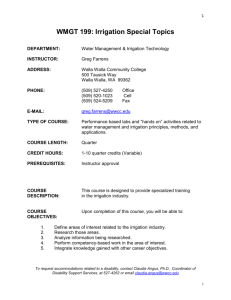

Accounting Information Systems (ACCT341)

advertisement

Accounting Information Systems (ACCT341) Practice Set - Cleaners By Bruce Toews NOTE: This document has been created in landscape orientation. If you choose to print this document, it should be printed landscape SCHEDULE The following schedule is meant to help you pace yourself through this material. Final due dates are shown below in blue color. Day 1: Skim through the background and general information. Then complete steps 1-7. Days 2-4: Complete steps 8-13. Day 5: Complete steps 14-20. Days 1-5 or a-e (Steps 1-20) are due no later than Thursday, Feb. 4 (midnight). Days 6-7: Complete steps 21-26. Days 8-10: Complete steps 27-37. Days 6-10 or f-j (Steps 21-36) are due no later than Monday, Feb. 22 (midnight). You should submit work in the order listed in the grade grid at the end this document. All work should be submitted via email to acct341@wallawallal.edu. Please attach the files in the order specified in the grade grid. The final exam will cover concepts in this practice set. Note: in all instances where it suggests you save a QuickBooks output using PDF Writer, you may also do so using Excel by clicking on the Excel export icon at the top of a report. Note: if you want a copy of this document in Word, see the K:drive. BACKGROUND & GENERAL INFORMATION This practice set involves a laundry and dry-cleaning business in Walla Walla which you purchased on July 1, 2015. The business has three sources of income: (1) it washes the uniforms and linens for a number of local organizations such as the State Penitentiary and St. Mary’s Hospital; (2) it dry-cleans suits, coats, quilts, curtains, etc.; and (3) it sells items such as lint remover, garment bags, hangers, and traveling irons. When you purchased the business on July 1, there were no employees so just you and your family did all the work until Oct. 1, when one employee was hired to ease the load. You kept the books by hand from July to September. On Oct. 1, you started to use QuickBooks, which you believe will be a great improvement. Revenue/Receipts Cycle The business washes bedding & uniforms for the three hospitals in the valley, for the WA State Pen, and for a number of other businesses. A statement is sent at the end of every month to each customer who owes money. Credit customers send their checks in the mail which must be post-marked no later than the 15th of the following month. Payments for all cash sales of inventory items are made by check at the time of purchase. All collections received during the week are deposited at Baker Boyer Bank. Petty Cash A petty cash drawer is kept for making misc. purchases and giving change to customers (which rarely happens since customers usually pay with checks). Initially only $100 was topped off in the drawer each morning, but because you occasionally ran out of change you upped the amount to $500 during October. Prepaid Insurance At 9/30/15, there was a balance of $723.00 in prepaid property insurance, which represented a six-month policy prepaid through 3/31/15. Long-Term Notes Payable Page 1 The original mortgage balance to Baker Boyer Bank for the building was $88,000 on July 1, 2015. The first payment was made on August 1, 2015. The mortgage balance is to be paid in equal monthly payments, including principal and interest at the fixed annual rate of 9.5% over 30 years. The mortgage payment is due at the beginning of every month but there’s a fifteen day grace period until the middle of the month. The payment is made by automatic payment from the BBB checking account. To get capital for the business purchase, you also borrowed $20,000 from your Uncle George on July 1, 2015. The principal is due in one balloon payment on July 1, 2024. Interest is payable every 6 months at a fixed rate of 9% APR. The note is unsecured. Line of Credit You have established a line-of-credit with Baker Boyer Bank with a credit limit of $10,000. If you need an infusion of cash, you can draw on the credit line. Payments are due the 15th of every month and include a portion of the principal (15%) of the previous month-end balance plus interest at a rate of 12% APR on the previous month-end balance. Payroll There is only one employee, Shirley Scrubber, who was hired on Oct. 1 to answer the telephone, be a sales clerk, and also help with the laundry/drycleaning work. With your assistance, she completed forms I-9 and W-4 before starting work as required by law. Shirley is paid monthly on the last business day of each month. After completing high school, Shirley worked as manager at Dairy Queen for a few years. She hopes one day to be able to go to college. She is a single mother of one, three-year old child and files as Head of Household on her tax return. Her SS# is 467-52-3492 and her address is 324 Stahl St., Walla Walla, WA 99362. Unfortunately, the payroll feature in QB works best if you purchase Intuit’s update package (which includes the most recent tax withholding tables, etc.). Because this update service is fairly expensive, you have decided that it is not worth subscribing to this service for one employee. Rather, you will do the payroll calculations in Excel instead. You will enter the totals from the Excel worksheet into QB. See the end of this document for an example of the worksheet. Shirley is paid $14 per hour for regular hours and is paid time-and-a-half for overtime hours, as required by law. Overtime hours are defined as hours worked in excess of 40 per week. Because she is paid a good wage for her level of education and has a flexible work schedule (comes in to do laundry in the evenings, etc.), she has agreed to accept no benefits (no retirement or healthcare benefits). The following amounts are withheld from Shirley’s pay: Social Security (SS) tax at a rate of 6.2%. Medicare (MC) tax at the rate of 1.45%. Federal income tax (FIT) withholding is determined using the number of withholding allowances claimed on Form W-4 and tables in IRS Publication 15. Use the 2015 Pub. 15, Tables for Wage Bracket Method. See table of contents in the front for pages numbers. For withholding purposes on these tables, Shirley is considered single and she is paid monthly. Shirley has asked that $100 be withheld from each paycheck and sent to Blue Mountain Credit Union. This works as a type of forced-savings plan for her. The following amounts are paid by the employer: The employer matches the SS and MC contributions made by the employee. The total of SS, MC and FIT is submitted to the IRS once a month by the 15th day of the following month. Once a quarter, Form 941 must be filed with the IRS to report these amounts. The employer pays Federal Unemployment Tax (FUTA) of 0.6% on the first $7,000 