3 Q 1 5 U P D AT E

BLACKROCK MUNICIPAL TARGET

TERM TRUST (BTT)

OCTOBER 2015

manages the maturity of its securities to seek a dollar

weighted effective maturity approximately equal to the

target term trust’s scheduled termination date. Given BTT’s

scheduled termination date of on or about December 31,

2030 and its investment objective, the Trust’s portfolio is

structured to avoid callability, where possible, and its

holdings generally fall around the 15 year part of the yield

curve, currently resulting in a higher duration than a typical

perpetual municipal closed-end fund. BTT has an effective

duration of 9.98 years as of 9/30/2015. The Trust also uses

leverage in seeking to achieve its investment objective,

although the use of leverage creates risks. As of September

30, 2015, the Trust’s portfolio was leveraged 36.64% and

yields 4.71% on market price.

Overview

BlackRock Municipal Target Term Trust (“BTT” or the “Trust”)

is a target term trust that is scheduled to terminate on or

about December 31, 2030, at which time it will distribute

substantially all of its net assets. The Trust’s investment

objectives are to provide current income that is exempt from

regular federal income tax (but which may be subject to the

federal alternative minimum tax in certain circumstances)

and to return $25.00 per common share (the initial public

offering price per common share) to holders of common

shares on or about December 31, 2030. There can be no

assurance that the Trust’s investment objectives, including

to return $25.00 per common share to holders of common

shares on or about December 31, 2030, will be achieved or

that the Trust’s investment program will be successful.

BTT is organized as a closed-end investment management

company and its common shares are listed and traded on

the New York Stock Exchange.

Financial advisors often use the 10 year U.S. Treasury

(“10yr UST”) as a proxy to gauge the movement of interest

rates in the market. While this method is generally accepted,

we believe that using the 10yr UST as a proxy may cause

misperception around investment performance for certain

securities as it does not have a perfect correlation to all

fixed income assets, such as municipal securities maturing

in 2030 or municipal target term trusts like BTT.

The investment universe for a target term trust like BTT is

generally more limited than that of a typical perpetual

municipal closed-end fund, as a target term trust typically

3.1

23.5

2.9

23.0

2.7

22.5

NAV ($)

YIELD (%)

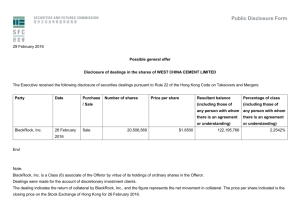

MUNICIPAL YIELDS VS. BTT’S NAV DURING 3Q15

2.5

3/15

4/15

5/15

6/15

7/15

8/15

AAA-Rate 2030 Municipal Bond

22.0

9/15

BTT NAV

Source: BlackRock, Bloomberg and Municipal Market Data (“MMD”). 2030 municipal bond yield is represented by an offering-side AAA-Rated bond as of 9/30/2015 (MMD.15).

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted.

BTT PERFORMANCE ATTRIBUTION

July

August

Sept.

2030 municipal bond yield

2.91%

2.89%

2.84%

Change from previous month

-0.09%

-0.02%

-0.05%

10yr UST yield month-end

2.20%

2.21%

2.06%

Change from previous month

-0.15%

+0.01%

-0.15%

BTT NAV total return

1.51%

0.13%

1.41%

BTT market price total return

3.01%

-1.35%

0.10%

BTT NAV cumulative total

return since inception

8.90%

BTT market price cumulative

total return since inception

-6.17%

BTT NAV annualized total

return since inception

3.05%

BTT market price annualized

total return since inception

-2.22%

BTT Distribution Yield

(Market Price)

4.71%

BTT Tax Equivalent Yield

(Market Price)

7.80%

The inception date of BTT is August 28, 2012.

Performance is net of fees. Fees include management fee,

leverage costs, administrative and other expenses. Source:

BlackRock, Morningstar as of 9/30/15. Performance data

quoted represents past performance and does not guarantee

future results. Investment return and principal value on an

instrument will fluctuate so that an investor’s shares may

be worth more or less than the original cost. The Trust’s market

price and net asset value will fluctuate with market conditions.

