). Operating profit in Childcare Service fell 3.6% YoY to JPY176mn, due to increased employment costs and other factors. A tough market in the Health & Elder Care segment—as shown by increasingly competitive prices for supplies—drove gross profit down 0.4% YoY to JPY212mn. Operating profit in the overseas segment was JPY10.2bn (+59.3% YoY) as the company increased operations of a production facility in China, a move that raised gross profit margin and absorbed an increase in SG&A expenses. Versus the company’s full-year estimates, sales were 0.3% higher; operating profit was 1.6% higher; recurring profit was 2.8% higher; and net income was 7.5% higher. Pigeon raised its year-end dividend from the forecasted JPY37 to JPY55 per share. With this upward revision, the annual dividend is JPY88 per share (forecasted: JPY70). (Note, on August 1, 2013, the company carried out a 2-for-1 stock split. The interim dividend is calculated based on post-split levels.) The company has also established its fifth mid-term management plan, which will begin in FY01/15 (and run until FY01/17). The plan calls for the following results in FY01/17: Sales: JPY100.0bn (versus sales of JPY77.4bn in FY01/14); Gross profit: JPY44.2bn (versus JPY34.4bn); Operating profit: JPY15.0bn (versus JPY10.3bn); Recurring profit: JPY15.0bn (versus JPY11.0bn); Net income: JPY9.0bn (versus JPY6.9bn); ROE: at least 21.0% (versus 19.7%); ROIC: at least 15.0% (versus 14.2%).

FY01/14 Results Briefing

FY01/14 Earnings Highlights

The company twice made upward revisions to its forecasts, and yet FY01/14 results still came out slightly ahead of forecasts.

Gross profit margin (GPM) increased by 1.8pp YoY, thanks to increased profit margins (up 2pp) in manufacturing subsidiaries in China and Thailand.

Operating profit margin (OPM) was 13.4% (against 10.9% the previous year).

Overall Segment Results Sales increased in all segments, driven by strong results overseas.

Operating profit fell 3.6% YoY in the Childcare Service segment and 0.4% in the Health & Elder Care segment. It rose 1.0% in the Domestic Baby & Mother Care segment. Overseas businesses saw a jump in operating profit of 59.3%.

Approximately half of the increase in overseas sales was down to the effects of yen depreciation, but even so, businesses in China and North America saw YoY growth of 126.4% and 120.6% respectively on a local currency basis.

Domestic Baby & Mother Care Pigeon increased its already considerable share of the domestic baby bottles market by value, from 81.9% in FY01/13 to 84.5% in FY01/14.

Health & Elder Care http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 7/57

Pigeon Corp. (7956)

2014/3/20 The company continues to struggle in this segment. However, President Yamashita is looking at fundamental changes aimed at moving this business toward profitability.

Pigeon Tahira, which sells nursing supplies and equipment, reported healthy sales.

Henceforth the company will move personnel to Pigeon Tahira and shift the focus of the business from drugstore-oriented sales to facility-oriented sales (see the section below on the Fifth Medium Term Management Plan for further details).

Overseas Pigeon’s business in China continued to report strong results. However, sales of disposable diapers got off to a tough start, underperforming the company’s initial plan. This was due to low brand recognition in disposable diapers and competitors strategically lowering prices to coincide with Pigeon entering the market. Having said that, sales have increased every month since October 2013, thanks to the company’s marketing efforts, including sampling programs. The company has high hopes for sales of these products in FY01/15 given that they have received very favorable reviews.

The company made its first shipments of baby bottles and baby bottle nipples to Europe. This will be the first time it has sold these products in Europe.

The company established a new agency in India, where it is developing new sales channels such as drugstores, outside of specialist baby goods retailers. At the time of the results briefing, about 6,000 drugstores in India stocked Pigeon products.

Profits in North America rebounded to increase by about 3x YoY, following poor results the previous year. Private brand products and breast pads were particular drivers of profit, though sales increased most for electric breast pumps in FY01/14. The company maintains that it has won out amid fierce competition.

The company’s business in Russia continued to report strong results, with sales increasing by over 50%.

Consolidated Results

Inventories increased by about JPY1.2bn, but JPY700mn of that can be put down to disposable diapers for the company’s business in China.

Fifth Medium Term Management Plan

Looking back on the Fourth Medium Term Management Plan The fourth mid-term plan drew to an extremely favorable close. The Childcare Service and Overseas segments achieved their targets, though the Health & Elder Care and Domestic Baby & Mother Care segments fell short.

The company’s businesses in China and North America both outperformed targets, with particularly strong results in China.

Pigeon Way: the Heart of the Fifth Medium Term Management Plan Pigeon wants to bring its corporate philosophy of “love” to the world. Love to Pigeon means the vision and values within us that make us care about others—and it considers a mother’s selfless devotion to her child as the epitome of love.

This mid-term plan places a strong emphasis on becoming a global company. The English slogan for the plan is, “Pursuing world class business excellence, think globally, plan agilely, and implement locally.” Vision 2016: the Aspirations of this Mid-Term Plan This is the company’s fifth three year plan. It is hoping that efficient management will lift its bottom line, thereby laying the groundwork for vast increases in the top line in the next (sixth) three-year plan, starting in FY01/18. The plan includes strengthening its brand and its management structure, as well as driving up the quality of its business by focusing on cash flows. It also calls for global employee http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 8/57

Pigeon Corp. (7956)

2014/3/20 training and increases in the value of the firm.

The company hopes to achieve a 50% share of the baby bottle nipple market in all major international markets. Given that it seems unlikely the company will be able to achieve this in the course of the fifth mid-term plan, it will instead focus on preparations to achieve this goal in the next (sixth) three-year period.

Overseas Segment The company will decide what markets to focus on, then direct management resources to the relevant businesses. It will also focus on products that make the most of its strengths. In addition, the company will look for opportunities to benefit from synergy as it strengthens its brand and expands its activities in maternity and general hospitals across more facilities.

In China the company will carry out capex as necessary to respond to expected growth in disposable diapers and existing products.

In North America the company will begin trading with Babies”R”Us.

The company has been able to develop its business faster than expected in the UK, where 100 large-scale Mothercare stores will stock its breast pumps and baby bottle nipples.

In other Asian regions and the Middle East the company has been developing with an eye to building a customer base from people of low and middle income, as per its established model. However, henceforth the company will look to increase sales in the Middle East by employing a similar business model to that of its Chinese business—namely targeting higher income consumers.

Domestic Baby & Mother Care There were no remarkable new product launches in the previous three year term (the fourth). However, the company believes it will need to launch large-scale products in this three year term (the fifth), if it is to achieve the growth it is hoping for in the next three year term (the sixth).

Health & Elder Care At present there is no mechanism in place for Pigeon to conquer this market. It must scrutinize what products and sales channels it can use to get ahead. There are also areas to which the company’s network of sales stores does not stretch. Therefore President Yamashita is looking at fundamental changes to this business.

Due to difficulties associated with expanding its market share of sales through drugstores, the company is planning to reorganize its sale channels around sales to facilities. In order to achieve this it will move personnel to Pigeon Tahira, which it acquired in 2004 and which sells nursing supplies and equipment.

The company is also hoping for success from major product launches during this year—namely wheelchairs and skincare products.