of each employee’s gross pay. FUTA is usually paid to the IRS once a quarter by the end of the month following each quarter. FUTA is reported once a year on Form 940. The employer also pays State Unemployment Tax (SUTA) of 1.5% of each employee’s gross pay. The SUTA rate is dependent on the layoff history of the employer as well as some other factors. SUTA is paid once a quarter to the Wash. Employment Security Dept. and is submitted along with the quarterly report, due by the end of the month following each quarter. Page 2 Workers Compensation Insurance (WCI) is a mandatory industrial insurance program run by the state to provide disability compensation if hurt on the job. In the Washington State, it is operated by the Dept. of Labor & Industries and is thus also called L&I insurance. The rate for laundry & dry-cleaning services of 0.03825 is multiplied by the total number of hours in the payroll to get the total amount of insurance premium due. Basing the tax on total hours worked makes sense because if you were out on sick leave or on vacation, you obviously couldn’t be injured on the job. An employer may choose to pass on a small portion of the cost to the employee. You have chosen however to pay all of the insurance and pass on none of the cost to Shirley. The premiums for WCI are submitted once a quarter to the Wash. Dept. of Labor and Industries, due by the end of the month following the quarter. Sales Tax and B&O Tax Some states primarily raise money through an income tax, such as Oregon. Other states primarily raise money through sales tax, such as Washington. Still other states raise money by a combination of income and sales tax, such as California. In Washington State, there is a state-wide sales tax of 6.5%. In addition, Walla Walla County/City add another 2.4%. Therefore, assume the total rate for taxpayers in Walla Walla County is 8.9%. The cleaning business must collect this tax from all customers at the point of sale and submit the tax to the state by the 25th of the following month. Both cash sales (inventory, etc.) and credit sale customers (cleaning, etc.) are subject to the full sales tax. For businesses there is also a special income tax in Wash. State called a Business & Occupation tax (B&O tax), which is based on the gross income of the business. For personal services, such as laundry and dry-cleaning, assume a rate of 1.5% of gross income. If a business earns less than $12,000 gross per year, the business is not subject to B&O tax. B&O tax is submitted once a month, due the 25 th of the following month, to the Wash. Dept. of Revenue, which is paid along with the sales tax. INSTRUCTIONS & TRANSACTIONS Days 1-2 (2PS#1, 2PS#2) Steps 1-7 below In order to get the software setup, complete the following steps: 1. Starting the Program. In any of the WWU computer labs, access QuickBooks from the programs listed via the Start Button. If new updates have been issued, a message may pop up. If you wish, you can update the software; but this step is usually unnecessary and you can skip it. 2. Create a new company file and set-up company information and preferences. Use the Detailed Start or Advanced Setup to create a new company and proceed through the advanced setup process. Note the following information. Please read carefully because an improper setup configuration can cause headaches for you down the road. For company and legal name, enter your own initials followed by the word Cleaners (e.g. BJT Cleaners). This would also be the legal name. Address is 125 South 2nd Street, Walla Walla, WA 99362. The federal employer identification number (EIN) is 91-0586010. You can leave the other fields blank. Skip the type of industry by clicking Next. The business is a sole proprietorship (tax form 1040). The first month of the fiscal and tax year is January, as is the first month of the income tax year. Do NOT set up an administrator password. When it prompts you to save the file, name it whatever you want, but you should save it to your USB drive -- not to a local hard drive (e.g. C:\). Creating a new file will take a minute or two so be patient. Next, you want customize QuickBooks. Your business offers both services and products. Creating a file may take a minute or two so be patient as the little wheel spins. You do NOT sell products online and are not interested in doing so. You DO charge sales tax, at a rate of 8.9%, to a single tax agency called the Wash. Dept. of Revenue (for name and description use WA Sales Tax). You do NOT want to create estimates. You do NOT want to track customers but you DO want to use Statement to Customers and Sales Receipts. You do NOT want to use progress invoicing. You DO want to manage bills you owe. You do NOT currently print checks and you do not plan to. You DO want to track inventory. You will sell both products and services. If the question comes up, you do NOT currently accept credit cards. You DO want to track time. You do NOT have Page 3 any employees (note: even though you have one employee, you do not want to use the QB Payroll module because Intuit charges an arm/leg for the withholding table updates, so the answer here is NO). You DO have 1099 contractors. Your start date will be September 30, 2015. Next, you want to review income/expense accounts. If any accounts have checkmarks next to them, remove the checkmarks. Your goal is to create a chart of accounts that matches the one below. Go to Setup. Note: To make your life easier in the future (so that annoying windows don’t keep popping up), you may want to go the Edit on the top menu, Preferences, Accounting, Company Preferences, and remove the Date Warnings. 3. Creating a Chart of Accounts. Go to Lists on the top menu, Chart of Accounts, Account tab in bottom-left corner, and New. Create new accounts as shown below. To delete account, hit Control-D. Later on, more accounts will be created on the run but below are the accounts that should be created at this point. Print/Save a chart of accounts using PDFWriter. Type Name Sub Account of Opening Balance Date Bank Checking Account –BBB N/A 3011.60 9/30/15 Other Current Asset D/C Inventory N/A 0.00 9/30/15 Other Current Asset Petty Cash N/A 100.00 9/30/15 Other Current Asset Prepaid Insurance N/A 723.00 9/30/15 Fixed Asset Building N/A 0.00 9/30/15 Fixed Asset Bldg Original Cost Building 72000.00 9/30/15 Fixed Asset Bldg Accum Depr Building 0.00 9/30/15 Fixed Asset Equipment N/A 0.00 9/30/15 Fixed Asset Equip Original Cost Equipment 42900.00 9/30/15 Fixed Asset Equip Accum Depr Equipment 0.00 9/30/15 Fixed Asset Land N/A 20000.00 9/30/15 Long Term Liab N/P Baker Boyer Bank N/A 87913.09 9/30/15 Long Term Liab N/P Uncle George N/A 20000.00 9/30/15 Equity Withdrawals by Owner N/A 0.00 9/30/15 Page 4 4. Equity Contributions