All return data assures reinvestment of all distributions. Current

performance may be lower or higher than the performance data

quoted. For more information, please refer to www.blackrock.

com. Tax Equivalent Yield assumes highest tax bracket (39.6%).

statement that factored in international concerns like never

before, stoking worry over global economic conditions. Fixed

income assets rallied, with particular strength in municipal

bonds, led by longer duration and high yield credits. Munis’

positive performance was further aided by the lightest

September issuance in over a decade. New supply for the month

came in at $18.3 billion, which was 23% below the five-year

average and 31% lower than the 10-year average. Meanwhile,

the demand trend seemed to point to a looming sense of

investor uncertainty, with negative flows turning decidedly

positive after the Fed’s decision, only to resume outflows in

the final week of the month. In all, September was marked by

$1.25 billion in outflows, though flows remain positive year-todate at $5.6 billion. For the year, BTT is up 1.41% on NAV and up

5.03% on market price. BTT’s market price has outpaced its’

NAV as its discount has narrowed from -13.85% at the

beginning of the year to -11.08% by the end of September.

Municipal closed-end funds trade at an average discount of

-8.2%. Discounts remained wide and have been persistent

since the “taper tantrum” in the summer of 2013 as investors

remain reluctant to have exposure to long duration assets that

utilize leverage for fear of future interest rate increases.

Portfolio Details as of 9/30/15

}Top 5 States:1

Texas18.6%

Illinois8.9%

California10.6%

Pennsylvania7.2%

Florida9.6%

}Top 5 Sectors:2

Transportation 20.9%

Corporate Muni’s 8.7%

Health 18.3%

School Districts 7.6%

Local Tax-Backed 9.6%

}Maturity Structure:3

3-6 Years

0.3%

6-8 Years

8-10 Years

10-12 Years

6.0%

12-15 Years

24.3%

1.9%

15-20 Years

62.8%

1.1%

Cash and Derivatives3.6%

}Portfolio Characteristics:

The S&P Municipal Bond Index returned 0.74% in September,

bringing the year-to-date total return to 1.72%. Long and

intermediate maturities led their shorter brethren, and high yield

outpaced the broader market. Munis underperformed the more

dramatic move in U.S. Treasuries. This kept muni to- Treasury

ratios above 100% for maturities of 10 years and longer, making

munis an attractive income proposition before and especially

after tax. September featured heightened volatility, fueled by

the Fed’s decision not to raise interest rates and a dovish

Net Assets

$1.62 billion

Managed

Assets

Effective

Duration

$2.55 billion

Percent

Leveraged36.64%

9.98 years

}Credit Quality:4

Cash and Derivatives 3.6%

BBB Rated

AAA Rated or Above

2.9%

18.9%

BB Rated

4.3%

AA Rated

29.7%

B Rated

1.2%

A Rated

35.7%

Not Rated

3.7%

1 As a percentage of managed assets. 2 As a percentage of managed assets. 3 As a percentage of managed assets. Securities deposited into tender option bond trusts use call and

maturity information for the underlying bonds. Securities that have multiple call dates and/or are continuously callable use a rolling call date. 4 As a percentage of managed assets. Please see

“Important Information about the Trust”.

Portfolio statistics are provided by BlackRock as of 9/30/15, unless otherwise specified. For more information, please refer to www.blackrock.com.

What to Keep in Mind

In evaluating BTT’s share price and NAV performance,

we believe that it’s important to recognize several

factors, including:

}The share prices of CEFs can trade independently from

their NAV on a public stock exchange (e.g., NYSE) and have

historically fluctuated due to, among other factors, supply

and demand dynamics in the market.

}CEF market price discounts to NAV often widen during

times of market volatility and uncertainty.

}The use of leverage within a CEF’s portfolio has the

ability to enhance returns, but also poses downside risk,

including the potential of increased share price and

NAV volatility.

}BTT is managed as a target term trust with an investment

objective to return $25 per common share (the initial

offering price per common share) to common shareholders

on or about December 31, 2030, its scheduled termination

date. There can be no assurance that this investment

objective will be achieved or that the Trust’s investment

program will be successful.

On July 1st 2014, BTT announced a distribution reduction

from $0.093750 per share to $0.080000 per share.

The distribution reduction reflects the Trust’s current and

projected earnings potential when considering BTT’s

investment objective of returning $25 per common share

(the initial public offering price per common share) to

common shareholders at maturity. There can be no

assurance that this investment objective will be achieved

or that the Trust’s investment program will be successful.

As of 8/31/2015 the trust had a 3 month average earned

rate of $0.090976 per share and was paying a distribution

of $0.080000.

BlackRock believes that given BTT’s investment objectives,

the steepness of the municipal yield curve and low short

term rates, that it is prudent to use leverage for BTT. Low

short term rates may provide a CEF with an attractive cost of

financing. Many CEFs, including BTT, pay a spread over the

SIFMA rate that floats on a weekly basis. As of September 30,

2015, the SIFMA rate stood at 2 bps. The use of leverage

involves risk.

