MGM Resorts International - Scholarworks @ CSU San Marcos

MGM Resorts International

MGM Resorts International: Linking Strategy and Organizational Learning for Long-

Term Growth

Case Study

Luiza Dogariu, Melissa Horning, Natalie Maurer

California State University San Marcos

Master's Project

BA 690

Prof. Martin J. Gannon

April 13, 2013

1

MGM Resorts International 2

Executive Summary

MGM Resorts International, a reputable Fortune 500 global hospitality company operating a diverse portfolio of destination resort brands, needs to redefine its identity within the hospitality and casino entertainment industry, and seek opportunities that enable long-term sustainability.

This case analysis will focus on the strategic management process and strategic planning at MGM Resorts International, comprising of a situation analysis (of the general environment, industry environment, competitor environment, and internal environment), strategy formulation, strategy implementation, and reactions of competitors. The strategic direction manifested in

MGM’s mission, vision, and values, combined with the knowledge gained from this strategic analysis, will be used to develop competitive strategies, as well as plans for implementing them.

In the pursuit of strategic competitiveness and above-average returns, the proposed corporate-level strategy will address growth from two perspectives: (1) an external perspective that involves business expansion in markets fueling future growth and profitability; (2) an internal organizational perspective where training and development (T&D) becomes a core competency, involving a shift from functional HR to strategic HR, and leading to a unique high level of customer service (Signature Engagement at MGM).

The goal of the proposed strategy is for MGM Resorts International to become a learning organization, encouraging individual learning and development though shared information, culture, training, and leadership.

MGM Resorts International

Table of Contents

1.

INTRODUCTION............................................................................................ 5

2.

STRATEGIC MANGEMENT PROCESS AT MGM .................................. 6

3.

GENERAL ENVIRONMENT ANALYSIS ................................................... 7

3.1.

Demographic.............................................................................................. 7

3.2.

Economic.................................................................................................... 9

3.3.

Physical ...................................................................................................... 9

3.4.

Political/Legal.......................................................................................... 10

3.5.

Sociocultural ............................................................................................ 10

3.6.

Technological ........................................................................................... 11

3.7.

Global ...................................................................................................... 11

4.

INDUSTRY ENVIRONMENT ANALYSIS ............................................... 12

4.1.

Threat of New Entrants ............................................................................ 12

4.2.

Power of Suppliers ................................................................................... 14

4.3.

Power of Buyers ....................................................................................... 14

4.4.

Product Substitutes .................................................................................. 14

4.5.

Intensity of Rivalry ................................................................................... 15

5.

COMPETITOR ENVIRONMENT ANALYSIS ......................................... 15

5.1.

Strategic Group Map ............................................................................... 16

5.2.

Types of Competitors ............................................................................... 17

5.3.

Market Share Analysis ............................................................................. 22

6.

MGM UPDATE ............................................................................................. 24

7.

MGM’S CURRENT AND PROJECTED STRATEGY ............................. 27

8.

COMPETITOR UPDATE ............................................................................ 29

8.1.

Las Vegas Sands ...................................................................................... 29

8.2.

Wynn Resorts Ltd ..................................................................................... 29

8.3.

Penn National .......................................................................................... 30

8.4.

Boyd Gaming Corp .................................................................................. 30

8.5.

Caesars Entertainment Corp ................................................................... 31

9.

CAESARS’ CURRENT AND PROJECTED STRATEGY ....................... 32

10.

GROWTH SHARE MATRIX ...................................................................... 33

11.

INTERNAL ENVIRONMENT ANALYSIS ............................................... 35

11.1.

Four Cell Matrix ...................................................................................... 35

3

MGM Resorts International

11.2.

Quadrant 1 ............................................................................................... 37

11.3.

Quadrant 2 ............................................................................................... 41

11.4.

Quadrant 3 ............................................................................................... 45

12.

EXTERNAL THREATS AND OPPORTUNITIES ................................... 47

13.1.

Threats ..................................................................................................... 47

13.1.

Opportunities ........................................................................................... 50

13.

BLUE OCEAN STRATEGY ........................................................................ 52

13.1.

Strategy Canvas and Strategy Curves...................................................... 52

13.2.

Four Actions Framework ......................................................................... 54

14.

STRATEGY FORMULATION .................................................................... 58

14.1.

Strategic Actions and Tactical Actions .................................................... 58

14.2.

Strategic Action 1 ..................................................................................... 62

14.3.

Strategic Action 2 ..................................................................................... 63

15.

STRATEGY IMPLEMENTATION ............................................................ 66

15.1.

Strategic Action 1 ..................................................................................... 67

15.2.

Strategic Action 2 ..................................................................................... 68

16.

POSSIBLE COMPETITOR REACTIONS ................................................ 71

16.1.

Strategic Action 1 ..................................................................................... 71

16.2.

Strategic Action 2 ..................................................................................... 74

17.

MGM AS A LEARNING ORGANIZATION ............................................. 76

18.

CONCLUSION .............................................................................................. 77

4

MGM Resorts International 5

Company Introduction

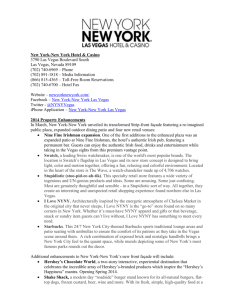

MGM Resorts International (MGM) is a reputable Fortune 500 global hospitality company, operating a diverse portfolio of destination resort brands, divided into two reportable segments: Wholly Owned Domestic Resorts and MGM China. Through its Wholly Owned

Domestic Resorts segment, the company owns, manages, and operates 15 wholly owned resorts in Mississippi, Nevada and Michigan in the United States. The resorts consist of Bellagio, MGM

Grand Las Vegas, Mandalay Bay, The Mirage, Luxor, Excalibur, New York-New York, Monte

Carlo and Circus Circus Las Vegas, in Las Vegas, Nevada; Circus Circus Reno, Gold Strike and

Railroad Pass in other regions of Nevada; MGM Grand Detroit in Michigan; Beau Rivage and

Gold Strike in Mississippi. Additionally, the company has 50% investments in other properties in Illinois and Nevada. For the second segment, MGM owns 51% of MGM China Holdings,

Ltd. that operates MGM Macau Resort and Casino. Through MGM Hospitality, the company operates MGM Grand Sanya on Hainan Island in China and MGM Grand Ho Tram in Vietnam.

According to its mission statement, “MGM is the leader in entertainment and hospitality - a diverse collection of extraordinary people, distinctive brands and best in class destinations.

Working together, we create partnerships and experiences that engage, entertain and inspire”

(2012 MGM Annual Report, 2013, p. 4). The company has a high brand recall which provides it with a distinct advantage in competing with other major casino resorts brands, thus enabling it to draw more customers.

The MGM vision is “to be the recognized global leader in entertainment and hospitality.”

In order to achieve this vision, the organization is committed to the following guidelines: (1)

Embrace innovation and diversity to inspire excellence, (2) Reward employees, invest in

MGM Resorts International 6 communities, and enrich stakeholders, and (3) Engage, entertain, and exceed the expectations of guests worldwide (2012 MGM Annual Report, 2013, p. 4).

The primary business of MGM is the ownership and operation of casino resorts, which includes the following business groups: gaming, hotel, convention, dining, entertainment, retail, and other resort amenities. Most of the MGM revenue is cash-based, through customers wagering with cash or paying for non-gaming services with cash or credit cards. MGM relies heavily on the ability of its resorts to generate operating cash flow to repay debt financings, fund capital expenditures, and provide excess cash flow for future development.

