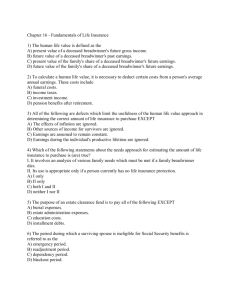

FINC 3200 Sample Quiz Chapter 11

advertisement

FINC 3200 Sample Quiz Chapter 11 MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Which of the following types of families is likely to have the least need for a large amount of life insurance? A) a single person family B) a blended family C) a sandwiched family D) a traditional family 2) The human life value is defined as the A) future value of the family's share of a deceased breadwinner's future earnings. B) present value of the family's share of a deceased breadwinner's future earnings. C) present value of a deceased breadwinner's future gross income. D) future value of a deceased breadwinner's past earnings. 3) Which of the following pieces of information is needed to calculate a person's human life value? A) the person's estimated annual Social Security benefits after retirement. B) current outstanding debts, including mortgage debt. C) the person's cost of self-maintenance. D) the marital status of the person. 4) To calculate a human life value, it is necessary to deduct certain costs from a person's average annual earnings. These costs include A) pension benefits after retirement. B) income taxes. C) investment income. D) funeral costs. 5) All of the following are defects which limit the usefulness of the human life value approach in determining the correct amount of life insurance to purchase EXCEPT A) Earnings during the individual's productive lifetime are ignored. B) The effects of inflation are ignored. C) Earnings are assumed to remain constant. D) Other sources of income for survivors are ignored. 6) Which of the following statements about the needs approach for estimating the amount of life insurance to purchase is (are) true? I. It involves an analysis of various family needs which must be met if a family breadwinner dies. II. Its use is appropriate only if a person currently has no life insurance protection. A) I only B) II only C) both I and II D) neither I nor II 7) Which of the following is a cost/expense that an estate clearance fund is designed to pay? A) burial expenses B) retiring the mortgage C) income to the widow(er) during the readjustment period D) education costs 1 8) What is the length of the readjustment period which is considered when the needs approach is used to determine the amount of life insurance to own? A) 3 to 6 months B) until the surviving spouse reaches age 65 C) 1 to 2 years D) until the youngest child reaches age 18 9) Under the needs approach, when is the dependency period of a surviving spouse assumed to end? A) when the surviving spouse dies B) when the youngest child reaches age 18 C) when the surviving spouse reaches age 65 D) 1 or 2 years after the breadwinner's death 10) The period during which a surviving spouse is ineligible for Social Security benefits is referred to as the A) dependency period. B) blackout period. C) emergency period. D) readjustment period. 2 Answer Key Testname: CHAPTER-11 1) A 2) B 3) C 4) B 5) A 6) A 7) A 8) C 9) B 10) B 1