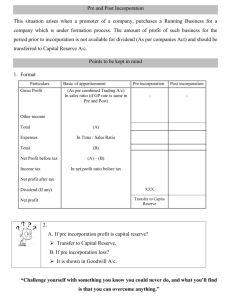

Profit prior to Incorporation

advertisement

Meaning :It means a profit earned by the company before incorporation. The profit arises when the business is started or taken over a date before incorporation. Such profit is a capital profit and cannot be used for distribution of dividend. Steps :1) Prepare Trading A/c for the full year and determine gross profit for the whole year. 2) Prepare profit & loss A/c with two columns pre & post. 3) Divide the gross profit between two periods on the basis of sales. 4) Expense in profit & loss A/c are to be divided between two periods either on time ratio or on sales ratio. a) Time Ratio:- It is a ratio of pre & post period. It is used for bifurcating expenses like salaries, rent, electricity etc. b) Sales Ratio:- It is the ratio of sales during pre & post period. It is used for bifurcating expenses like Advertising, Commission to salesman, Discount allowed, Bad debts etc. 5) Certain expenses like Directors fees, Managing directors, remuneration, debenture interest, preliminary expenses written off relate to only post period. 6) Audit fees can either be divided on the basis of time ratio or it can be considered only in the post period. 7) Date of certificate of commencement of business is not to be considered. 8) If there is loss in the pre-period it should be debited to goodwill or cost of acquisition. 9) If there is profit in the pre-period it should be written in Capital Reserve A/c. OBJECTIVE TEST Q1 State whether true or false :1) Pre-incorporation profit is not chargeable to income-tax. 2) The purchase should be allocated in the ratio of sales. 3) The wages should be allocated in the ratio of time. 4) The manufacturing expenses should be allocated in the ratio of sales 5) Columnar Trading Account for pre and post incorporation period can never be prepared. 6) Loss prior to incorporation is debited to Goodwill Account. 7) Director’s fees are divided in pre and post incorporation period in time ratio. 8) Capital Reserve and Goodwill should appear in the same Balance Sheet after incorporation. 9) Post incorporation period is available for dividend. 10) Profit prior to Incorporation is distributed as dividend. Ans: False : 1,2,3,4,5,7,8,10 True : 6, 9.