Strategic Management Process at MGM

As stated in the Hitt textbook case, “MGM is at a crossroads that could provide the opportunity for a timely strategic evaluation; it needs to reevaluate its identity within the industry and seek opportunities that enable long-term sustainability” (Hitt, Ireland, & Hoskisson, 2013, p.

231).

Generally speaking, the strategic management process is an ongoing, dynamic process consisting of four key elements: situation strategic analysis, strategy formulation, strategy implementation, and strategy evaluation. At MGM, the strategic direction manifested in the company’s mission, vision, and values, combined with the knowledge gained from the strategic analysis, must be used to develop competitive strategies, as well as plans for implementing them.

Change is the way of life nowadays. Knowing what forces are driving the change is essential to achieving competitive advantage and above-average returns. Some factors driving change in the hospitality and casino entertainment industry are capacity control, technology, assets and capital, new management, safety and security, social responsibility, and sustainability.

These forces are creating ripples throughout the globe and changing the way the industry

MGM Resorts International 7 competes. In their classic bestselling book, Competing for the Future , contemporary strategists

Hamel and Prahalad suggest that companies must stop thinking about the past and compete for the future. To do this, MGM must reinvent its strategies. To be effective in tomorrow’s competitive and complex environment, MGM must invest in its human capital and develop a workforce whose members adopt a forward-looking philosophy. Strategies are discussed in this paper how MGM can grow with the industry as it changes.

An example of a metaphor that describes the need for anticipating the future and monitoring change is the “rearview mirror” perspective. This metaphor suggests that most people and organizations look at the future from this perspective, trying to interpret the future by looking at the past. Think of the danger of driving down a crowded superhighway looking mostly in the rearview mirror. The distractions that are behind can often limit the ability to develop a clear vision of the future, especially if the driver needs to anticipate fast-moving changes ahead. Most drivers know better and look as far down the road as they can to anticipate these, yet many companies today ignore the need to foresee the immediate and long-term future, and rely too heavily on experiences that have served them well in the past, but are not relevant in today’s or tomorrow’s business environment (Olsen, West, & Ching Yick Tse, 2008, p. 64).

General Environment Analysis

Demographic: 2, of some importance

When MGM attempts to increase business by directing its efforts towards a specific demographic segment, it has three main groups to target: Baby Boomers, Generation X, and

Generation Y.

Baby Boomers have finished raising their children and are nearing retirement age. These customers visit casinos and other entertainment venues because they want to gamble, although

MGM Resorts International 8 they also enjoy dining at fine restaurants and experiencing the live shows (Haussman, 2010, web). This age group is relatively resistant to change, meaning they are loyal customers to one hotel or chain (Las Vegas Visitor Demographics, 2010, web). This demographic group knows what they want out of retirement, a lively and entertaining experience, and choose to make several vacation trips a year. Although they are only approximately a quarter of the population of the US, their influence makes up approximately half of the discretionary income. This industry should focus on this older demographic to attain that large part of the market share.

Generation X is approaching the climactic point in their careers. Contrary to their baby boomer parents, Generation X often moved in their careers and communities, causing them to be accepting of change and less loyal (Sherman, 2010, web). These customers are continuing to move up the corporate ladder and are looking for similar activities as their parents in enjoying the dining, entertainment and gambling aspects of casinos. However, since they are not yet established in their careers and have other monetary obligations, this demographic is looking for the same experience at a reasonable price (Las Vegas Visitor Demographics, 2010, web). This demographic is looking for activities appropriate for multiple ages because they vacation as a family. Their vacation time is limited by a focus on careers, so this age group vacations the least amount of the three age groups. However they are still important for the industry to positively influence as they are nearing retirement age.

Lastly, Generation Y is looking for a considerably different experience when visiting entertainment venues. They are highly tech savvy and network through media such as Facebook and text messaging, which makes them bored very quickly and hard to market to (Sherman,

2010, web). Contrary to the other generations, these customers do not have as much disposable income and prefer to share a hotel room with friends (Haussman, 2010, web). Their

MGM Resorts International 9 entertainment comes from partying all day and night, and this age group is more concerned with bottle service and being seen at the right parties. They prefer to spend their money on bottle service at clubs instead of the shows and exquisite dining opportunities (Las Vegas Visitor

Demographics, 2010, web). They travel in large groups within the same age range and tend to make more frequent, shorter trips.

Economic: 1, of high importance

Economic factors strongly influence entertainment resorts such as MGM. Industry growth was notably slowed by the recession in the United States. As people’s disposable income decreased, casinos/entertainment venues and restaurants experienced fewer travelers and visitors.

However, domestic gaming-focused destinations and Asian properties were thriving during this time (Hitt et al., 2013, p. 244). Having properties both domestically and internationally has allowed the company to fare well through the economic recession in the US. Fortunately, experts are reporting that trends are looking up for MGM and Las Vegas casinos moving forward. In fact, the company reports that their new properties show an increased demand that puts them in a favorable market position (Las Vegas Visitor Demographics, 2010, web). With room rates in Las Vegas trending upward and the international hotel market also in high demand,

MGM continues to have financial improvements.

Physical Environment: 1, of high importance

The physical environment is an important feature of any casino or entertainment venue.

Guests need to feel welcomed and excited in a way that encourages them to return. It must be upscale, clean and inviting. Attractions such as wild animals, rain forests or other living creature exhibits help the overall brand appear high class. Large statues, fountains, and other aspects of

MGM Resorts International 10 the casino help give it the ‘Wow’ effect that causes guests to return (Gambling Marathon, n.d., web).

Political/Legal: 2, of some importance

There are some political and legal factors that contribute to the hospitality and casino entertainment industry. There are multiple organizations that affect the business with different acts, regulations and local ordinances. For example, the Nevada Gaming Control Act, Nevada

Gaming Commission, Nevada Gaming Control Board, Clark County Liquor and Gaming

Licensing Board, and more control gaming in Las Vegas, Nevada. Internationally, the government in Macau imposes similar regulations through the Macau Gaming Authorities (2012

MGM Annual Report, 2013, web).

Sociocultural: 1, of high importance

Understanding social and cultural norms is critical for the hospitality and casino entertainment industry overall. The image of casinos and MGM entertainment venues in Las

Vegas has changed from a gambling, smoking and late night place to a family vacation destination. For example, seasonal holiday promotional packages are prepared to entice family vacationers. Also, diversity of experiences and entertainment options expand as people enjoy doing more diverse activities. Health consciousness has become a larger factor in vacation destination, and MGM has responded by increasing availability of healthy food selections

(MGM Resorts International Website, 2013, web). Also, international cultures have different needs and desires, so the casino entertainment industry must have an understanding of different cultural influences to effectively operate the business domestically and overseas (Scholars

Archive, 2011, web).

Technological: 2, of some importance

MGM Resorts International 11

Technology influences many aspects of casino and entertainment venues that MGM runs.

Customers use and enjoy various technology applications and benefits during their stay. For example, the slot machines continue to develop and become a more prominent part of the experience. Security features of the hotel are also an important aspect of the gaming industry.

MGM must have the most updated security systems to ensure their customers are safe and their own assets are protected. Internet technologies and other media sources represent the main avenue used for marketing and attracting new customers. However, the technology aspects are not a critical business feature of the company. Generally speaking, people do not visit the casino or entertainment center for the latest technology, but they are looking for stellar customer service and a fun experience. Therefore, technology is ranked as only a moderately strong factor affecting the industry.