by Owner N/A 0.00 9/30/15 Income Sales of Inventory N/A N/A N/A Income Laundry Service Income N/A N/A N/A Income Dry Cleaning Income N/A N/A N/A Cost of Goods Sold D/C Solution Expense N/A N/A N/A Creating Items. Go to Lists on the top menu, Items, Item tab, and New. The fields listed below are the ones that you need to change. When you are done, print/save the item lists using PDF Writer. Purchase/Sale Description Cost Cost Acct. Sales Price/Rate Income Account Min. Reorder Point Quantity on Hand As of Date Type Item Name Invent part Lint Remover Lint Remover 3.00 COGS 4.00 Sale of Invent 4 5 9/30/15 Invent part Wrinkle Spray Wrinkle Guard Spray 3.75 COGS 5.00 Sale of Invent 6 20 9/30/15 Invent part Garment Bag Garment Bag 7.50 COGS 10.00 Sale of Invent 5 10 9/30/15 Invent part Reg Hangers 50-pack Regular Hangers 3.75 COGS 5.00 Sale of Invent 5 15 9/30/15 Invent part Spec Hangers 50-pack Specialty Hangers 7.50 COGS 10.00 Sale of Invent 5 14 9/30/15 Invent part Trav Iron Traveling Iron 15.00 COGS 20.00 Sale of Invent 2 7 9/30/15 Invent part *D/C Solution *Gallons of D/C Solution 25.20 ** 0.00 D/C Income 50 83 9/30/15 *Note: in this item window, change COGS Acct to D/C Solution Expense & Asset Account to D/C Inventory. Noninvent part D/C QuiltCurtain Dry Clean Quilts-Curtains Page 5 N/A N/A 20.00 D/C Income N/A N/A N/A 5. 6. Noninvent part D/C CoatSuit Dry Clean CoatSuit N/A N/A 15.00 D/C Income N/A N/A N/A Noninvent part D/C P-S-DS Dry Clean Pants-ShirtDress-Skirt N/A N/A 8.00 D/C Income N/A N/A N/A Service Wash P-SD-S Wash PantsShirt-Dress-Skirt N/A N/A 3.00 Laundry Serv Inc N/A N/A N/A Service Wash Uniforms Wash Uniforms N/A N/A 2.00 Laundry Serv Inc N/A N/A N/A Service Wash Linens Wash Linens N/A N/A 2.00 Laundry Serv Inc N/A N/A N/A Item Type Item Name Description Rate Sales Tax Item WA Sales Tax WA Sales Tax 8.9% Tax Agency N/A WA Dept of Revenue Creating Vendors. Go to Vendors on the top menu and under the Vendor tab click on New Vendor. Create new vendors as shown below. Put the vendor name also in the address tab but you ignore the rest of the address. When you’re done, print/save a list of vendors using PDF Writer. One way to do this is to go to Reports on top menu and then to Vendors & Payables and then to phone or address list. Company Name 9/30/15 Balance Chemco Distributors Inc. 2236.63 H&F Industrial Supplies Inc. 889.62 Creating Customers. Go to Customers on the top menu, Customers & Jobs tab, and New Customer. Create new customers as shown below. Put the company name also in the address tab but leave the other address data blank. Note that governmental and nonprofit organizations are generally not exempt from paying sales taxes as an end user of the product or service. When you are done, print/save a customer list using PDF Writer. You can go to Reports on the top menu and then to Customers to print a phone or address list. Company Name 9/30/15 Balance American Janitorial Service 321.06 Page 6 7. City of College Place 255.67 City of Walla Walla 478.98 Doyle Electric 86.25 Grassi Refrigeration 56.25 St. Mary Medical Center 923.63 VA Medical Center 805.04 Walla Walla General Hospital 580.40 Wash. State Penitentiary 3,622.13 Whitman College Plant Service 166.45 Correcting Beginning Vendor/Customer Balances: (A) QB has a really annoying habit whenever beginning balances are recorded. In order to enter beginning balances for customers or vendors, QB creates an invoice or bill (respectively). In the case of customers, QB knows to debit accounts receivable but it doesn’t know what to credit, so it credits an account called uncategorized income. In the case of vendors, QB knows to credit accounts payable, but it doesn’t know what to debit, so it debits an account called uncategorized expense. The balances in uncategorized income and expense really belong in opening balance equity, so they need to be reversed against opening balance equity. To do this, you need to prepare a general journal entry (see Company menu, Make Journal Entry) dated 9/30/15 which debits Uncategorized Income for the balance in the account, credits Uncategorized Expenses for the balance in this account, and credits Opening Bal Equity for the difference between the two. This will zero out balances in uncategorized income/expense. (B) Sales tax of $583.84 is owed for September’s sales. Because the sale tax is included in the customer balances above, you need to prepare a general journal entry dated 9/30/15 to record the sales tax payable separately. Debit Opening Balance Equity and credit Sales Tax Payable for $583.84. The vendor is WA Dept. of Revenue. Days 3-4 (2PS#3, 2PS#4) Steps 8-13 below. You should have already completed the company and account set up on the previous assignment (Steps 1-7). Complete the steps below for the next two days. 8. There is only one employee, Shirley Scrubber, who was hired on Oct. 1 to answer the telephone and run the till during the day and also help with the laundry/dry-cleaning work. Every new employee must complete a Form I-9 and a Form W-4. The forms can be obtained by Googling them. Use fill-in forms and save them using PDF Writer. [Note: if a form does not allow you to save your fill-in work, take a screen shot of the form and paste it into a Word file.] Shirley knows nothing about these forms so you help her complete both of them by following the instructions (only do Page 1 of W-4). Shirley is a single mother of one, 3-year-old child and she files Head of Household for income tax purposes. She has essentially no dependent care expense because her mother babysits the child while she works. Her SS# is 467-52-3492 and her address is 324 Stahl St., Walla Walla, WA 99362. Shirley has a WA driver’s license (No. SCRUBSS343QZ, exp. 9/1/17) and a Social Security Card (no expiration) that she shows to you. Her birthday is 10-10-85. Her maiden name is Johnson. She is a US citizen and has a Certificate of US Citizenship, issued by the Dept. of Homeland Security, Document # 560-A3297, no expiration date. Print/save the forms using PDF Writer or screen shots. Page 7 9. Enter transactions for the month of October using the rules shown below. Transactions are listed at the end of this document. NOTE: Enter transactions chronologically. You should not go more than a week without entering ALL transactions for the week, including invoices, cash receipts & disbursements, etc. RULES FOR ENTERING TRANSACTIONS: For sales on credit, use Customers, Invoices. For cash sales, use Customers, Create Sales Receipts To record payments received from customers, use Customers, Receive Payments To record deposit at bank, use Banking, Record Deposits To record payment of all bills (except inventory and sales tax, see below), use Banking, Write Checks To record an order of inventory, use