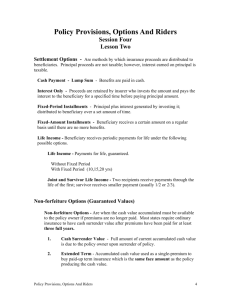

life insurance - Insurance Continuing Education

advertisement