Global: 1, of high importance

The current state of global affairs is a major factor for the hospitality and casino entertainment industry. Globalization, terrorism threats, and international events and conventions are determining factors people use in their decision to travel. If terrorism is high, people will be scared to travel and are less inclined to visit MGM properties. Terrorism and other factors of globalization cause safety and security to be an important aspect of the casino and hotel properties so guests feel comfortable (Scholars Archive, 2011, web). Expanding their business to Asian markets has proven to be an effective endeavor for the hospitality and casino entertainment industry, so companies such as MGM need to be aware of these factors. Holding meetings and conventions on their properties will increase the number of visitors and will also give them additional press exposure for marketing purposes. The hospitality and gaming industry in Macau, China has already begun to expand similarly as Las Vegas, Nevada.

MGM Resorts International 12

Alternatively, countries such as the Philippines experience corruption and poor regulation that should deter US companies from expanding into those areas. Culture is also a significant factor when companies are considering doing business internationally. What is acceptable in one country is completely unacceptable in another. Even minor discrepancies can cause major offenses in different cultural interpretations. For example, the equality of men and women in the workplace are prevalent in the US. In overseas companies, this is not always the case. In countries such as India, women are not allowed to work. Even a simple gesture such as a handshake would not be an acceptable practice between genders. Conversely, Nordic countries are similar to the US, even overcoming the gap where women have the dominant position in the marketplace (The Economist, 2011, web). These factors should all be considered when companies are looking to broaden their borders for global expansion.

Industry Environment Analysis

Compared with the general environment, the industry environment has a more direct effect on MGM’s strategic actions. According to Porter’s model, the five forces of competitive strategy include the threat of new entrants, the power of suppliers, the power of buyers, product substitutes, and intensity of rivalry among competitors. “By studying these forces, the firm finds a position in the industry where it can influence the forces in its favor or where it can buffer itself from the power of the forces in order to achieve strategic competitiveness and earn aboveaverage returns” (Hitt et al., 2013, p. 63).

Threat of New Entrants: 3, of limited importance

In terms of the threat of new entrants (rated 3, of limited importance), the US hospitality and casino entertainment market is currently saturated with rooms and gaming space, and it is estimated to be several years before this capacity is absorbed. Consequently, it is highly unlikely

MGM Resorts International 13 that there will be many new entrants to the industry. Some of the barriers to entry are government regulation (due to a highly regulated industry), capital requirements, and switching costs. The cost of developing a large new casino can be as high as $550 million to $600 million initially, depending on the casino gaming area and the number of hotel rooms provided. Industry growth overall has been notably slowed in Las Vegas by the most recent recession. After the recession, domestic gaming-focused destinations and Asian properties have been thriving. This is an area of opportunity for growth for MGM.

In terms of domestic operators in foreign markets, globalization within this industry is low, largely due to major operators not generating significant revenue internationally. Part of these weak market conditions come from restrictions in some countries that do not allow the operation of casinos with hotels. Other regulations abroad that hinder globalization include restrictions on maximum ownership or shareholding by any one person or company, as well as on foreign-ownership levels in this industry. Nonetheless, many US-based operators have expanded abroad. International resorts owned by MGM include the MGM Grand Macau in

China (opened 2007) and a number of properties in the planning stages in Dubai. Las Vegas

Sands also owns the Sands Macau (opened 2004), Venetian Macau (opened 2007) and Marina

Bay Sands in Singapore (opened 2010). There are no major foreign casino operators in the

United States. While this industry is subject to a low level of globalization, expansion abroad is increasing as major US operators continue to pursue revenue and profit growth from international markets.

Power of Suppliers: 2, of some importance

From the power of suppliers perspective (rated 2, of some importance), there are two major categories that need to be taken into consideration: hospitality-related supplies and

MGM Resorts International 14 casino/gaming specific supplies. For hospitality-related supplies (from food to sheets and soap etc), there is a large variety of suppliers to choose from, and casinos/hotels are often able to leverage the relationship. Therefore, supplier power is low. For casino/gaming specific supplies

(such as slot machines etc), there is a small number of suppliers and a tough battle between them.

Therefore, supplier power is high because suppliers are large and few in number, and their products are critical to buyers’ marketplace success.

Power of Buyers: 2, of some importance

The power of buyers (rated 2, of some importance), hotels/casinos in this case, increases when they purchase a large portion of an industry’s total output and the purchases are a significant portion of a seller’s annual revenues. Buyers are usually concentrated, with significant market share, as in the case of MGM and its major competitor Caesars Entertainment

Corporation (Caesars).

Product Substitutes: 1, of high importance

A substitute can be described as something that can take the place of the MGM product without having an impact on the satisfaction of the customer, as it is a complete replacement.

The threat of substitute products (rated 1, of high importance) is present if there are alternative products available to the customer that can satisfy the need of the customer at prices better than the existing products or if these products can better satisfy the required performance parameters of the clients for the same or better price. As a result of this, the opposition could potentially draw a considerable percentage of the market segment and thus drive down the prospective sales volume of existing market proponents. Therefore, MGM needs to develop core capabilities that are rare, valuable, difficult to imitate, and non-substitutable, thus becoming core competencies leading to sustainable competitive advantage.

MGM Resorts International 15

Intensity of Rivalry: 1, of high importance

The intensity of rivalry is high (rated 1, of high importance) within the hospitality and casino entertainment industry. The rivalry among the largest hotel/casinos has been fueled by desperate attempts to stay economically viable in a difficult time. Hotels/casinos seek to differentiate their products in ways that customers value and in which the firms have a competitive advantage. Common rivalry dimensions are price, branding, service, and innovation. According to Porter, the intensity of rivalry is one of the main forces that shape the competitive structure of an industry. A larger number of companies within the hospitality industry increases rivalry because more companies must compete for the same customers and resources. The rivalry intensifies if the companies have similar market share, leading to a struggle for market leadership, as in the case of MGM and Caesars. Strategic stakes are high when a company is losing market position or has potential for great gains; this also intensifies rivalry.

Competitor Environment Analysis

The hospitality and casino entertainment industry is highly competitive in nature and is characterized by competitors that vary considerably by their size, quality of facilities, number of operations, brand identities, marketing and growth strategies, financial strength and capabilities, level of amenities, management talent, and geographic diversity. Most of the competitors described in the Hitt textbook case have similar strategies that focus on growth in the industry and committed customer service. The case discusses five primary competitors: Las Vegas

Sands, Wynn Resorts Ltd., Penn National, Boyd Gaming Corporation, and Caesars. The selected competitor to be studied will be Caesars.

MGM Resorts International 16

The first step in analyzing the competitor environment is to establish a two-dimensional strategic group map for the industry, by clustering competitors into a small number of competitive groups. The competition within the strategic group is greater than the competition between strategic groups. The Strategic Group Map below shows MGM and Caesars as direct competitors, competing for overall market share and overall guest/customer satisfaction.

Figure 1

Strategic Group Map

Hospitality and Casino Entertainment Industry

100%

High

INTERNET

• Online Gaming

• Booking Services

• MGM

• CAESARS

• WYNN

• LVS

• Penn

• Boyd

• Tribal

Casinos Low

0%

0% Low High 100%

Overall Market Share

What is important here is that firms cannot compete without financial resources.

Knowing the financial position of all competitors in the strategic group gives MGM a clear view of what the competitive landscape will look like in the future. This clearly serves well in making important resource allocation decisions. Beyond the financial analysis and comparison, MGM needs to also look at all the other functional areas of the business to determine who is the strongest relative to marketing, human resources, operations, administration, and research and development. In other words, MGM has to invest in learning what key performance indicators

MGM Resorts International 17 are in each of these functional areas and how the company compares to competitors, in particular to Caesars.

