1 Meals charged to Company credit cards totaled $9,448. As noted

advertisement

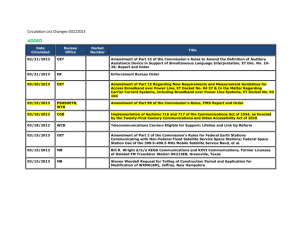

1 Meals charged to Company credit cards totaled $9,448. As noted earlier, we 2 limit meals to the lower of $25 per person or the actual amount. Meals are a normal 3 business expense, especially when employee travel is required. 4 Rental car ($6,625) and rental car gas ($1,239) were charged to the Company 5 credit card. When travelling, especially by air, renting cars is a common expense. As 6 noted in the Company travel policy, when renting a car, AEP's employees are asked 7 to be good stewards with the Company's expenses by filling up the gas tank before 8 returning the rental car, as the cost of that gas is much lower than what rental car 9 companies typically charge. 10 Parking accounted for $1,939 of third party credit charges. It is common for 11 employees that travel to incur parking fees, especially at airports. 12 Postage fees incurred on the Company credit card totaled $1,468. Over 99.7% 13 of these fees were incurred by the Austin office. Regulatory proceedings require the 14 personnel responsible for compiling, distributing, and serving documents to incur 15 postage charges. 16 Company employees charged $689 to their credit card for taxis. Taxis are a 17 common expense for employees that travel. 18 One toll of $4 was charged to the Company credit card by a witness in the 19 20 21 case and a credit for a hotel reimbursement of $44 makes up the remaining item. Q. WHY DO YOU BELIEVE THE $3,378 SUPPORTED BY "THIRD PARTY INVOICES" SHOULD BE RECOVERED? SOAH DOCKET NO. 473 -15-0617 PUC DOCKET NO. 42370 18 REBUTTAL TESTIMONY RANDALL W. HAMLETT 50 1 A. The $3,378 is supported by third party invoices and is further backed up by the 2 Company's internal controls, policies and procedures discussed in more detail later in 3 my rebuttal testimony. 4 page reference to where the third party invoice was provided, either in our original 5 filing or in the response to Staff's First Request for Information, Question No. Staff 6 1-1, Attachment 3. 1 am not sure why Mr. Luna included these items in his 7 recommended adjustment as the documentation supplied by the Company included 8 the only type of documentation he accepted, and he raises no objection to the level of 9 these expenses. 10 11 EXHIBIT RWH-2R provides a list of these charges and a These expenses were reasonable, necessary and are appropriately includable in recoverable rate case expenses. Q. DO YOU AGREE WITH MR. LUNA'S ADJUSTMENTS OF $2,117 12 CATEGORIZED AS "SYSTEM GENERATED TAX OBLIGATION" AND $1,694 13 CATEGORIZED AS "DUPLICATE TAX"? 14 A. No on the $2,117 and yes on the $1,694. As the Company explained in its response 15 to Staff's First Request for Information, Question No. Staff 1-1, these items were 16 generated by the Company's Accounts Payable system. When an invoice from a third 17 party is received, it is reviewed for sales tax and if none has been billed, the system 18 will generate a payment to the appropriate state for the tax that should be collected. 19 In this instance, the sales tax billed on the invoice was inadvertently overlooked. 20 Upon further review of these items, it was determined that on four of the invoices, a 21 sales tax payment was generated, but the original invoice had already included that 22 tax. Those duplicate tax items totaled $1,694 and the Company agrees to remove that 23 amount (as part of the $2,267 discussed earlier). SOAH DOCKET NO. 473-15-0617 PUC DOCKET NO. 42370 19 REBUTTAL TESTIMONY RANDALL W. HAMLETT 51 1 On the remaining invoices, totaling $2,117, sales tax was not charged on the 2 original invoice and was correctly calculated by the SWEPCO Accounts Payable 3 system. Because the tax charge is calculated by the system, there is not a third party 4 invoice to provide aside from the original invoice from the vendor, which was 5 provided. 