Mutual Funds

advertisement

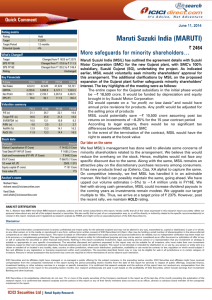

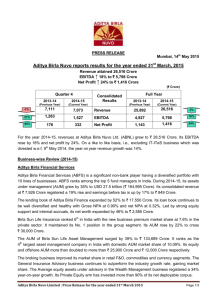

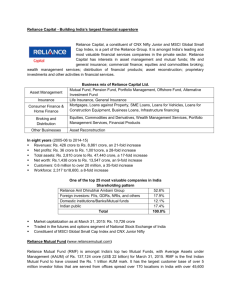

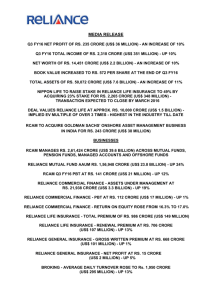

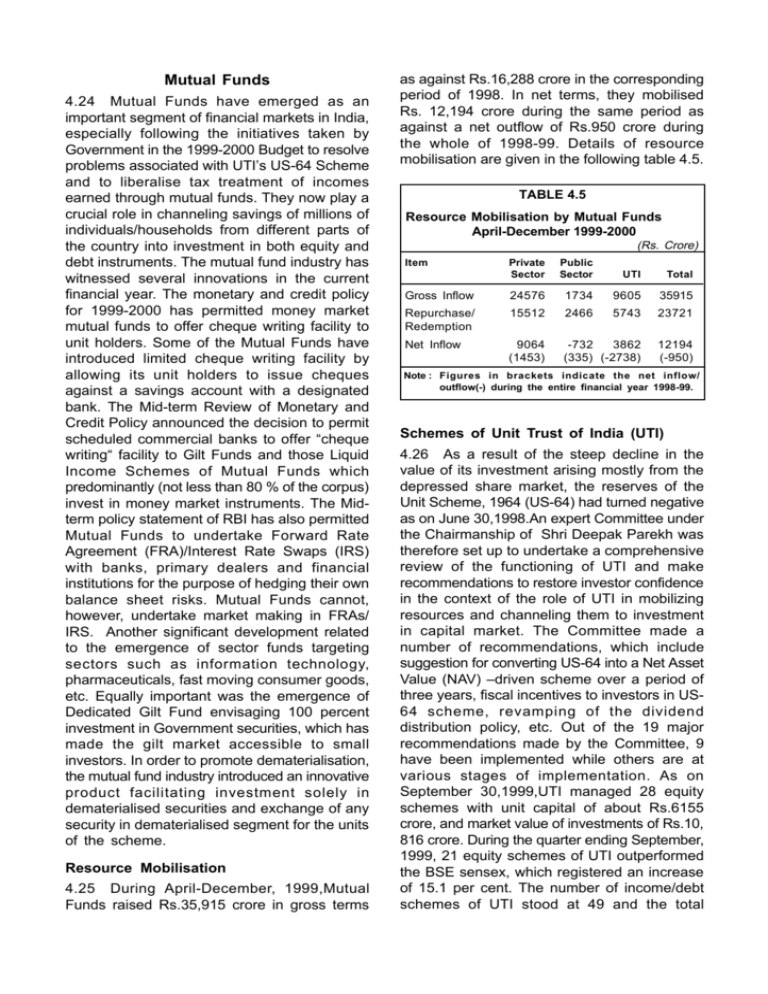

Mutual Funds 4.24 Mutual Funds have emerged as an important segment of financial markets in India, especially following the initiatives taken by Government in the 1999-2000 Budget to resolve problems associated with UTI’s US-64 Scheme and to liberalise tax treatment of incomes earned through mutual funds. They now play a crucial role in channeling savings of millions of individuals/households from different parts of the country into investment in both equity and debt instruments. The mutual fund industry has witnessed several innovations in the current financial year. The monetary and credit policy for 1999-2000 has permitted money market mutual funds to offer cheque writing facility to unit holders. Some of the Mutual Funds have introduced limited cheque writing facility by allowing its unit holders to issue cheques against a savings account with a designated bank. The Mid-term Review of Monetary and Credit Policy announced the decision to permit scheduled commercial banks to offer “cheque writing“ facility to Gilt Funds and those Liquid Income Schemes of Mutual Funds which predominantly (not less than 80 % of the corpus) invest in money market instruments. The Midterm policy statement of RBI has also permitted Mutual Funds to undertake Forward Rate Agreement (FRA)/Interest Rate Swaps (IRS) with banks, primary dealers and financial institutions for the purpose of hedging their own balance sheet risks. Mutual Funds cannot, however, undertake market making in FRAs/ IRS. Another significant development related to the emergence of sector funds targeting sectors such as information technology, pharmaceuticals, fast moving consumer goods, etc. Equally important was the emergence of Dedicated Gilt Fund envisaging 100 percent investment in Government securities, which has made the gilt market accessible to small investors. In order to promote dematerialisation, the mutual fund industry introduced an innovative product facilitating investment solely in dematerialised securities and exchange of any security in dematerialised segment for the units of the scheme. Resource Mobilisation 4.25 During April-December, 1999,Mutual Funds raised Rs.35,915 crore in gross terms as against Rs.16,288 crore in the corresponding period of 1998. In net terms, they mobilised Rs. 12,194 crore during the same period as against a net outflow of Rs.950 crore during the whole of 1998-99. Details of resource mobilisation are given in the following table 4.5. TABLE 4.5 Resource Mobilisation by Mutual Funds April-December 1999-2000 (Rs. Crore) Item Private Sector Public Sector UTI Total Gross Inflow 24576 1734 9605 35915 Repurchase/ Redemption 15512 2466 5743 23721 Net Inflow 9064 (1453) -732 3862 (335) (-2738) 12194 (-950) Note : Figures in brackets indicate the net inflow/ outflow(-) during the entire financial year 1998-99. Schemes of Unit Trust of India (UTI) 4.26 As a result of the steep decline in the value of its investment arising mostly from the depressed share market, the reserves of the Unit Scheme, 1964 (US-64) had turned negative as on June 30,1998.An expert Committee under the Chairmanship of Shri Deepak Parekh was therefore set up to undertake a comprehensive review of the functioning of UTI and make recommendations to restore investor confidence in the context of the role of UTI in mobilizing resources and channeling them to investment in capital market. The Committee made a number of recommendations, which include suggestion for converting US-64 into a Net Asset Value (NAV) –driven scheme over a period of three years, fiscal incentives to investors in US64 scheme, revamping of the dividend distribution policy, etc. Out of the 19 major recommendations made by the Committee, 9 have been implemented while others are at various stages of implementation. As on September 30,1999,UTI managed 28 equity schemes with unit capital of about Rs.6155 crore, and market value of investments of Rs.10, 816 crore. During the quarter ending September, 1999, 21 equity schemes of UTI outperformed the BSE sensex, which registered an increase of 15.1 per cent. The number of income/debt schemes of UTI stood at 49 and the total investible funds of these schemes amounted to Rs. 35,467 crore as on September 30,1999. As on June 30,1999 investments in debt instruments, including money market instruments, was Rs. 23,600 crore (71%) and in equity Rs. 9724 crore (29%). The corresponding figures rose to Rs.25026 crore (Market value Rs. 25649 crore) and Rs.10441 crore (Market value Rs. 11745 crore) as on September 30,1999. The portfolio restructuring process initiated last year has begun bearing fruits in terms of improved performance of core equity portfolio and the improvement in credit quality of debt.