Know More

advertisement

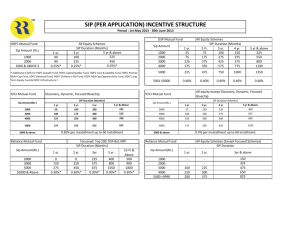

Systematic Investment Plan (SIP) A Systematic Investment Plan (SIP) is a method of investment like your recurring deposit that allows you to invest a fixed sum, regularly, in a mutual fund scheme. SIP allows you to invest pre-determined amount at a regular interval (weekly, monthly, quarterly, etc.). A SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future. How does SIP help? • • • • • Helps in rupee cost averaging Inculcates the habit of disciplined investing Thrives in volatile market conditions It is easy on the wallet, as we don’t have to commit large sums of money at one go Benefits from the Power of compounding Invest Smartly – • Adopt a disciplined & long term approach – Invest regularly and systematically • Start investing as early as possible • Allow your money to grow – stay invested & do not get distracted with market fluctuations What is Rupee Cost Averaging With volatile markets, most investors remain skeptical about the best time to invest and try to 'time' their entry into the market. Rupee-cost averaging allows you to opt out of the guessing game. Since you are a regular investor, your money fetches more units when the price is low and lesser when the price is high. Month Amount invested Cost Units Month 1 5000 15 333.33 Month 2 5000 17 294.12 Month 3 5000 18 277.78 Month 4 5000 15 333.33 Month 5 5000 13 384.62 Month 6 5000 12 416.67 Total 30000 2039.84 Average cost per 14.71 Instead if Rs. 30000 was invested in Month 1, the investor would have got (30000/15) 2000 units with the cost of unit at 15. (Above is a hypothetical example for illustrative purpose only) What is Power of Compounding Simply put, Compounding refers to the re-investment of income at the same rate of return to constantly grow the principal amount, year after year. In other words, Compounding is earning “interest on interest”. Staying invested and contributing regularly can significantly increase your assets over time as your savings grow and the effect accelerates – a powerful force in a long-term savings strategy Happy SIPPing! Average Rate of Return 10% 12% 15% Invested Amount 5000 5000 5000 End of Year 1 5500 5600 5750 End of Year 3 6655 7025 7604 End of Year 5 8053 8812 10057 End of Year 10 12969 15529 20228