Corporations BusinessNet

advertisement

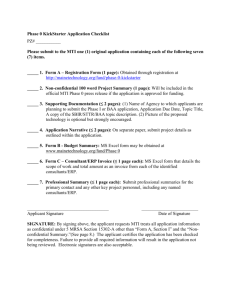

Corporations BusinessNet It’s crucial to have all needed things in one place. BusinessNet is an exceptional tool kit, that lets your company effectively manage finances. We invest in relationships GE Capital Group Dynamism ensuring an advantage BusinessNet financial portal BusinessNet is a state-of-the-art financial portal, the most modern one on the Polish market, ensuring immediate and unlimited access to banking products. Thanks to the system, the users can manage their finances at all times from any place in the world, and maintain contact with the Bank through fast and reliable The European Medal communication channels. Recommendation of the Office of the Committee for BusinessNet has been successful not only in Poland, but European Integration and Business Centre Club given to also worldwide. This is proven by the constantly growing BusinessNet. number of users of the portal and, what is more, numerous, prestigious awards and distinctions granted to BusinessNet by independent experts, both Polish and international. The awards include: Europroduct The Europroduct title and statuette in the 8th edition of the Poland-wide competition for the integrated package of international electronic services for Corporate Customers. The European Banking Technology Awards The main award for the BusinessNet system in the sixth edition of the prestigious competition, one of Europe’s most highly recognised awards given every year to, inter alia, financial institutions promoting and using modern technologies in their products and services. The IT Product of the Year The main prize in the competition of the Gazeta Bankowa weekly in the “E-banking/e-finance project” category. The Best Internet Bank for Corporate Customers in Poland A title in the “Best Corporate/Institutional Internet Banks” category in the competition of the “Global Finance” monthly. 1 BusinessNet The actual benefits Companies using BusinessNet gain: BusinessNet is a state-of-the-art internet banking system, the most modern one on the Polish market, which Complete information guarantees efficient management of company finances. It offers access to various tools improving the work online access to the current financial data, efficiency and ensuring great comfort of operation. The access to all the data concerning accounts and orders, system, available in two language versions, Polish and access to electronic banking statements English, is the first portal in Poland adjusted to the needs in the PDF format, of both the biggest Polish and international corporations, option of searching and selecting operations and enterprises of medium and small size. The numerous according to the chosen criteria, access to the current banking information functionalities of BusinessNet satisfy the requirements of (exchange rate tables, deposit interest rates, etc), the most demanding users. info: 0 801 676 662 2 Financial benefits authorisation of orders with qualified certificates which identify the issuers and confirm their identity execution of orders at the most suitable date beyond doubt, for the company, security of the organisational and technical supporting diverse Cash Management solutions, infrastructure – the security system adopted by the Bank reduction of payments costs. fully complies with international standards. Saving of time Full integration the possibility to use BusinessNet any time, BusinessNet is compliant with the ERP systems used anywhere around the world, by companies. This is possible owing to the modern aggregation and access to products and banking solution offered by the Bank – BPH Integrator. services through a single, modern access channel, The full list of manufacturers of the ERP systems whose automatic exchange of information between products have obtained the certificate of compliance the portal and the ERP systems, with the BusinessNet internet banking system as part of export and import of data. the BPH Integrator solution is presented on the website: http://www.bph.pl/bph_integrator An easy and user-friendly system easy, intuitive configuration, ergonomic application, ensuring optimum working conditions, personalisation of access to functionalities and authorisations to view the company’s accounts, intuitive interface, which can be customised to the users’ needs, support from the Bank. Security safe logging into the system, full security thanks to modern IT solutions, the possibility to specify the IP addresses which can access the system and times when particular persons may use BusinessNet (time restrictions), security of information and flexible authorisation management – the “managing user” functionality, thanks to which users’ rights may be monitored and managed, advanced payment acceptance schemes – representing and replacing complicated signature specimen cards, www.bph.pl 3 BusinessNet Each statement is secured with the electronic signature The advantages that distinguish us of the Bank. Current information about the accounts The BusinessNet system enables you to control the enterprise’s finances and offers constant access to information on the current and historical balances, statements and transaction history. Users can also print It is also possible to define automatic notification of the confirmations of the payments made, statements and selected orders and events in the system by means of an other required data directly from the system. e-mail or a text message. BusinessNet offers you the eStatements service, which saves time, increases the efficiency of the accounting work while maintaining the highest security standards. eStatements offer the system users the possibility to receive statements of bank accounts in the PDF format. info: 0 801 676 662 4 meetings, conferences and messages. BusinessNet Full