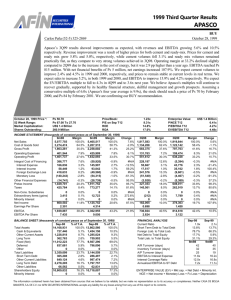

Putting EBITDA in Perspective

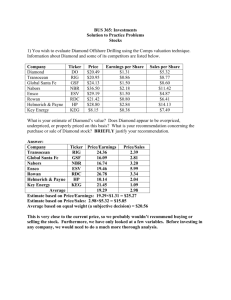

advertisement