Once the competitors have been mapped into strategic groups, it is then necessary to define the type of competition and the level of threat that MGM is faced with. The table below identifies three different types of competitors (immediate, impending, and invisible) and gives each competitor a rating of 1, 2 or 3 based on the level of threat.

Figure 2

Immediate competitors are those that currently exist in the hospitality and casino entertainment industry. These companies are viewed as major players, have a publicly established market share, and a high knowledge base of the industry. Falling within the immediate competitors are Caesars, Las Vegas Sands, and Wynn Resorts Ltd. Caesars is classified as a level 1 immediate competitor. This means that the company is viewed as the most threatening to MGM’s business. Both companies fight for a large portion of the market share and use similar strategies to attract business. Las Vegas Sands is rated as a level 2 threat. The company is not viewed as threatening as Caesars, but maintains a large portion of the market share and has a very high knowledge base of the industry. Las Vegas Sands has the potential to become a level 1 immediate competitor if a strategy is developed that can trump both Caesars and MGM. Currently, Las Vegas Sands’ strategy is a convention-centered approach which has the potential to attract more business with the recent recovery of the economy. Like Las Vegas

Sands, Wynn Resorts is also rated as level 2 immediate competitor. The company has been in

MGM Resorts International 18 the hospitality and casino industry since the boom of Las Vegas Boulevard, yet mostly maintains a domestic presence concentrated in Las Vegas, Nevada.

The second type of competitors that are analyzed are the impending competitors.

Impending competitors are those that are considered smaller players in the industry with a medium knowledge base, but are taking strides to increase their market share. On the other hand, impending competitors can also be major players from other related industrial segments that are announcing entry into the hospitality casino market. The impending competitors of

MGM are Penn National, Boyd Gaming, and Tribal Casinos. Penn National and Boyd Gaming are major players when it comes to gaming, but have less knowledge in the hospitality segment.

About 90% of Penn National’s revenue comes from gaming (mid-sized casinos and racetracks), whereas only about 10% comes from non-gaming (Wikinvest, n.d., web).

Penn National also has a history of recording higher revenues than Boyd Gaming does. The company focuses mostly on slot machine gaming and medium sized casino acquisitions. In the last two years,

Penn National acquired the M Resort on the Las Vegas Strip and Harrah’s St. Louis. Below is a chart of Penn National’s Company Summary. As a result of their entrance into resort style hospitality, plus a small international presence in Canada, Penn National is rated as a level 1 impending competitor. The threat level increases if the company focuses on a wider demographic instead of just the local population.

Figure 3

(Penn National, 2012, web)

MGM Resorts International 19

Like Penn National, Boyd Gaming also operates 22 casinos and has a domestic presence in only eight states. The company owns 5,000 hotel rooms overall, yet they only just built their first full scale resort to appeal to Las Vegas locals. To the company’s detriment, Penn National recently sold the iconic Sahara to SBE Entertainment, a hospitality and entertainment empire

(Vegas Inc., 2013, web). This sale weakened Boyd Gaming’s presence on the Strip, but is a testament to the fact that the company typically likes to operate in locations where there are few competitors (Seeking Alpha, 2012, web). Their closest casinos to the Las Vegas Strip are The

Orleans and Gold Coast. Boyd Gaming has been vocal about their intention to pursue opportunities in both their existing business and new opportunities (Boyd Gaming, n.d., web).

Currently, Boyd Gaming is considered a level 2 impending competitor. If Boyd Gaming expands their operations internationally and continues to develop resort style casinos, then there is a potential of progressing to a level 1 impending competitor. To progress even further, Boyd

Gaming would need to market towards a wider demographic base in order to be considered an immediate competitor of MGM.

The third impending competitor analyzed is tribal casinos. The casinos located on Indian reservations in California pose the biggest threat to MGM. Due to the proximity of California to

Las Vegas and the fact that a high concentration of MGM’s casino hotels are located on The

Strip, tribal casinos are rated as a level 2 impending competitor. Another factor that makes tribal casinos a threat is the fact that the company’s primary competitor, Caesars, manages three casinos on Indian land in the US. In 2010, the Indian hotels and motels industry grew by 16.5% reaching a value of $15.7 billion (Market Line, 2012, p. 6). Over the next five years it is anticipated that the value will double (Market Line, 2012, p. 6). The best way for MGM to enjoy revenue from and to reduce the threat of Indian reservation casinos is to form alliances with

MGM Resorts International 20 them. In the company’s 2012 annual report, MGM announced an agreement with the

Mashantucket Pequot Tribal Nation (MPTN) to use the “MGM Grand” brand name for one of the casino resorts located on the Indian reservation. Forming strategic alliances like the one with

MPTN will help expand the MGM brand while, at the same time, build relationships with one of their competitors.

The invisible competitors of MGM are a bit trickier to uncover. Invisible competitors are typically those that are big players in an unrelated industry that are considering an unanticipated or secret move into the hospitality and casino entertainment industry. These types of competitors also tend to have a low knowledge base. Our research revealed two possible invisible competitors: (1) online gaming, and (2) internet travel and booking services.

Online gaming has been around since about 1994 when the government of the Caribbean nation of Antigua and Barbuda passed the Free Trade & Processing Act, which allowed the issuance of licenses to companies that wanted to open online casinos (Online Gambling, n.d., web).

As a result of the new act, the first online gaming software provider was founded,

Microgaming. It was only a matter of time before other online casino outlets began to emerge.

There are now thousands of internet gaming websites and new online gaming businesses appear every day (Vegas Inc., 2013, web). Most online gaming is done in the form of video poker, roulette, black jack, sports betting, bingo, and lotteries. Online gaming is allowed in over 70 countries including, Australia, South Korea, France, Germany, Israel, and some provinces in

Canada (How Online Gambling Works, 2005, web). However, it is the responsibility of the players to know whether or not it is legal in their country to gamble online. Because of this, online gaming is very difficult to regulate and, often times, no action is taken against an offender. It is estimated that 30 million gamblers visited internet gambling sites in 2005 and, in

MGM Resorts International 21

2010 around $14 billion was seen in revenues (University of North Carolina, n.d., web).

Revenues for 2012 were estimated to reach amounts as high as $100 billion (IntelLogix, n.d., web). In China alone, 43% of internet users go online for the sole purpose to gamble. This statistic is just a glimpse of the possible effect that it could have in the United States. It is clear that the online gaming industry is growing incredibly fast with the potential for astronomical revenues. Nonetheless, it is currently illegal to participate in online gaming in the United States, and therefore it is not considered a major threat just yet.

In the end, online gaming is an invisible competitor to MGM when it comes to the casino entertainment industry in the US. Our analysis rates online gaming as a level 1 threat under invisible competitors. However, if online gaming becomes legal in the US, then the casino entertainment industry will be extremely vulnerable to losing a large portion of market share.

Nonetheless, it should be noted that online gaming will only be an equal competitor to MGM if somehow a way is found to offer hospitality and entertainment services in conjunction with online casinos and gambling. Conversely, MGM could potentially overcome an attack from online gaming if it actually came up with a unique MGM online casino. For the time being, this option would only be feasible abroad. However, if gaming ever does become legal in the US, then MGM will already be prepared with the infrastructure and the resources to enter online gaming. In essence, MGM will be one step ahead of similar competition.