The wheelchair market is about JPY20bn in size. At present the company buys products from other companies and sells them on. However it plans to being selling its own wheelchairs from some time in FY01/15. The products will follow its own designs and supply chain (manufacture will take place in China).

The company has the fourth largest share of the skincare products market in Japan (Kao Corporation [TSE1: 4452] leads the market). However, it is building its own supply chain, and hopes this will help it take the second largest share of the market and achieve profitability over the course of the three year plan.

Childcare Service Pigeon plans to continue improving the quality of this business, in such a way that it does not cause any accidents or unexpected issues The company is not expecting huge leaps in sales, but it will aim to improve profitability by enhancing both the design of its products and grassroots research—such as R&D based on observations of customer movement)—which is one of its strengths.

http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 9/57

Pigeon Corp. (7956)

2014/3/20 Shareholder Return; Capital Policy The company plans to remain committed to a dividend payout ratio between 45% and 50%.

The company is aiming for a ROE of 21% and a ROIC of 15% by the end of the three years.

FY01/15 Full-Year Earnings Plan

Overall Segment Forecasts The company forecasts more or less flat results in the Domestic Baby & Mother Care segment. It expects to see a decrease in sales but an increase in profits in the Childcare Service segment.

The company forecasts an 18% increase in overseas sales, which would take it up to 54% of group sales.

Issues to Tackle in FY01/15 The company will attempt to improve profits in the Health & Elder Care segment through sales to facilities, as mentioned above.

The company hopes also to enjoy the benefits of integration in Pigeon Will Co., Ltd. (a group company that procures and sells maternity and baby products for the Domestic Baby & Mother Care business).

The company expects that China will continue to drive growth in its Overseas business. It is aiming for sales of JPY2.5bn in disposable diapers in China.

In its European and North American businesses the company will aim for stable earnings growth with regard to baby bottles and baby bottle nipples.

In terms of new markets, the company plans to establish a company in Brazil. It does not expect for this venture to contribute to profits in the course of this three year plan (the fifth), but it hopes it will be profitable from the next three year term (the sixth) onward.

Shareholder Return The company plans to pay mid-term and year-end dividends of JPY45, for a full-year dividend of JPY90 (against JPY88 the previous year). If all goes to plan, this will mean a payout ratio of 49.3%.

For details on previous quarterly and annual results, please refer to the Historical Financial Statements section.

http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 10/57

Pigeon Corp. (7956)

2014/3/20

Full-Year Outlook

FY01/15 Company Forecast (million yen) Sales

YoY CoGS

Gross Profit

YoY GPM SG&A SG&A / Sales

Operating Profit

YoY OPM

Recurring Profit

YoY RPM

Net Income

YoY

FY01/14 Actual 1H 36,622 2H 40,843 Full-Year 77,465

17.3%

20,436 16,186

20.6%

22,556 18,287

19.0%

42,992 34,473

22.2% 44.2%

11,350

31.0%

4,814

26.1% 44.8%

12,748

31.2%

5,552

24.3% 44.5%

24,099

31.1%

10,366

49.3% 13.1%

5,162

58.0% 14.1%

3,121

63.3% 43.8% 13.6%

5,840

41.6% 14.3%

3,864

45.1% 46.3% 13.4%

11,002

48.9% 14.2%

6,986

52.7%

FY01/15 Company Forecast 1H

CE=Company estimates; figures may differ from company materials due to differences in rounding methods.

Source: Company data, SR research

2H Full-Year 84,500

9.1%

11,600

11.9% 13.7%

11,800

7.3% 14.0%

7,300

4.5%

(million yen)

Sales GPM Overseas GPM China (Inc. Hong Kong) Other Asia North America Middle & Near East Others Domestic Baby & Mother Care GPM Health & Elder Care GPM Childcare Service GPM Other GPM Operating Profit OPM Recurring Profit Net Income ROE Source: Company data, SR Inc. Research

FY01/14 Est. FY01/15 Est.

77,465 44.5% 84,500 44.3% 38,540 52.6% 22,417 6,125 5,418 2,118 2,412 24,451 45.8% 6,721 29.8% 6,599 11.5% 1,151 20.5% 10,365 13.4% 11,002 6,985 19.7% 11,600 13.7% 11,800 7,300 18.3% 45,600 51.3% 27,319 7,014 5,694 2,547 2,985 24,500 45.4% 7,100 30.7% 6,300 11.7% 1,000 11.5%

Sales, Gross Profit

For FY01/15, Pigeon expects consolidated sales of JPY84.5bn (+9.1% YoY). Sales forecasts by segment are as follows: Domestic Baby & Mother Care: JPY24.5bn (+0.2% YoY) http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 11/57

Pigeon Corp. (7956)

2014/3/20 Childcare Service: JPY6.3bn (-4.5% YoY) Health & Elder Care: JPY7.1bn (+5.6% YoY) Overseas: JPY45.6bn (+18.3% YoY) The company expects an increase in sales at the Health & Elderly Care segment after strengthening its sales activities at care facilities. Sales forecast by region is as follows: China: JPY27.3bn (+21.9% YoY) Other Asia: JPY7bn (+14.5% YoY) North America: JPY5.7bn (+5.1% YoY) The Middle and Near East: JPY2.5bn (+20.3% YoY) Other Regions: JPY3bn (+23.8% YoY) Pigeon expects to generate about JPY2.5bn in sales from disposable diapers in China, which the company began to sell during the previous fiscal year (when sales were about JPY1bn). The company also plans to enhance its brand recognition at hospitals through various promotional activities. In North America, the company will expand sales of breast pumps and baby bottle nipples under a new local-staff structure implemented in FY01/13. In Latin America, the company plans to establish a Brazilian subsidiary. Local production is being considered there. Depreciation expenses are likely to total JPY2.2bn (+30.9% YoY) due to an expansion of plants in Thailand and China’s Changzhou. Gross profit margin is expected to be 44.3% (compared with 44.5% a year earlier). The company plans to expand capacity at factories for main products, which are now running at more than 90% capacity. Gross profit margins by segment are as follows: Domestic Baby & Mother Care: 45.4% (45.8% a year earlier) Childcare Service: 11.7% (11.5% a year earlier) Health & Elder Care: 30.7% (29.8% a year earlier) Overseas: 51.3% (52.6% a year earlier) As a result, gross profit is expected to total JPY37.4bn (+8.5% YoY).

Operating Profit (Operating Profit Margin)

Operating profit is expected to reach JPY11.6bn (+11.9% YoY), with an operating profit margin of 13.7% (13.4% a year earlier) due to an increase in sales and gross profit. Operating profit forecast by segment is as follows: Domestic Baby & Mother Care: JPY3.7bn (+7.1% YoY) Childcare Service: JPY190mn (+6.8% YoY) Health & Elder Care: JPY280mn (+34.0% YoY) Overseas: JPY11.9bn (+17.1% YoY)

Recurring Profit

The company expects consolidated recurring profit of JPY11.8bn for FY01/15 (+7.3% YoY). The forecast is based on the assumption that average foreign exchange rates during the period would be USD=JPY100.00 (JPY97.72 a year earlier) and CNY=JPY16.50 (JPY15.91 a year earlier). A 1 yen http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 12/57

Pigeon Corp. (7956)

2014/3/20 fluctuation would affect sales by JPY430mn, gross profit by JPY240mn, and recurring profit by JPY70mn (if all the foreign currency transactions were conducted in dollars).

