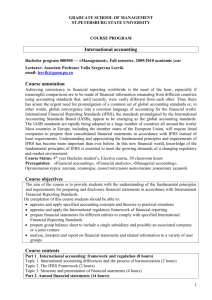

Separate Financial Statements

advertisement