That brings us to the second potential invisible competitor of MGM, internet travel and booking services. It would be unanticipated for this type of industry to cross over into gaming and entertainment. However, if the restrictions on online gaming are lifted in the U.S, then internet travel and booking services could threaten MGM’s business. As a result, a rating of 2 is applied to the threat level of internet and travel booking services. Nonetheless, like tribal

MGM Resorts International 22 casinos, internet travel and booking services can be seen as another opportunity for MGM to build strategic alliances.

Now that each competitor has been defined in detail, a further analysis can be performed by comparing MGM’s market share to each competitor’s market share over a period of time.

Our analysis dates back five years to 2008, just after the fall of the economy. The year 2007 and

2008 showed plummeting revenues for the entire industry, but as the years have gone by, things have slowly picked up. To date, MGM and Caesars are considered the major players in the US hospitality and casino entertainment industry. Data reveals that for the year 2012, the two companies alone hold almost 30% of the market, MGM with 12% and Caesars with 17.2%

(IBISWorld, 2013, p. 21). The market share for these businesses was calculated by dividing individual annual revenues by total industry revenues for each year, 2008 through 2012. The total industry consists of 260 businesses with revenues averaging $45.6 million over the course of five years. Other competitors of MGM, such as Las Vegas Sands, Wynn, Penn National and

Boyd Gaming, hold approximately 20% of the market share combined. Overall, six casino hotel companies alone carry almost 50% of the entire market share of the industry. The graph below illustrates each competitor’s market share.

MGM Resorts International 23

Figure 4

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

50%

4%

2%

21%

3%

15%

2008

Total U.S. Market Share

52%

4%

20%

3%

14%

2009

51%

5%

19%

3%

13%

2010

51%

5%

18%

4%

13%

2011

51%

5%

18%

4%

13%

Other

Boyd

Penn

Wynn

Caesars

LVS

MGM

2012 * percentatges are rounded

It can be seen by looking at the graph that both MGM’s and Caesars’ market share has slowly declined. This decline can be attributed to their high debt and leveraged positions, to other players entering the market, and strengthened strategies by competitors. To circumvent the declining market share, MGM must come up with a way to expand and create new sources of revenue so as to be able pay off the interest on their debt and still come out ahead. The only way for a company to expand is to be able to have cash that can be invested into new projects.

It becomes difficult to invest in new projects when a company has extremely high debt and interest that, on its own, is wiping out a positive EBITDA. MGM’s primary competitor,

Caesars, “essentially has no cash coming in to pay taxes, maintain its properties, or invest in new projects” (Calvin Ayre, 2012, web). As a result, the company has evolved into what industry analyst, Calvin Ayre, calls a “debt servicing organization” (Calvin Ayre, 2012, web).

Fortunately, MGM has $2.4 billion in cash whereas Caesars only has half that amount. Having made what seems to be the perfect move at the perfect time, the cash flow from MGM’s Macau property has the potential to assist the company in gaining more market share. In addition, if the

MGM Resorts International 24

Las Vegas Strip picks back up and continues to show a healthy recovery from the recession,

MGM’s position will be further strengthened in the market. Analysts at Wells Fargo gave MGM one of its two “buy” ratings in the gambling sector, arguing that a potential rebound on The Strip could return the company to profitability (Calvin Ayre, 2012, web). The debt positions of MGM and Caesars will be discussed in more detail during the presentation of the Four Cell Matrix.

One player in particular who is threatening MGM’s market share is Wynn Resorts. Wynn

Resorts, mentioned earlier as a level 2 impending competitor, is projected to gain a significant increase in its market share with the opening of its casino in Cotai (The Motley Fool, 2013, web).

One analyst forecasts that Wynn Resorts could double the company’s revenue over the next year

(The Motley Fool, 2013, web). Wynn Resorts is worth keeping an eye on, but there is still a long way to go in order to catch up with the 13% market share that MGM currently holds.

MGM Update

The MGM case study in the Hitt textbook ends in 2011. One of the major questions that the case leaves the reader with is whether MGM is properly managing its portfolio of properties.

Where can the company most quickly make up the biggest difference between itself and its competitors? What is the right model for MGM internationally? And, does the exit of Kirk

Kerkorian mark the end of an era or simply make MGM an open target? For the past year and a half, MGM has attempted to find answers and solutions to these questions facing the company.

Firstly, in just a short amount of time the company’s property portfolio has greatly expanded. MGM is actively pursuing development opportunities in key regions both domestically and internationally including Massachusetts, Connecticut, Japan, Taiwan, and

South Korea (2012 MGM Annual Report, 2013, p. 11).

Currently, MGM appears to still be highly reliant on the Las Vegas Strip for the vast majority of its revenues (Berzon & FitzGerald,

MGM Resorts International 25

2011, web). The company’s domestic gaming resorts are concentrated on the Las Vegas Strip and, therefore, are subject to greater risks than a gaming company that is more geographically diversified. However, the company feels that several of their brands, particularly the “MGM

Grand,” “Bellagio,” and “Skylofts” brands, are well suited to new projects in both gaming and non-gaming developments outside of Las Vegas (2012 MGM Annual Report, 2013, p. 9).

Secondly, MGM has taken on several initiatives in order to set the company apart from its competitors. The company moved away from the outdated practice of building themed hotels.

In 2009, the company opened a mixed-use urban complex, CityCenter. CityCenter is now in its third year of operations and all of its components (ARIA, Vdara, Crystals, etc.) continue to progress.

In 2011, M Life was launched, which is a customer loyalty program that strived for brand awareness, promoted the breadth of the company’s offerings and proved to be a game-changer in the competitive market. In 2012, M Life expanded to include non-gaming expenditures. M Life utilizes advanced analytic techniques and information technology to identify customer preferences and behavior, allowing the company to make more relevant offers, influence incremental visits, and build lasting customer relationships (2012 MGM Annual Report, 2013, p.

6).

To get a head start in a new era of gaming, MGM has partnered with the digital entertainment company, bwin.party, in anticipation of the legalization of online gambling. If legalized, the joint venture will offer online poker in the US.

The company is also entering uncharted waters with the intended development of a new

Las Vegas arena. The state of the art sports and entertainment facility will be situated right on the Las Vegas Strip capable of seating 20,000 people and hosting boxing matches, headline

MGM Resorts International 26 entertainment, and other special events. Murren anticipates that this project will help the company optimize its existing assets (MGM Resorts International Website, 2013, web).

Thirdly, MGM and its joint venture partners have expanded into international destinations including China, Vietnam, United Arab Emirates, United Kingdom, and Canada.

The initial public offering of MGM China occurred in June 2011. As part of the transaction,

MGM purchased an additional 1% of capital stock and positioned the company as the controlling shareholder. MGM China plans to build another hotel and casino in Cotai, Macau by January

2014. The 17.8 acre land concession was officially announced on January 9, 2013 (MGM

Resorts International Website, 2013, web).

However, if MGM China is unable to complete the development of this resort and casino by January 2018, there is a risk of losing the land concession resulting in an adverse affect on the business.

MGM’s latest project is a joint venture with The Cadillac Fairview Corporation Limited.

This partnership with Canada will help strengthen MGM’s presence in the international hospitality and casino entertainment industry. The purpose of the joint venture is to develop an integrated resort that offers entertainment, gaming, hotel, retail, and conference facilities.

Nonetheless, the two companies have a 50/50 share, which could turn out to be risky if not managed properly. Ideally, it is more favorable for one of the partners to have a 75% or more share in order to avoid a learning race where one company dissolves the other (M. Gannon,

Lecture, March 23, 2013).