Net Income

The company expects net income of JPY7.3bn for FY01/15 (+4.5 YoY), with a return on equity of 18.3% (19.7% a year earlier).

Future Outlook

In March 2014, Pigeon released a fifth medium-term management plan that covers a period through FY01/17. Slogan: The medium-term plan, which emphasizes globalization, came with this English-language slogan: Pursuing world class business excellence, think globally, plan agilely, and implement locally For FY01/17, the company expects consolidated sales of JPY100bn (+29.1% vs FY01/14). Sales forecast by segment is as follows: Domestic Baby & Mother Care: JPY27bn (+10.4% vs FY01/14) Childcare Service: JPY6.7bn (+1.5% vs FY01/14) Health & Elder Care: JPY8bn (+19.0% vs FY01/14) Overseas: JPY57.3bn (+48.7% vs FY01/14) Under the fifth medium-term management plan, sales at China operations are forecast to reach JPY 34.7bn (+54.8% vs FY01/14). Sales from other Asian regions are expected to reach JPY9.2bn (+49.9% vs FY01/14), of which JPY3bn would come from South Korea (+130% vs FY01/14), JPY6.4bn from North America (+18.4% vs FY01/14), and JPY3.1bn from the Middle and Near East (+45.1% vs FY01/14).

(million yen)

Sales GPM Overseas GPM China (Inc. Hong Kong) Other Asia North America Middle & Near East Others Domestic Baby & Mother Care GPM Health & Elder Care GPM Childcare Service GPM Other GPM Operating Profit OPM Recurring Profit Net Income ROE Source: Company data, SR Inc. Research

FY01/14 Est. FY01/15 Est. FY01/16 Est. FY01/17 Est.

77,465 84,500 92,500 100,000 44.5% 44.3% 44.2% 38,540 52.6% 22,417 6,125 5,418 2,118 2,412 24,451 45.8% 6,721 29.8% 6,599 11.5% 1,151 20.5% 10,365 13.4% 11,002 6,985 19.7% 45,600 51.3% 27,319 7,014 5,694 2,547 2,985 24,500 45.4% 7,100 30.7% 6,300 11.7% 1,000 11.5% 11,600 13.7% 11,800 7,300 18.3% 51,700 31,195 8,258 5,850 2,870 3,479 25,690 7,555 6,555 1,000 13,000 14.1% 13,000 8,000 15,000 15.0% 15,000 9,000 over 21% 57,300 49.1% 34,694 9,181 6,418 3,072 3,882 27,000 45.3% 8,000 33.6% 6,700 12.7% 1,000 12.4% http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 13/57

Pigeon Corp. (7956)

2014/3/20 According to Pigeon, the fifth medium-term management plan is a preparation for yet another management plan (the sixth medium-term plan) that calls for a vast increase in sales during a three-year period. Under the fifth medium-term plan, the company will boost its brand recognition, strengthen management structure, and focus on cash flows to improve its operations. This plan also calls for an increase in earnings and corporate value through efficient management and global employee training. The company, which seeks to capture 50% of the global market for nipples, will take steps toward this goal in the sixth medium-term plan. During FY01/14, the capacity utilization rate exceeded 90% at the company’s factories for major products. Thus, the company plans to make aggressive investments to raise production capacity. Pigeon, which made capital investments of JPY3bn in FY01/14, plans to spend 4.5bn in FY01/15, JPY3.8bn in FY01/16 and JPY6.7bn in FY01/17. The company will expand plants in China’s Changzhou, Thailand, Indonesia, and Japan’s Hyogo prefecture. In the Domestic Baby & Mother Care segment, the company is considering offering a new range of products, including large-scale items such as baby strollers, or other maternity-related goods. Overseas, Pigeon seeks to expand its share in the growing China market. The company estimates that its market share of baby bottles among the country’s top 20% income earners is about 60%, meaning it has between 10% and 20% of the entire market in China (20% x 60%). Pigeon wants to raise this share to 40% during its fifth medium-term plan, and more than 50% in the longer run. Depreciation expenses are rising. However, the company expects gross profit margin to either remain unchanged or rise between 1 point and 2 points as the composition of profitable products, such as baby bottles and nipples, may rise. (Sales of such products rose 38.3% in FY01/14 from a year earlier.) In China, the company’s online store contributes to about 10% of its entire sales in the country. In a country as large as China, potential growth in online sales is significant; sales may expand when distribution networks are established. The company’s brand recognition is definitely an advantage as it sells items that could harm babies if not property manufactured. Currently, the company sells products in China through local agents. (Even online sales are conducted through agents.) The company stated that it would expand sales through these agents while maintaining its pricing power. It is also noteworthy that China has recently relaxed its one-child policy. The company’s fifth medium-term management plan does not reflect this policy shift. In Other Asia, sales in South Korea are expected to expand. The company will strengthen its cooperation with Yuhan-Kimberly. In North America, the company will seek to change the notion that baby bottles are used only for baby formula. Pigeon will promote the use of breast pumps, storage bags, and baby bottles to provide breast milk to infants. The company does not expect a huge expansion in the North American market under the fifth medium-term plan. Even so, the company, which sells its products at Babies “R” Us, will expand to other large-scale retailers. In the longer run, the company plans to enter Latin America. Sales in the Americas are expected to increase under the sixth medium-term business plan. SR believes that the company would be able to reduce its dependence on China by expanding sales in North America. That would provide a hedge against political uncertainties in China. Pigeon also plans to increase in Europe, which comprises a small portion of the company’s overall sales. In the UK, 100 large-scale Mothercare stores will stock its breast pumps and baby bottle nipples http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 14/57

Pigeon Corp. (7956)

2014/3/20

Business

Business Description

Pigeon operates five business segments: Domestic Baby & Mother Care, Overseas, Health & Elder Care, Childcare Service, and Other. As overseas business represents baby and mother care products, this product group is overwhelmingly most important for the company.

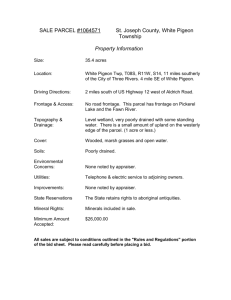

Sales by Segment (FY01/14)

Childcare Service 8.5% Other 1.5% Health & Elder Care 8.7% Domestic Baby & Mother Care 31.6% Overseas 49.8% Source: Company Data, SR Inc. Research

Domestic Baby & Mother Care

Sales in FY01/14 were JPY24.5bn (+2.4YoY), or 31.6% of the company’s total sales. Gross profit margin stood at 45.8%. Operating profit was JPY3.4bn (+1.0% YoY), with an operating profit margin of 14.0%. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 15/57

Pigeon Corp. (7956)

2014/3/20 Pigeon’s core products are baby bottles and nipples and its main market are mothers of babies 0-24 months old. About a half of the segment sales, these two product types therefore represent approximately 20% of domestic sales (SR Inc. understands the number to be about 25% of total consolidated sales), and their importance for both the brand and the bottom line cannot be underestimated. Apart from bottles and nipples, the product lineup includes breast pads, baby wipes, bottom wipes, skincare goods, maternity products, strollers, and electric breast pumps. The product cycle is two to three years for baby food and about five years for other products. The product-renewal cycle offers a chance to secure shelf space and negotiate with store owners. Pigeon spent 2.5% of consolidated sales on R&D in FY01/13, a growing ratio that underlines the importance of innovation and change for the company’s product strategy. Pigeon products enjoy exceptional support of its Japanese consumers as illustrated by the market share chart below. The strong brand allows the company to maintain premium pricing and avoid discounting. This not only helps to perpetuate the brand image but contributes to high profitability.