customisation has the option of placing and modifying electronic BusinessNet enables its users to adapt the features applications, for example applications for modification available on the portal to their individual requirements. of rights. The configuration of the working area (desktop) helps to The latest banking solutions adjust the appearance, range and sequence of presented information according to individual needs, while setting the aggregated display of all the accounts ensures BusinessNet provides full functionalities of internet fast access to comprehensive financial information. banking, thanks to which it is possible to manage the By granting the relevant access rights to accounts and entire transaction servicing process via the internet, functionalities, users can reconstruct any existing internal to exchange documents and have ongoing control structures of the company within the system. of balances in the accounts kept in banks abroad. Integration and analysis of accounts, kept not only in Bank BPH but also in other banks, are also supported Modern transaction service by the system. Owing to the TransNational Services BusinessNet can be used to support all types of domestic module, it is possible to control and manage accounts and foreign payment orders. Its users can define standing in all the countries in which the company has its orders and make recurring payments in accordance with branches. the specified schedule. Thanks to the mechanism which periodically verifies the account balance, payment orders Servicing of transaction and treasury sent to the Bank when there are not enough funds in banking products the account are not rejected and the system executes them after the account has been credited with adequate GAITS (Global Account Information and Transfer Service) amounts. – the feature of centralised servicing and monitoring The Integration Centre offers the widest range of of all the clients’ accounts kept by other banks all over predefined financial reports available on the market, the world (the banks must belong to the SWIFT network). customised to the needs of individual companies. It offers the possibility of placing domestic and foreign orders from these accounts, an overview of statements and statuses of order execution by a bank maintaining A new dimension of communication with the bank the account. BusinessNet contains the Communication Platform, which enables its users to communicate with the Bank TransPayroll – a transaction banking service for in a fast and convenient way. The Platform stores all Corporate and SME Clients of Bank BPH expecting the telephone and address data, as well as photos of a top level of confidence and security related to payroll bank consultants and product specialists cooperating payments. The TransPayroll service offers automatic and with the company. It is equipped with a set of useful fast execution of remuneration payments. This service tools which enhance communication and ensure secure is intended for all the clients who: use internet banking services in our Bank, but do not authenticated messaging and document sharing between transfer remuneration to their employees in this way, the company and the Bank, as well as among the users keep their accounts in our Bank, but do not use within a company. The Platform also allows the clients an internet banking system, to prepare their private calendars, which offers access are our new clients. to summarised information on past and future orders, www.bph.pl 5 TradeFinance BusinessNet Subscription packages BusinessNet can also significantly help in executing trade transactions with domestic and foreign partners. BusinessNet offers a wide range of functionalities, which The TradeFinance module contains the following (considering the specificity of clients’ individual needs) services: are available in various packages. TransFinancing - offers electronic servicing of discount products such as various factoring and forfaiting BusinessNet Light is a perfect solution for companies models. Monitoring and service of the entire process are which need ongoing information on bank accounts available online. and constant control and monitoring of the concluded TradeNet, in which transactions can be managed at all banking transactions. In this package, users can obtain stages of their execution, thus ensuring ongoing access electronic bank statements and follow the history of to trade information in real time. Owing to TradeNet, balances, turnovers and executed operations. the system users can process trade finance documentary products, such as letters of credit and BusinessNet Basic is offered to enterprises which want to collections. perform payments in their full range via the internet and DealingNet, in which treasury transactions can be which expect the option of import and export of data, as concluded online at market prices. Using the internet well as the possibility of depositing free funds. BusinessNet platform, clients can observe the market and select Basic facilitates effective management of users’ rights an appropriate moment for concluding transactions and offers a secure channel for correspondence with without having to call the Bank agent. Users of the the Bank. internet platform receive modern tools to monitor the concluded transactions and financial flows on the BusinessNet Professional was designed for users who accounts. expect the electronic financial servicing as part of advanced Cash Management services or who conclude Custody trade transactions with domestic and foreign partners. It Custody services include storing and settling of is a perfect solution for holdings – companies functioning transactions on securities in Poland and on foreign within capital groups – as users can swiftly change the markets, as well as administration of investment funds context of the