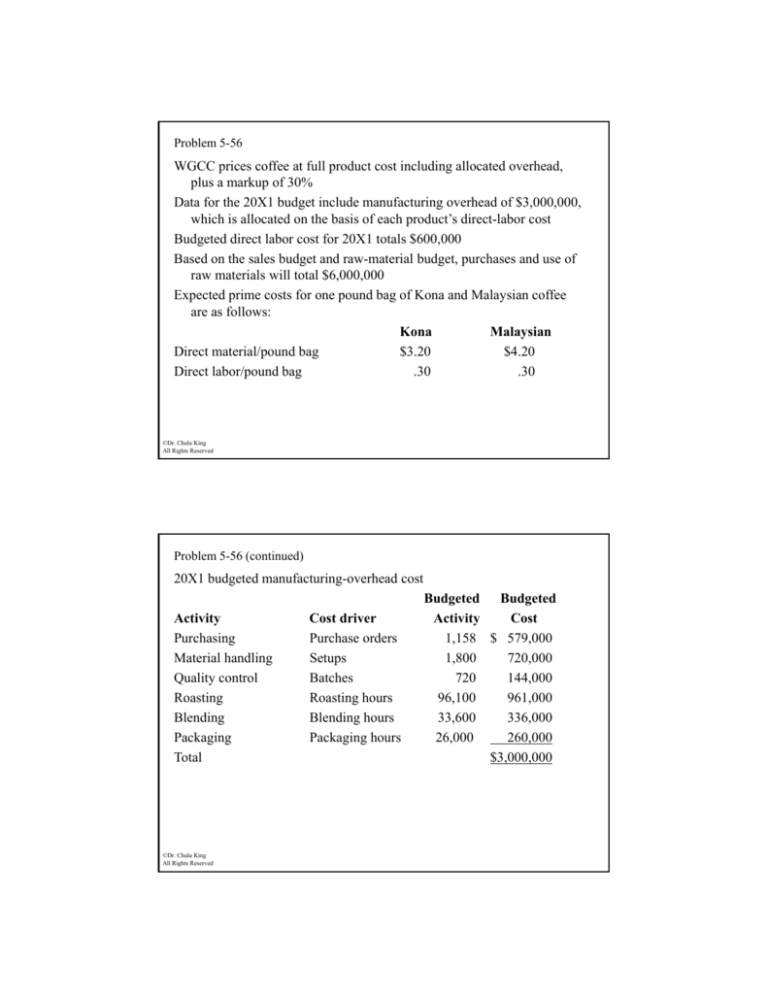

Problem 5-56

WGCC prices coffee at full product cost including allocated overhead,

plus a markup of 30%

Data for the 20X1 budget include manufacturing overhead of $3,000,000,

which is allocated on the basis of each product’s direct-labor cost

Budgeted

d

d direct

di

labor

l b cost for

f 20X1 totals

l $600,000

$

Based on the sales budget and raw-material budget, purchases and use of

raw materials will total $6,000,000

Expected prime costs for one pound bag of Kona and Malaysian coffee

are as follows:

Kona

Malaysian

Di

Direct

material/pound

i l/

d bag

b

$3 20

$3.20

$4 20

$4.20

Direct labor/pound bag

.30

.30

©Dr. Chula King

All Rights Reserved

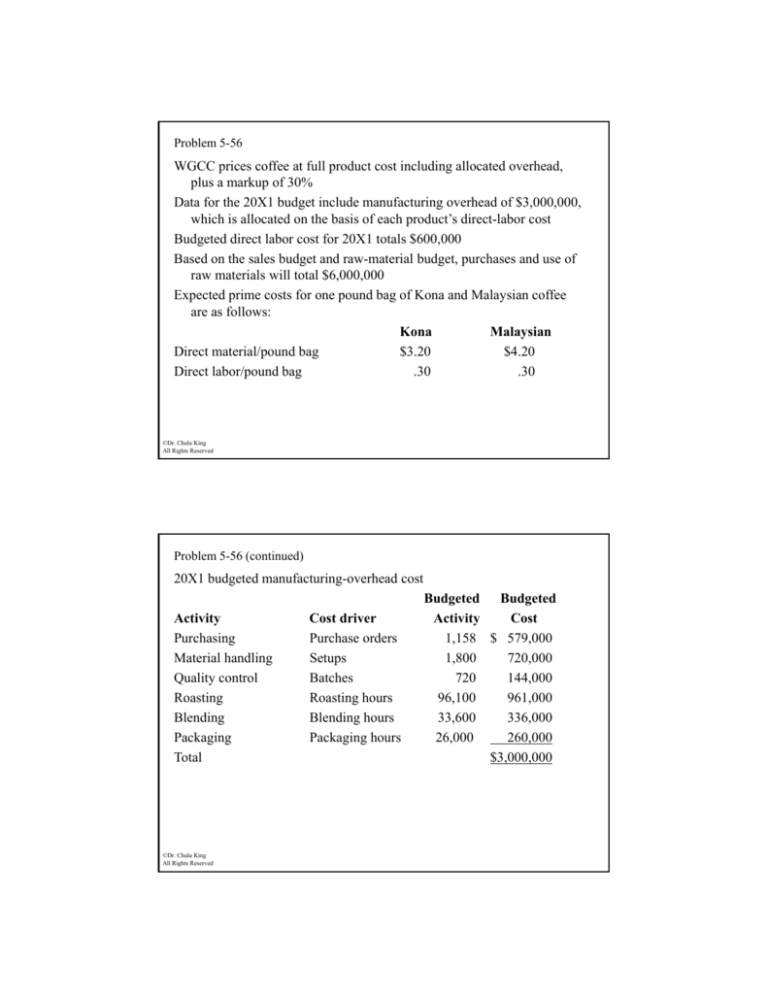

Problem 5-56 (continued)