Pigeon Core Product Market Share (January 2014)

Source: Company data http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 16/57

Pigeon Corp. (7956)

2014/3/20 Pigeon makes about 60% of its products in house. The company did not have its own manufacturing facilities till mid-80s when it established Pigeon Home Products Corp. in Shizuoka Prefecture. Pigeon opened its first overseas factory in Thailand in 1996. As of FY01/13, the in-house manufacturing is carried out by several domestic and overseas manufacturing subsidiaries. The remaining 40% of the products are sourced from over 100 partner manufacturers. Pigeon’s end clients in Japan are major drugstores (about 50% of domestic sales), baby goods retailers (40%), and department stores and general merchandisers (10%). The company has three-way sales negotiations with a retailer and distributor in attendance. As an exception to this practice, Pigeon deals directly with baby goods retailers such as Toys “R” Us and Akachan Honpo. The company also sells online, at third-party e-commerce sites such as Amazon.co.jp and at its own Pigeon Mall. The company also maintains the largest Japanese community website forum (Pigeon Info.) for exchanging information about pregnancy, birth, and child-rearing. As part of its broader marketing effort, Pigeon also hosts various events for expecting and new mothers as well as women who are planning pregnancies.

Mag Mag Baby Cups Nipple Cup Spout Cup Straw Cup Training Cup

Source: Company data, SR Inc. Research

Overseas Business

Sales in FY01/14 were JPY38.5bn (+42.9% YOY), or 49.7% of the company’s total sales. Gross profit margin was 52.6%, and operating profit was JPY10.2bn (+59.3% YoY). As of January 2014, the overseas business only handled baby goods and was characterized by the high sales weight and growth in China. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 17/57

Pigeon Corp. (7956)

2014/3/20

Overseas Sales Breakdown (FY01/14)

Middle/Near East 5.5% Others 6.3% N. America 14.1% Other Asia 15.9% China 58.2% Source: Company Data, SR Inc. Research China Sales were JPY22.4b (+58.9% YoY). The figures include Hong Kong, a minor contributor. China is Pigeon’s fastest-growing overseas market. Other Asia Sales in this region were JPY6.1bn (+16.8% YoY). The biggest market is South Korea (1/5 of Other Asia sales), followed by Singapore, Malaysia, Taiwan, and Thailand. North America North American sales were JPY5.4bn (+47.7% YoY). In this market, the company depends on Lansinoh Laboratories, Inc., which sells Pigeon products under the Lansinoh brand. The Middle and Near East Middle and Near East sales were JPY2.1bn (+12.8% YoY). Other Regions Sales were JPY2.4bn (+19.4% YoY). Other Regions include Europe and South Africa. What are the factors that so far have been helping Pigeon to succeed overseas? Pigeon cites two reasons, its superior products and a skillful use of local partners. According to the company, the product superiority is what drives its success not only in China but in all

section) in the baby product area, particularly in bottle and nipple design, is arguably second to none. The second pillar of Pigeon’s success overseas is its strong relationships with local partners. It has relied on local distributors to grow the Pigeon brand recognition and penetrate the market. That relatively early move has since won Pigeon brand recognition and deep market penetration thanks to its partners’ selling power. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 18/57

Pigeon Corp. (7956)

2014/3/20

Overseas Sales

(million yen) 25,000 22,417 20,000 15,000 10,000 5,000 0 14,112 7,265 8,685 9,090 10,167 3,931 3,732 1,751 1,166 FY01/09 3,838 3,908 3,302 1,535 1,177 FY01/10 3,855 1,588 1,411 FY01/11 4,221 3,842 1,819 1,532 FY01/12 6,125 5,243 5,418 3,668 2,020 1,878 FY01/13 2,412 2,118 FY01/14 China Other Asia N. America Middle/Near East Others Source: Company Data, SR Inc. Research China As of November 2012, China accounted for the largest proportion of the company’s overseas business, and its growth rate is by far the highest. Pigeon built strong relationships with local primary distributors since it began exporting to China in the 1990s. The company established a local subsidiary in China in 2002 when it saw the country as a final market rather than a manufacturing base. Through the subsidiary, the company has enhanced the Pigeon brand recognition and expanded its presence in this country. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 19/57

Pigeon Corp. (7956)

Sales Organization in China

2014/3/20 Note: Percent of total sales Source: C ompany data At the end of FY01/13, approximately 14,000 stores in China stocked Pigeon products. Pigeon has contracts with one primary distributor for each channel; baby specialty stores have contracts with secondary distributors (one for each province). Pigeon signs with one distributor per province as a rule to avoid distributor price wars that can damage Pigeon’s brand. Pigeon targets wealthy Chinese families and is looking for retailers that also target this segment (monthly household income of around 10,000 yuan). At department and baby-goods stores in China, Pigeon set up “Pigeon shelves”—a space dedicated to Pigeon products—and pursuing recognition as a high-end brand (the company had 2,425 stores that had “Pigeon corner” retail spaces in FY01/13).

"Pigeon Corner" at a Store in China

Source: C ompany data, SR Inc. Research http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 20/57

Pigeon Corp. (7956)

2014/3/20 From 2H FY01/14, Pigeon began to sell disposable diapers in the Chinese market. These are high-end products (selling for RMB2.0–3.0 compared with regular products retailing for RMB1.5–2.0) targeting the affluent segment. The company also started sales of baby food in China in FY01/14. Although it will be necessary to establish various food-specific rules in conjunction with local sales partners, including shipment deadlines, in the Chinese market where food safety awareness is on the rise, SR Inc. sees strong potential for the Pigeon brand to win market share. The company began to operate a plant in Changzhou in March 2011 after completing Phase 1 construction to manufacture products for the Chinese market. Phase II construction, which began during FY01/13, was also completed. The new addition of the factory began to operate during FY01/14. In FY01/12, the company made some 50% of its products sold in China within the country. This ratio rose to 60% in FY01/13 and 70% in FY01/14. The capacity utilization rate of the plant was more than 90% as of FY01/14. The company plans to further expand its factory production lines. According to the company, despite a large percentage of products being made locally, pricing is in line with Japan (or slightly higher), as is product quality. North America In April 2004, Pigeon brought Virginia-based Lansinoh under the group umbrella as a launching pad for expansion into the United States and Europe. Lansinoh makes nursing products, including nipple cream, breast pads, and breast pumps, which are stocked at over 40,000 stores in the United States. General merchandisers (e.g., Walmart, Target) are the main sales channels for Lansinoh products. In January 2009, Lansinoh bought the rights to Soothies from Puronyx Inc. in order to bolster its product offerings and strengthen its sales distribution in maternity and general hospitals.

