November 1, 2012

The Status Quo is Not an Option

JIMMY CHANG, CFA

Managing Director

“Fiscal cliff” negotiation to gather steam post-election;

European debt crisis in remission for now

H

urricane Sandy wreaked havoc on the U.S.

Northeast and forced the New York Stock

Exchange to close for two consecutive days. It is

estimated to have cost $20 billion in property damage

and up to $30 billion in lost business. A different storm

is brewing in Washington as the negotiations to

minimize the “fiscal cliff” will gather strength after the

November 6th general elections. The success of these

negotiations may be an important catalyst for stocks,

which lost some momentum in October as corporate

earnings were mixed at best. However, spreads for both

investment grade and high yield corporate bonds

continued to narrow month on month, indicating that

investors remain comfortable with the financial strength

of corporations. On the currency front, the improving

tone of the European sovereign debt market helped to

lift the euro, while the yen fell on weak Japanese

economic data. The escalating dispute between Japan

and China over an uninhabited island (Diaoyu/Senkaku)

has hurt Japan’s exports to China. The commodity

complex took it on the chin as some base metals (e.g.,

nickel and zinc) suffered double-digit losses, while crude

oil and even precious metals also posted sizeable

declines. Some surmised that the decline in commodities

prices may reflect Governor Romney’s rising polls, as a

Romney victory could potentially mark an earlier

conclusion of the ultra loose monetary environment

(Governor Romney has indicated that, if elected

president, he will not re-nominate Chairman Bernanke).

