Quick Glance: Yield Curve Spread - Week Ending February

advertisement

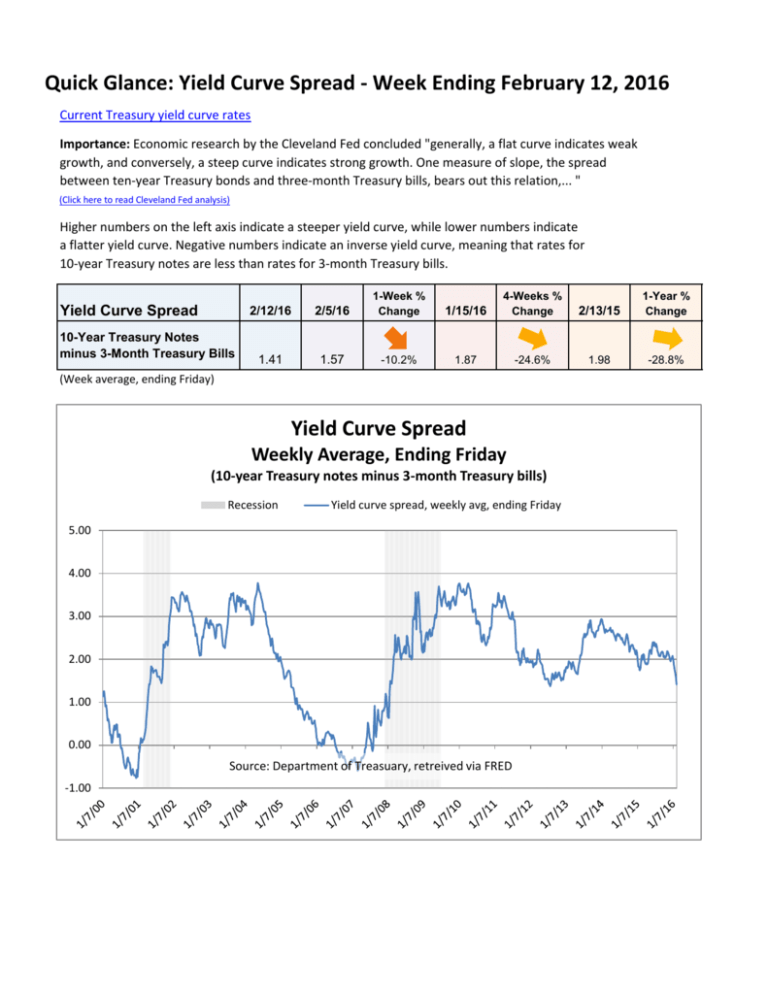

Quick Glance: Yield Curve Spread - Week Ending February 12, 2016 Current Treasury yield curve rates Importance: Economic research by the Cleveland Fed concluded "generally, a flat curve indicates weak growth, and conversely, a steep curve indicates strong growth. One measure of slope, the spread between ten-year Treasury bonds and three-month Treasury bills, bears out this relation,... " (Click here to read Cleveland Fed analysis) Higher numbers on the left axis indicate a steeper yield curve, while lower numbers indicate a flatter yield curve. Negative numbers indicate an inverse yield curve, meaning that rates for 10-year Treasury notes are less than rates for 3-month Treasury bills. Yield Curve Spread 10-Year Treasury Notes minus 3-Month Treasury Bills 2/12/16 2/5/16 1-Week % Change 1/15/16 4-Weeks % Change 2/13/15 1-Year % Change 1.41 1.57 -10.2% 1.87 -24.6% 1.98 -28.8% (Week average, ending Friday) Yield Curve Spread Weekly Average, Ending Friday (10-year Treasury notes minus 3-month Treasury bills) Recession Yield curve spread, weekly avg, ending Friday 5.00 4.00 3.00 2.00 1.00 0.00 Source: Department of Treasuary, retreived via FRED -1.00 Yield Curve Spread - Previous 12 Months Weekly Average, Ending Friday (10-year Treasury notes minus 3-month Treasury bills) 3.00 2.50 2.00 1.50 1.00 0.50 Source: Department of Treasury, retrived via FRED 0.00 Provided courtesy of Econ P.I.