Vendors, Purchase Order To record receipt of inventory shipment, use Vendors, Receive Inventory (with bill) To record payment of inventory bill, use Vendors, Pay Bills To record the payment of sales tax, use Vendors, Manage Sales Tax To record non-routine transactions not involving cash (depreciation, interest, etc.), use Make Journal Entry (under Company menu) To record adjustment of inventory quantities, use Company, Adjust Qty on Hand 10. (A) As part of October’s transactions (Step #9), you should have already prepared an amortization table in Excel for at least the first 12 monthly payments of the mortgage. Make sure to save it for later submission. (B) QuickBooks has a Loan Manager (under the Banking menu) that creates amortization tables and even automates loan payment splits between interest and principal. In other words, you can set up an automatic loan payment to occur every month, and the entry will pull the correct interest and principal split, thereby doing all the work for you. Unfortunately, QuickBooks has synced this function with MS Explorer, a browser that, as you know, is on its way out. Therefore, it is doubtful that you’ll be able to get this function to work. So . . . you’re in luck – you get points for doing absolutely nothing for this question. If only I could make money by doing nothing, I’d be rich. 11. Create a statement for just one customer, WA State Penitentiary, and save it using PDF Writer. Write a response in a Word file to this question: What is the difference between a statement and an invoice? (Note: accumulate answer to all open-ended questions together in one Word file). 12. Create an Inventory Valuation Summary as of Oct. 31 and save it using PDF Writer. Record in a Word document the method used by QB for valuing inventories (e.g. FIFO, LIFO, weighted average, etc.). Hint: use the search feature in the Help function to find “How QuickBooks tracks inventory assets and Cost of Goods Sold.” Note that most other accounting packages (e.g. Sage50/Peachtree) allow the small business to choose its inventory method. 13. Create a standard balance sheet as of Oct. 31 and a standard P&L for Oct. and save them using PDF Writer. In a Word document, write a response to the following questions: (A) In your opinion, how did the business do in Oct.? Provide specific analysis. (B) What steps do you think could be taken to improve the operating results of this business? Be specific. Page 8 Day 5 (2PS#5) Steps 14-20 below. Because we are usually in the hurry to get assignments done, it is easy to overlook the accounting that QB does behind the scenes. After all, QB is known as the accounting program for dummy’s (those who don’t know a debit from a credit). Create a table in MS Word and complete the right two columns in a table similar to below. 14. List the accounts that QB automatically created by default. Look at your chart of accounts. Which accounts did you not create? Also, go to the help index and search for “Accounts that QuickBooks Sets Up for you”. 15. Determine what accounts are automatically debited and/or credited for each function listed below. For example, in the Checks window, the checking account is automatically credited and the debit is to various accounts. In order to answer the questions, you may have to actually enter fictitious transactions, view the registers, and then later void or delete the transactions. On the other hand, if you understand basic accounting, the answers are mostly common sense. Account options to select from: Checking, A/R, Inventory Asset, Undeposited Funds, A/P, Sales Tax Payable, Credit Card Liability, Sales or Service Income, Cost of Goods Sold, Various. ACCTS DEBITED ACCTS CREDITED 1. Customers: Invoices A. Assume non-sales-tax service provided (Which account is debited? Which is credited?) B. Assume inventory is sold subject to sales tax (two accounts debited, three credited) 2. Customers: Receive Payments (two options for debits, one for credits) 3. Banking: Record Deposits (various debit accounts possible, one credit) 4. Customers: Create Sales Receipts A. Assume non-sales-tax service provided (two options for debits, one for credits) B. Assume inventory is sold subject to sales tax (two options for debits, one specific debit, three specific accounts credited) 5. Customers: Refunds and Credits A. Assume credit memo for non-sales-tax service provided (one account debited, one credited) B. Assume credit memo for return of inventory subject to sales-tax. (three debits, two credits) C. Assume check refund for non-sales-tax service provided (one account debited, one credited) D. Assume check refund for return of inventory subject to sales-tax. (three debits, two credits) 6. Vendors: Purchase Orders (this one is tricky) 7. Vendors: Receive Inventory With Bill (one type of account debited, one credited) 8. Vendors: Enter Bills (various debits, one account credited) 9. Vendors: Pay Bills (one account debited, one account credited) 10. Vendors: Manage/ Pay Sales Tax (one account debited, one account credited) 11. Company: Adjust Quantity on Hand (assume the adjustment is to decrease inventory: various options debited, one account credited) 12. Banking: Write Checks (one credit, various debits) Page 9 16. (A) Why did we not use the payroll function within QB? (B) Explain the purpose of Form I-9 and determine whether the following statement is true or false: If every business properly completed Form I-9, no illegal workers would be hired in the U.S. (C) Explain the purpose of Form W-4 and determine whether the following statement is true or false: It is the employer’s fault if too much or too little income tax is withheld from an employee’s check (and s/he ends up getting a big refund or owing Uncle Sam big bucks). (D) Explain how the employer using a complete Form W4 to determine how much income tax to withhold. Be specific. 17. When you write a check by mistake (and then rip up the check), would you be better off deleting or voiding the check entry in QB? Why? How do you void a check entry in QB? 18. (A) Can you delete an account in QB that has transactions posted to it? (B) Can you rename an account at any time? 19. What does it mean to make an account inactive? Is this the same as deleting an account? Why might you want to make an account inactive? 20. (A) Does QB allow the use of account numbers in its chart of accounts? (B) What advantages might exist for using account numbers instead of merely account names? NOTE: Make sure that all reports for Steps 1-20 are in the order of the list at the end of this document. Submit these reports via email to acct341@wallawalla.edu. Days 6-7 (2PS#6, 2PS#7) Steps 21-26 below. You should have already completed steps 1-20 before the mid-term exam. Over the next few days, complete the steps below. 