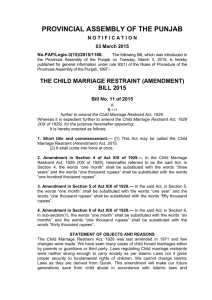

New pages Aman Set.fh10 - Engro Polymer & Chemicals Limited

advertisement