On the other hand, the online prediction market

intrade.com has given President Obama a 68% chance

212-549-5218

jchang@rockco.com

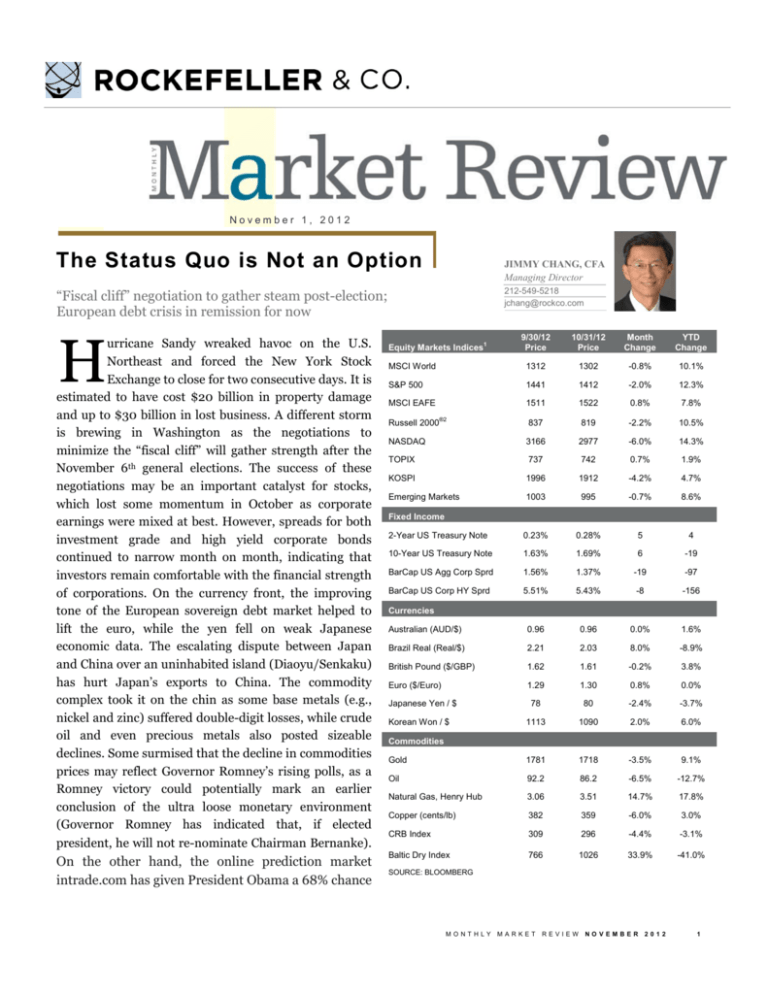

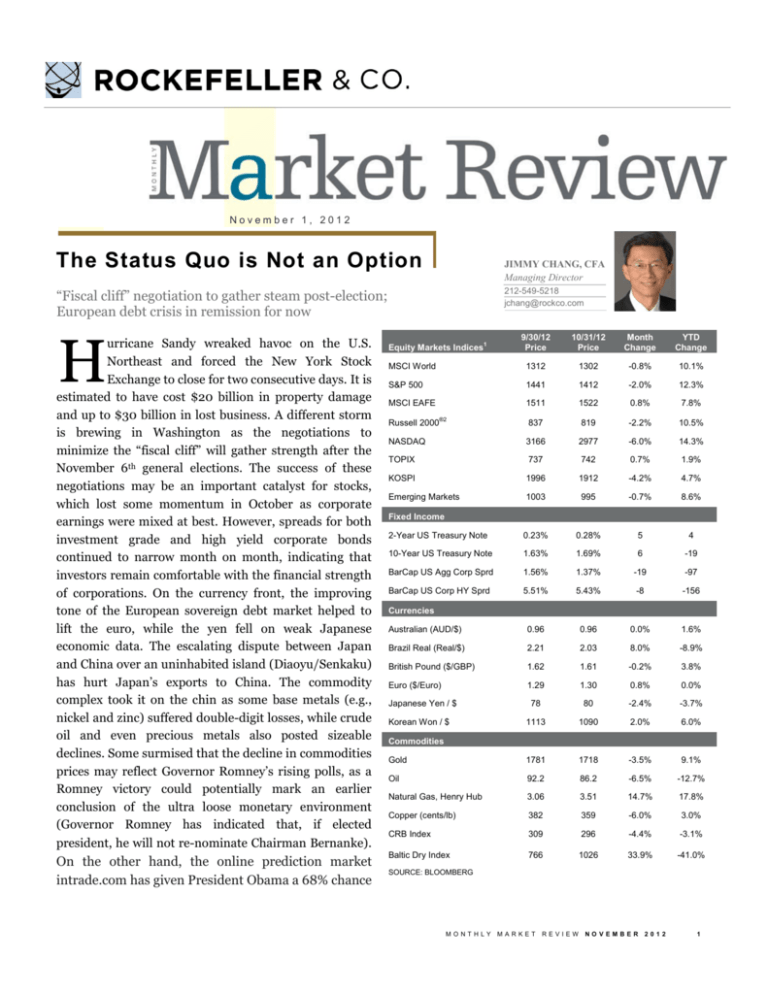

9/30/12

Price

10/31/12

Price

Month

Change

YTD

Change

MSCI World

1312

1302

-0.8%

10.1%

S&P 500

1441

1412

-2.0%

12.3%

MSCI EAFE

1511

1522

0.8%

7.8%

Russell 2000®2

837

819

-2.2%

10.5%

NASDAQ

3166

2977

-6.0%

14.3%

Equity Markets Indices1

TOPIX

737

742

0.7%

1.9%

KOSPI

1996

1912

-4.2%

4.7%

Emerging Markets

1003

995

-0.7%

8.6%

2-Year US Treasury Note

0.23%

0.28%

5

4

10-Year US Treasury Note

1.63%

1.69%

6

-19

BarCap US Agg Corp Sprd

1.56%

1.37%

-19

-97

BarCap US Corp HY Sprd

5.51%

5.43%

-8

-156

Australian (AUD/$)

0.96

0.96

0.0%

1.6%

Brazil Real (Real/$)

2.21

2.03

8.0%

-8.9%

British Pound ($/GBP)

1.62

1.61

-0.2%

3.8%

Euro ($/Euro)

1.29

1.30

0.8%

0.0%

78

80

-2.4%

-3.7%

1113

1090

2.0%

6.0%

Gold

1781

1718

-3.5%

9.1%

Oil

92.2

86.2

-6.5%

-12.7%

Natural Gas, Henry Hub

3.06

3.51

14.7%

17.8%

Copper (cents/lb)

382

359

-6.0%

3.0%

CRB Index

309

296

-4.4%

-3.1%

Baltic Dry Index

766

1026

33.9%

-41.0%

Fixed Income

Currencies

Japanese Yen / $

Korean Won / $

Commodities

SOURCE: BLOOMBERG

MONTHLY

MARKET

REVIEW

NOVEMBER

2012

1

of getting re-elected. In any case, the suspense will be

lifted fairly soon, unless the race is too close to call in

a key battleground state, which could then lead to

recounts and even legal challenges.