21. Enter transactions for the month of November in the same manner you did for October. Transactions are listed at the end of this document. Enter transactions chronologically. You should not go more than a week without entering ALL transactions for the week, including invoices, cash receipts & disbursements, etc. 22. (A) Keeping track of time spent on customer jobs can be burdensome. Fortunately, QuickBooks has a nifty feature that can track time. Go to Customers, Time/Enter Single Activity. Note how you can choose a customer, start the clock running, and QuickBooks will automatically add the time the customer’s bill. The feature is especially handy for professional service firms, such as accounting and law firms, that bill hourly. In your Word file, record your best guess of the typical rate a top CPA and lawyer in Walla Walla might bill per hour. [I will tell you what it is if you ask.] (B) Many small businesses today email their invoices to their customers in order to save paper, postage, and time. Select one of the invoices that you created for credit customers. Notice at the top of the invoice the envelope icon, which is an auto-email icon. Unfortunately, in order for this feature to work, QB needs to be synced with MS Outlook, which has not been done on the lab computers. Therefore, the invoice email function will not work. So . . . to get around this, convert the invoice into a PDF file and “pretend” that you emailed to yourself. Save the PDF file. (C) Note the format of the invoice you “emailed” to yourself in the previous step. This is a classic QB invoice and many of the invoices used by small business look just like this. It is ugly- go ahead and admit it! You can spot a standard ugly QB invoice a mile away. Fortunately, QB allows you to customize invoices, which we will now do. With the invoice window open, click on Formatting and Customize Design. Change the background to something other than blank. Add a logo by uploading a .jpg or .bitmap file you create using Microsoft Paint or any graphic program (Note: If QB does not allow you to upload your logo, email your logo in separately). Add whatever other customizations you want. Keep clicking Next until you apply the design. Note that QB will take a while to think about this because it is accessing the Internet. Finally, save the invoice by printing it (Control-P) to a PDF Writer. 23. Go to Reports on top menu and Inventory. Save an Inventory Stock Status By Item report as of Nov. 30, using PDF Writer. In a Word file, record which inventory item you think is closest to its reorder point and therefore should be ordered soon. Page 10 24. You want to send an advertisement to all your customers. Under File on top menu, Print Forms, Print Labels, use the feature to print labels for all customers. Accept the default label type. Note that addresses were never entered for customers so only the names will print. Use PDF Writer to save the printout. 25. (A) Under Reports on top menu and Customers & Receivables, create an A/R Aging Summary for all customers as of Nov. 30 (use PDF Writer to save the printout). (B) On the aging summary, double click on the balance of the one customer who is past due (i.e. QuickZoom). Create a QuickZoom report showing how many days have passed since you created the invoice for that customer (use PDF Writer to save the printout). Note that we ignored entering due dates on invoices so the aging days may be off a bit. (C) Use your Word file to record at least three steps you could take to prevent customers from getting behind on their payments. (D) Under the Company top menu, Prepare Letters with Envelopes, Prepare a Harsh Collection Letter to American Janitorial Services. This may require you to copy a template and edit it. QuickBooks should open a Word file with suggested wording for the letter. Edit the letter in Word to your satisfaction and then save it. Sign off with your own name, as business owner. 26. Print a standard balance sheet as of Nov. 30 and a standard P&L for Nov. Use PDF Writer to save the printouts. In your Word file, write a response to the following questions: (A) How did the business do in Nov.? Better or worse than Oct? Why do you think this is? Be specific. (B) What steps do you think could be taken to improve the operating results or this business? Be specific. Days 8-10 (2PS#8, 2PS#9, 2PS#10) Steps 27-37 You should have already completed steps 1-26 on previous assignments. Complete the steps below to finish up the practice set. 27. Enter transactions for December. Transactions are listed at the end of this document. Note: to minimize data entry you should only enter the total sales transactions for month, dated Dec. 13 (e.g. one invoice for each credit customer for the month and one sales receipts entry for the whole month). 28. Print a standard balance sheet as of Dec. 31 and a standard P&L for the quarter-ended Dec. 31 (with a separate column for each month). Use PDF Writer to save the printouts. In your Word file, indicate which of the three months in the quarter was the most profitable and why. 29. One of the most misunderstood but important subjects that small business owners must deal with is payroll and other taxes. There are a multitude of tax forms which must be filed correctly or penalties will be assessed. We will focus on three common federal forms that must be filed by Jan. 31 of each year. (For time’s sake, we are skipping the state forms, including Wash. sales tax, Wash. B&O tax, WCI tax, and SUTA tax). By Googling, obtain 2015 Form W-2, Form 940, and Form 941. There are instructions for the forms that can also be downloaded if you need them, but the forms are quite self-explanatory. (A) You should have already completed the Excel spreadsheet for payroll. Make sure to submit the spreadsheet as part of this step. (B) Regarding the 2015 Form W-2 for Shirley Scrubber, indicate in a Word file what would appear on the following lines: b,c,e,f, 1,2,3,4,5,6 (C) Complete Form 941 for the 4th quarter of 2015. Use a fill-in form. Assume the full payment for December’s payroll tax was made the following month (Jan. 15) and that you are completing the form after this payment was made. Save/print the form using PDF Writer. (D) Complete Form 940 for the calendar year 2015. Assume that full payment for unemployment was made the following month (Jan. 15) and that you are completing this form after this payment was made. Page 11 30. Go to the Company menu (at the top), Planning & Budgets, Set Up Budgets. Proceed to create a 2015 budget for the following P&L income accounts with no additional detail; enter budget figures (not based on previous periods) for October, for November and December. We are ignoring expense accounts for time’s sake. Here are the budget amounts: Dry Cleaning Income $1,000/mo.; Laundry Service Income, $10,000/mo.; and Sale of Inventory $400/mo. Go to Report, Budget, and save a Profit & Loss Budget vs. Actual for the 4th quarter 2015 (using PDF Writer) showing each month in separate columns together with a total. Make the page landscape. Note that for expediency sake, we only entered budget figures for income. But obviously in the real world expenses would be budgeted as well. 31. (A) Go to Reports, Company & Financial, and save a net worth graph for the last three months of the year. Use PDF Writer. (B) Go to Reports, Sales, and save a sales graph for the quarter, using PDF Writer. 