Year End Tax Planning 2012

advertisement

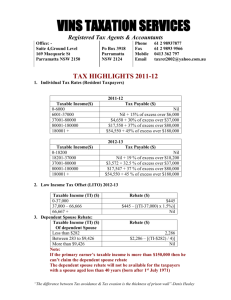

YEAR END TAX PLANNING BY R W FOX & ASSOCIATES 2011 / 2012 TAX FACTS Changes to Tax Rates Good news is, that from 1 July 2012, the tax-free threshold will increase from $6,000 to $18,200, which will result in tax cuts of up to $600 for lower-income earners. As the tax cuts are only directed to the lower income levels, the bad news is, that tax rates will be increased for the next two income brackets, as follows: Taxable Income Tax Rate Increases $18,201 to $37,000 Increase in tax rate from 15% to 19% $37,001 to $80,000 Increase in tax rate from 30% to 33% Business Tip The simplest tax planning strategy for business owners is to defer income & capital gains and to bring forward deductions. Foe some business deferring income will mean not invoicing work and for others deferring the receipt of payment until the new financial year. Capital Items costing under $5,000 As of 1 July, 2012, Plant and Equipment items acquired (for Small Business Entity tax payers only), that cost under $5,000 are fully deductible (increased from $1,000 in prior years). Other business tax payers must pool and depreciate these assets, unless they cost under $300. Dependant Spouse Tax Offset The Dependant Spouse Tax offset will no longer be available for spouses born after 30 June 1971. Some exceptions will apply including where the spouse is an invalid or permanently disabled. Education Tax Refund - Removal For the 2011-2012 year, taxpayers will no longer be able to claim the Education Tax Refund, which will be replaced with a “Schoolkids Bonus’, to be paid by the Department of Human Services. Farm Management Deposits A legislative change now allows eligible primary producers, who have received Category C Natural Disaster Assistance to report the withdrawal of their deposits within 12 months while retaining the FMD deduction. Flood Levy A temporary one-year progressive flood and cyclone reconstruction levy (flood levy) will apply in the form of additional income tax on Australian resident and foreign resident individuals with an Australian taxable income in the 2011-12 year financial year. Medical Expenses Claim The net medical expenses rebate, which currently allows you to claim a 20 per cent tax offset on out-of-pocket medical expenses above $2,000 (this includes medical costs for all family members), will be means tested as of 1 July 2012. The test will apply to people with adjusted taxable incomes in excess of $84,000 and in excess of $168,000 for couples. For people in this income category, the offset will only be available for out-of-pocket expenses in excess of $5,000 allowing a claim of 10 per cent only. Motor Vehicle Write-Offs The Government will provide small businesses with an instant tax write-off of the first $5,000 of any motor vehicle purchased from 2012-13. For example, a tradesman on a 30 per cent marginal tax rate, buying a new ute for $22,960 would receive an extra tax benefit of $1,275 in the year they purchased the vehicle. The remainder of the purchase value can be transferred into the general small business depreciation pool, which is depreciated at 15 per cent in the first year and 30 per cent in later years. Pre-Payments Deductible expenses (such as interest, leases, insurance, rates and services to be provided in the future) may be paid in advance (prepaid) by Small Business taxpayers and individual non-business taxpayers and claimed at the time of payment, provided the 12 month rule is not breached! Changes to Super Co-Contribution This is the last year to get the maximum $1,000 government co-contribution for earnings up to $31,920 . (You still receive a partial co-contribution for earnings up to $61,920), if you make a non-deductible super contribution. Next year the maximum government co-contribution will be reduced to $500 and the upper-limit will be reduced to $46,920. Concessional Super Contributions People who earn less than 10 per cent of their income from employment are eligible to make a personal deductible contribution before the 30 June. Needs to be in fund by 30 June!!! From 1 July, 2012, the limit on concessional contributions for people aged 50 or more will halve to now $25,000. People earning more than $300,000 will now have to pay 30 per cent contributions tax (increased from 15 %) on their concessional contributions. June 2012 is the last chance to make a contribution of $50,000 for people aged 50 or more. Other Super Options If your spouse earns less than $13,800, you have the option of making a spouse contribution to their super. You can claim a maximum rebate of $540 on a $3,000 contribution if your partner earns less than $10,800. There is also the option of ‘Splitting Super’ with your spouse by asking your fund to transfer up to 85 per cent of your concessional contributions in the previous year to your spouse’s super account. Another option to keep in mind (if your spouse is younger and you wish to apply for the age pension) is to transfer your concessional contributions to your spouse, because super held by your spouse below pension age is not means tested by Centrelink. Prepay Private Health Insurance If you are likely to be effected by the new means test for the 30% tax rebate on private health insurance premiums consider prepaying up to 13 months in advance. The means tests cut in from 1 July 2012 for singles over $84,000 and couples earning over $168,000.