Lastly, it is evident that Chairman and CEO, Jim Murren, is capable of leading MGM and that the vision and culture that Kirk Kerkorian created have stayed intact. MGM has seen significant growth in the last two years as a result of Murren’s unwavering determination and savvy business sense. Growth remained nearly flat in 2010, but 2011 proved to be a critical year

MGM Resorts International 27 for MGM. The company made great strategic steps, improved their business, and overcame the economic recession.

Some examples of MGM’s recent successes can be seen with the refinancing of $2 billion in debt at their CityCenter property, the opening of their first Hospitality property in Sanya, a complete room remodel in the Bellagio and MGM Grand, and the launch of mlife.com.

MGM’s Current and Projected Strategy

MGM aims to be the leader in the hospitality and casino entertainment industry by maintaining a portfolio of brands and destinations. The current strategy of MGM focuses on the following: (1) maintaining and strategically investing in a strong portfolio of resorts, (2) operating all resorts in a manner that emphasizes the delivery of excellent customer service while maximizing revenue and profit, (3) increasing brand awareness and customer loyalty through M

Life, and (4) leveraging the strong brands and taking advantage of significant management experience and expertise (2012 MGM Annual Report, 2013, p. 4). Moreover, MGM’s financial strategy for allocation of resources focuses on managing a proper mix of investments in existing resorts, spending on new resorts or initiatives, and repaying long-term debt (Global Data, 2013, p. 16).

In order to identify the projected strategy, we look at both models of strategic decision making (the external I/O model and the internal resource-based model). However, we will choose the resource-based model in the pursuit of strategic competitiveness and above-average returns, examining MGM’s unique resources, capabilities, and core competencies. Moving forward, we suggest that MGM should capitalize on emerging growth prospects both in the US domestic and international markets. The focus should be on training and developing the MGM workforce to deliver consistent excellent customer service in order to achieve competitive

MGM Resorts International 28 advantage and earn above average returns, becoming a leader in reputation and corporate social responsibility. This projected strategy will be a corporate-level strategy that addresses growth from two perspectives: (1) an external perspective that involves business expansion in markets fueling future growth and profitability, (2) an internal organizational perspective where training and development (T&D) become a core competency, leading to a unique high level of customer service (to be called Signature Engagement at MGM), thus differentiating MGM from the main competitors.

The proposed corporate level strategy can also be viewed from the perspective of valuecreating diversification because MGM will create value by building upon and extending the existing resources and capabilities with the purpose of gaining market power relative to competitors. This related diversification will help MGM create value by transferring competencies and knowledge between different business groups in the company’s portfolio.

“Economies of scope and market power are the main sources of value creation when the firm diversifies by using a corporate-level strategy with moderate to high levels of diversification”

(Hitt et al., 2013, p. 184). By linking and integrating MGM’s core capabilities with specific resources and competitive methods, the company is more likely to achieve advantages in the hospitality and casino entertainment industry that are not easily copied by its competitors.

Competitor Update

Las Vegas Sands (LVS)

Las Vegas Sands’ strategy focuses on international expansion as well as their customer service platform. As new strategies are brainstormed to improve the customer experience at their facilities, LVS is building feverishly overseas. Multiple projects are currently in progress, including a gambling resort project in Madrid nicknamed “EuroVegas”. This ten-year project

MGM Resorts International 29 will consist of twelve hotels, six casinos, three golf courses, a convention center, shopping areas, bars and restaurants. The project is currently in the early phases of the development cycle, therefore the European economy will continue to be a large factor into the outcome of the final project. Las Vegas Sands also continues to expand in the profitable section in Macau, China. In

April 2012 a new $4 billion resort was opened called the Sands Cotai Central (Las Vegas Sands,

2012, web).

Wynn Resorts Ltd

Wynn’s business strategy focuses more on the high-end segment, and strives to be a multi-dimensional social outlet for high-end adults unlike any theme hotel (Macau Daily Times,

2011, web).

Wynn also has an international strategy of purchasing land in Macau, China and building more properties. The Wynn Cotai is currently being built on the Cotai Strip which

Steve Wynn hopes will be opening in late 2013 or early 2014. However, many reports state this could be delayed to as late as 2016 (Macau Daily Times, 2011, web). The delay is very likely due to a lack of structure at the corporate level. During previous hard times for the company, the founder Steve Wynn leaned on Japanese billionaire Kazuo Okada, who eventually became the biggest shareholder. The company was looking to expand to the Philippines, but decided against it due to significant corruption in the country’s gaming industry. Okada was accused of bribing

Filipino gaming regulators, which eventually lead to a split in the Okada/Wynn partnership in late 2011 (Macau Daily Times, 2011, web). The company continues to struggle to move forward and their current international expansion strategy is under scrutiny and feels the effects of the drastic decisions made in the past few years.

Penn National

MGM Resorts International 30

Penn National focuses on racetracks as well as casinos. Efforts are directed towards expansion in the Midwest section of the United States. In 2012, Penn opened three “Hollywood

Casinos” in Ohio and Kansas, and acquired Harrah’s in St Louis that needed to be rebranded to

Penn National (Penn National, 2012, web).

Penn National has recently taken on a unique approach to their real estate strategy. The company is planning to split their property portfolios into two separate publicly traded companies. About half of their properties have been sold into a new shareholder-owned real estate investment trusts (REIT). These trusts reduce taxes and the cost of capital, and eliminates license ownership restrictions. Penn National will continue to operate both the casino and REIT.

Other players in the industry are watching closely and may imitate if this tax-efficient strategy is proven successful (Las Vegas Review Journal, 2012, web).

Boyd Gaming Corp.

Boyd Gaming continues to expand domestically. In November 2012, Peninsula Gaming was acquired, which has five casinos in the Midwest and the South. The company is also investing in intrastate online gaming in Nevada (Vegas Inc., 2013, web). This will help expand brand and customer base in these areas. Boyd Gaming has also sold their Dania property in

Florida to Dania Entertainment Center LLC for a significant amount of cash sales (NJ Biz, 2013, web).

Moving forward, their mission statement does not include customer satisfaction like other hospitality venues. Instead, their focus is on execution of their current growth strategy, rolling out branding initiatives, and improving operating performance (Boyd Gaming, n.d., web).

Caesars Entertainment Corp.

MGM Resorts International 31

Caesars went public in 2012, more than a year after it cancelled a previous initial public offering (IPO) (Hoovers D&B Company, n.d., web). At this time the stock jumped, which was a different outcome than the previously scrapped attempt. Caesars currently has a substantial amount of debt that they are trying to reduce by offering the shares of stock. The Octavius tower was also recently added on the Las Vegas Strip. This $1 billion project was originally scheduled for completion in 2009, but due to the recession and lack of demand for hotel rooms, the project was stalled (Las Vegas Review Journal, 2012, web).

Caesars is also expanding its dining selection for customers. This includes a new casual dining facility in Caesars Palace that seats 600 people (Las Vegas Review Journal, 2012, web).

This investment costs $17 million, and a hired executive chef is the leading attraction.

The Nobu tower also recently emerged on the Las Vegas Strip. Reservations were available starting in February 2012, and these luxurious suites highlight 24-hour room service with one of the world’s top chefs (Las Vegas Sun, 2012, web).