32. Go to Reports, Company Snapshot. Expand the window. List the information on this dashboard. Can you think of any information helpful to a manager than is not on this dashboard? 33. (A) Save a Summary Balance Sheet as of Dec. 31, using PDF Writer. (B) Use the filter feature (under Modify Report button) to restrict the accounts to long-term liabilities. Save the long-term liabilities section as of Dec. 31, using PDF Writer. 34. Go to Reports, Inventory and save a Physical Inventory Worksheet, using PDF Writer. Explain what this form would be used for in your Word file. 35. Go to Reports, Vendors & Payables, and create 1099 summary report for all vendors on all allowed accounts. In your Word file, make a list of vendors, if any, that need Forms 1099-MISC issued to them. Remember the rule that Forms 1099-MISC don’t have to be sent to corporations (except fishing or attorney corporations) or to vendors that were paid less than $600 during the previous year. Note that all banks, utility companies, and gov’t entities are incorporated. 36. Go to the Help (QuickBooks Help) and search for condensing data. Explain the purpose of this feature in your Word file. 37. Go to the Help (QuickBooks Help) and search “Why are passwords important?” Explain in your Word file how this feature can assist in strengthening internal control in QuickBooks. NOTE: Make sure that all reports are emailed to acct341@wallawalla.edu in the order of the list at the end of this document. Page 12 Week Date TRANSACTIONS 10/5 Recorded cash sales for week (see details at end of this document. Use only one Create Sales Receipts window for all the week’s cash sales. Then recorded the deposit of receipts in bank checking account (using Make Deposit window). Also, recorded all invoices for week, creating a separate invoice for each customer. Sales details are listed in a separate table below. Do NOT record sales for more than one week at a time before completing all other transactions for that week, i.e. you should not go more than a week without entering ALL transactions for the week, including invoices, cash receipts & disbursements, etc. Recorded direct payment (where it comes directly out of bank account automatically) for $189.76 to Cascade Natural Gas for Sept. (Create new utilities expense account.) For all direct or automatic payments, use the Write Check window without assigning a check number. Direct payment made for mortgage (use Excel to calculate monthly payment and prepare a 12-month amortization table). Make sure to split the payment between mortgage principal and interest. You will create a new interest expense account. Recorded cash sales for week and deposited receipts in bank checking account. Recorded invoices for week. Follow each of these steps carefully before proceeding. Wrote check for $81.90 to Qwest of which $56.91 was for Sept. telephone and $24.99 for Yellow Pages listing. No liability for this was set up at Sept. 30. Yellow pages should be charged to Advertising Expense, a new account. Last check written in Sept. was #1465 Received payments from all customers for September 30 balances, except American Janitorial Services. (See 10/19 for deposit.) Use Receive Payments window. Wrote check for $566.93 to Pacific Power for Sept. electricity (those dryers really lap up the juice). No liability was set up at 9/30, which means you should charge an expense (not a liability) when you pay. Recorded cash sales for week and deposited all receipts (from cash sales and from credit customers) in bank checking account. Recorded invoices for week. Follow each of these steps before proceeding. Wrote check for $951.22 to the City of Walla Walla for Sept. water/sewer. No liability was set up at 9/30 for this. 1 10/5 10/10 10/12 2 10/12 10/16 10/16 3 10/19 10/19 10/22 4 10/23 10/24 10/25 10/25 10/26 10/31 5 10/31 10/31 Sent purchase order to H&F Industrial Supplies for the following inventory items: 5 lint removers @ $3.03; 20 wrinkle guard sprays @ $3.78; 10 garment bags @ $7.57; 8 regular hangers @ $3.75; 10 specialty hangers @ $7.50; and 5 traveling irons @ $15.13. Print a copy of the purchase order and save it using PDF Writer. Decided to increase petty cash from $100 to $500, so wrote check for $400 to petty cash and cashed it. Received payment from American Janitorial Services for September. This company often pays late. Wrote checks to pay Sept. balance in accounts payable to Chemco Distributors and H&F Industries Supplies. Use Pay Bills function on the Vendor Section. Wrote check to Wash. Dept. of Revenue to pay Sept. sales tax. (Use Vendor section, Manage/Pay Sales Tax). Recorded cash sales for week and deposited all receipts in bank checking account. Recorded invoices for week. Estimated 64.5 gallons of dry-cleaning solution left. Use Adjust Qty on Hand in Company section. Adjust to D/C Solution Expense account. Shirley turned in her timecard for Oct. showing 160 regular hours and 3 OT hours. Wrote check to record employee’s payroll. Also, used Make Journal Entry to record employer's payroll. See example of worksheet at end of document and description of payroll at beginning of document. For proper month-end cutoff, recorded cash receipts for week to date and made deposit. Recorded invoices for week-to-date. Page 13 11/1 11/1 11/2 11/5 11/7 6 11/9 11/9 11/13 11/14 11/16 7 8 11/16 Statements summarizing activity for October were prepared and mailed to each credit customer with balance owing, so that customers would know how much to pay (due Nov. 15). In order to save time, save (using PDF Writer) one statement for Wash. State Penitentiary (go to Customers on top menu and then to Create Statements). Wrote check for $100 to BMCU for withholding from Shirley's Oct. payroll Recorded cash sales for remainder of week and made deposit. Recorded invoices for remainder of week. Automatic payment of $193.54 made from bank account to Cascade Natural Gas for Oct. Received shipment from H&F Industrial Supplies for inventory items ordered on 10/22. An invoice was included with the shipment. Invoice showed shipping & handling charges