Basic Concepts

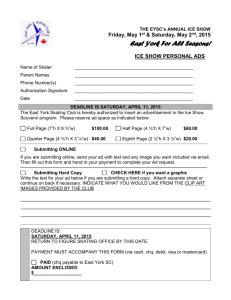

advertisement

BUS 257 Midterm (UWO) Study Sheet Bank Reconciliation Definition: A statement that allows one to compare their personal bank account records to the bank's records of the one's account balance in order to uncover any possible discrepancies. The goal of reconciliation is to determine if the discrepancy is due to error rather than timing. Steps to Putting Together a Bank Reconciliation Statement: 1) 2) 3) 4) 5) Compare Bank Statement with Cash Receipts Compare Bank Statement with Cash Disbursements Compare Bank Statement with Outstanding Cheques Start to build your Bank Reconciliation Statement Make adjusting entries ABC Inc Ltd. Bank Reconciliation As at December 31, 2004 Balance Per Company Balance Sheet Balance, DATE (beginning) ADD: Cash Receipts LESS: Cash Disbursements 50,000 15,000 - 10,000 $ 5,000 55,000 -$ 21,000 $ 24,000 58,000 Balance LESS: NSF Chq/ Debit Memos Unrecorded Chq # Driver Payroll Bank Service Charge Loan payment Error in Chq (if we understated) ADD: Interest Earned *Error in Chq (we overstated) Credit Memos - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 Adjusted Cash Balance Balance Per Bank Statement: Bank Statement Balance - Date LESS: Outstanding Chq # 1 Outstanding Chq # 2 Outstanding Chq # 3 50,000 - 3,000 6,000 9,000 - ADD: Late Deposit # 1 Late Deposit # 2 18,000 12,000 14,000 26,000 Adjusted Cash Balance $ 58,000 Possible causes of a bank balance error: Total outstanding checks added incorrectly Total deposits in transit added incorrectly Bank balance written down incorrectly Failed to record all items clearing the bank statement Journals added incorrectly Failed to record a check or deposit Incorrectly recorded an amount More free study sheet and practice tests at: Accounts Receivable Formulas: ¾ ¾ ¾ Net Credit Sales = Tot. Gross CR Sales – CR Sales R&A – CR Sales Dis. Net Cash Sales = Tot. Gross Cash Sales – Cash Sales R&A – Cash Sales Dis. Net Realizable value = E/B for A/R – E/B for A4DA 2 Approaches to Estimating Bad Debt Expense: Approach Account Used Solve for Formula Balance Sheet Accounts Receivable A4DA ending balance % outstanding x E/B for A/R Income Statement Net Credit Sales Bad Debt Expense % outstanding x total net credit sales More free Study Sheets and Practice Tests at: www.prep101.com www.prep101.com More free study sheets and practice tests at Inventories 2 Types of FOB: FOB Type Meaning Freight paid by FOB Destination Shipping TO… Supplier FOB Shipping Point Shipping FROM Buyer 4 Inventory Methods: 1. LIFO (Last in, first out) 2. FIFO (First in, first out) 3. Specification Identification Method 4. Weighted Average Cost Method Solving E/B in inventory to find COGS: 5. LIFO – E/B is what’s left in the OLDEST purchases 6. FIFO – E/B is what’s left in the NEWEST purchases 7. Specification Identification Method – Physical Inventory Counts Exhibit Will be given 8. WAC – COGA4S/ UA4S Inventory O/B + Purchases + Taxes & Duties + Transportation-in - Purchase Returns & Allowances - Purchase Discounts COGA4S COGS COGS Expense E/B COGS Manufacturing Accounting Depreciation Methods & Formulas: ¾ Straight line = (HC – SV)/a *n/12 Double Declining = BV * 2/a *n/12 Don’t need to subtract SV! But need to subtract A/D in 2nd year! ¾ Units of output = (HC – SV)/ units available * units used Entry Type List of Entries Adjusting Disposals Drawings Extraordinary Repairs Insurance Loan Rent Salary & Wages Tear down Trade-in Unpaid bills Closing Sales Expenses Retained Earnings Production Raw Materials WIP Finished Goods More free study sheet and practice tests at: RM O/B Purchases Trans-In Returns Allowances Discounts WIP O/B FOH - Rent FOH - Utilities FOH - Equip FOH - Insurance DL - Wages E/B CORMU COWIP COFGM E/B COGS E/B COGS Expense COGS CORMA4U CORMU FG O/B COGFM COGA4S Steps: 1) Find E/B of RM to solve for CORMU 2) Find E/B of WIP to solve for COFGM 3) Find E/B of FG to solve for COGS Helping students since 1999

![[Name of Business]](http://s2.studylib.net/store/data/005439490_1-eb485795b6ab94ac46e88cc0426770e1-300x300.png)