Caesars’ Current and Projected Strategy

From the company corporate website, Caesars touts focusing on superb customer service, similar to MGM: “Caesars is focused on building loyalty and value with its customers through a unique combination of great service, excellent products, unsurpassed distribution, operational excellence, and technology leadership. We concentrate on building loyalty and value for our customers, employees, business partners, and communities by being the most service-oriented, technology-driven, geographically-diversified company in gaming” (Caesars Entertainment

Corp. Website, 2013, web).

Additional research shows that Caesars has other strategies besides a customer service driven strategy. The company has a very high amount of debt, which it is desperately trying to

MGM Resorts International 32 reduce. The strategy employed to minimize debt is re-organizing management at both property and corporate levels (Market Line, 2012, p. 6).

Additionally, similar to MGM, Caesars employs the strategy of capturing the market without destroying it, or “Win All Without Fighting” (McNeilly, 2012, Chapter 1). Acquiring a similar company or property, whether domestic or overseas, would be an example of such a strategy. Both MGM and Caesars continue to use effective techniques used by previous management, as well as add other proven effective strategies. Since the parent has more resources than the acquired company, additional beneficial training and entertainment opportunities are provided that were missing prior to the acquisition.

MGM Resorts International

Growth Share Matrix

Figure 5

33

The industry growth share matrix helps companies determine how to most effectively utilize their cash. Products with high market rates and slow industry growth are known as “cash cows” because they generate large amounts of cash. However, this cash should not be reinvested into the same products used to generate the cash flow because the rate of return exceeds the growth rate. More cash is produced than is needed to generate their share of the market, ultimately leading to depressed returns. Caesars’ position over a five-year average is high in this category, and similarly MGMs’ five year average is in this category as well. This is an indication that both of these companies should divest this case into other products or portfolios in order to gain the most return for their investments.

Products with low market share and low industry growth are also known as “dogs”.

Competitors such as Penn, Boyd, Las Vegas Sands, and Wynn five year average, which include

MGM Resorts International 34 the US recession, are in this category. These companies must continuously reinvest their “profit” into the firm to maintain their market share, leaving the companies with no remaining cash. It is usually difficult for companies to get out of this situation.

The competitors other than Caesars are “question marks,” meaning they have low market share and high industry growth companies. These products require large amounts of cash, and can easily fall behind competition and fail. Even if these types of companies have enough cash, they will be dog companies until any growth stops. The four dog competitors to MGM may fall into this category if the business model is not improved to acquire more profit and cash.

The high share and high industry growth quadrant is the “star” and is a goal for all of these companies. MGM and Caesars 2012 points fall into this category. When the industry is growing, such as in 2012, they have much more potential for success. However during the recession both of these companies slumped into the cash cow category as previously discussed.

A “star” company reports profits, but may not generate all of its own cash. If it maintains this category, it will become a large cash generator when growth slows, which could end up putting it in the “cash cow” category. MGM and Caesars are both in this cyclic loop, where it is preferred to stay in the star category rather than the cash cow. Companies need their business to generate cash, otherwise they are essentially worthless (Boston Consulting Group, p. 2). This can best be done by diversification strategies.

It can be seen in Figure #5 that all companies have moved significantly to the right of the growth share matrix because the industry growth has significantly improved. With a poorer economy, the industry was suffering, and so were all companies as far as their status in the growth share analysis. As the economy continues to improve, so will the industry and individual companies. This thesis focuses on the US economy, although it may be noted that Caesars and

MGM Resorts International 35

MGM are both international companies. This focus is necessary because not all of the competitors in this analysis are international and it would otherwise not be a fair comparison. If instead global market share was chosen, competitors listed in the Hitt textbook other than MGM and Caesars, would have completely diluted data and instead international competitors would have to be analyzed. However our focus is on US companies and their corporate strategies

(which may or may not include global expansion) therefore we have focused on US market share.

Internal Environment Analysis

Four Cell Matrix

One of the most important processes in developing a business strategy for MGM is to clearly organize and define the primary competitors’ (Caesars’) strengths and weaknesses against the company. The purpose of doing this exercise is to identify ways to take advantage of external opportunities and minimize external threats. At the same time, opportunities are revealed for directly attacking the weaknesses of Caesars. The analysis of the matrix provides

MGM with an insight on how to leverage the company’s critical resources, strengths, core capabilities, and core competencies. The matrix is organized into four quadrants and, within each quadrant, there is a break down of resources, strengths, weaknesses, core capabilities, and core competencies for both MGM and Caesars. All, but the core competencies and core capabilities, are rated on a scale from 1-3. Below is an illustration of the full matrix. This is followed by a discussion for each individual quadrant with the exception of quadrant 4

(weaknesses vs. weaknesses).

MGM Resorts International

Figure 6 –Four Cell Matrix

36

Quadrant 1

Figure 7

Quadrant 1 shows the strengths of both MGM and Caesars. Strengths are typically internal, under the control of the company, and positive to the company’s performance. MGM’s property portfolio is classified as one of the company’s strengths and is given a rating of 3. A 3 is designated for this rating because MGM’s properties are heavily concentrated in Las Vegas and therefore, the property portfolio is not as strong or diverse as it could be.

The company wholly owns and operates 15 properties located in the US including

Bellagio, MGM Grand, Mandalay Bay Circus Circus, MGM Grand Detroit, and Beau Rivage

(Mississippi) among others. The company holds 50% share in three other properties in Nevada and Illinois, CityCenter being one of them. Additionally, a 51% share is held in MGM China

Holdings, Ltd. that operates its Macau resorts and casino. A Global Data market research report

MGM Resorts International 37 states that MGM “leverages its extensive property portfolio to cater to customers in domains such as tourism and leisure sectors, namely gaming, hospitality and entertainment” (Global Data,

2013, p. 17). The company’s newest property venture is entering into non-gaming hotels and resorts. This is due to the fact that burgeoning markets are opening up in countries where gambling is illegal or not culturally accepted. MGM recently opened MGM Grand Sanya in

China and is developing MGM Grand Ho Tram in Vietnam. These latest ventures will help the company further strengthen its property portfolio.

MGM’s resources are listed as diversified products and holding a healthy liquidity position. These resources help MGM maintain operational efficiency and a strong brand portfolio as the company’s core capabilities.

MGM offers a wide range of products and services including gaming, hotel, dining, entertainment, retail, and other resort amenities. In addition, over half of the company’s net revenue is derived from non-gaming activities (Market Line, 2012, p. 5).

All of these products and services combined allow MGM to provide a diversified and complete resort experience to its customers. The diversified products and services ensure that there is always revenue coming into the company from at least one area and therefore, the company does not need to depend on a particular product segment or customer group. Overall, this characteristic stabilizes MGM’s business operations, earning it a rating of 2 for its resources.

Having a healthy liquidity position helps MGM to fulfill its operational and working capital needs. Between 2010 and 2011, the company reported that cash from its operating activities increased from $504 million to $675 million (Market Line, 2012, p. 17). This increase reflects the company’s ability to meet its ongoing needs for a smooth flow in business.

Additionally, the company’s current ratio improved from 1.16 times in 2010 to 1.61 times in

MGM Resorts International 38

2011, its quick ratio increased from 1.09 times in 2010 to 1.54 times in 2011, and its cash ratio improved from 0.4 times in 2010 to 1.06 times in 2011 (Market Line, 2012, p. 17). MGM’s healthy liquidity position is its greatest resource and therefore is rated a 1. If the company had an unfavorable liquidity portfolio, then it would not be able to invest in its operations and branding, which are its core capabilities.