of $14.55 in addition to inventory charges. Use Receive Inventory with Bill window. Create new Freight-in Acct (type COGS) and enter the freight cost on the expense tab. Made mortgage payment (automatic payment). Recorded cash sales for week and deposited receipts in bank checking account. Recorded invoices for week. Paid $86.55 to Qwest ($61.56 for Oct. telephone and $24.99 for Yellow Pages listing) Wrote check to H&F Industrial Supplies for invoice received on 11/7. Automatic withdrawal is made from checking account to the US Treasury for payment SS, MC and FIT due for October. (Note: Employers use the internet or telephone to set up a scheduled payment with the IRS which comes out of the checking account automatically. Recorded cash sales for week and checks received in the mail from all credit customers for Oct., except American Janitorial Service which almost always pays late. Deposited receipts in bank checking account. Recorded invoices for week. 11/16 Paid $579.75 to Pacific Power for Oct. electricity. 11/19 11/23 11/23 Paid $962.37 to the City of Walla Walla for Oct. water/sewer. Recorded cash sales for week and deposited them. Recorded invoices for week. Sent purchase order to Chemco Distributors for 30 gallons of dry-cleaning solution at $25.20 per gallon. 11/26 Paid sales tax accrued through the end of Oct. to Wash. Dept. of Revenue. Separately, paid Dept. of Revenue the B&O tax due for October. The B&O tax is 1.5% of total income for Sept. and Oct. plus a $20 penalty for failing to pay Sept. tax when due. Sept.'s total revenue was $11,303. You’ll need to create a P&L statement to find October’s total revenue. Create a new account called B&O Tax Expense. Need to replenish petty cash. Balance of cash/coin in drawer was $392.79. Documents in drawer included: a receipt for stamps $39, an IOU slip where Shirley had borrowed $35 in order to take a friend of hers out to lunch, a receipt for $32.21 from the office supply store for some envelopes and paper supplies. You will need to create a new Other Current Asset account entitled Receivable-Employee to record the IOU. Also, you should create an expense account for Office Supplies and another for any Over/Short Expense. Received shipment from Chemco Distributors for dry-cleaning solution ordered on 11/23. Invoice included with shipment. Invoice showed shipping & handling of $23.87 to be charged to the Freight-In account. 11/27 9 11/29 11/30 11/30 11/30 11/30 11/30 Paid the invoice from Chemco Distributors received the previous day. Recorded cash sales for week and deposited receipts in bank checking account. Recorded invoices for week. Estimated about 59 gallons of dry-cleaning solution left in end-of-month inventory. Wrote check to Shirley Scrubber who turned in a timecard for Nov. showing 158 reg hrs plus 1 OT hr. Recorded employer’s payroll for Nov. Page 14 10 11 12/4 12/5 12/6 Paid $100 to BMCU for withholding from Shirley's Nov. payroll Automatic payment of $167.71 made from bank account to Cascade Natural Gas for Nov. Sent purchase order to H&F Industrial Supplies for the following inventory items: 7 lint removers @ $3.05; 18 wrinkle guard sprays @ $3.80; 12 garment bags @ $7.60; 10 regular hangers @ $3.78; 10 specialty hangers @ $7.55; and 6 traveling irons @ $15.15. 12/10 12/11 Mortgage payment was automatically made out of bank account. Received shipment from H&F Industrial Supplies for inventory items ordered on 12/06. An invoice was included with the shipment. Invoice showed shipping & handling charges of $15.05 in addition to inventory charges. 12/12 Recorded customer invoices for month. Notice that to save the accountant time, we have totaled all invoices for December into one amount per customer, rather than show weekly amounts. Recorded cash sales for month and deposited receipts in bank checking account. (All of Dec. transactions have been lumped together to save time.) Paid $82.49 to Qwest (of which $57.50 was for Nov. telephone and $24.99 for Yellow Pages listing) Automatic withdrawal is made from checking account to the US Treasury for payment SS, MC and FIT due for November. 12/12 12/13 12/13 12 13 12/17 12/18 Paid $590.71 to Pacific Power for Nov. electricity. Recorded checks received in the mail from all credit customers for Nov., except American Janitorial Service which you find out has declared Ch. 7 bankruptcy. Deposited receipts in bank checking account. 12/19 12/20 12/24 12/25 12/26 Paid $962.37 to the City of Walla Walla for Nov. water/sewer. Wrote check to yourself for $2,000 to cover personal expenses. Closed for Xmas Closed for Xmas Paid sales tax and B&O tax for November to Wash. Dept. of Revenue. Write separate checks. The B&O tax is 1.5% of gross revenue for November. 12/28 Wrote off the balance in American Janitorial Service account to Bad Debt Expense. See Bad Debts in help index for instructions. You must write-off each invoice separately as a discount to Bad Debt Expense. In addition, you will need to total the amount of sales tax included in the written-off invoices and create a journal entry debiting sales tax payable and crediting bad debts expense. Adjusted prepaid insurance to record 4th quarter expense. Set up an interest payable for the accrued interest owed to Uncle George at end of year. Estimated 42 gallons of dry-cleaning solution left in end-of-month inventory. Recorded half-year of straight-line depreciation on buildings (39-year life, no salvage value) and equipment (7-year life, no salvage value). Wrote check to Shirley Scrubber who turned in a timecard for December showing 120 regular hours plus 2 OT hours. Also recorded employer's payroll for Dec. 12/28 12/28 12/28 12/28 12/28 12/31 1/1 Closed for New Years Closed for New Years Page 15 WEEKLY LOG OF SALES ACTIVITY IMPORTANT: Transactions on the left (under blue heading) are invoices to be sent to the customers listed. Transactions on the right (under orange heading) are cash sales (called cash receipts), for which we don’t care about the customer’s name (e.g. Wal-Mart doesn’t need your name when you buy something there). Therefore, the customer names listed (e.g. American Janitorial Service) apply only for invoices, but these names do NOT apply to cash sales. If you are confused, ask me and I’ll explain it to you. Sales on Credit (Invoices) Cash Sales (Sales Receipt -- name of customer is irrelevant) Wash CLEANERS U uniforms CREDIT CUSTOMERS L linens Week Ending Oct. 5 Sales of Inventory pntshrt drsskt lint wrinkle garmet Reg spec trav quilt coat rmvr spray bag Hangers hangers iron curtain suit pntshrt drsskt 2 2 50 (1 package) 50 4 8 4 2 American Janitorial Service U 20 St. Mary Medical Ctr L 45 are in Doyle Electric U 18 50-pack City Of College Place U 33 units Grassi Refrigeration Inc U 14 Wash. State