s means financial difficulties “wheeler

advertisement

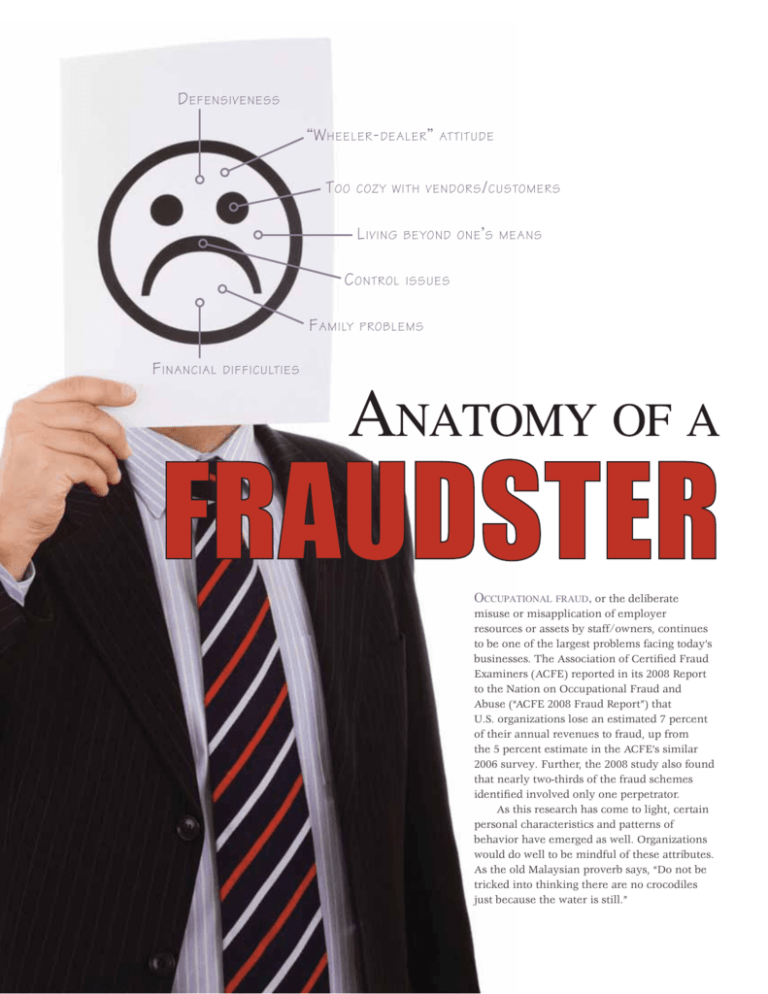

D EFENSIVENESS “W HEELER - DEALER ” T OO COZY WITH VENDORS / CUSTOMERS L IVING C ONTROL F AMILY F INANCIAL ATTITUDE BEYOND ONE ’ S MEANS ISSUES PROBLEMS DIFFICULTIES OCCUPATIONAL FRAUD, or the deliberate misuse or misapplication of employer resources or assets by staff/owners, continues to be one of the largest problems facing today’s businesses. The Association of Certified Fraud Examiners (ACFE) reported in its 2008 Report to the Nation on Occupational Fraud and Abuse (“ACFE 2008 Fraud Report”) that U.S. organizations lose an estimated 7 percent of their annual revenues to fraud, up from the 5 percent estimate in the ACFE’s similar 2006 survey. Further, the 2008 study also found that nearly two-thirds of the fraud schemes identified involved only one perpetrator. As this research has come to light, certain personal characteristics and patterns of behavior have emerged as well. Organizations would do well to be mindful of these attributes. As the old Malaysian proverb says, “Do not be tricked into thinking there are no crocodiles just because the water is still.” A N AT O M Y O F A F R A U D S T E R Behavioral Red Flags Fraud perpetrators (often known as “fraudsters”) often display certain behaviors that may serve as warning signs to management and co-workers. The two most common red flags identified in the ACFE’s 2008 Fraud Report include living beyond one’s means and financial difficulties. However, it’s important not to ignore the other warning signs identified, from a “wheeler-dealer” attitude, control issues, and family problems to defensiveness, addictions, and getting too close to vendors/customers. All can play a role in influencing behavior. It’s important to note that none of these red flags should be considered in isolation. As with most things in life, it’s the total package that must be analyzed. However, if your organization has someone that exhibits several traits on this list, extra vigilance may be warranted — but it must be emphasized that displaying one or more behavioral red flags is in and of itself not proof that an individual is committing fraud. s Age. The survey concluded that more than 50 percent of the reported fraud studies involved a perpetrator over the age of 40, with more than one-third of those involving a person between the ages of 41 and 50. Of equal importance, the correlation between age and the amount of the loss appears to be strong; median losses involving fraudsters in their 50s more than doubled those of any younger age group. s Tenure. The study showed no strong correlation between the length of time an individual worked for an organization and when that individual was likely to begin stealing from it. However, the study did conclude that longer-term employees tended to commit the larger frauds in terms of median losses per incident. s Position. More than 75 percent of frauds are committed by staff and managers. While owners and executives commit a smaller fraction of fraud (just over 23 percent), the median loss from these reported incidents was more than five times greater than that of frauds committed by employees and managers. s Prior Record. The study found that a large majority of reported frauds involved first-time offenders. Some 87 percent of the cases in the survey involved perpetrators who had no prior criminal record for fraudulent activities, and 83 percent had never previously been punished or terminated by an employer for such activities. s Collusion. In most cases, occupational fraud is committed by an individual acting alone. The study reported that nearly two-thirds of all reported fraud schemes involved only one perpetrator. However, for those frauds involving multiple perpetrators, the median loss was four times higher than the amount lost in schemes committed by a single person. Profile of a Typical Fraudster In addition to observed behavioral red flags, the ACFE’s 2008 Fraud Report also analyzed the traits of fraudulent individuals. Those traits include: s Gender. Almost 60 percent of reported fraud cases were committed by males. The median loss of frauds perpetrated by males is more than twice that of frauds committed by females. It’s theorized that this disparity is derived from males holding more management and executive-level positions, providing a greater opportunity to commit larger-dollar frauds. s Education Level. While nearly 34 percent of the reported frauds were committed by people with no college education, more than half of the reported frauds were committed by individuals who had attended or graduated from college. Only 11 percent of the reported frauds were committed by individuals who had obtained an advanced degree. However, the survey also showed that as the perpetrator’s education level rose, so did the median loss caused by the fraud. Employees with a college degree absconded with a median amount of $210,000, more than twice that of those with no college education. Watch out for Crocodiles Organizations, both large and small, face increasing threats of loss related to occupational fraud. All companies should increase their awareness of the behavioral red flags and demographic composition of those prone to committing fraud. Remember — the most effective fraud prevention programs incorporate knowing who and what to look for, always being on the lookout for tell-tale behavioral red flags, and taking swift action when fraud is detected.