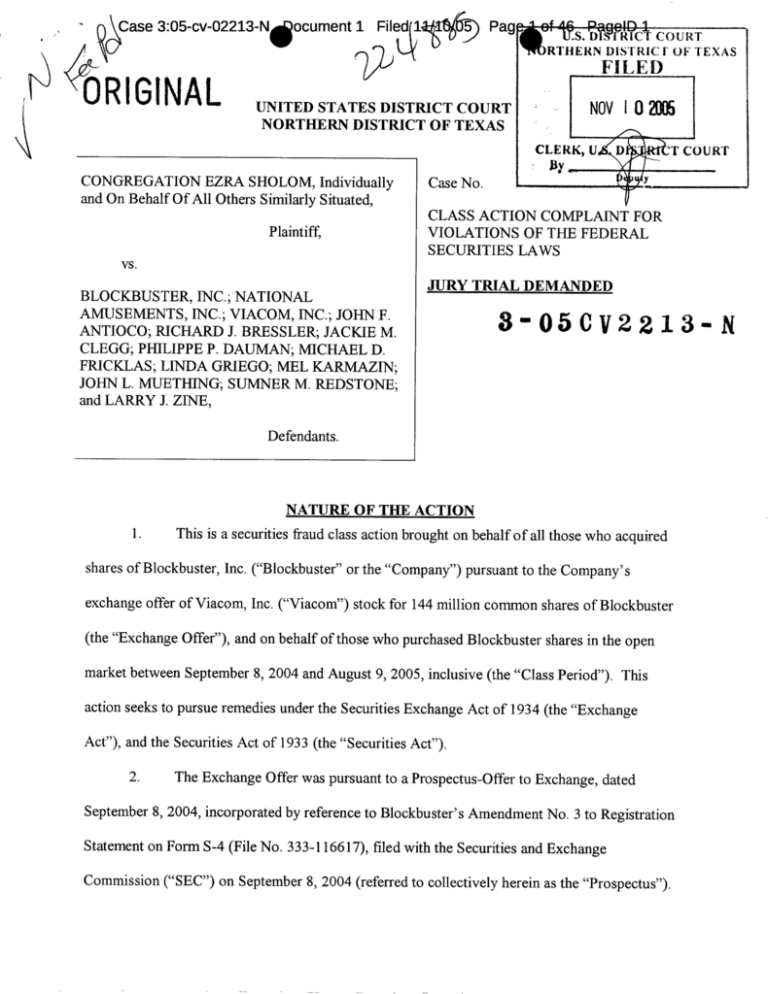

Congregation Ezra Sholom, et al. v. Blockbuster, Inc., et al. 05

advertisement