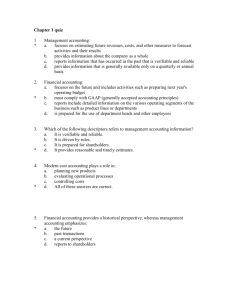

Advantages and Disadvantages of a Private Limited Company (Ltd)

advertisement

Limited Companies Private Limited Companies - Ltd Many private limited companies start out as sole traders or partnerships. They are mostly small scale operations and often run by family members. They form a limited company to: 1. Improve their financial security as the owners (now called shareholders) are no longer personally liable for the business debts. This is called limited liability. This means that if the company went out of business and left debts then the shareholders would only lose the money they put into the company. The company would go into liquidation. 2. Provide a better image to the customers who presume the business is more secure. Benefits for the owners The business can still stay small – many ltd businesses only have three or four shareholders. The minimum is one director and one shareholder and there is no upper limit on the number of shareholders. The owners usually work in the business are interested in its success. The shareholders are often directors and are responsible for running the business. It is quite easy to set up a private limited company. In some cases the owners may only have invested £100 or £200 to start up. Shares can only be transferred of all shareholders agree, they cannot be sold to the public. This means the owners have direct control over the business. As the owners have limited liability they will never lose more that they have invested. Banks are more willing to lend money to a limited company. The accounts are still private between the owners, their accountants and the Inland Revenue. Drawbacks for the Owners Shares cannot be sold to the general public to raise additional capital. Limited companies have to comply with more regulations that sole traders or partnerships. A limited company is not allowed to trade under the name of an existing company if this will cause confusion for customers and suppliers. If the company ceases trading it must officially be ‘wound up’. There are two legal documents that have to be completed in order to form a limited company: The Memorandum of Association – this gives details about: • The name of the company • The address of the registered office • A statement that the shareholders will have limited liability • The type and amount of share capital • A description of the business activities The Articles of Association – this gives details about: • Details about the voting rights of the shareholders • How profits will be distributed • • The directors of the company What procedures will be followed at the annual general meeting Once these documents are completed they are sent to the Registrar of Companies who issues a Certificate of Incorporation. A company must have this before it starts trading. Every year the company must send a copy of its audited accounts to Companies House. All profit in theory belongs to the shareholders, however, a proportion of the profit is usually put back into the business each year to replace old equipment or fund growth. The remaining profit is then distributed between the shareholders according to the number of shares held. Public Limited Company – PLC These are the largest type of privately owned businesses in the UK. Many started as small businesses, growing into Ltd’s before being floated on the stock exchange. This means that any member of the public can buy shares in the business. the shareholders in these companies are different from the directors who are usually employed by the business. A company must have more that £50,000 before it can go public and must have a good financial track record. Benefits for the Owners Much more capital (money) is available as there are more people to buy the shares – this makes expansion easier. Some public companies can be quite small – there needs to be a minimum of two directors and two shareholders. Large public companies can often operate more cheaply than small companies as they can operate economies of scale. This means they could mass produce goods or buy in bulk to save money. If the company is successful then the shares will increase in value which will increase the overall value of the company. Drawbacks for the Owners A public company must be registered with the Registrar of Companies nad has external regulations to comply with. An annual general meeting (AGM) must be held each year nad all shareholders must be invited. Specific accounts must be prepared each year and audited, the public can have access to these accounts. Shareholders invest their money into and in return for this investment they are entitled to part of the profits – this is called a dividend. Shareholders may have little interest in the long term success of the business and may only be interested in a quick return on their investment. The original owners may lose control over the company. Multinational Companies As businesses grow they may find that their national markets are too small for them. They may begin to export their products. Later they find it an advantage to switch their production to foreign countries. At this point they can be called multinational company. A multinational company means that it operates in at least two countries, usually both selling products and producing them in these countries. A UK multinational will almost certainly be a PLC. All major industrialised counties have their own multinational companies owned by shareholders in their own country but operating internationally. Companies often become multinationals as size can help them compete against other businesses. Size can lead to lower costs of production and economies of scale. The company may also be able to locate production more cost effectively. A multinational needs to be able to cope with a number of different problems: Size – often the sheer size and geographical spread of the company will make good communication essential Law & politics – the company must understand all the legal systems in the locations it operated. They usually are dealing with local and national government. They also have to be aware of the environmental regulations. Exchange rate fluctuations – multinationals may sell products and earn profits in a large number of different countries. However, the values of currencies are constantly changing against each other – this may make the difference between profit and loss. Globalisation can be seen it as a primarily economic phenomenon, involving the increasing interaction, or integration, of national economic systems through the growth in international trade, investment and capital flows. However, it can also include the rapid increase in cross-border social, cultural and technological exchange. Advantages and Disadvantages of a Private Limited Company (Ltd) Advantages Limited Liability More capital can be raised as no limit on number of shareholders Control of company can not be lost to outsiders – Disadvantages Profits have to be shared out amongst a potentially larger number of people Detailed Legal procedures must be followed to set up the business – consuming shares only sold if all shareholders agree The business will continue even if one of the owners dies, Shares being transferred to another owner time and money Financial information can be inspected by any member of the public once filed with the Registrar, including competitors Advantages and Disadvantages of a Public Limited Company (Plc) Advantages Essentially those of the Ltd, plus Increased potential for raising finance by share issues or through other financial investors Due to their size they can gain from Economies of Scale. Many Plcs are Multinationals, with production facilities in more than one country The Plc Can use its power / size to dominate a market, by for example purchasing competitors Disadvantages Most expensive set up cost of all forms of business organisation considered Due to public transfer of shares, more open to hostile takeover bids Tighter levels of regulation Public ownership by minority shareholders does not provide them as owners with any real control of the business Large Plcs may suffer from diseconomies of Scale