"Lansinoh" Brand

Source: C ompany data, SR Inc. Research Lansinoh was founded in 1984 and was initially selling Pigeon products on an OEM basis (as of January 2013 it was only involved in sales and marketing). It procured a limited range of Pigeon products and sold it under Lansinoh brand name. Lansinoh management historically had strong convictions in favor of breastfeeding and has been marketing itself as such, with nipple cream, breast pads, and breast pumps at the core of its product lineup. This has made marketing Pigeon mainstay baby bottles and nipples in the United States somewhat of a challenge. Currently Lansinoh does offer these products, marketing them as a way to ensure the mother can provide her children with the breastmilk even when she is away. However, after an overhaul of local staff in FY01/13, Lansinoh is putting in place a structure to more aggressively expand sales of baby bottles and nipples. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 21/57

Pigeon Corp. (7956)

2014/3/20 In December 2010, Lansinoh acquired the mOmma brand (children’s products in Europe) from Baby Solution SA and Baby Solution Italia Srl to expand its product categories. The mOmma brand is well-known for baby bottles and nipples, Mag Mag, baby utensils, etc. Europe The company sells Lansinoh-branded products mainly in the United Kingdom and Germany through distributors. Main sales channels in Germany are drugstores, while in the United Kingdom main channels are general merchandisers, baby-goods stores, and drugstores. As discussed above, Lansinoh is in favor of breastfeeding, Pigeon sells Lansinoh-branded baby bottles and nipples under the mOmma brand (the mOmma brand was originally big in Italy and Switzerland). In Turkey, Lansinoh operates a breast-pump factory and accordingly sells the product under its namesake brand. In Russia, the company began selling Pigeon-brand products through distributors in 2010. Other Asia The company incorporated a Mumbai representative office of Pigeon Singapore Pte. Ltd. as Pigeon India Pvt. Ltd. in November 2009. The India subsidiary sets up “Pigeon shelves” in pharmacies and conducts other sales and marketing efforts. As of FY01/13, India was primarily an export market (with some local procurement from 2010), but Pigeon is pushing for local production due to high import tariffs in India. Meanwhile, not all of the country’s wealthy consumers live in major cities such as New Delhi and Mumbai. Additionally, many of these wealthy consumers in regional areas tend to send housekeepers to do the shopping, so marketing to those who can’t understand English is important.

"Pigeon Corner" at a Store in India

Source: C ompany data, SR Inc. Research In South Korea, the company operates under the Double Heart brand in cooperation with distributors. In Singapore and Malaysia, Pigeon has eventually bought out its local distributors making them subsidiaries Pigeon Singapore Pte. Ltd. and Pigeon Malaysia (Trading) Sdn. Bhd. A large number of births in the Middle and Near East have created an attractive market, and Pigeon is mainly selling bottles and nipples in these markets. Historically, Pigeon has heavily relied on local distributors in Other Asia, causing its growth in this geographical segment to lag behind that in China. However, from 2012, Pigeon’s distributors in Other Asia began visiting Chinese distributors to learn from them. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 22/57

Pigeon Corp. (7956)

"DoubleHeart" Brand in South Korea

2014/3/20 Source: C ompany data, SR Inc. Research

For more information about the competitors in each market, see Competition .

Health & Elder Care

Sales in FY01/14 were JPY6.7bn (+0.3% YoY), or 8.7% of the company’s total sales. Gross profit margin was 29.8%, and operating profit was JPY210mn (unchanged from a year earlier). This segment offers two brands: Habinurse (nursing products) and Recoup (for active seniors). These brands cover products and services related to toilet use, bathing, hygiene, meals, sleeping, and mobility. Pigeon plans to use its expertise and quality control cultivated though its development of baby products to fulfill unmet needs in the senior market. Source: C ompany data, SR Inc. Research http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 23/57

Pigeon Corp. (7956)

2014/3/20 Habinurse brand, born in 1975, sells to retailers, care facilities, and hospitals, while Pigeon sells the brand’s products to retailers. Pigeon Tahira Corporation, a Pigeon subsidiary since 2004, makes the company’s Habinurse-branded products. In 1991, Pigeon Tahira moved away from direct sales and introduced a distributor system (the first in the Japanese nursing industry). It has been a Pigeon subsidiary since 2004. The company began to strengthen sales activities at care facilities in FY01/14. Pigeon Manaka Corporation sells in-home nursing support services and products in and around its home prefecture of Tochigi. The group offers house call services, in-home bathing assistance, daycare, assisting devices, home renovation, and care consultation. Pigeon Manaka hires care workers with level 1 and 2 helper qualifications and standard driver’s licenses. In August 2011, it opened centers in Ohira-machi, Tochigi City, and Kanuma City, offering home-visit nurses and in-home bathing services. In December 2011, it also opened adult daycare center “San San” in Tochigi City (on the premises of Pigeon Manaka’s head office) where clients needing nursing or assistance can go to receive help with bathing and meals (including associated nursing) as well as advice, health checks, help with everyday living, and functional training. Recoup, started in August 2007, mainly conducts catalog and TV sales.

Childcare Service

Sales in FY01/14 were JPY6.6bn (+3.3% YoY), or 8.5% of the company’s total sales. Gross profit margin was 11.5%, and operating profit was JPY180mn (-3.6% YoY).

Childcare Services

Source: C ompany data, SR Inc. Research This division operates licensed and certified childcare centers, including onsite company centers, contract centers, Kids World preschool, and a babysitter dispatch service. As of FY01/14, the division had 189 sites, including nine licensed and certified childcare centers, 116 hospital centers under the National Hospital Organization, 48 onsite company centers, and 16 other facilities. A “licensed childcare center” is one approved under the provisions of the Child Welfare Act, which cover standards (e.g., facility size, number of caregivers, kitchen facilities, disaster management, and hygiene management) set by the national government and approved by the prefectural governor. In contrast, a “certified childcare center” is peculiar to Tokyo. The Tokyo prefectural government felt that that many of the requirements for “licensed” centers were not applicable to large cities (size being one—in densely populated Japanese cities, it is often impossible to secure enough space meeting the national standard). Pigeon hires its own childcare workers and cooking staff, providing training where appropriate. Childcare http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 24/57

Pigeon Corp. (7956)

2014/3/20 staff receives training at Pigeon Heartner Open College to ensure safe and reliable care. Pigeon Hearts Corporation, a group company, offers licensed and certified childcare facilities, as well as in-house childcare services for companies. Kids World, a childcare center, offers childcare, English classes, and preschool activities and is primarily a franchise operation that generates royalty revenues for Pigeon. This labor-intensive business is not a high-margin one, but it does offer synergies with the Domestic Baby & Mother Care business, which targets babies 0-24 months unlike other general childcare centers to better support working mothers.