20X1 budgeted manufacturing-overhead cost

Activity

Purchasing

Material handling

Quality control

Roasting

Blending

Packaging

Total

©Dr. Chula King

All Rights Reserved

Cost driver

Purchase orders

Setups

Batches

Roasting hours

Blending hours

Packaging hours

Budgeted Budgeted

Activity

Cost

1,158 $ 579,000

1,800

720,000

720

144,000

96,100

961,000

33,600

336,000

26,000

260,000

$3 000 000

$3,000,000

Problem 5-56 (continued)

20X1 data for production of Kona and Malaysian coffee:

Kona

Malaysian

Budgeted sales

2,000 lb

100,000 lb

Batch size

500 lb

10,000 lb

Setups

3 per batch

3 per batch

Purchase order size

500 lb

25,000 lb

Roasting time

1 hr. per 100 lb

1 hr. per 100 lb

Blending time

0.5 hr. per 100 lb

0.5 hr. per 100 lb

Packaging time

0.1 hr. per 100 lb

0.1 hr. per 100 lb

©Dr. Chula King

All Rights Reserved

Problem 5-56 (continued)

Part 1(a): Using WGCC’s current product-costing system, determine the

company’s predetermined overhead rate using direct-labor cost as the

single cost driver.

$5 per direct labor dollar ($3,000,000 ÷ $600,000)

Part 1(b): Using

i WGCC’s current product-costing

d

i system, determine

d

i the

h

full product cost and selling prices of one pound of Kona coffee and

one pound of Malaysian coffee.

Kona

Malaysian

Direct material

$3.20

$4.20

Direct labor

.30

.30

O h d ((.30

Overhead

30 x $5)

1 50

1.50

1 50

1.50

Full product cost

$5.00

$6.00

30% markup

1.50

1.80

Selling price

$6.50

$7.80

©Dr. Chula King

All Rights Reserved

Problem 5-56 (continued)

Part 2: Develop a new product cost, using an activity-based costing

approach, for one pound of Kona coffee and one pound of Malaysian

coffee:

First, determine the unit cost for each of the activities (Cost ÷ Activity):

Budgeted

Budgeted

Unit

Activity

Cost driver

Activity

Cost

Cost

Purchasing

Purchase orders

1,158 $ 579,000

$500

Material handling Setups

1,800

720,000

400

Quality control

Batches

720

144,000

200

Roasting

Roasting hours

96,100

961,000

10

Blending

Blending hours 33,600

336,000

10

Packaging

Packaging hours 26,000

260,000

10

©Dr. Chula King

All Rights Reserved

Problem 5-56 (continued)

Standard Cost per pound: Kona Coffee (2,000 lbs)

Direct material (given)

$3.20

Direct labor (given)

.30

Purchasing (2,000 ÷ 500 = 4 orders x $500 = $2,000 ÷ 2,000)

1.00

Material handling (3x4 batches=12 setups x$400=$4,800÷2,000) 2.40

Quality control (4 batches x $200 = $800 ÷2,000)

.40

Roasting (20 hrs x $10 = $200 ÷ 2,000)

.10

Blending (10 hrs x $10 = $100 ÷ 2,000)

.05

Packaging (2 hrs x $10 = $20 ÷ 2,000)

.01

Total cost

$7 46

$7.46

©Dr. Chula King

All Rights Reserved

Problem 5-56 (continued)

Standard Cost per pound: Malaysian Coffee (100,000 lbs)

Direct material (given)

$4.20

Direct labor (given)

.30

Purchasing (100,000÷25,000=4 ordersx$500=$2,000÷100,000)

.02

Material handling (3x10batches=30setupsx$400=$12,000

÷100,000)

.12

Quality control (10 batches x $200 = $2,000 ÷100,000)

.02

Roasting (1,000 hrs x $10 = $10,000 ÷ 100,000)

.10

Blending (500 hrs x $10 = $5,000 ÷ 100,000)

.05

Packaging

g g (100

(

hrs x $10

$ = $1,000

$ ,

÷ 100,000)

,

)

.01

Total cost

$4.82

©Dr. Chula King

All Rights Reserved

Problem 5-56 (continued)

Part 3(a): What are the implications of the activity-based costing system

with respect to the use of direct labor as a basis for applying overhead

to products?

Under ABC, several activities other than direct labor drive overhead.

Because of this,

this the current system significantly undercosts the low

volume Kona coffee ($6.50 versus $7.46), and overcosts the high

volume Malaysian coffee ($7.80 versus $4.82).

Part 3(b): What are the implications of the activity-based costing system

with respect to the use of the existing product-costing system as the

basis of pricing.

g pprice of $$6.50 compared

p

to its

Kona,, the low volume pproduct has a selling

ABC cost of $7.46. Therefore, the selling price is not covering the cost

of the Kona. As a result the high volume, high margin Malaysian

coffee is subsidizing Kona coffee.

©Dr. Chula King

All Rights Reserved