The Status Quo is Not an Option

By the time some of you start reading this newsletter, the

U.S. presidential election will be over. Regardless of who

emerges as the occupant of the White House for the next

four years, there will be little time to savor the victory as

the attention will quickly shift to the contentious

negotiation to avoid the fiscal cliff. There is a growing

concern that Congress may let the country go off the

fiscal cliff as representatives on both sides of the aisle dig

in their heels on the issue of tax increases for the

wealthy. Should Congress fail to reach a deal by the end

of 2012, federal tax rates will revert to pre-Bush levels,

and there will be across-the-board budget cuts to nearly

all federal government discretionary spending, including

defense. The prospect of a failed negotiation would

therefore create much market anxiety and volatility.

More importantly, the U.S. government needs to

demonstrate to the world that it is serious about tackling

its fiscal challenges, as the status quo is simply not a

credible option. To wit, in fiscal year 2011 the federal

government collected $2.2 trillion in tax revenue, but

spent $3.6 trillion. That means for fiscal 2011 the U.S.

federal government only took in 60 cents of revenue for

each dollar it spent.

On the campaign trail one may get the impression that

all is well if we could just make the rich pay their fair

share of tax. Well, the so-called “Buffett Rule” (30% tax

rate on individuals making more than $1 million a year)

would raise an extra $5 billion to $16 billion a year,

depending on one’s assumptions. The $16 billion upperend estimate would close the budget gap by a whopping

1.1%!

How about cutting non-essential programs such as the

$430 million annual grant to the Corporation of Public

Broadcasting? Well, there are not enough Big Birds when

80% of the federal budget in fiscal year 2011 was taken

up by social security (20%), Medicare/Medicaid/CHIP

We suspect that even the most recalcitrant ideologues do

(21%),

safety net programs (13%), defense-related (20%),

not intend to plunge the U.S. economy into a deep

and interest on debt (6%). The fact

recession. The risk is that our

is that the massive budget gap will

representatives

in

Congress

There are not enough Big

not be materially narrowed until

misjudge their political opponents’

these

big

ticket

items

are

Birds when 80% of the federal

resolve in a game of chicken. An

restructured

and

serious

revenueeasier way out for now may be

budget in fiscal year 2011 was

raising

tax

reforms

are

another temporary stopgap measure

taken

up

by

social

security,

implemented.

It

will

inevitably

lead

to kick the can down the road for a

to a period of shared pain, but the

few more months and buy more time

Medicare, Medicaid,

long-term effect on the economy

for a bipartisan deal, especially if

Children’s

Healthcare

could be so positive that investors

there is a new president. Such a

would be willing to look past shortmove would produce continued

Insurance Program (CHIP),

term setbacks.

policy uncertainty which has the

safety net programs, defense-

effect of discouraging new business

Europe on the Mend

related, and interest on debt.

investments and hiring. More

While the impending fiscal cliff may

cynically, Congress could let Bush

serve

as

a

catalyst

to force the U.S. to embark on

tax cuts expire at the end of 2012, then heroically work

structural reforms to address its fiscal challenges

out a deal to “cut” taxes for the middle class. The new

starting in 2013, the European Union has been working

federal tax rates could be higher than where rates are

hard to maintain status quo. After all, the EU was just

today, but they would nevertheless allow politicians to

awarded the Nobel Peace Prize. To its credit, the effort to

claim credit for fighting for the middle class.

maintain status quo has been quite successful, at least

MONTHLY

MARKET

REVIEW

NOVEMBER

2012

2

for now. Much credit should go to the European Central

Bank President Mario Draghi. His bond buying scheme,

the Outright Monetary Transactions (OMT) program

(ECB buying sovereign bonds of a country that officially

requests assistance), has driven peripheral European

countries’ borrowing costs significantly lower even

though Spain has yet to officially request a bailout. On

October 30, 2012, Italy was able to sell 10-year bonds at

an average yield of 4.92%, which is a huge relief from the

7% level in late 2011. Spain’s 10-year bond yield has also

retreated from the July 2012 peak of 7.5% to 5.6% at the

end of October 2012. Achieving affordable interest rates

to roll over maturing debt is a critical first step in setting

Spain and Italy on the path of fiscal sustainability.

