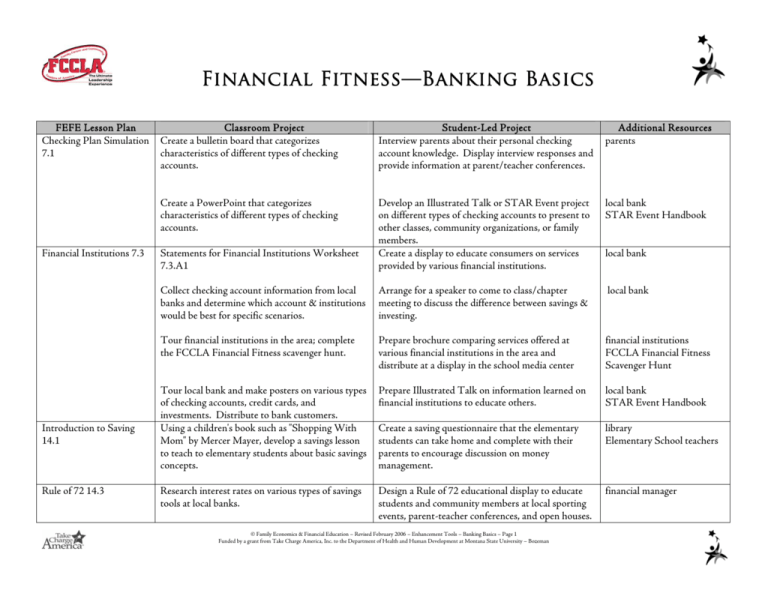

Financial Fitness—Banking Basics

advertisement

Financial Fitness—Banking Basics FEFE Lesson Plan Checking Plan Simulation 7.1 Financial Institutions 7.3 Introduction to Saving 14.1 Rule of 72 14.3 Classroom Project Create a bulletin board that categorizes characteristics of different types of checking accounts. Student-Led Project Interview parents about their personal checking account knowledge. Display interview responses and provide information at parent/teacher conferences. Additional Resources parents Create a PowerPoint that categorizes characteristics of different types of checking accounts. local bank STAR Event Handbook Statements for Financial Institutions Worksheet 7.3.A1 Develop an Illustrated Talk or STAR Event project on different types of checking accounts to present to other classes, community organizations, or family members. Create a display to educate consumers on services provided by various financial institutions. Collect checking account information from local banks and determine which account & institutions would be best for specific scenarios. Arrange for a speaker to come to class/chapter meeting to discuss the difference between savings & investing. local bank Tour financial institutions in the area; complete the FCCLA Financial Fitness scavenger hunt. Prepare brochure comparing services offered at various financial institutions in the area and distribute at a display in the school media center financial institutions FCCLA Financial Fitness Scavenger Hunt Tour local bank and make posters on various types of checking accounts, credit cards, and investments. Distribute to bank customers. Using a children's book such as "Shopping With Mom" by Mercer Mayer, develop a savings lesson to teach to elementary students about basic savings concepts. Prepare Illustrated Talk on information learned on financial institutions to educate others. local bank STAR Event Handbook Create a saving questionnaire that the elementary students can take home and complete with their parents to encourage discussion on money management. library Elementary School teachers Design a Rule of 72 educational display to educate students and community members at local sporting events, parent-teacher conferences, and open houses. financial manager Research interest rates on various types of savings tools at local banks. © Family Economics & Financial Education – Revised February 2006 – Enhancement Tools – Banking Basics – Page 1 Funded by a grant from Take Charge America, Inc. to the Department of Health and Human Development at Montana State University – Bozeman local bank Financial Fitness—Banking Basics Time Value of Money 14.5 Selecting a Credit Card 4.1 Create a PowerPoint and informative handout to educate students and community members on the time value of money. Selecting a Credit Card 4.1.A1 Comparison Shopping for a Credit Card 4.1.A2 Complete a STAR Event/Illustrated Talk to educate peers, family, and community members on time value of money. Design and distribute a brochure on “How To Select a Credit Card” to parents and community members. Make table tents for faculty break rooms about credit facts. Use the table tents in the student lunchroom during a FCCLA sponsored Credit Information Awareness Week. Understanding Credit Reports 4.2 Make a video or scenario role play on different credit card users. Select three basic credit card users: one that always carries an amount on their credit card, one that always pay off full amount and one that usually but not always pay off full amount. Include why they selected the credit cards they use. For example, low finance charges and yearly membership fee would be the example for the person who always carries an amount on their credit card from month to month. Understanding Credit Reports 4.2.A1 Credit Report Scenario 4.2.A2 Electronic Banking 7.2 STAR Event Handbook local bank Create flyers, public service announcement’s, and table tents to encourage consumers to check their credit reports. Present large poster and information to other student led organizations. www.annualcreditreport.com Electronic Banking Worksheet 7.2.A1 Scenarios 7.2.A2 Design flyers or PowerPoint to educate consumers on the safety issues associated with using ATM’s, debit cards and credit cards. local bank Create a brochure illustrating all of the forms of electronic banking. Reserve the computer lab at either school or the public library with access to the internet and demonstrate to the public or school staff how to use online banking products. May also want to invite a guest speaker into talk about the do's and don'ts of guest speaker Work in small groups to make posters of oversized debit cards and credit cards. Write tips to use debit and credit cards wisely. © Family Economics & Financial Education – Revised February 2006 – Enhancement Tools – Banking Basics – Page 2 Funded by a grant from Take Charge America, Inc. to the Department of Health and Human Development at Montana State University – Bozeman Student Council National Honor Society CTSO’s Financial Fitness—Banking Basics electronic banking. Language of the Stock Market 12.2 Identity Theft 3.1 Ask students to share stock market terms they have heard in the media. Compile terms and introduce one or two stock market terms a day previous to the unit on the stock market. Have students keep a record. Identity Theft Interview Questions (survey) 3.1.A2 Use investment statistics as announcements for the school bulletin/announcements. stock market consultant Prepare PowerPoint presentation and handouts to give at a Senior Center, Lions Club, or other adult group with information focusing specifically on the results from the surveys. parents senior centers © Family Economics & Financial Education – Revised February 2006 – Enhancement Tools – Banking Basics – Page 3 Funded by a grant from Take Charge America, Inc. to the Department of Health and Human Development at Montana State University – Bozeman