Group Companies

Pigeon Home Products Corp.: Manufactures toiletries for Domestic Baby & Mother Care and Health & Elder Care. 100% owned. Pigeon Will Co., Ltd.: Procures and sells maternity and baby products for Domestic Baby & Mother Care. 100% owned. Pigeon Hearts Corp.: Provides contracted childcare and education services for Domestic Baby & Mother Care. 100% owned. PHP Hyogo Co., Ltd.: Makes bottom wipes for Domestic Baby & Mother Care and Health and Elder Care. 100% owned. PHP Ibaraki Co., Ltd.: As above. Pigeon Tahira Co., Ltd.: Sells nursing products for Health & Elder Care. 85.6% owned. Pigeon Manaka Co., Ltd.: As above. 67.0% owned. Pigeon Singapore Pte. Ltd.: Local subsidiary in Singapore. Procures and sells Pigeon-branded products for expecting and nursing mothers, as well as baby goods. 100% owned. Pigeon India Pvt. Ltd.: Indian subsidiary. Sells Pigeon-branded products for expecting and nursing mothers, as well as baby goods. 100% owned. Pigeon Malaysia (Trading) Sdn. Bhd.: Local subsidiary in Malaysia. As above. 100% owned. Pigeon (Shanghai) Co., Ltd.: Chinese subsidiary. As above. 100% owned. Pigeon Manufacturing (Shanghai) Co., Ltd.: Chinese subsidiary. Makes Pigeon-branded products for expecting and nursing mothers, as well as baby goods. 100% owned. Pigeon Industries (Changzhou) Co., Ltd.: As above. 100% owned. Lansinoh Laboratories, Inc.: U.S. subsidiary. Sells baby products. 100% owned. Lansinoh Laboratories Medical Devices Design Industry And Commerce Co., Ltd.: Turkish subsidiary. Makes branded products for expecting and nursing mothers, as well as baby goods. 100% owned. Pigeon Industries (Thailand) Co., Ltd.: Thai subsidiary. Makes Pigeon-branded products for expecting and nursing mothers, as well as baby goods. 97.5% owned. Thai Pigeon Co., Ltd.: Thai subsidiary. Makes Pigeon-branded products for infants. 53.0% owned. P.T. Pigeon Indonesia: Makes Pigeon-branded products for infants. 35.0% owned (equity-method affiliate). http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 25/57

Pigeon Corp. (7956)

2014/3/20

R&D

Since its founding, Pigeon has been conducting significant amounts of R&D in nipple technology. The company says that long years of research have resulted in a product that functions more like the real thing than anything competitors offer. Source: Company data Through half a century of research into breastfeeding and children’s development, Pigeon has delved deep into childhood growth processes and milk-drinking action. As an example of the thorough research, the company has used ultrasonic tomography to observe how babies’ tongues move during breastfeeding to squeeze out the mother’s milk. Pigeon’s researchers also developed methods to observe wave motion using motion analysis. By comparing actual breastfeeding with artificial-nipple breastfeeding, they were able to demonstrate how a soft silicone-based nipple material provided an experience similar to suckling on the human mother (2002).

Pigeon’s Baby Bottle Development

1949: Introduced Japan’s first wide-neck bottle with cap. Much more hygienic than bottles with connected nipples, which prevailed until then. 1954: First polyethylene bottle in Japan (S-type). Hexagonal shape easy for babies to grip. Shape and material represented a revolutionary advance. 1956: First glass bottle with pictures (F-type) in Japan. Spread the idea that childrearing could be fun, as compared to purely functional baby products. 1962: Introduced polycarbonate bottles. Full of features desirable in a bottle: light yet strong, transparent, and able to withstand boiling. R-8 type won 1962 Tokyo Invention Prize and is recommended by Japanese Red Cross Central and Main hospitals. 1965: Improved neck design to eliminate threads inside bottleneck (W-8 type). As the bottleneck was flat inside, no milk dregs remained, making it more hygienic. 1977: P-type bottle introduced. Specially designed for children with reduced sucking power due to problems with lips or upper jaws or low birth weight. 1982: New concept introduced: Mag Mag cup with interchangeable caps. With four different caps http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 26/57

Pigeon Corp. (7956)

2014/3/20 tailored to different stages of a baby’s growth, it was a big hit. Became a standard fixture in the company’s product line. 1988: Company research showed that babies have a unique drinking method—peristaltic movement of the tongue. Pigeon’s researchers explained that this particular tongue movement, not available to adults, is used when babies drink mother’s milk. 2000: Japan’s first polyethersulphone (PES) bottle released. 2002: “Bonyu-jikkan”—loosely translated as “Just like Mom”—nipples and bottles introduced, based on extensive research of babies’ sucking action. Flexible and fitting the mouth perfectly, the nipples enabled a smooth, natural, sucking action. 2003: “Just like Mom” line extended with PES bottles suitable for use when going out and about. 2007: “Just like Mom” line refreshed to reflect a new standard in childrearing. Four nipple sizes and plastic polyphenylsulphone (PPSU) bottles introduced. 2010: “Just like Mom” line again refreshed to serve the three key stages of feeding: attachment, sucking, and swallowing. Wide-Necked Bottle with Cap S-Type Bottle F-Type Bottle R-8 Type Bottle W-8 Type Bottle 1949 P-Type Bottle 1954 Mag Mag Cup 1956 PES Bottle 1962 Bonyu-Jikkan ("Just like Mom") 1965 Bonyu-Jikkan 1977 Bonyu-Jikkan 1982 Bonyu-Jikkan 2000 2002 2003 2007 2010 Source: Company data, SR Inc. Research In 1993, the company established a Central Research Center in Tsukubamirai City, Ibaraki Prefecture. The Fundamental Research Group of the Center studies nursing infants, sucking action, and the loss of function in the elderly. Since 2006, the Quality Control Group has tested the quality, safety, and security of company products developed worldwide. The Intellectual Property Group is responsible for patents and design trademarks. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 27/57

Pigeon Corp. (7956) Central Research Center (Tsukubamirai-shi, Ibaraki Prefecture)

2014/3/20 Source: Company data Overseas R&D Pigeon conducts research in China and Singapore as well as in Japan in order to meet the needs of overseas markets. The key criteria for its overseas research activities are tailoring development in line with market needs and constructing highly reliable quality-control systems. The local development divisions ensure that products sold in each region suit local consumers.

Factory in Changzhou, Jiangsu Province, China

Source: Company data http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 28/57

Pigeon Corp. (7956) Lactation Simulator

Source: Company data 2014/3/20 http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 29/57

Pigeon Corp. (7956)

2014/3/20

Profitability Snapshot, Financial Ratios

Profit Margins (million yen)

Gross Profit Gross Profit Margin Operating Profit OP Margin EBITDA EBITDA Margin Net Profit Margin

Financial Ratios

ROA ROE Total Asset Turnover Inventory Turnover Days of Inventory Working Capital Requirement (Million Yen) Current Ratio Quick Ratio OCF / Current Liabilities Net Debt / Equity OCF / Total Liabilities Cash Cycle (days) Changes in Working Capital

FY01/10 Cons.

20,891 39.1% 4,604 8.6% 6,414 12.0% 5.3% 7.3% 11.4% 137.2% 737.4% 49.5

8,805 208.3% 154.0% 45.3% -16.9% 37.5% 60.9

-1,281

FY01/11 Cons.

23,266 40.8% 4,547 8.0% 6,487 11.4% 5.1% 7.1% 11.2% 138.9% 734.4% 49.7

10,439 197.6% 145.3% 28.0% -7.2% 20.5% 69.8

1,635 Source: Company data, SR Inc. Research Figures may differ from company materials due to differences in rounding methods.

Gross profit figures are before reserves for returned products

FY01/12 Cons.

24,333 41.1% 5,043 8.5% 6,875 11.6% 5.4%

FY01/13 Cons.

27,744 42.7% 7,086 10.9% 8,903 13.7% 7.0% 7.4% 11.8% 136.8% 502.8% 72.6

11,568 205.5% 146.8% 34.2% -8.6% 26.6% 94.9

1,128 9.9% 15.5% 141.0% 735.7% 49.6

11,493 250.5% 189.8% 63.8% -21.5% 47.3% 60.7

-75

FY01/14 Cons.

