Budget Workbook - Blackhawk Bank

advertisement

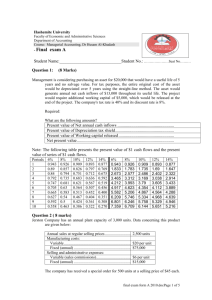

Budgeting Your Route to Financial Success n Managing Your Budget n Planning Your Budget n Budget Worksheet Managing Your Budget It’s not what you earn; it’s what you keep and how you spend it. If you earn $10 per hour and work 40 hours, you’ll have $400 to spend, right? NO! Gross income (the $400) is different from net income, which is the amount you have left after you pay taxes. Certain taxes are automatically deducted from your gross income – they include Social Security, Medicare and Federal income tax. Net income is what you can actually spend. Everyone has to stay within a budget. Whether you’re the movie star or the person selling popcorn at the movie theater, it’s really simple: if you spend more than your net income, you’ll have financial problems. Striving for a balanced budget means spending appropriately for food, clothing, shelter, transportation, savings and charity. How do you know how much to spend in each category? It depends on what you need, and what you value. Plan Your Budget Calculate the amount you should spend in each category based on the percentages provided on the worksheet. Use the illustrations on the opposite page to help you decide how to spend your income and write the amounts you plan to spend under My Budgeted Amount. You cannot spend more than you earn. Occupation: _______________________________________________________________________________ Monthly Net Income: _______________________________________________________________________ Budget Planner Suggested Percentage Savings Charitable Giving 5% 25% Transportation 15% Food 15% Entertainment 10% Other Expenses* My Budgeted Amount 10% Housing Clothing Suggested Amount 5% 15% *Other expenses can include utilities, (electricity, gas, phone, cable/satellite TV, Internet access, medical expenses, and insurance. Think about how you can change your spending so that is more in line with the suggested amount Budget Worksheet • Note your income per week and your monthly total. • Track your expenses each month, in each category - what you budgeted and what you actually spent. • Subtract your expenses from your income. • The difference can be applied to your savings or investments. INCOME: MONTHLY TOTAL: per week EXPENSES: continued MONTHLY BUDGET: ACTUAL Wages and Bonuses (Gross) TRANSPORTATION: Interest Income Car Payments Investment Income Gasoline/Oil Miscellaneous Income Auto Repairs/Fees Income Subtotal Auto Insurance INCOME TAXES WITHHELD: Other Expenses/Tolls Federal Income Tax DEBT PAYMENTS: State/Local Income Tax Credit Cards Social Security/401(k) etc. Student Loans Income Taxes Subtotal Other Loans SPENDABLE INCOME (Net) ENTERTAINMENT/RECREATION: EXPENSES: MONTHLY BUDGET: Cable TV/Videos/Movies ACTUAL Computer Hobbies HOME: Mortgage or Rent Subscriptions Vacations Homeowners/Renters Insurance Property Taxes PETS: Repairs/HOA Food Home Improvements Grooming, Boarding, Vet UTILITIES: CLOTHING: Electricity Water and Sewer Natural Gas or Oil Telephone INVESTMENTS & SAVINGS: 401(K)or IRA Stocks/Bonds/Mutual Funds College Fund FOOD: Savings Groceries Emergency Fund Eating Out, Snacks MISCELLANEOUS: FAMILY OBLIGATIONS: Toiletries, Household Child Support Gifts/Donations Alimony Grooming Day Care, Babysitting Miscellaneous HEALTH AND MEDICAL: TOTAL INCOME: Insurance TOTAL EXPENSES: Unreimbursed Medical Fitness DIFFERENCE: The advice you need for the life you want. blackhawkbank.com l 800.209.2616 Beloit l Roscoe l Machesney Park l Rockford l Belvidere l Capron MEMBER FDIC EQUAL HOUSING LENDER