company whose finances they currently assets, including their evaluation. manage. BusinessNet Professional is also addressed Custody services of Bank BPH are primarily offered to to companies which need access to current market domestic and foreign financial institutions, such as information and are interested in additional protection. investment funds, depositary banks, international brokers and brokerage houses. Detailed Thanks to the integration of custody services with the the BusinessNet system and those available in BusinessNet system, clients can monitor the status of subscription packages are presented in the table on the their securities via the internet. next page of this brochure. info: 0 801 676 662 6 information on the functionalities of Overview of functionalities, products and services available within BusinessNet subscription packages Functionality Groupi Functionality/Types of operations Availability in the Subscription Packages Personalisation of settings Desktop personalisation, language versions (Polish, English) Basic information Current balances, historical balances and turnovers, transaction history, statements Light Basic Professional Individual current and historical currency exchange rates Dictionary data, particularly account numbers of tax offices Orders Outgoing domestic payments (Elixir) and SORBNET, internal payments (transfers between accounts kept in Bank BPH) Tax (treasury) payment and Social Insurance payment Domestic payment in foreign currency/foreign payment (EuroElixir, STEP1, STEP2, SWIFT) Mass payments (charging an account with a single, collective amount) Standing orders Notification of cash withdrawals Integration centre Imports, exports, reports Predefined and individually defined import, export and reports formats Deposits Deposits opening, deposits overview, individual interest rate table Additional security Logging in with the electronic signature stored on chip cards Time access control (calendar, weekdays, hours) and IP address control Administration Administration of users’ rights in the company and overview of Acceptance Schemes Legal Module Binding documents in electronic form, data entry and possibility to make statements of intent. Analysis module Finance overview Monitoring of current balance, analysis of liquidity and transaction history Communication platform Exchange of correspondence within CIF(K) and between the Bank and the user Notices Text message and e-mail notifications sent once a particular event occurs in the system Related groups Creating a Related Group Cash Management TransDebit TransPrzekaz TransPłace TransCash TransCard TransPay Cash Management reports Cross-border services TradeFinance GAITS Active TradeNet TransFinancing Other modules DealingNet Individual BusinessNet modules are also available optionally within the BusinessNet Basic package. www.bph.pl 7 BusinessNet of the Bank, the password should be at least 10 characters Security long and consist of at least one small letter, one capital letter and one digit. The BusinessNet internet banking system ensures free To increase the security level, clients can also specify the and secure access to company accounts and guarantees TCP/IP addresses of the working stations from which the the highest, scalable security level with regard to data access to the system is possible. and users’ financial resources at the same time. The system offers comprehensive and consistent solutions as regards security in all areas that can influence the operation of the system: secure access to the system, secure internet technologies, authorisation of the sent instructions, infrastructure security means, organisational security means, technical security means. Access control to the system safe logging-in Integrated logon system In order to ensure safe logging-in process, each person authorised to use the BusinessNet system has its own ID and password. To make the work with banking applications easier, The password should be kept secret by its user and be we offer our clients an integrated logging-in system known only to the one, assigned user. Following this – SSO (Single Sign On). SSO enables them to make use of principle ensures security against unauthorised access a number of applications (with a single ID and password), to data. Individual ID and password are given to users provided as part of the internet platform of Bank BPH, in the form of a starter kit – in a safe envelope delivered without the necessity to log out and log in again. personally by an authorised Bank agent. Upon receiving the starting kit, the user can log into the system for the It means that, by using only one ID and password, a user first time. can access all bank accounts – both corporate and retail, including those kept in the Brokerage House. Users can log into the BusinessNet system by using one of the methods listed below: hidden password, microchip card, qualified certificate, while at the same time the characters of the password and PIN can be entered from the standard or the onscreen keyboard. During the first logon, the system automatically forces the change of password. According to the security policy info: 0 801 676 662 8 Secure internet technologies Secure communication with Security of access to data and functionalities the Bank through In the BusinessNet system, users’ rights can be precisely the BusinessNet internet banking system is based on: defined, both regarding each feature offered by the certification of WEB servers (Thawte Server CA), system and data of individual accounts, thanks to: use of the SSL 3.0 encryption technology with configuration of the data access profile on accounts a 128-bit key, and of data management, e.g. the right to access securing the data being sent against tampering or loss, the account balance or the right to place orders, control of activity in the