One thing that MGM should be mindful of is allocating too many of its resources towards one competency. The company must ensure that it is not putting too many eggs into one basket in the case that a proposed strategy ends up not working out. The ideal result of implementing our proposed strategy is that MGM will effectively and efficiently utilize its strengths and resources to develop a training and development program that produces high quality customer service (Signature Engagement at MGM). The resulting output of high quality customer service in turn will be viewed as the company’s core competency. In other words, MGM will use diversified products and a healthy liquidity position to invest in their current capabilities including operational efficiency and a strong brand portfolio, ultimately resulting in high quality customer service.

However, in order to avoid investing too much of its resources into one competency,

MGM can also consider applying some of its resources to strengthen its core capability of a strong brand portfolio. The ideal output in this case will be the creation of a second core competency- a diverse and highly recognizable brand that offers an assortment of experiences.

MGM’s diversified products facilitate this movement of the company’s strong brand portfolio from a capability to a competency. One way that MGM can strengthen its brand portfolio is to invest in unique advertising such as its own line of nightclubs that are positioned outside of the

MGM Resorts International 39 casino hotel environment. Nonetheless, the focus of this paper will be on the core competency of training and development with the output of high quality customer service.

Strong market presence in the casino entertainment market is listed as Caesars’ strength for quadrant 1. The company is one of the largest casino entertainment providers in the world, with a strong presence in the US and UK (Market Line, 2012, p. 4). The corporation operates a variety of different types of casinos, including dockside casinos, thoroughbred racing facility casinos, and Indian Reservation casinos. Caesars is given a rating of 2 for this strength because of the advantage of having tapped into the Indian Reservation Casino market, unlike MGM.

Caesars’ resources listed in quadrant 1 are a strong network of facilities and the implementation of a recent cost savings initiative. Caesars’ strong network of facilities enables the company to serve its customers while they travel to any of the different hotel casino locations. Recently, the company witnessed an increase in revenues from its customers visiting multiple properties in the same market (Market Line, 2012, p. 5). In line with the company’s network growth is the launch of one of their marketing programs, Total Rewards. Total Rewards is a customer loyalty program that allows Caesars to obtain data from their customers spending habits and in return, more effectively service them. A strong network of facilities is rated 2 for resources because, while there are many properties that attract their customers, MGM also has a similar network of hotel casinos and offers a loyalty program as well.

In 2008 Caesars undertook a comprehensive cost reduction study that examined all areas of the business including organizational restructuring. As a result of the study, Caesars put forth efforts to “right size” expenses with each of its business levels. The company called this downsizing and restructuring “Project Renewal”. Caesars’ cost savings initiative is viewed as a resource because, by cutting costs, the company can then invest savings into new projects and

MGM Resorts International 40 properties which could strengthen their market presence mentioned above. In addition, the created funds may also be used to assist with their large scale operations, listed as the company’s core capability. Caesars’ large scale operations include 52 hotel casinos in seven different countries that it currently owns, operates or manages. This adds up to a total of three million square feet of gaming space and 43,000 hotel rooms.

If the results of Project Renewal are positive, then MGM should pay careful attention to this strength. However, our analysis foresees that this restructuring may actually be more of a detriment than a benefit to Caesars. Because of a possible negative outcome, Caesars’ cost savings initiative is only rated as a 3.

Overall, if Caesars’ resources are adequately coupled with the company’s strengths, this could pose a threat to MGM. Therefore, it is critical that MGM create a strategic plan ensuring that Caesars does not create an advantage in the market. The combination of MGM’s strengths pitted against Caesars’ weaknesses will reveal the appropriate strategy to ensure MGM comes out ahead. It is critical for the MGM to be on a quest to improve its core capabilities so as to remain competitive and assure its investors. By linking and integrating MGM’s strengths and core capabilities with specific resources and competitive methods, the company is more likely to achieve advantages in the hospitality industry that are not easily copied by its competitors. It should also be noted that our research revealed that Caesars does not have a recognized core competency. Quadrant 2 illustrates how MGM can attack Caesars.

Quadrant 2

MGM Resorts International

Figure 8

41

MGM must be aware of Caesars’ strengths so that the company has an idea of how their competitor may try to counterattack them. Yet, it is not necessary to focus too much attention on them. MGM should focus their energy and resources towards Caesars’ weaknesses. This is where MGM will be able to attack the competitor with the greatest results. Quadrant 2 is described by McNeilly as being the most useful in developing a strategy against the competitor

(Sun Tzu and Art of Business, pg.193). The outcome of quadrant 2 illustrates how MGM can leverage their strengths against Caesars’ weaknesses.

Caesars has two primary weaknesses that affect and/or have the potential to affect the company’s position in the industry and its market share. The first of these two weaknesses is the fact that the company currently has a high debt position on its balance sheet which makes it a highly leveraged entity (Market Line, 2012, p. 5). At the end of 2011, Caesars had $22,657.9 million face value of outstanding indebtedness with a current debt service obligation of $1,693 million, including required payments of $1,647.7 million (Market Line, 2012, p. 5).

Furthermore, its wholly-owned subsidiary, Caesars Operating Company was in a similar debt position with almost $20,000 million face value of outstanding indebtedness.

On top of its high debt position, Caesars’ bottom-line performance has been very slow and inconsistent over the past five years. For instance, in 2007 the company recorded a net profit of $619.4 million, a net loss of $5, 096.3 million in 2008, a net profit of $827.6 million in 2009,

MGM Resorts International 42 a net loss of $831.1 million in 2010 and a net loss of $687.6 million in 2011 (Market Line, 2012, p. 6). The huge drop in net profits between 2007 and 2008 can partly be credited to the state of the economy at the time. However, Caesars has barely been able to make up for this loss and the lack of inconsistency in the company’s ability to turn a reliable profit raises a red flag. Industry reports raise doubt and suggest that Caesars’ weak bottom line will prevent the company from being able to repay its current debt and interest. This will most likely result in the company’s bargaining power being tarnished. With this in mind, a rating of 1 is given to Caesars’ high debt position because it is a very critical weakness that can greatly affect their business and which

MGM can use to its advantage. As mentioned earlier, MGM’s healthy liquidity position allows them to pay off their debt and interest, in turn allowing them to invest in new projects and properties. To MGM’s advantage, Caesars is currently not in a position to make similar investments due to the fact that the company has a large amount of debt and is highly leveraged.

Then again, MGM does face some risk with their financial situation. The company’s current debt is $13.59 billion as of the end of 2012 and their profitability levels are in a less than favorable position with the ROE at -18%, the ROA at 1.93%, and the EPS at -$3.62 (MGM

Annual Report, pg. 16, 38). Additionally, MGM’s current ratio of 1.3 is quite low suggesting that the current assets barely cover the obligations of the current liabilities. As a result, this low current ratio may affect the company’s ability to pay back any short-term obligations. MGM’s current financial position poses some uncertainty in spite of the fact that the company has a strong liquidity position. The business' substantial indebtedness and significant financial commitments have the potential to adversely affect the company’s future development and its ability to react to changes in the industry. With over 70,000 people employed at MGM, layoffs could be an inevitable outcome of the company’s attempt to recover. However, one way that

MGM Resorts International 43

MGM can avoid layoffs, recover from some of its debt, and increase its liquidity position is to enforce the collection of credit that has been issued to a large portion of its customers. It is also worth mentioning that MGM was able to pay off $535 million of its outstanding principle amount on its 6.75% senior notes at maturity (MGM Annual Report, pg. 55). Therefore, our analysis suggests that MGM is still in a better financial position than Caesars because they have alternative resources for paying off debt.