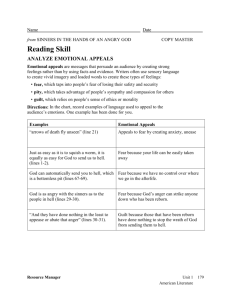

Section VIII “Appeals

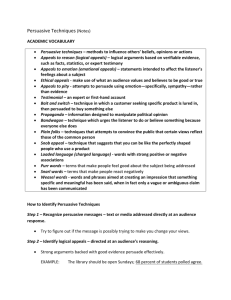

advertisement