system with the use of session configuration of the profile of access to functionalities, keys, e.g. the right to sign and send orders to the Bank. system logs – the register of all the activities of users To make the work with application easier, we offer and the system. the functionality of the managing user, the so-called Superuser, in which the rights of the selected users The SSL (Secure Socket Layer) cryptographic protocol can be managed without the necessity to contact applied in the BusinessNet system uses two cryptographic the Bank. The Superuser function enables clients to limit methods: public key methods and the symmetric the functionality available to users on their own and even cryptosystem. block the possibility to log in. The rights may be modified Its functions include: certifying and authorising of clients at all times following an application sent to the Bank. and the confidentiality of the information sent and ensuring data integrity. Authorisation of orders sent acceptance schemes In internet browsers such as Internet Explorer, establishing and limits a secure connection is marked with the icon of a locked padlock in the lower right corner of the screen. The BusinessNet internet banking system enables users SSL uses the so-called certificates of authenticity to configure any acceptance schemes in accordance with issued to institutions by the competent Certification the competences established in the company. Owing to Authorities (in the case of BusinessNet – Thawte Server the applied solutions, we offer our clients: defining separate acceptance schemes for orders, CA). The certificate of the Bank contains its public key, applications and messages sent to the Bank, and thanks to the authorisation, users can be sure that it configuration of acceptance schemes for each belongs to Bank BPH. account, Operations performed in the system verification of scheme correctness, acceptance schemes overview (to check whether In the first phase of establishing an SSL connection, a particular group of persons can authorise an order). the server and the browser exchange certificates, which are equivalents of ID documents for the WWW server and for clients of the Bank. A very important issue for the security of the sent data is the length of keys encrypting the transmission, used in certificates. In the BusinessNet system, the keys are 128-bit long, which nowadays ensures a very high level of security. www.bph.pl 9 using intelligent and intuitive forms, To ensure even greater security of transactions, users of BusinessNet can define any acceptance schemes and the customer can access and view the actual legal specify the limits. It is also possible to: relationship for BusinessNet, define the amount limits, a possibility to create the company Representation in convert the limits into any currency, electronic acceptance scheme for customer, based on set period limits, such as one-time, daily, weekly the company’s founding documents, and monthly totals of transactions, BusinessNet Key or Qualified Certificate is used as a limit utilisation control – the system controls trusted electronic signatures the defined transaction limits for each of the accounts starting packages are sent via SMS text message, separately on a current basis. activation of the BusinessNet Key without calling the Hotline, a faster and simpler BusinessNet implementation for Customer. Legal Module in BusinessNet A new module in BusinessNet is used as an electronic channel for entering statements of intent. BusinessNet user can assign or modify users rights, add other users and setup new acceptance schemes. Once the e-document has been filled-in and signed with an electronic signature, it’s activated in real-time and implemented with no Bank’s contribution. Electronic signature In the transactions concluded in the BusinessNet system, the electronic signature (also called a digital signature) is the unquestionable evidence of a transaction being executed by a particular person. The electronic signature: identifies the signature owner, distinguishes the ultimate declaration of wil Bank BPH is proud to present this solution, as the first who from drafts, introduced this solution to the market. The Customer has makes it possible to determine that the declaration also the possibility to access the complete documentation really comes from the user who is signed on the order in electronic form (binding documents). sent to the Bank, constitutes a proof that the declaration of will with the content found in the order was placed. Legal Module extends the functionality of BusinessNet system with the following elements: documents are filled-in and realized in electronic form, info: 0 801 676 662 10 signature, as well as select, hide, modify and block them. A new key can be signed with the existing active key. Qualified certificates Qualified certificates function similarly to the electronic signature. Certificates are issued by third parties, which in Poland are Certification Authorities – CA. A certificate assigned to the client’s key authenticates and certifies Users can easily and securely place an electronic it. For more information on the qualified certificate signature in the BusinessNet system owing to the technology, see the National Certification Centre website: modern internet technology. www.nccert.pl The electronic signature is placed in a new window, which additionally increases the security level. At any moment a user can view the formatted and signed version of prepared order. Using the on-screen keyboard while entering the password to the electronic signature key secures the system against intercepting the characters entered on a physical keyboard, e.g. with the use of the so-called Trojans. Signing electronic documents The process of signing an order is based on a private key known only to the given