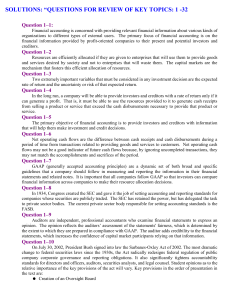

(US GAAP) to International Financial Reporting Sta

advertisement