PS4 - Cornell

advertisement

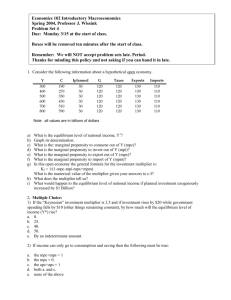

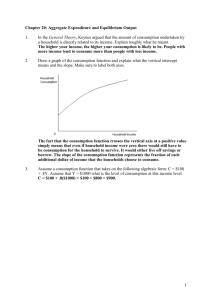

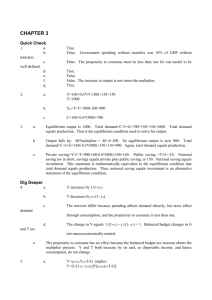

Economics 102 Introductory Macroeconomics Spring 2006, Professor J. Wissink Problem Set 4 Due: Wednesday 3/15 at the start of class. Boxes will be removed ten minutes after the start of class. Remember: We will NOT accept problem sets late. Period. Thanks for minding this policy and not asking if you can hand it in late. 1. Consider the following information about a hypothetical open economy. Y C Iplanned G Taxes Exports Imports 300 400 500 600 700 800 190 270 350 430 510 590 30 30 30 30 30 30 120 120 120 120 120 120 120 120 120 120 120 120 130 130 130 130 130 130 110 110 110 110 110 110 Note: all values are in billions of dollars a) b) c) d) e) f) What is the equilibrium level of national income, Y*? What is the marginal propensity to consume out of Y (mpc)? What is the marginal propensity to invest out of Y (mpi)? What is the marginal propensity to export out of Y (mpx)? What is the marginal propensity to import of Y (mpm)? In this economy the general formula for the investment multiplier is: KI’ = 1/(1-mpc-mpi-mpx+mpm), what is the numerical value of the multiplier given your answers above? g) What does the multiplier actually tell us? h) What would happen to the equilibrium level of national income if planned investment exogenously increased by $1 Billion? 2. Suppose that the following set of equations describes ALL the relevant information about the Czech Republic. Consumption function: C = 2000 + .4Yd (where Yd = disposable income) Planned Investment function: I = 800 Government expenditures function: G = 900 Tax function: T = 700 Export function: EX = .2Y Import function: IM = 100+.1Y The full employment level of national income: YFull Employment = 7,000. a) Determine the equilibrium level of national income, Y*. b) Draw a graph representing Czech aggregate desired expenditure function. Clearly label the expenditure equilibrium point. c) Calculate the aggregate desired expenditures multiplier for the Czech Republic. (This is the multiplier that applies when autonomous expenditure increases by one dollar.) d) Calculate the balanced budget multiplier for the Czech Republic. (This is the multiplier that applies when both government spending and taxes increase by one dollar, so that the budget planned impact is zero.) e) Calculate the tax multiplier for the Czech Republic. f) If Czech government increases taxes by 200, what will be the change in equilibrium level of national income? (HINT: Use the tax multiplier). g) How could the government use fiscal policy to achieve full employment national income? Be specific with respect to the values and directions of the policy you suggest. Give at least two suggestions. 3. Your friend Bob took econ 102 a long time ago. He remembers that his professor derived a basic GDP identity for a frugal economy: SAVING=ACTUAL INVESTMENT during his lectures. Bob finds in his notes following derivation: GDPYC+S (income can be either consumed or saved). GDPYC+IA (from the expenditure approach to GDP accounting for a frugal economy). So: C+S=C+IA So: S=IA. Bob is however puzzled. He argues: If people save part of their incomes and their saving is channeled via financial intermediaries (banks) to the firms who use this money to buy new capital goods (i.e. to invest), than it is obvious that saving equals actual investment. But then again imagine, he continues, that firms do not use all the saving made by people (households). Then he concludes, the identity cannot hold! Please, explain this issue to your friend Bob and why it will still hold. In fact it does hold! 4. Multiple Choice: 1) If the “Keynesian” AEd multiplier is 2.5 and if investment rises by $20 while government spending falls by $10 (other things remaining constant), by how much will the equilibrium level of income (Y*) rise? a. b. c. d. e. 0. 25. 40. 50. By an indeterminate amount. 2) If income, Y, can only go to consumption and saving, then which one of the following must be true? a. b. c. d. e. the mpc+mps = 1 the mps = 0 the apc+aps = 1 both a. and c. are true the apc+mpc=1 3) A reduction in the marginal propensity to consume will: a. cause the AEd line to become flatter and a given change in investment to have a smaller effect on output. b. cause the AEd line to become flatter and a given change in investment to have a greater effect on output. c. cause the AEd line to become steeper and a given change in investment to have a smaller effect on output. d. cause the AEd line to become steeper and a given change in investment to have a great effect on output. e. cause the AEd line to shift up. 4) Refer to the figure depicting the relationship between income (Y) and consumption spending (C) for a given household. Assume there is no government spending and taxes. This household's saving will be zero when income is: a. b. c. d. e. 1,400. 1,200. 1,000. 800. 600. Consumption function C 440 370 100 200 Y