Penitentiary L 950 City Of Walla Walla U 25 Va Medical Ctr L 35 Walla Walla General Hospital L 30 Whitman College Plant Service U 16 Walla Walla Electric U 14 Doyle Electric U 19 City Of College Place U 34 City Of Walla Walla U 26 American Janitorial Service U 21 Grassi Refrigeration Inc U 15 Wash. State Penitentiary L 951 Va Medical Ctr L 36 St. Mary Medical Ctr L 46 Walla Walla General Hospital L 31 Whitman College Plant Service U 17 Walla Walla Electric U 15 Week Ending Oct. 12 Hangers 6 Week Ending Oct. 19 Doyle Electric 4 1 U Dry Cleaning 16 Page 16 3 3 100 100 1 2 12 1 50 100 2 4 5 3 City Of College Place U 31 City Of Walla Walla U 23 American Janitorial Service U 18 Grassi Refrigeration Inc U 12 Wash. State Penitentiary L 948 Va Medical Ctr L 33 St. Mary Medical Ctr L 43 Walla Walla General Hospital L 28 Whitman College Plant Service U 14 Walla Walla Electric U 12 Doyle Electric U 20 City Of College Place U 35 City Of Walla Walla U 27 American Janitorial Service U 22 Grassi Refrigeration Inc U 16 Wash. State Penitentiary L 952 Va Medical Ctr L 37 St. Mary Medical Ctr L 47 Walla Walla General Hospital L 32 Whitman College Plant Service U 18 Walla Walla Electric U 16 Week Ending Oct. 26 Partial Week Ending Oct. 31 pntshrt drsskt lint wrinkle garmet Reg spec trav quilt coat rmvr spray bag Hangers hangers iron curtain suit pntshrt drsskt 2 1 2 2 50 50 4 8 4 50 50 1 2 7 1 2 Doyle Electric U 23 City Of College Place U 38 City Of Walla Walla U 30 American Janitorial Service U 25 Grassi Refrigeration Inc U 19 Wash. State Penitentiary L 955 Va Medical Ctr L 40 St. Mary Medical Ctr L 50 Walla Walla General Hospital L 35 Whitman College Plant Service U 21 Walla Walla Electric U 19 Partial Week Ending Nov. 2 pntshrt drsskt 4 Page 17 3 lint wrinkle garmet Reg spec trav quilt coat rmvr spray bag Hangers hangers iron curtain suit 50 50 1 5 pntshrt drsskt Week Ending Nov. 9 4 Doyle Electric U 14 City Of College Place U 29 City Of Walla Walla U 21 American Janitorial Service U 16 Grassi Refrigeration Inc U 10 Wash. State Penitentiary L 946 Va Medical Ctr L 31 St. Mary Medical Ctr L 41 Walla Walla General Hospital L 26 Whitman College Plant Service U 12 Walla Walla Electric U 10 Doyle Electric U 21 City Of College Place U 36 City Of Walla Walla U 28 American Janitorial Service U 23 Grassi Refrigeration Inc U 17 Wash. State Penitentiary L 953 Va Medical Ctr L 38 St. Mary Medical Ctr L 48 Walla Walla General Hospital L 33 Whitman College Plant Service U 19 Walla Walla Electric U 17 Week Ending Nov. 16 Week Ending Nov. 23 Doyle Electric U 15 City Of College Place U 30 City Of Walla Walla U 22 American Janitorial Service U 17 Grassi Refrigeration Inc U 11 Wash. State Penitentiary L 947 Va Medical Ctr L 32 St. Mary Medical Ctr L 42 Walla Walla General Hospital L 27 Whitman College Plant Service U 13 Walla Walla Electric U 11 3 3 50 100 2 7 7 3 pntshrt drsskt lint wrinkle garmet Reg spec trav quilt coat rmvr spray bag Hangers hangers iron curtain suit pntshrt drsskt 2 1 2 2 2 6 4 2 1 3 1 lint wrinkle rmvr spray pntshrt drsskt Page 18 50 100 50 1 2 11 garmet Reg spec trav quilt coat bag Hangers hangers iron curtain suit pntshrt drsskt Week Ending Nov. 30 4 Doyle Electric U 18 City Of College Place U 33 City Of Walla Walla U 25 American Janitorial Service U 20 Grassi Refrigeration Inc U 14 Wash. State Penitentiary L 950 Va Medical Ctr L 35 St. Mary Medical Ctr L 45 Walla Walla General Hospital L 30 Whitman College Plant Service U 16 Walla Walla Electric U 14 Doyle Electric U 69 City Of College Place U 129 City Of Walla Walla U 97 American Janitorial Service U 0 Grassi Refrigeration Inc U 53 Wash. State Penitentiary L 3797 Va Medical Ctr L 137 St. Mary Medical Ctr L 177 Walla Walla General Hospital L 117 Whitman College Plant Service U 60 Walla Walla Electric U 55 Totals For All Of December 3 3 50 100 2 7 7 3 pntshrt drsskt lint wrinkle garmet Reg spec trav quilt coat rmvr spray bag Hangers hangers iron curtain suit pntshrt drsskt 12 2 9 4 200 250 2 12 24 8 Page 19 Payroll worksheets to be created in Excel: Employee's Payroll Reg OT Month Rate (entered as a check, see dr/cr below) See IRS 0.062 0.0145 Table Hrs Hrs Oct ? ? $14.00 $ Gross - $ SS - $ MC - $ FIT - $ Cr. Un. - $ Net Pay - Nov ? ? $14.00 $ - $ - $ - $ - $ - $ - Dec ? ? $14.00 $ - $ - $ - $ - $ - $ - Qtr TL ? ? $ - $ - $ - $ - $ - $ - Debit/Credit Template: Enter employee’s payroll as a check, with debits as positive numbers and credits as negative numbers. Columns above correspond to the account below. Debit/Credit Template: dr cr cr cr cr cr wage exp ss pay mc pay fit pay cu pay cash Employer's Payroll (entered as a journal entry, see dr/cr below) 0.062 0.0145 0.03825 0.006 0.015 SS MC WCI FUTA SUTA Month Total Oct $ - $ - $ - $ - $ - $ - Nov $ - $ - $ - $ - $ - $ - Dec $ - $ - $ - $ - $ - $ - Qtr TL $ - $ - $ - $ - $ - $ - Jan $ - $ - $ - $ - $ - $ - General Journal Template Enter employer’s payroll as a general journal entry cr cr cr cr cr dr payr ss pay mc pay wci pay futa pay suta pay tax exp New Accounts Needed: Wages Expense Payroll Tax Expense SS Payable MC Payable FIT Payable WCI Payable Credit Union Payable FUTA Payable SUTA Payable Type Expense Expense Other Cur. Liab. Other Cur. Liab. Other Cur. Liab. Other Cur. Liab. Other Cur. Liab. Other Cur. Liab. Other Cur. Liab. Page 20 ACCT341, PS#2, Grading Grid for first half Step 3 4 5 6 8 9 10 10 11 12 13 13 13 14 15 16 17 18 19 20 TOTAL Pts 2 2 2 2 8 2 6 2 4 4 11 11 4 4 18 10 2 2 2 2 100 Description Chart of accts Item list Vendor list Customer list Forms I-9 and W-4 Purchase Order on Oct. 22 Amortization table Loan Manager (points for stating it’s not working?) Customer stmt and question Inventory valuation summary and question Oct. Balance Sheet Oct P&L Questions about results and improvements Default accounts Debits & credits Questions on why payroll not used, I-9 and W-4 To delete or void acct? Can you delete acct if transactions recorded? Inactive vs. delete acct? Account numbers vs. account names Steps 1-20 are due all together on the date shown on the course schedule (before the mid-term exam). Page 21 ACCT341, PS#2, Grading Grid for second half Step Pts Description 22 23 24 25 26 28 29 29 29 28 30 31 31 32 33 33 34 35 36 37 TOTAL 10 4 4 8 12 10 14 4 4 4 4 2 2 4 2 2 2 2 3 3 100 Tracking time, emailed invoice, and customized invoice Inventory stock status and question Customer labels Aging and collections Nov. BS & P&L and questions Dec. BS and Quarterly P&L Payroll spreadsheet Form W-2 Form 941 Form 940 P&L Budget vs. Actual Net worth graph Sales graph Snapshot and questions Summary Bal. Sheet Filtered L/T liabilities Physical inventory worksheet and question 1099 Vendors Purpose of condensing data Use of passwords as internal control GRAND TOTAL 200 points Page 22