6 part of the charge for the service the vendor provided. SWEPCO's responsibility to 7 pay the sales tax to the taxing authority rather than to the vendor (who in turn would 8 have to pay the taxing authority) provides no legitimate basis to disallow these costs. 9 These are reasonable and unavoidable costs that should be recovered. 10 Q. 11 12 SWEPCO is not exempt from paying sales tax and those costs are a valid DOES PURA OR ANY PUC SUBSTANTIVE RULE REQUIRE THIRD PARTY INVOICES FOR RECOVERY OF RATE CASE EXPENSE? A. No. Mr. Luna, on page 6, lists two sections of PURA and one PUC Substantive Rule. 13 However, none of these provisions require third party invoices for recovery of rate 14 case expense. 15 reasonable and necessary but does not specify or restrict how that must be 16 demonstrated. His citation to the PUC Substantive Rule, however, is inappropriate, 17 as I am informed by counsel that the Rule is not applicable to this case. In any event, 18 nowhere does the Rule require third party invoices for a determination of 19 reasonableness. As noted by Mr. Luna, PURA basically requires that the costs be SOAH DOCKET NO. 473-15-0617 PUC DOCKET NO. 42370 20 REBUTTAL TESTIMONY RANDALL W. HAMLETT 52 1 Q. HAS MR. LUNA PROVIDED AN EXPLANATION OF WHY HE IS DEPARTING 2 FROM STAFF'S PRIOR PRACTICE AS IT RELATES TO DOCUMENTATION 3 REQUIREMENTS EXPECTED OF AEP COMPANIES? 4 A. No, he does not. 5 Q. DO YOU BELIEVE IT IS APPROPRIATE TO MAKE THIS CHANGE NOW? 6 A. No, I do not. SWEPCO had no reason to retain third party invoices for every penny 7 spent. 8 policy that complied with IRS guidelines and in the form previously accepted by PUC 9 Staff and the Commission. It is unreasonable to change documentation requirements The Company maintained its documentation in accordance with Company 10 on an after-the-fact basis. 11 requirement in advance, it could have instructed its employees to retain every piece of 12 paper for every penny spent, though I dispute the reasonableness of such a 13 requirement. Mr. Luna notes SWEPCO's argument that "it has followed its standard 14 documentation process used in previous rate case expense filings . . ." but then makes 15 no attempt to explain what has changed or why that argument is not persuasive. He 16 simply repeats his unsupported claim that "Without receipts [he was] unable to 17 determine the reasonableness and necessity of SWEPCO's request."6 18 Q. Had the Company known about this documentation DO YOU BELIEVE MR. LUNA'S NEW AND ABSOLUTE REQUIREMENT OF 19 THIRD PARTY INVOICES FOR EVERY PENNY SPENT IS A REASONABLE 20 REQUIREMENT? 21 22 A. No, I do not. Mr. Luna simply concludes, without any explanation, that nothing other than third-party paper receipts can support the reasonableness of an expense. He 6 Direct Testimony of Joe Luna at 13. SOAH DOCKET NO. 473-15-0617 PUC DOCKET NO. 42370 21 REBUTTAL TESTIMONY RANDALL W. HAMLETT 53 1 ignores the voluminous support detail provided in the form of manager-reviewed 2 employee expense reports, most of which reflect data directly inputted by the 3 Company's credit card vendor. Even though this documentation contains essential 4 information from a third party, he unreasonably dismisses such information as 5 relevant only for tax deductibility purposes. 