Long-suffering Greece has also seen its bonds mounting

a huge rally with the Greece’s 10-year bond yield falling

from early-March 2012’s 30.6% to 17.3% at the end of

October 2012. German Chancellor Merkel had made a

symbolic visit to Greece in early October 2012, signaling

her intention to help Greece to stay in the Eurozone. One

can argue that Chancellor Merkel will work hard to

minimize the chance of a “Grexit” that could trigger

unintended consequences and even another global

financial crisis. After all, she will be up for re-election in

less than a year. This kinder, gentler Chancellor Merkel

on European sovereign debt issues could go a long way

in changing the market and economic dynamics. It is

reported that the Troika (European Union, European

Central Bank, and International Monetary Fund) is

considering granting Greece a two-year extension to

meet its bailout targets. It may even allow further debt

restructuring. Chancellor Merkel also sided with Mario

Draghi in supporting OMT over the objection of her

handpicked Bundesbank president Jens Weidmann.

With the European sovereign debt crisis seemingly going

into remission for the time being, the European problem

has been reduced to a less intractable recession, which is

more of a cyclical than secular issue. There is also

renewed debate over how much latitude countries facing

economic challenges should have in implementing

austerity, which some believe to be worsening the debtto-GDP dynamic. In short, there may be hope for the

European Union after all, even though the structural

issues (e.g., big disparity in competitiveness between the

North and the South) remain unresolved. Of course, a lot

will depend on a Germany that says more Jå than Nein.

Mixed Earnings Season

The corporate earnings reporting season for the third

quarter of 2012 was mixed at best. Weakness in Europe

and slower growth in China were two major drags on

sales and earnings growth. The artificially low interest

rates engineered by the Federal Reserve also squeezed

many U.S. banks’ net interest margins. There were also a

number of technology product transitions – Windows 8,

iPhone 5, iPad mini – that temporarily disrupted sales.

The looming fiscal cliff may also have curtailed business

investment. One also cannot rule out the possibility of a

mild recession in early 2013, as some government

stimulus schemes will soon expire.

However, there is a silver lining on the horizon, as we

believe the market will likely look past short-term

weakness if there is a credible plan from Washington

D.C. to put America on the path of fiscal sustainability.

The U.S. housing market also appears to be in the midst

of a nascent recovery. With Europe’s sovereign debt

crisis under control and a new generation of leaders

taking over in China, one could argue that these regions

may be poised for a cyclical uptick in the not so distant

future. Interestingly, the common thread across these

regions is that so much depends on policymakers doing

the right things, or avoiding egregious mistakes.

MONTHLY

MARKET

REVIEW

NOVEMBER

2012

3

Rockefeller & Co., Inc. locations:

New York

10 Rockefeller Plaza

3rd Floor

New York, NY 10020

212-549-5100

Rockefeller Trust Company, N.A.

10 Rockefeller Plaza

3rd Floor

New York, NY 10020

212-549-5100

Washington DC

900 17th Street NW

Suite 603

Washington, DC 20006

202-719-3000

The Rockefeller Trust Company (Delaware)

1201 N Market Street

Suite 1401

Wilmington, DE 19801

302-498-6000

Rockit® Solutions, LLC

201 Tresser Boulevard

Suite 200

Stamford, CT 06902

866-497-9111

www.rockitco.com

Boston

99 High Street

17th Floor

Boston, MA 02110

617-375-3300

www.rockco.com

This paper is provided for informational purposes only. The views expressed are of one of Rockefeller &Co., Inc.’s senior portfolio

managers as of a particular point in time and are subject to change without notice. The information and opinions presented herein

have been obtained from, or are based on, sources believed by Rockefeller & Co., Inc. to be reliable, but Rockefeller &Co., Inc.

makes no representation as to their accuracy or completeness. Actual events or results may differ materially from those reflected

or contemplated herein. Although the information provided is carefully reviewed, Rockefeller &Co., Inc. cannot be held

responsible for any direct or incidental loss resulting from applying any of the information provided. Past performance is no

guarantee of future results and no investment strategy can guarantee profit or protection against losses. These materials may not

be reproduced or distributed without Rockefeller& Co., Inc.’s prior written consent.

1

Index pricing information does not reflect dividend income, withholding taxes, commissions, or fees that would be incurred by an

investor pursuing the index return.

2

®

The Russell 2000 Index is a registered trademark of the Frank Russell Company. Frank Russell Company is the owner of the

copyright relating to this index and is the source of its performance value.

Copyright 2012 © Rockefeller & Co., Inc. All Rights Reserved.

MONTHLY

MARKET

REVIEW

NOVEMBER

2012

4