user, and a public key, which is stored on the bank server and used for checking the authenticity of signatures. Generating a signature is based on calculating the control amount of the transmitted file and signing the information with the private key. The private key can be stored on any of user’s carriers (microchip card, hard drive, pen drive, etc.) or placed in Infrastructure protection the Bank’s repository. a firewall system – protects the BusinessNet system If a signature with the key kept in the Bank’s repository or against unauthorised access, on an external carrier is used, the signature is additionally a load balancing system, failover, geographic clusters authorised with an SMS code sent to the previously – secure the BusinessNet internet banking system defined trusted phone number in order to increase the against the undesirable effects of a breakdown. Owing level of the system security. to these functionalities, a user can access the system The keys used on the BusinessNet microchip cards are at any time, without the necessity to possess another 2048-bit long, which currently is the highest level of backup system, security used in electronic banking systems. A user of the the system for monitoring the activity of users BusinessNet system can use many keys of the electronic and the system – it ensures security as regards the www.bph.pl 11 full control of operation correctness in the BusinessNet Follow the safety rules system and indisputability of data (particularly clients’ orders). The system saves all traces of users’ activity and Users must get acquainted and comply with the rules performed operations in the memory of secure use of the system, presented in the Logging-in (e.g. logging attempts into the system, account history Page, in the Security section. reconstruction, making a payment etc). The saved data Users must not open the system using attachments also include the IP addresses of stations from which and links received via e-mail and not located on the the operations were performed. pages of the Bank. Before each logon users must make sure that they Organisational protection have established a connection with the Logon Page by checking if: The keys used on the BusinessNet microchip cards are in the address bar of the browser, the website address 2048-bit long, which currently is the highest level of starts with https://www.bph.pl, security used in electronic banking systems. A user of the within the browser window, there is a small locked BusinessNet system can use many keys of the electronic padlock/key as a mark of a security certificate issued signature, as well as select, hide, modify and block them. by a trusted certification centre, A new key can be signed with the existing active key. the security certificate was issued for www.bph.pl, consistent operational procedures for administrators the logon date falls within the certificate validity of the BusinessNet system, Client Advisors and period, the BusinessNet Hotline staff, the issuer of the security certificate is a trusted blocking users’ IDs – if wrong data are repeatedly certification centre and a full certification path exists. provided (three times by default) while logging in, access Users must not store the carrier of the Private Key to the system is automatically blocked, together with the Private Key Password. automatic logout – of a user is not active in the system Users must not store the user ID together with the for a predefined time, he/she is automatically logged Access Password, the PIN Code or the Phone Order out. Password. Users must not share their ID Codes with other Technical protection persons. Clients undertake to secure users’ workstations in the security system used in Bank BPH fully complies order to avoid interception of the ID Codes by third with the world standards regarding protection of bank persons, in particular, the infrastructure must be data centres, secured against software intercepting the combinations access to technological and IT zones is strictly of characters entered from the keyboard or software controlled. such as Trojans. If a user exceeds the allowed number of errors while entering the Access Password, the Bank blocks access to the system. The access can be unblocked by calling the BusinessNet HotLine through the IVR Phone Channel or by issuance of a new starter kit. If a user exceeds the allowed number of errors while entering the PIN Code or the Phone Order Password, the Bank blocks the IVR Phone Channel. The unblocking is info: 0 801 676 662 12 executed through an appropriate function in the system BusinessNet or issuance of a new Starter Kit. Integration centre If a user exceeds the allowed number of errors while entering the Private Key Password, the access BusinessNet offers a perfect solution for clients who to the Private Key is blocked. The blocked Private Key expect fast and automatic flow of data between the ERP cannot be reused, the system must generate a new pair systems used in the company and the internet banking of electronic signature keys which must be initialised in systems – the BPH Integrator. the system. The system has a mechanism which automatically logs Effective benefits out the user when the inactivity period is longer than 30 minutes. Integration of systems makes it possible to: The Bank never requests users to reveal ID Codes, and reduce the time of operational service and improve consequently users must not reply to e-mail messages the existing accounting processes thanks to: implying that the messages have been sent by the Bank automation of order exchange between the ERP and requiring users to give or verify the ID Codes. and internet banking systems, A client may define the range of IP addresses from automatic accounting and consulting of statements which a connection with the system can be established, in the