6 SWEPCO's expense documentation comports with IRS guidelines is not to suggest 7 that a deductible expense is automatically reasonable for the PUC's purposes. Rather, 8 meeting IRS guidelines is evidence that SWEPCO's rate case expense support 9 documentation is organized, thorough, and sufficiently detailed to describe the nature 10 Of course, my point in noting that of the expenses at issue. 11 Mr. Luna's requirement of third party receipts for every charge would be 12 burdensome and impossible in the case of certain expenses such as mileage and sales 13 tax. The practice employed by the Company is reasonable. That practice as applied to 14 the AEP companies was to follow Company policy and IRS guidelines, rely on credit 15 card system output and manager-reviewed expense reports to document expenses, and 16 follow established Commission practice regarding the types and levels of expenses 17 that are considered to be reasonable. This approach has served the Company and the 18 Commission well by providing adequate assurance of the reasonableness of 19 SWEPCO rate case expenses. 20 21 IV. CONCLUSION 22 Q. DOES THIS CONCLUDE YOUR REBUTTAL TESTIMONY? 23 A. Yes. SOAH DOCKET NO. 473-15-0617 PUC DOCKET NO. 42370 22 REBUTTAL TESTIMONY RANDALL W. HAMLETT 54 SOAH Docket No. 473-15-0617 PUC Docket No. 42370 EXHIBIT RWH-1R Page 1 of 2 Entergy Texas, Inc. - Rate Case Expense Docket No. 40295 Meal Receipt Accepted by Staff and Commission Date: Card Type: Acct 4: Card Entry: Trans Type: Trans Key: 4uth [,nde: Check: Table: Server: 14ay02'12 08:50pM AMEX XXXXXXXXXXX1007 SSqIPEO PURCHASE EIE006194191851 543235 4312 Ne/1 27 THOMAS 14 Subtotal: Contains: • Date • Number of People ("A6/1") Tip • • Total Amount Requested 23-83 7ip:_ Total: 2- -7• -_...•----____._^. Signature I agree to pay above total according to my card issuer agreement. Provided as part of ETIs Response to StaffRFI 9-1, Addendum 2, Accounting Consulting LegalInvoices, DWMR (6-13-12), PDFpage 65. SWEPCO - Rate Case Expense Docket No. 42370 SWEPCO Expense Report for Meal Number 6 Category Mea! - Business Amount Date 22 Feb 2012 Meth.Pmt. Carporate Card Pers.Amount GL Code 520 Location Comp. Paid 1 Exp.Type 0.0 Expense Client Comp. Paid 2 48.91 United States 48.91 0.0 Provider CCB OF BOSSIER Guideline Unlimited Recovery on #6 0.00 Fin. Code 103.11405. L EGAL. EON 018181. S WPCTX1201.9280002.286...TX.520 Description Taxes TAX 174 0.001 0.00 VAT 0.00 Num of Guideline er 2 People Unit p Unlimited Units Attendees MURPHREE, Name Title employee ANDREW L Name Brenda Meyers Title Director of Business Operation Contains: • Date • Number of People ("Num of Units 2 People") • Total Amount Requested • Name of Restaurant ("CCB of Bossier") Employee Name and Title • Provided as part of SWEPCO's Docket No. 42370 Application, Volume 4 of 5, EMPLOYEE EXPENSES tab, March 2012 tab, page 17. SOAH Docket No. 473-15-0617 PUC Docket No. 42370 EXHIBIT RWH-1R Page 2 of 2 Entergy Texas, Inc. - Rate Case Expense Docket No. 40295 Taxi Receipt Accepted by Staff and Commission Tefelshcr.ne # NEW ORLEANS CARRIAGE CAB CORP JEF PERSON CARRIAGE CAB C1iECKER 1 YELLOW CAB CO. ' Contains: PA,SSENGER'S RECEIPT, TAXICAB FARE 20 CJate • Total Amount • Name of Taxi Company (ambiguous, 3 names) Amount of Fare $ Other Charges u Total . ....... .....