WHY BLACKROCK®

BlackRock helps people around the world, as well as the world’s largest institutions and governments, pursue their

investing goals. We offer:

}A comprehensive set of innovative solutions, including mutual funds, separately managed accounts,

alternatives and iShares® ETFs

} Global market and investment insights

} Sophisticated risk and portfolio analytics

We work only for our clients, who have entrusted us with managing $4.5 trillion, earning BlackRock the distinction

of being trusted to manage more money than any other investment firm in the world.*

* Source: BlackRock. Based on $4.5 trillion in AUM as of 9/30/15.

Want to know more?

blackrock.com

Important Information About the Trust: All information and data, including portfolio holdings and performance characteristics, is

as of 9/30/15, unless otherwise noted, and is subject to change.

Closed-end fund shares are not deposits or obligations of, or guaranteed by, any bank and are not insured by the FDIC or any

other agency. Investing involves risk, including possible loss of principal amount invested. This is not a prospectus intended for

use in the purchase or sale of Trust shares. Shares may only be purchased or sold through registered broker/dealers. For more

information regarding any of BlackRock’s closed-end funds, please call BlackRock at 800-882-0052. No assurance can be given

that a fund will achieve its investment objective.

The market value and net asset value (NAV) of a fund’s shares will fluctuate with market conditions. Closed-end funds may trade

at a premium to NAV but often trade at a discount. CEF shares are bought and sold at “market price” determined by competitive

bidding on the stock exchange. Net asset value (NAV) is the value of all fund assets, less liabilities divided by the number of shares

outstanding. Some BlackRock CEFs may utilize leverage to seek to enhance the yield and net asset value of their common stock,

through bank borrowings, issuance of short-term debt securities or shares of preferred stock, or a combination thereof. However,

these objectives cannot be achieved in all interest rate environments. While leverage may result in a higher distribution for the

fund, the use of leverage involves risk, including the potential for higher volatility of the NAV, fluctuations of distributions paid by

the fund and the market price of the fund’s common stock, among others.

Before investing in the Trust’s common shares, you should consider the risks associated with an investment in the Trust carefully. There may be less information available on the financial

condition of issuers of municipal securities than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Municipal obligations are subject to

the risk of non-payment. Many state and municipal issuers are under significant economic and financial stress. A portion of the income received from the Trust may be taxable. Some

investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable. The Trust may utilize leveraging to seek to enhance the yield and net asset

value of its common stock, as described in the Trust’s prospectus. These objectives will not necessarily be achieved in all interest rate environments. The use of leverage involves risk,

including the potential for higher volatility and greater declines of the Trust’s net asset value, fluctuations of dividends and other distributions paid by the Trust and the market price of the

Trust’s common stock, among others. The Trust’s limited term may cause it to sell securities when it otherwise would not, which could cause returns to decrease and the market price

or NAV to fall. In addition, the Trust’s limited term may cause it to invest in lower yielding securities or hold cash or cash equivalents which may adversely impact performance. For more

information, please refer to the Trust’s prospectus which can be found on www.sec.gov.

The implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) may result in a reduced availability for certain types of leverage

and/or increase the costs associated with certain types of leverage.

BlackRock receives credit quality ratings on underlying securities of the Trust from the three major reporting agencies - S&P, Moody’s and Fitch. The credit quality breakdown is provided

by BlackRock by taking the median rating of the three agencies when all three agencies rate a security. BlackRock will use the lower of the two ratings if only two agencies rate a

security, and BlackRock will use one rating if that is all that is provided. Securities that are unrated by all three agencies are reflected as such in the breakdown. Below investment-grade

is represented by a rating of BB and Below. BlackRock converts all ratings to the equivalent S&P major rating category for purposes of the category shown. Ratings and portfolio credit

quality may change over time. Unrated securities do not necessarily indicate low quality, unrated securities do not have an assigned credit rating. The Trust itself has not been rated by an

independent rating agency.

Municipal Market Data (MMD) – Thomson Reuters, MMD is the premier source for tax-exempt data and analysis including the industry benchmark yield curves, analytics and in depth

analysis on the municipal and treasury cash and derivatives markets.

©2015 BlackRock, Inc. All Rights Reserved. BLACKROCK and iSHARES are registered trademarks of BlackRock, Inc. All other trademarks are those of their respective owners.

Prepared by BlackRock Investments, LLC, member FINRA.

Not FDIC Insured • May Lose Value • No Bank Guarantee

3150B-CEF-0915 / CEF-0179-1015