ERP systems; particularly in order to prevent users from logging into the system outside the client Location. eliminate mistakes and operational errors owing to: A client can define the time frame in which he/she preparation of all the orders in the ERP systems, can log on, particularly in order to prevent users from elimination of “human” errors made as a consequence logging into the system outside the working hours of of working in various applications, databases the client. (e.g. of partners) and manual copying of information The client can define the Logon and the electronic from paper reports; signature individually for each user only with the use of the card. ensure high level of information transparency by: The client undertakes not to introduce changes to the uniformity of information in the ERP and internet the databases of the system partners’ dictionaries, banking systems, particularly the account numbers of beneficiaries, providing one place to enter data without a proper verification whether the information the common repository of archive data; on the account modification has indeed been generated and sent by the beneficiary. make financial savings thanks to: reducing the time necessary to perform the actions, reduction consumable materials costs, the possibility to reduce the “operational” accounting staff. www.bph.pl 13 Payments servicing http://www.bph.pl/businessnet/erp The process of import/export of data from Statements servicing the BusinessNet system to the ERP systems The BusinessNet system uses defined Export of statements from the BusinessNet system world (import into the ERP systems) standards both in export and import of data between the BusinessNet and the ERP systems. Export of statements from the BusinessNet system is Import of transaction data in the BusinessNet system possible in the standards predefined by the Bank: (Export of transactions from the ERP systems) Clients can export transactions from ERP systems to BusinessNet according to the procedures and instructions of their software. The created file with transactions is prepared for import into the BusinessNet system. Statements can be exported from the Statements book, The BusinessNet system contains predefined file import located in the Banking Transactions container. If this form standards. of statements export is selected, users can export The specification of these standards together with statements separately for each account. a detailed description of fields can be found on the Bank BPH website: THE PAYMENT PROCESSING USING THE INTEGRATION OF ERP SYSTEMS WITH INTERNET BANKING SYSTEMS PAYMENTS SERVICING Indication of payments to be processed in ERP system Payments file import to the Internet Banking System Chosen and authorised payments sent from ERP system to the Internet Banking System (txt export file) Approval and payments authorization in the Internet Banking System Invoice entry – registration in ERP system Payment orders transmission to the Bank Invoice received for settlement Payment orders posted by the Bank STATEMENTS SERVICING Payments statements posted on Client's accounts Statements entry to ERP system (file import) Statements sent to ERP system (file export) info: 0 801 676 662 14 Statements received from Bank via the Internet Banking System In order to do this, select from the list of statements the one to be exported and then select the preferred format after-sale support from the Bank and the producers from the combo box next to the [Export] button. of ERP systems. Bank BPH issues the following conformity certificates: – Silver Certified Partner certificate Certainty through certification As part of the BPH Integrator solution, Bank BPH signs cooperation agreements with producers of the ERP – Gold Certified Partner certificate software. These agreements obligate the producers to build a module – an interface that integrates the ERP software with the BusinessNet system. The correctness of the module-interface is verified by BPH Bank specialists. A positive result of verification enables the producer to receive the BPH Bank Certificate for their system. Thanks to the cooperation agreements concluded between Bank BPH and the producers of ERP systems, clients can also benefit from: fast implementation of a ready solution without the – Platinum Certified Partner certificate necessity to define the technical specification of integration, support of specialists from the Bank and the system producers during the implementation of the integrating module implementation, adjustment of information collected from the Bank to individual needs (individual accounting codes of transactions, individual descriptions of transactions, catalogue numbers of orders), guarantee of conformity of the data exchange formats A complete list of the manufacturers of the ERP systems if new versions of the electronic banking program with whom Bank BPH has signed cooperation agreements or the ERP program are released, and of the correct and who have been awarded the conformity certificates implementation, of Bank BPH for their products can be found on the Bank’s www.bph.pl 15 website: www.bph.pl/bph_integrator SUPPORT A complete list of payment file formats descriptions, The BusinessNet HotLine team supports users in matters intended for the clients who create interfaces of orders regarding the functioning of the system. Its members from ERP systems to the BusinessNet system can be also help clear up any doubts and solve problems that found on the website: may arise while working with the system. Owing to the http://www.bph.pl/businessnet/erp full verification of users who contact us, we can securely transfer all the data and information. HotLine BusinessNet for Corporate Customers: 0 801 676 662 (cost of call as per one call unit) 22 531 81 00 (cost of call as per one call unit) BusinessNet@bph.pl 16