$ Driver's Nam Provided as part of ETI's Response to StaffRFI 9-1, Addendum 2, A ccounting Consulting LegalInvoices, DWMR (5-15-12), PDF page 98. Cab Number SWEPCO - Rate Case Expense Docket No. 42370 SWEPCO Expense Report for Taxi Number Date Gl. Code 46 08 Mar 2012 510 Exp.Type Provider Expense Client YELLOW CHECKER CAB CO Guiideiine Fin. Code 103.1 3128. LEGAL.eon018181.swpctx1201.9230001.290....510 Category Taxi/Limo Fare Meth.Pmt. Corporate Card Location United States Amount Pers.Amount Comp. Paid 1 Comp. Paid 2 Unlimited Recovery on #46 24.00 0.0 0.0 V 24.0 0.00 Description Taxi transportation for Welsh Unit 2 NBV analysis Taxes TAX 174 ©.00 Contains: • Date • Name of Taxi Company ("Yellow Checker Cab Co.") • Total Amount • Purpose of Taxi Ride ("Taxi transportation for Welsh Unit 2 NBV analysis") 0.0Q VAT 0.00 Provided as part of SWEPCO's Docket No. 42370 Application, Volume 4 of 5, EMPLOYEE EXPENSES tab, May 2012 tab, page 70. 56 SOAH Docket No. 473-15-0617 PUC Docket No. 42370 EXHIBIT RWH-2R e-i M n I, 01 -I ci ci N N M u"] I, r, Ol N^^ -zf N l0 lf) N r, f, r, r, p1 pl q N N M O N N m m m L!) l0 l0 f, 0p I, w -1 N N N N m m m D l0 I, i--I rl Co m m m m M M m m M o0 0o rn rn rn m rn m rn rn rn m rn c-i m on on o0 ou bD oU Go oU h0 op o0 bn op ao on en oU 00 Oq Gp ou w o0 on to a a a a a a a a a O. fl. a a a a a O. a a a a a a O. a tD l0 01 Q) 01 c-f N N N Co V l0 lD lD l0 lD lD rl I, 00 00 00 N 00 N N N N N N M M M M M Ol 01 0 0 0 0 0 0 0 0 0 0 c-I 0 Co ^ O r-1 ,1 r-q ,-•i ,1 ^ r-1 ,1 r-l rq 0 0 .1 .1 ,1 ,-•i .I ,1 T--i ,1 ,-i ,^ -4 r-l 0 0 0 0 0 0 0 0 0 0 0 0 o 0 0 O O O O O 0 o O 0 N N N N N N (N N N N N N N N N N N N N N N N N N } 0 Z W 0 ^ ui Nc E m z Y o W} J O_ a Z Z Y ::) N L :) > W N W V W O 2 W CO CO 00 CO m K C N £ A J d' 3: ^ W Of LL LL - Y Y O_., , O In "I ^ 0 p ^^ o ^ ^2 Q O x o^c = ^R ^^ CO m --------------------N m rl m 00 m ^n a S= w^ Z ZV) Z } > > > ^ > > > ^ 0 a a a a a a a FV LU J Q Y]G Y Y w W Q Z Z^ Z CC 2 W J W W W^ Z^>> w>>> w ^ Fa-- Q^ Q Q Q Q ^^ W Q ^ O O O OC OC CC u 3: O CL U J 0 o a o Z a O_ _O a O_ O_ O ^ ^ LU N 0 ^ Y ^ a O O O OQ rl N O V1 01 I N O O tn b V O V) m N V1 00 Mch M ct LA C) Ql O N. O Ol O M O 1- Co q N I- M V1 1, V CM Mr-I cM .--I 00 O c•i ci 00 M l!1 I, b I, m LA (M c-1 1^r 0 09 I 00 M ^ ^ ^ ^ ^^ !:^ ^ v s a ^ ^ ^ ^ ^ ^ ^ SS i i-^i M = Z W N W F=- p v V O F = 9 N O N Ql Ol 01 N M M M M lD I, N I, rl r, r, N N ri r, r, ifl -i 01 0 L/1 v) 41 -;T 00 00 -:T O^-I 00 I, -I .-I ci H I^ rl 00 vl u') H Lf1 ri 1l N N N c- I H e-1 N M c-i O I- ln u1 m t!1 O O rl ci ri tO `"I 1-1 ^'`I d' CO 00 00 CO 0) 01 0 c-1 N N N N N N M Co M 00 M u) u7 Ln V1 V1 i11 ll1 L11 Il) 1--1 N Co Co Co M(M M Co m m Co M Co H H ci ei H c-I c-I ci i--I i--I 1•i ^-I e1 H 1-1 e•i c-I a-i e--I ci i--I c-I ei V ^ r-q O 00 LO 'i 00 C = O Cu - m s .. ` .00 AL c C -2 wLO N (U ^ cV- 2 c a x 4- to (6 ^ r- OJ VI VI 0 N VI IA L I -L -1 -L f6 f0 f6 f6 f0 f0 c0 f6 f0 '8 1A w w w N w N N N N Q a, 41 4+ U1 CJ 41 .O Y^+ i+ VI ^ ^ Y J^^+ O E Q O L a-^^ J^^+ Y v^ E E E E E E E E E^ t r.Q E E r ^^ a t -r- ° Z° v a^ v m v v a^ v ar a^ v v a^ m v v w v a^ v v a^ a^ v o^ c a, a, v a, v a, v a, a, ai a, v a, m a, v a, a, a, a, v a, m a, T T T T T>- > T^. ???> ^. ^. T>?> T? T> T W.20-2.2-2.2-2.2-2-2-200000000000000 a a a a a a a a a n a a n a a a a a a a fl. U f'0 E E E E E E E E EE E E E E E E E E E E E E E E ^' G1 N U) N N N U) UJ N N N N N N O1 N G/ N N N v N N 4) d M Co m Co Co M Co mm Co N N N N N N N N N N N N N N E v v v a v v - v a vLO - Uo - LO io ^'-o LO ID to LO LO r, 11' v a v a v v v v a'i r•q ,1 .1 rl ,-, ,-l ,1 c•4 ,1 ^- , -1 I, V,3, 0 0 O O O O O 0 0 0 r" I, r" rl r, r- rl n n r. n n n N no Qo ^ a d v v v a v^ v m M M M m Co Co M M M Co M Co m a 0 a fo a, a, 0 a E N M 0 v 57