34,473 44.5% 10,366 13.4% 12,437 16.1% 9.0% 13.1% 19.7% 145.5% 845.7% 43.2

13,402 275.9% 209.3% 64.9% -24.2% 44.1% 57.5

1,909 The main drivers of SG&A expenses for Pigeon are sales promotion and personnel. Sales promotion costs grew from 2.9% of sales in FY01/09 to 6.2% in FY01/13 due to an aggressive overseas push. Personnel costs rose from 6.5% to 6.8% of sales. Pigeon raised its operating profit margin from 8.3% to 13.4% from FY01/09 through FY01/14. This is partly due to the start-up of the Shanghai and Changzhou factories in China, which helped boost gross profit margins from 38.0% to 42.7%.

SG&A Breakdown (million yen)

Shipping and Handling Sales Promotions Salaries and Bonuses Provision for Bonuses Provision for Doubtful Accounts Retirement Benefits Director Retirement Benefits R&D Others

Total FY01/09 Cons.

1,616 1,539 3,434 297 4 257 24 1,129 7,596

15,895 FY01/10 Cons.

1,604 1,725 3,736 316 66 260 39 1,211 7,343

16,299

Source: Company data, SR Inc. Research Figures may differ from company materials due to differences in rounding methods.

FY01/11 FY01/12 FY01/13 Cons.

1,748 3,328

Cons.

1,782 3,336

Cons.

1,969 4,042 3,904 289 10 274 26 1,359 7,796

18,734

4,116 311 10 271 33 1,497 7,919

19,276

4,205 335 -100 285 38 1,621 8,280

20,675

http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 30/57

Pigeon Corp. (7956)

2014/3/20

Strengths & Weaknesses Strengths

Super-brand in Japan: The Pigeon brand is the most well-known and one of the most trusted in Japanese children’s goods. SR Inc. believes that Pigeon’s strong brand and trustworthiness are powerful weapons, not just in existing product categories but in new ones as well. Overwhelming share in a niche market: The company has a roughly 80% share of the domestic baby bottle market. As its baby-bottle history suggests, the company created many “industry firsts.” Its ability to develop innovative products in niche markets is obviously second to none. Such ability will likely remain one of the company’s strengths going forward, underpinned by its extensive know-how accumulated through vigorous customer hearings and R&D. Also, its Changzhou factory (the section scheduled to start operating in FY01/14) will probably drive up the company’s profitability while increased in-house production could mean lower risk of knowledge outflows. Growth potential overseas: Pigeon can effectively use its business model (e.g., premium products, R&D operations) in Domestic Baby & Mother Care when seeking growth outside Japan. In fact, the company generates about 50% of operating profit from overseas activities and has attained the leading share in the market of the wealthy in China. SR Inc. believes that the company can replicate similar successes in other foreign markets.

Weaknesses

Possible competition against giants in peripheral businesses: Here, giants refer to certain cash-rich toiletry goods companies. Fortunately, as of January 2013, the company hasn’t faced direct competition against such companies. Any of these potential competitors could in the future penetrate the lucrative niches where the company currently has high shares and subsequently snatch some shares from the company, particularly for non-core products that the company has yet to develop unbeatable presence. On the other hand, SR Inc. wonders if the presence of these potential competitors is preventing the company from reaching out to new business fields. Limited domestic growth potential: Given its shrinking population and limited economic growth prospects, Japan may take some blame for the company’s narrow domestic growth. Behind declining birth rates are such socioeconomic factors as an increase of DINKS households and people getting married later in life, and there are no signs of the rates making a positive turnaround. Thus, the company’ potential for further domestic growth should depend on its ability to penetrate the senior care products market and strengthen product categories and market shares for these categories in Domestic Baby & Mother Care. Minor-player status in Europe and the U.S.: The company essentially does not operate in developed countries other than Japan. In North America, the company depends on the Lansinoh brand. SR Inc. wonders if such somewhat indirect control may be preventing the company from expanding in the region. Also, as the fact that Europe is a part of the Others geographical segment (as of January 2014) suggests, Pigeon’s European operations have been an immaterial earnings contributor. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 31/57

Pigeon Corp. (7956)

2014/3/20

Market and Value Chain Market Overview Domestic Baby & Mother Care

According to the Ministry of Health, Labour and Welfare (MHLW), in 2012 the birth rate (estimated number of children a woman will give birth to in her lifetime) was 1.41, an increase of 0.02 percentage points from a year earlier. However, the number of births in Japan fell by 13,750 over the previous year to 1.04 million births, a historical low. The ministry noted that the fall occurred despite a steady birth rate as the number of women (denominator) had shrunk. In the younger generation, the birth rate is falling and there is a waning desire to have children, suggesting an unavoidable further decline in the number of births. Source: Ministry of Health, Labour and Welfare data, SR Inc. Research Meanwhile, the drugstore market—Pigeon’s main sales channel—is growing. According to a survey by the Japan Association of Chain Drug Stores, total sales in the Japanese drugstore market for FY2012 were JPY5.9tn (+2.4% YoY). The market has been expanding for 12 years since the survey began in FY2000, although the pace of growth is slowing. There were 17,144 drugstores in Japan (+329 YoY). http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 32/57

Pigeon Corp. (7956)

2014/3/20

Childcare Service

According to MHLW statistics, the number of children awaiting entrance to licensed childcare facilities as of April 2013 fell by 2,084 YoY to 22,741, a third year of decline. The ministry indicated that local government efforts to increase nursery capacity were paying off. The number of children attending nurseries was 2.22 million, a rise of 42,779 YoY. Nursery capacity rose by 49,000 to around 2.29 million. As of April 2013, 80.3% of the children on waiting lists were in the Tokyo metropolitan area, the seven prefectures in the Kinki region, and other core cities. By age, 82% were 0-24 months old. Looking at statistics for the month of October, the waiting list had 48,356 children in 2010, 46,620 in 2011 and 46,127 in 2012—1.8 times as long as in April of those years, when the school year begins in Japan. According to a July 2012 MHLW survey, the share of working women increased for the ninth year in a row (through 2011). The number of women wanting to bear children and continue working, or those wishing to return to the workforce while raising children is increasing, supporting a strong need for childcare services despite the trend toward smaller families. Further, the extended economic malaise means that one-income households cannot make ends meet, which is also spurring childcare needs. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 33/57

Pigeon Corp. (7956)

2014/3/20 The Ministry also surveyed single women (18-34 years old) and found that 60.8% of women plan to continue working after giving birth.

