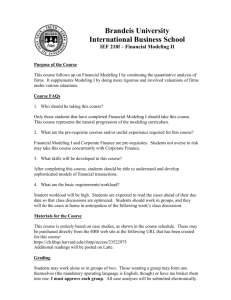

Syllabus - Brandeis University

advertisement

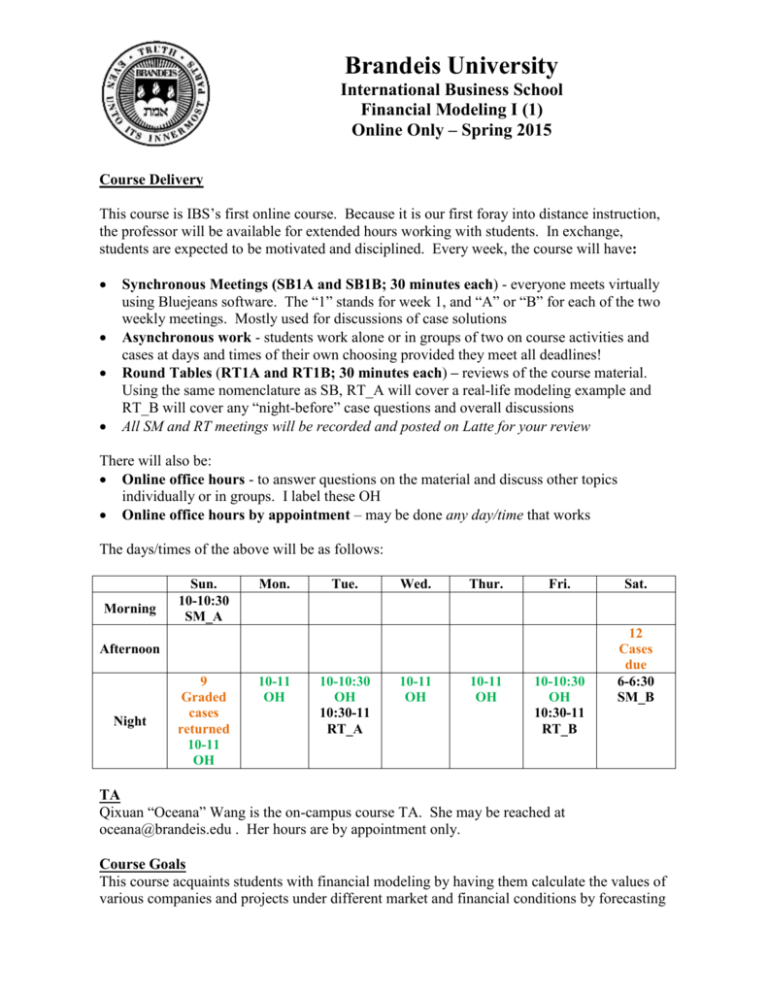

Brandeis University International Business School Financial Modeling I (1) Online Only – Spring 2015 Course Delivery This course is IBS’s first online course. Because it is our first foray into distance instruction, the professor will be available for extended hours working with students. In exchange, students are expected to be motivated and disciplined. Every week, the course will have: Synchronous Meetings (SB1A and SB1B; 30 minutes each) - everyone meets virtually using Bluejeans software. The “1” stands for week 1, and “A” or “B” for each of the two weekly meetings. Mostly used for discussions of case solutions Asynchronous work - students work alone or in groups of two on course activities and cases at days and times of their own choosing provided they meet all deadlines! Round Tables (RT1A and RT1B; 30 minutes each) – reviews of the course material. Using the same nomenclature as SB, RT_A will cover a real-life modeling example and RT_B will cover any “night-before” case questions and overall discussions All SM and RT meetings will be recorded and posted on Latte for your review There will also be: Online office hours - to answer questions on the material and discuss other topics individually or in groups. I label these OH Online office hours by appointment – may be done any day/time that works The days/times of the above will be as follows: Morning Sun. 10-10:30 SM_A Mon. Tue. Wed. Thur. Fri. Afternoon Night 9 Graded cases returned 10-11 OH 10-11 OH 10-10:30 OH 10:30-11 RT_A 10-11 OH 10-11 OH 10-10:30 OH 10:30-11 RT_B Sat. 12 Cases due 6-6:30 SM_B TA Qixuan “Oceana” Wang is the on-campus course TA. She may be reached at oceana@brandeis.edu . Her hours are by appointment only. Course Goals This course acquaints students with financial modeling by having them calculate the values of various companies and projects under different market and financial conditions by forecasting its cash flows. Once students complete this course, they will understand finance for what it is - the sum total of quantitative analysis, judgment, understanding of various industries and markets, timing, and cleverness. Most importantly, students will become comfortable in making quantitative assessments under conditions of extreme uncertainty. Course FAQs 1. Who should be taking this course? Students concentrating in finance should take this course. This course provides the foundation for doing quantitative valuations. The fact that the course is online should not limit students. That said, students taking this online-only course should be motivated and disciplined. They may use the IBS network to access the course. 2. What are the pre-requisite courses? Accounting and Corporate Finance are pre-requisites for this course. If students are taking corporate finance concurrently, the professor’s permission will be required. 3. What skills will be developed in this course? After completing this course, students should be able to develop sophisticated financial models. Students should also be comfortable with the basic mathematics underlying these models and understand their strengths and weaknesses. 