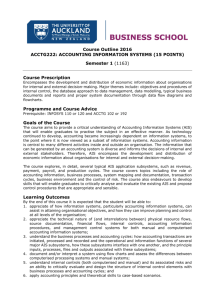

Course Outline 2016 ACCTG 101: ACCOUNTING INFORMATION

advertisement

Course Outline 2016 ACCTG 101: ACCOUNTING INFORMATION (15 POINTS) Semester 1 (1163) Course Prescription Business decisions require accounting information. This course covers the role of accounting information and systems to support decision making, control and monitoring in organisations. It examines general purpose financial statements and the analysis and interpretation of accounting information. It assesses investment opportunities using capital budgeting techniques and compares and evaluates alternative funding sources. Programme and Course Advice Restriction: 600.121, 600.171, ACCTG 191 Goals of the Course To show how and why accounting information matters. The idea is that accounting information is an integral part of the decision-making process, both inside and outside the firm. Learning Outcomes By the end of this course it is expected that the student will be able to: 1. 2. 3. 4. 5. 6. appreciate the importance of accounting information to the firm and its providers of capital and understand its communicative value; explain and apply cost behaviour patterns to quantitative modelling techniques such cost-volume-profit analyses; budgeting and basic costing. understand the basics of reading a set of financial statements of a business and show the impact of accounting events on the financial statements; interpret financial statements with an awareness of context while recognising the limitations of such analyses; show how the time value of money and risk are incorporated into long-term decision-making and perform capital budgeting techniques; understand the basics of debt management. Content Outline Week Week Week Week Week 1 2 3 4 5 Week 6 Introduction Business Plan: Cost-Volume-Profit Business Plan: Budgeting Costing No lectures Planning and Control Decisions Week Week Week Week Week Week Week 7 8 9 10 11 12 13 The Accounting System and the Balance Sheet The Accounting System and the Income Statement The Cash Flow Statement and Owner’s Equity Financial Statement Analysis Time Value of Money Capital Investment Financial Management Learning and Teaching ACCTG 101 is delivered through multiple lecture streams. During three one hour lectures each week, lecturers discuss and apply theory. A fourth hour is provided each week in the form of a workshop which is optional. It is highly recommended that student attend this workshop as emphasis is placed in class on demonstrating how to solve accounting problems and provides opportunities for group work which many students find to be a valuable learning tool. Teaching Staff Course Director: Associate Professor Paul Rouse Office: 5119, OGG Building Tel: 373 7599 (xtn. 87192) Fax: 373 7406 Email: acctg101-help@auckland.ac.nz Course Co-Ordinator (Leader): Debbie Alexander Office: 541, OGG Building Tel: 373 7599 (xtn. 89415) Fax: 373 7406 Email: acctg101-help@auckland.ac.nz Lecturers: Various Learning Resources Reading: The prescribed text for this course is Cunningham, Nikolai, Bazely, Kavanagh, Slaughter, & Simmons (2015) Accounting: Information for Business Decisions (2nd Editon). Cengage Learning: Australia. Material and questions from the text are discussed during lectures. Additional questions from the textbook as used for self-study. Course Book: The Course Book includes supplemental problems used in lectures, additional notes, and the latest financial statements for two well-known NZ companies. Canvas: Canvas is used to distribute student guides to problems, and to make announcements. It is also used to quiz students online over the assigned readings and problems. The quizzes may later be used for revision. ‘Walk-in’ Help Centre: Assistance is provided at the ‘walk-in’ help centre for queries about the lecture material. Details of the venue and times will be made available on Canvas. Assessment Two individual assignments Ten CSL quizzes One semester test Final examination Total 10% 10% 20% (Date to be confirmed) 60% 100% Further details on these assessments will be provided on Canvas. Learning Outcome Semester Test Assignments 1 2 3 4 5 6 X X X X X X X Online Quizzes X X X X X Final Exam X X X X X X Minimum Requirements To pass this course an overall grade of at least 50% is required. Inclusive Learning Students are urged to discuss privately any impairment-related requirements face-to-face and/or in written form with the course convenor/lecturer and/or tutor. Student Feedback These are the ways in which student feedback from 2012 has been used to shape or change the course: 1. Fewer assessments that are worth more marks. There is now one less assignment than in the past. The two assignments are now worth 5% each rather than worth 3% as in previous years. 2. More practice exercises. At the end of each module there are a large number of self-study exercises and problems that allow students more practice. They cover everything that is required to be learnt for that module. 3. Feedback in the Online quizzes. More feedback has been provided on each quiz in order to assist with your learning. If you find a question that does not have sufficient feedback please email acctg101-help@auckland.ac.nz and we will improve it. 4. Revision practice for the Online quizzes. Online revision quizzes (that do not count for marks) are now available so that you can practice answering multiple choice questions on each module before you attempt the assessed Cecil quizzes. 5. No tutorials but more interactive workshops. Some students have requested that we offer tutorials but unfortunately we do not have the resources to provide for these. A major difficulty the Department of Accounting & Finance faces is the large numbers of students who take our courses not just at stage one, but at stages two and three. We are the largest Department in the University in terms of student numbers and consequently resources are strained to provide all the support we would like to provide, especially at stage one. In order to accommodate this request in some way we are introducing more interactive workshops. Feel free to email your queries to acctg101-help@auckland.ac.nz or your workshop tutor if you would him or her to discuss those issues in class. 6. Course book slides and problems have now been made available on Cecil. 7. Lecture recordings of all lecture streams. In the past only one lecturer’s stream was recorded despite there being more than one lecturer taking the various streams. Students have requested that their lecturer’s stream be recorded so now all lecture recordings for each lecturer on the course can be found under their name on Canvas. 8. Practice Assignment for Finance. Students have suggested that they have a practice assignment for the Finance section of the course. It will not count for marks but can be marked by the students themselves. This is because there is no assignment that counts for marks on this section as it is the last section of the course. It is however examined in the final exam so students wanted to practice for the exam.