Health & Elder Care

As of October 2012, Japan’s over-65 population was 30.79 million (April 2013 estimate by the Statistics Bureau of the Ministry of Internal Affairs and Communications), an increase of 1.04 million from October 2011 (29.75 million). While Japan’s overall population is shrinking, its graying continues; in 2013, those over 65 will be 25.2% of total population, or one in every four people. Baby boomers (those born in 1947-49) will become senior citizens in 2014, increasing the number of over-65s by 2.3 million per annum. According to Japan’s Cabinet Office’s “Policy on Cohesive Society” 2011 data, the share of over-65s will break 30% in 2025, and as baby boomers’ children turn 65 around 2040, the number will reach 35%. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 34/57

Pigeon Corp. (7956)

2014/3/20

Chinese Market

The annual number of births in China (population 1.3 billion) is estimated at 17 million, 17 times that of Japan. Pigeon targets wealthy consumers, suggesting a potential market of about 3.5 million babies. According to the company’s assessment, by extrapolating Japan’s 1.057 million births in 2011 and Pigeon’s sales of 24.0 billion yen in the segment, this suggests potential sales of 40.0 billion yen. The company expects Chinese sales to grow at an annual rate of 15%-20% from 2013 onward. Source: Company data According to the Japan External Trade Organization (JETRO), the Chinese market (including Hong Kong) for essentials and food for babies 0-3 years old and children 4-6 (excluding healthcare and education) was 240 billion yuan at the retail level in 2010, versus 160 billion yuan in 2007—a dramatic increase over three http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 35/57

Pigeon Corp. (7956)

2014/3/20 years (one yuan equals roughly 12 yen since 2010). In 2004-2009, the market growth rate for baby products was 14.8% in China against 6.9% in Europe and 3.3% in North America. Within the Chinese market for children’s goods, infants 0-3 years old command 70% of the total. Birth rates have languished due to the one-child policy, but disposable incomes have grown with the economy, resulting in higher spending on children. For nipples and bottles alone, the market was 1.7 billion yuan in 2010 and 1.9 billion yuan in 2011, according to JETRO. China has a policy to promote breastfeeding. In 2009, the country’s Ministry of Health partnered with Pigeon to open breastfeeding counseling offices in 34 major maternity and general hospitals across the nation (41 counseling offices as of FY01/13). In FY01/12, over 200 hospitals offered breastfeeding education using Pigeon’s bottles. This increased brand penetration with end users—pregnant and nursing women. The company plans to launch sales of disposable diapers in the Chinese market in FY01/14. The market penetration rate for disposable diapers has grown from around 2% in 2000 to 32% in 2010. According to research firm Euromonitor International, the market is forecast to be worth approximately 500 billion yen (42.1 billion yuan) in 2015, with an average annual growth rate of 15.6%. Pigeon is targeting the affluent segment of the market (accounting for around 7–8% of the total market) for its disposable diapers, and the company has indicated it is seeking to win a 30% share of the affluent segment (2–3% of the total market).

Indian Market

The Indian population continues to grow by over 10 million per annum, reaching an estimated 1.24 billion in 2011 (UN Population Fund, State of World Population 2011). The population is also young, with over half under 25 years old, and despite the wide gap between rich and poor, the notable growth in the rich demographic means births are increasing. The company estimates the number of births in India at 27 million annually.

U.S. Market

The overall birth rate in the United States was 1.89 in 2011 (source: U.S. Centers for Disease Control), a relatively steady rate for an industrialized country, though the rate has been on a downward trend recently due to economic slowdown. The number of births is around 4.0 million per annum, and the population is rising.

Customers

The company’s end users are babies 0-24 months old and their mothers. The customers are overwhelmingly mothers. In Health & Elder Care segment, the customers are seniors over 65. Pigeon sells mainly through drugstores. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 36/57

Pigeon Corp. (7956)

2014/3/20

Barriers to Entry

Barriers to entry in the domestic baby goods market—particularly for the company’s core bottles and nipples—are exceptionally high as demonstrated by the company’s dominant market share. Mothers buy Pigeon products to feed their babies, choosing the brand they know and trust (and likely used themselves as babies). Both the reputation and technology have been developed over many years and represent a formidable barrier to entry. In other baby products, the barriers may vary—in certain niches having enough capital may be enough to become a competitor overnight—and the company emphasizes its niche status and has so far been staying away from the markets where price competition may start easily (and spread into other product groups), such as disposable diapers. Barriers to entry are also arguably lower in the developing countries. There, the impenetrable brand equity is yet to be built and price often plays more important role, allowing new entrants to try their hand.

Competition

Pigeon has about 80% of the Japanese market for bottles and nipples. Combi Corp. (unlisted), Aprica Children’s Products Inc. (unlisted), and Wakodo Co., Ltd. (Asahi Group Holdings, Ltd.; TSE1: 2502) carry a similar wide range of baby goods. These companies, though, focus on different product categories. In China, competitors include AVENT (UK), NUK (Germany), and chicco (Italy). Pigeon has the top market share within the wealthier demographic. There are a number of competitors in the United States, including local player Evenflo Company, Inc. (unlisted), U.K.-based Philips AVENT, and Swiss-based Medela Inc. According to Pigeon, it has 64.0% of the U.S. market for nipple care, 53.7% of the U.S. market for breast pads, and 62.9% of the market for breast milk bags (2011). http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 37/57

Pigeon Corp. (7956)

2014/3/20

Strategy Domestic Strategy

In Domestic Baby & Mother Care segment, the strategy centers on going into new product categories. The company focuses on 0- to 24-month-old babies. However, as of late 2012, even for that market the Pigeon’s offering does not cover the entire possible product range. Examples of areas to explore include babywear. Pigeon has already started selling strollers and child safety seats in FY01/11; in 01/14, Pigeon continues to focus efforts on these items. One possibility to expand the product range would be to offer premium disposable diapers to the range. The company says that many of its customers have been asking why they can’t find Pigeon diapers. This would suggest that the Pigeon brand power may have transcended the existing product range and that creates intriguing opportunities, including entering the diaper market. SR Inc. notes that if Pigeon actually decides to enter this market, it should be prepared for existing market players’ moves to block a new entrant. Pigeon is cautious if not outright dismissive about expanding the target market beyond the age of 24 months, saying that that stepping outside the core competence would do little but weaken its focus. In Health & Elder Care, Pigeon aims to strengthen sales activities for elder care products—a promising market—by using sales channels of subsidiary Pigeon Tahira Corp. The company’s Childcare Service is expected to accelerate consigned operations of childcare facilities on the back of strong demand for such services. Despite the not-so-outstanding profitability that the segment offers, Pigeon appears to want to generate synergy of Childcare Service and Domestic Baby & Mother Care.

Overseas Strategy

Pigeon’s overseas strategy calls for capturing market share of over 50% in each country in bottles and nipples. Market shares over 50% increase brand power and boost sales of bottles and accessories. The company appointed Shigeru Yamashita, who had headed the overseas operations, as president. The founder’s grandson, Yusuke Nakata, became president of Pigeon Singapore Pte Ltd in January 2014, to oversee the company’s Asia operations. These personnel changes are intended to build a new framework to strengthen the company’s overseas business. In China, Pigeon notes that large socioeconomics gaps between rich and poor create difficulties in developing products for the mass market. The company thus aims to continue developing high-quality, safe products aimed at the wealth, rather than products for the mass market. In China, customs are quite different from Japan, and the concept of disposable goods has not caught on yet. These unaddressed markets remain on a watch-and-wait basis. But the company launched a disposable diaper business in 2H FY01/14 with high-end products (selling for RMB 2.0–3.0 compared with regular products retailing for RMB 1.5–2.0) targeting the affluent segment. In FY01/15, the company plans to generate sales of JPY2.5bn from disposable diapers, and is aiming to achieve sales of 10 billion yen at an early stage. Pigeon also began baby food sales in China in FY01/14. In the Chinese market, where food safety awareness is increasing, SR Inc. sees strong potential for the Pigeon brand to win market share. http://www.sharedresearch.jp/ Copyright (C) 2013 Shared Research Inc. All Rights Reserved 38/57

Pigeon Corp. (7956)