4. What are the basic requirements/workload? Workload is high. The course philosophy is that finance is a mind game and those that have been steeled through rigorous work will have an advantage – the self-confidence of having a thorough training under conditions of great uncertainty. Materials for the Course This course uses readings and cases at no additional charge and may be downloaded from Latte. Additional readings, as they come, will be posted on Latte. Grading Students may work alone or in groups of two. I must approve each group. All case analyses will be submitted electronically. The final grade will be based on the following: Case analyses (80%) Class participation (20% - considers oral as well as online written contributions) Please note that lack of class participation and, for that matter, quality class participation will result in a final grade no higher than a B. All case analyses will be returned the day following their submission. Final grades will be posted the day following the last case submission. Disabilities If you are a student with a documented disability on record and wish to have a reasonable accommodation made for you, please advise. Academic integrity You are expected to be familiar with and to follow the University’s policies on academic integrity (see http://www.brandeis.edu/studentlife/sdje/ai/). Instances of alleged dishonesty will be forwarded to the Office of Campus Life for possible referral to the Student Judicial System. Potential sanctions include failure in the course and suspension from the University. Week 1 Topics Activities Synchronous Meeting 1A: Syllabus review Discussion of course expectations Introduction Discounted cash flows Seasonality and forecasting Pro forma statement preparation Profitability vs. risk and liquidity Balance sheet forecasting Readings/Videos (read and understand before watching each reading’s video): Brazilians Build, Trade “Maid Routes” Introduction to CF Valuation Methods Using APV: A Better Tool for Valuing Operations Case: Toy World, Inc. RT1A, RT1B, and SM1B: Discussion of readings/case Answer student questions Industry metrics: Airlines (RT1A) 2 Discount rate methodologies Synchronous Meeting 2A: Toy World, Inc. – discussion of solutions Case/Video (read before watching video): Globalizing the Cost of Capital and Capital Budgeting at AES RT2A, RT2B, and SM2B: Discussion of concepts/case Answer student questions Valuation of Frequent Flyer Miles (RT2A) 3 Capital budgeting Debt and equity financings Acquisitions Consolidations Synchronous Meeting 3A: Globalizing the Cost of Capital and Capital Budgeting at AES – discussion of solutions Case/Video (read before watching video): Friendly Cards RT3A, RT3B, and SM3B: Discussion of concepts/case Answer student questions Valuation of a vaccine: Merck’s valuation of the Human Papilloma Virus vaccine (RT3A) 4 Comparables valuation Cash Flow valuation Exponential growth Synchronous Meeting 4A: Friendly Cards – discussion of solutions Case/Video (read before watching video): Boston Beer RT4A, RT4B, and SM4B: Discussion of concepts and case Answer student questions Pricing the rights to pollute (RT4A) 5 Synchronous Meeting 5A: Boston Beer - solutions Pricing the rights to pollute Industry regulation Optionality in contracts Case/Video (read before watching video): Acid Rain: The Southern Company RT5A, RT5B, and SM5B: Discussion of concepts and case Answer student questions How is an athlete’s contract valued? (RT5A) 6 Valuing an athlete and a team Pricing in uncertain markets Synchronous Meeting 6A: Roche’s Acquisition of Genentech - solutions Case/Video (read before watching video): Tottenham Hotspur plc – case preparation RT6A, RT6B, and SM6B: Discussion of concepts and case Answer student questions Valuing companies in the internet space (RT6A) 7 Wrap-up and reflection Synchronous Meeting 7A: Tottenham Hotspur plc - solutions RT7A, RT7B, and SM7B: Summation and reflection Answer student questions Professor Alfonso Canella Mobile: 978.394.7318 Skype: alfonso_canella email: canella@brandeis.edu